Farmland Values and Cash Rent

January 13, 2022

PAER-2022-8

Author: Todd Kuethe, Associate Professor, Schrader Endowed Chair in Farmland Economics

Farmland Values

Indiana farmland prices set a new record high in 2021. The 2021 Purdue Farmland Values and Cash Rent Survey indicated that top quality farmland prices increased by 14.1% to $9,785 per acre. Average quality land values increased by 12.5% to $8,144, and poor quality land values increased by 12.1% to $6,441. Farmland prices are determined by a complex set of economic forces, such as commodity prices, net incomes, interest rates, and agricultural policy. In 2021, the Purdue Farmland Values and Cash Rent Survey respondents suggest that all of these forces put upward pressure on farmland prices. Farm incomes and commodity prices were higher than recent years, as was agricultural policy support. Conversely, low interest rates lowered the cost of borrowing. The survey respondents were optimistic about continued growth for the remainder of 2021. In addition, recent results from the Purdue University-CME Group Ag Economy Barometer suggest farmers remain optimistic about long-term farmland value expectations.

While the prospects for continued farmland price growth seem likely, rising input costs and continued supply chain disruptions may dampen positive price appreciation. As the economy adjusts to changes originating with the COVID-19 pandemic, a large amount of economic uncertainty remains.

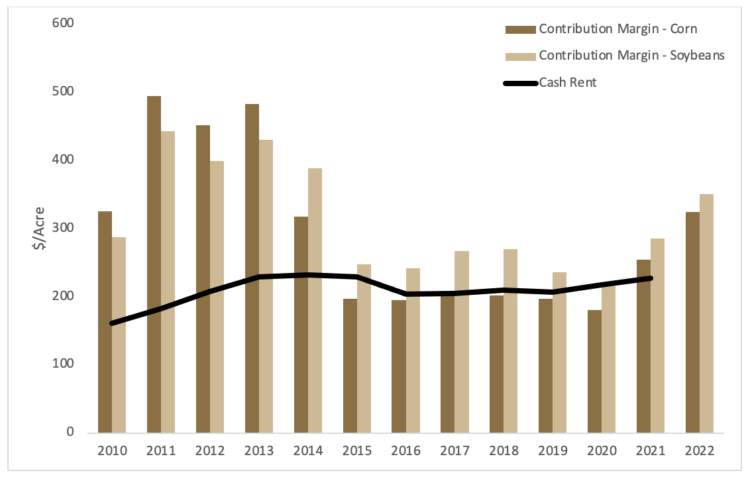

Cash Rental Rates

Cash rental rates also increased across Indiana in 2021. The 2021 Purdue Farmland Values and Cash Rent Survey indicated that cash rent on top quality farmland increased by 3.9% to $269 per acre. Average quality land rents increased by 4.6% to $227, and poor quality rents increased by 4.6% to $183. Unlike land values, the cash rental rates do not exceed the previous highs set 2013 or 2014. Cash rental rates are typically negotiated well in advance of the growing season, and as a result, rental rates reflect the expected costs and returns to production. While commodity prices remained above recent lulls, the expected costs of production may limit farmers’ willingness to pay higher cash rental rates in 2022. At the same time, landowners may expect farm incomes to remain elevated and try to negotiate rate increases.

The recent 2022 Purdue Crop Cost & Return Guide suggests that the contribution margin, the difference between market returns and variable costs, is expected to rise in 2022 for both rotation corn and rotation soybeans. Increasing margins generally sign upward pressure on cash rental rates, as farm operators will have additional revenues to allocate to labor, investment, and land. As shown below, the contribution margin for average quality farmland in 2021 exceed the average cash rental rate, which also places additional upward pressure on cash rental rates.

Figure 1: Cash rental rate and contribution margin for rotation corn and soybeans for average quality land, 2010-2022.