Catch our Discussions... Land Values, Cash Rents & Market Trends

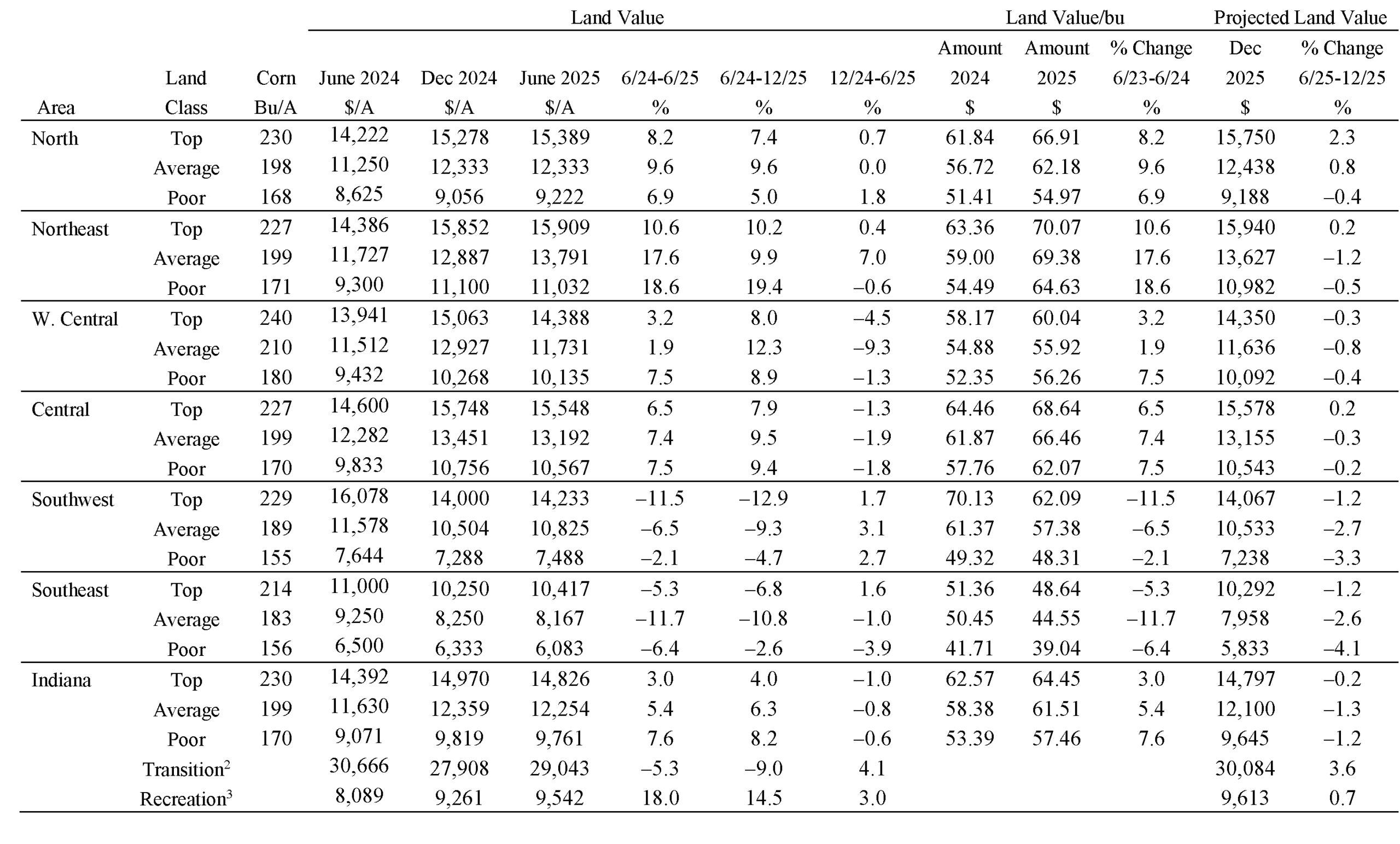

Purdue ag economists Todd Kuethe and Michael Langemeier discuss results from the 2025 Purdue Farmland Values and Cash Rental Rates Survey and implications for Indiana farmers and landowners on the Purdue Commercial AgCast. The survey shows Indiana land prices and cash rents continue to rise and are anticipated to continue a modest increase for the rest of 2025 for most of the state. The episodes share insights into U.S. and Indiana farmland value trends, agricultural balance sheets, debt-to-asset ratios, the impact of various economic factors on land values, future expectations for farmland values, historical trends in cash rents and how cash rents compare to share and flex lease rents, regional differences, net returns to land, and the increasing interest in flexible cash leases from both landowner and tenant perspectives.

Learn more about the Purdue Commercial AgCast podcast, plus see recent episodes! Consider subscribing!

Survey Archive

Farmland Prices Increase Despite Downward Pressure

August 2024

“While farmland prices increased between 2023 and 2024, survey respondents noted that much of the growth appears to have taken place in the latter half of 2023,” said Todd H. Kuethe, Schrader Endowed Chair in Farmland Economics and the survey’s author. “A number of forces, such as high interest rates and lower farm incomes, are placing downward pressure on prices, but the limited supply of land is keeping prices firm."

Indiana Farmland Prices Continue to Rise

August 2023

“While farmland prices reached a new peak in 2023, the appreciation rate from 2022 to 2023 was much lower than the record high price growth observed between 2021 and 2022,” said Todd H. Kuethe, Schrader Endowed Chair in Farmland Economics and the survey’s author. “Farm incomes and liquidity are playing a role in boosting price growth; however, rising interest rates continue to put downward pressure on purchases financed through mortgages.”

Indiana Farmland Prices Grow at Record Pace

August 2022

“Multiple factors are influencing the increase in farmland prices, including positive net farm incomes, relatively strong commodity prices, inflation, and high farmer liquidity,” said Todd H. Kuethe, Purdue associate professor and Schrader Endowed Chair in Farmland Economics and survey author. “However, rising interest rates are associated with increased costs of borrowing, which put downward pressure on purchases financed through mortgages.”

Prior reports are located at: https://purdue.ag/paer_archive

Index Numbers

Indiana farm real estate index numbers from 1912 through 1986 were taken from various USDA publications. Beginning in 1987, USDA discontinued publishing the index but continued publication of dollar estimates of farm real estate values and annual percentage changes. The index numbers from 1987 on were calculated from these published figures and were not adjusted to reflect census-based revisions on dollar values published by USDA. For this reason, year-to-year percentage changes in the index may differ from those based on dollar values published by USDA.

The data reported here provide general guidelines regarding farmland values and cash rent. To obtain a more precise value of an individual tract, contact a professional appraiser or farm manager that has a good understanding of the local market.