2024 Farmland and Cash Rent Outlook

January 16, 2024

PAER-2024-09

Todd Kuethe, Professor and Schrader Endowed Chair in Farmland Economics

Farmland Values

While the farmland market has been robust in recent years, there are signs that price growth may ease in 2024. In 2023, farmland prices across Indiana again set a new record high, at $13,739 per acre for top quality land, $11,210 for average quality land, and $8,689 for poor quality land. Price growth was robust, but muted compared to the record growth between 2022 and 2023.

The Purdue Farmland Values and Cash Rent survey is conducted in June of each year. The most recent iteration of Iowa State University’s land value survey, released in December 2023, found that farmland values across Iowa increased by 3.5% between November 2022 and November 2023, a muted growth rate compared to the 17% and 31% increases observed in the preceding years. In addition, the most recent agricultural banker survey by the Federal Reserve Bank of Chicago suggest that land value growth has slowed across their district, which includes northern portions of Indiana and Illinois, southern Wisconsin, the lower peninsula of Michigan, and all of Iowa.

The recent growth in farmland prices across the Corn Belt was supported by higher commodity prices, increased demand for land conversion to nonagricultural uses, and the overall strength of the farm economy. But price growth has been muted by rising costs of borrowing. While the overall picture remains optimistic compared to long run averages, it appears the rapid growth of the past two years may be coming to a close.

Cash Rental Rates

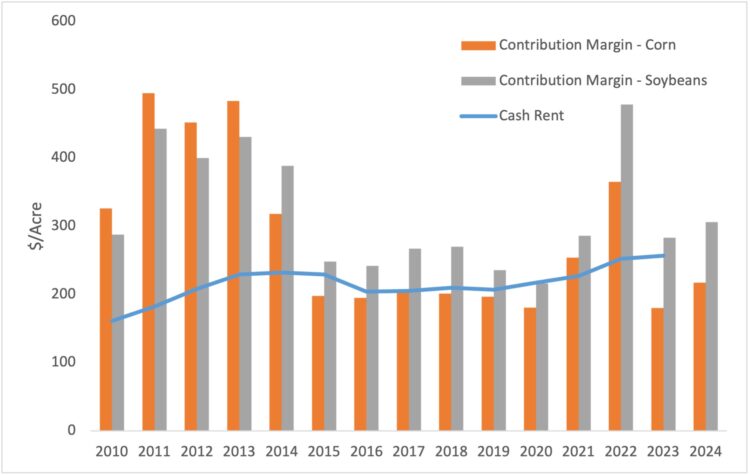

The recent 2024 Purdue Crop Cost & Return Guide suggests that the contribution margin, the difference between market returns and variable costs, will increase relative to 2023 levels for both rotation corn (up 20.6%) and rotation soybeans (up 8.1%). Increasing margins generally signals upward pressure on cash rental rates, as farm operators will have additional revenues to allocate to labor, investment, and land. However, in 2023, the cash rental rate exceeded the contribution margin for rotation corn, which puts downward pressure on 2024 rental rates for corn acreage. In addition, farmers will no doubt stress the increased costs and concerns for lower commodity prices when trying to negotiate less aggressive cash rent hikes.

Similar to the farmland sales market, the cash rental market shows a variety of positive and negative price pressures but the overall conditions suggest modest positive price pressure.