Food Prices

January 16, 2024

PAER-2024-07

Caitlinn Hubbell, Market Research Analyst; and Joe Balagtas, Professor of Agricultural Economics

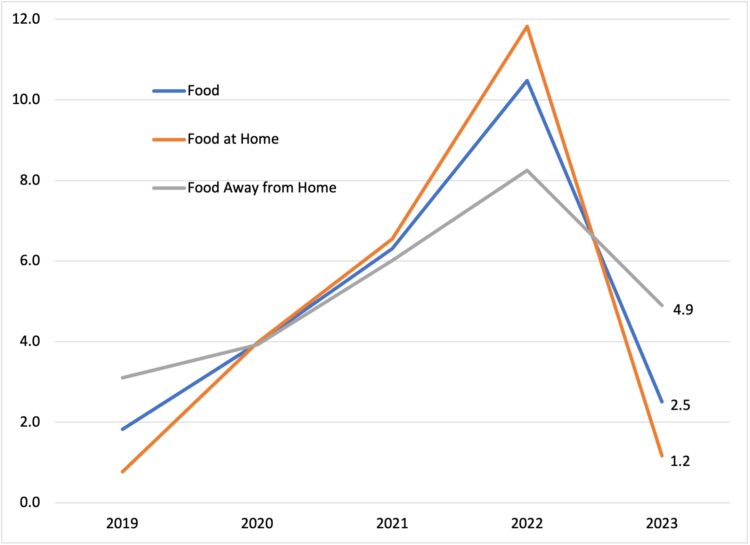

Food price inflation slowed in 2023, rising by 2.5% through the first 11 months of 2023 (see Figure 1). That was the slowest growth in food prices since 2019, before the onset of the COVID-19 pandemic and related disruptions to the economy. Prices of Food at Home (aka, groceries) rose by 1.2%, while prices for Food Away from Home (aka, food service, including restaurant meals) rose by 4.9%.

Figure 1. Annual Changes in the Consumer Price Indexes for Food, Food at Home, and Food Away from Home

Note: 2023 data are through November. Source: authors’ calculations from Bureau of Labor Statistics data

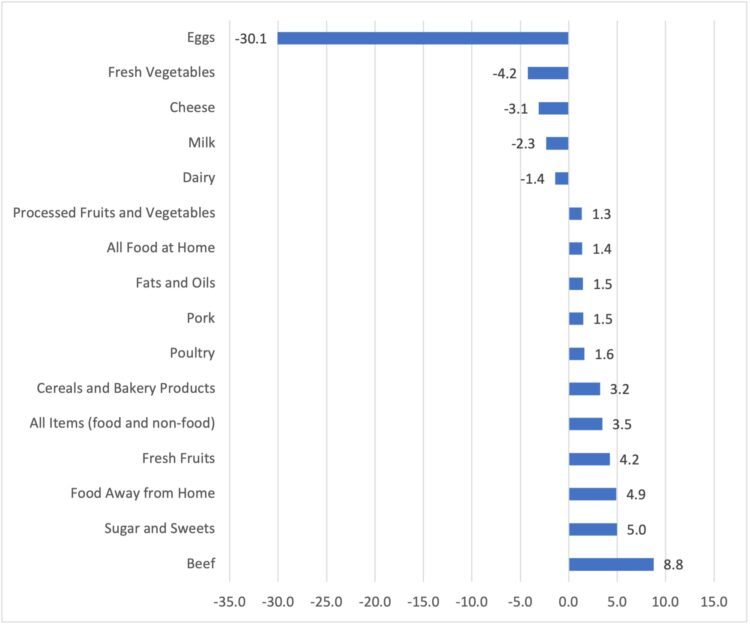

In addition to higher prices for Food Away from Home, the items with the largest price increases were beef and sugar and sweets. Beef prices were 8.8% higher this November than they were a year ago, driven by strong demand and low cattle inventories. Sugar prices were 5.0% higher than a year ago, as droughts in key producing areas around the world, including the U.S. South, have limited sugar production.

Meanwhile, prices for some food staples fell in the past year. Egg prices fell by 30%, as the incidence of Avian Influenza faded through the last half of the year. Prices of fresh vegetables fell by 4.3%, and prices of cheese products fell by 3.1%.

Figure 2. Price Changes in 2023 (through November)

Source: authors’ calculations from Bureau of Labor Statistics data

While food price inflation eased in 2023, the combined effect of inflation over the past several years has left food prices significantly higher than they were pre-pandemic. Food prices are 26% higher than they were in 2019, before the onset of the COVID-19 pandemic. Those price increases, together with higher prices in general, have eroded consumer purchasing power. As a result, consumer confidence in the economy is lower than it was even at the height of the COVID-19 pandemic.

But economic conditions started to improve in the last half of 2023. Historic interest rate hikes by the Fed starting in Spring 2022 seem to be having their intended effect of slowing inflation. Inflation has slowed not only for food prices, but across the rest of the economy, as well. Energy prices have fallen 5% in 2023 and core inflation (that is, prices of all items excluding food and energy), while not yet at the Fed’s 2% target rate, is moving in that direction. Core inflation was 3.8% through November 2023, and had slowed in the last half of the year.

At the same time, overall economic growth has contributed to increased incomes. Average wages rose by 3.6% through November, more than offsetting inflation. This marks the first year since 2020 that consumer purchasing power increased.

So what’s on the horizon for 2024?

Macroeconomic uncertainty will continue to exist through 2024. The Fed is focused on bringing inflation down, so hopefully the worst of inflation is behind us. However, higher rates may also slow economic growth, causing higher unemployment and slower wage growth. Thus far we have avoided the recession that some economists have been predicting for more than a year, but it still remains to be seen whether the Fed can pull off the so-called “soft landing.”

In food market news, highly pathogenic avian influenza (HPAI) has shown some signs of re-emerging, resulting in the loss of 1.5 million birds in December 2023. Should this resurgence continue, we could see higher poultry and egg prices, similar to what was seen in 2022. (To keep up to date on egg prices, visit the dashboard published by the Center for Food Demand Analysis and Sustainability.)

The U.S. Department of Agriculture Economic Research Service is forecasting food prices will continue to “decelerate” in 2024, with Food at Home prices decreasing by 0.6% and food away from home prices predicted to increase by 4.9%.