How has the Thrifty Food Plan increased the cost of the farm bill?

March 7, 2023

PAER-2023-14

Roman Keeney, Associate Professor of Agricultural Economics

Nutrition programs consistently account for more than 70% of total farm bill spending. In recent years, the COVID-19 pandemic has increased that spending considerably. The weakened COVID-19 economy lowered household incomes so that more families were eligible for programs like the Supplemental Nutrition Assistance Program (SNAP) and families that were already participating qualified for larger benefits. Additionally, SNAP and other programs were expanded as part of COVID relief packages. As some of that legislation has expired and the federal government transitions toward an end of the COVID public health emergency we might expect spending in SNAP to return to pre-pandemic levels. However, CBO projections dating back to 2022 show that this will not be the case.

The 2018 Farm Bill mandated a review and update to a key component of the SNAP program’s formula known as the Thrifty Food Plan (TFP). A recent hearing in of the Senate Committee on Agriculture, Nutrition and Forestry on nutrition programs featured extensive questioning on the increasing size of nutrition assistance over the next ten years. Much of that discussion focused on USDA’s 2021 TFP update as a cause for higher projected SNAP outlays. When the farm bill debate begins in earnest, the TFP and how it is determined going forward will be a key agenda item for legislators that want to bring entitlement spending under control.

What is the Thrifty Food Plan?

The TFP is a collection of food items selected to meet nutrition goals for limited resource families at lowest cost[1]. The food items in the plan have no specific policy role. Instead, the prices of those food items are aggregated to create an index that represents the expected cost of healthy eating for a representative low income household. This cost measure is used in policy as part of the SNAP benefits formula – establishing the maximum potential SNAP benefit. Deductions are made from this benchmark based on the household’s expected contribution toward food purchases to calculate the exact SNAP benefit.

This TFP’s maximum SNAP benefit is determined using a quantitative model based on current information about nutritional content and prices for food items. The purpose of the TFP model is to search a large set of options and find the lowest cost combination that meets a set of prescribed diet rules.

Nutrition requirements included in the model cover:

- Energy requirements

- Nutrient levels

- Diet balance

- Purchase practicality

The energy requirement is a basic accounting of calories to ensure sufficiency. Nutrient levels represent the USDA recommended targets for macronutrients like protein and carbohydrates and select micronutrients (e.g. Vitamin A & C). The diet balance component incorporates recommendations on how food servings should be distributed across categories of foods (e.g., meat, dairy, grains, etc.). Finally, data observations of food purchases by limited resource households are used to ensure that the food plan is constructed using accessible and representative food items.

How and why did the TFP change?

Prior to 2021, all TFP updates were constructed using a cost neutrality requirement that held inflation adjusted costs of the TFP constant. The cost neutrality requirement has been the subject of considerable criticism for making it increasingly difficult to find a practical purchase basket to meet the diet requirements of limited resource households. The 2021 TFP update set aside the cost neutrality condition and prioritized the representativeness of the food basket. This update to TFP methodology resulted in the maximum SNAP benefit increasing by more than 20% with individual benefit amounts increasing in proportion.

Unlike pandemic based benefit increases of the past three years, the benefit change based on the updated TFP is a permanent increase in the maximum benefit used in calculating SNAP payments for all years going forward. Changing the TFP to lower the maximum benefit would require Congress or a new presidential administration to direct USDA to roll back the change that was made in 2021.

How has the TFP affected the budget for the Farm Bill?

The farm bill budget implications of changing the SNAP formula via an increased TFP are significant. The size of the SNAP program is a consistent point of contention in the farm bill debate. The 2021 TFP update can be viewed as a political maneuver, using emergency authorization to justify an expedited process for permanently increasing the SNAP formula. The TFP update triggered a US Government Accountability Office (GAO) review that leveled sharp criticism at the steps taken in 2021’s revision to SNAP formulae.

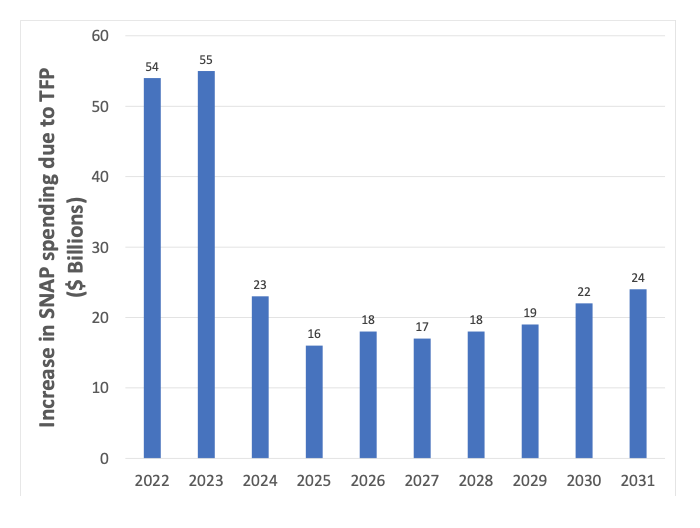

We reviewed the Congressional Budget Office’s role in setting the baseline spending level for the farm bill in a previous brief. The 2021 update to the TFP was first reflected in CBO’s 2022 budget outlook that incorporated new projections of mandatory farm bill program spending. The change to the TFP increased expected SNAP spending by +$266 billion (+33%) over the 2022-2031 period. The year by year increase to projected SNAP spending resulting from the increased TFP factor is shown in figure 1.

The first two years show larger changes because COVID relief enhancements were forecast to remain through both fiscal years. Beyond 2023, we see more typical budget impacts with increases averaging about $20 billion per year from 2024 to 2031. The annual impact of changing the TFP on SNAP spending is roughly the same size as most year’s combined spending on commodity programs and crop insurance subsidies.

Figure 1. Changes to SNAP spending from TFP update. Source: CBO 2022

These increases due to the updated SNAP formula come at a time when SNAP spending is forecast to increase due to economic factors like inflation, slowed growth in incomes, and weakening employment. The changes in figure 1 are the isolated effect of 2021’s UDSA update to the Thrifty Food Plan component of SNAP formulae. The 2023 CBO baseline published in February estimates that SNAP spending will increase above the forecast published in 2022 by some $9 billion per year.

Impacts on Farm Bill 2023

A lagged recovery from COVID, strong farm prices, and the revamped TFP formula have increased the farm bill’s baseline spending estimate and shifted the share of the spending considerably toward the nutrition title. As a practical matter, the update to TFP and other factors increasing SNAP’s projected spending have yielded the most robust farm bill baseline in history. More than $1.2 trillion of that spending over the next ten years is due to the nutrition title. In writing a 2023 Farm Bill, this budget allowance gives Congress a large sum to work with in building replacement legislation. Congressional committees that want to increase spending in the farm safety net, rural development, or other farm bill titles have money in the nutrition title to shift toward those objectives while keeping SNAP benefits above pre-pandemic levels.

Politically, reducing SNAP benefits has proven difficult. Experts and advocates in the food assistance area consider the large increase to SNAP from 2021’s TFP update as correcting a long out of date method for assessing need. This is particularly true when considering the increased role of diet in national health policy and combating obesity. As a budget matter, the large increase in the farm bill baseline makes the legislation a prime target for deficit reduction efforts.

Attempts to reduce the cost of the SNAP program by enhancing work requirements were set aside in 2020 to deal with the COVID-19 pandemic. The political motivation for those changes was significant, even though SNAP spending was much lower than it is today. The 2021 TFP update ensures that SNAP benefits will not return to pre-pandemic levels unless mandated by Congressional action. All of this points to the 2023 becoming the most difficult farm bill environment since 2012 – when the battle over nutrition spending resulted in multiple one-year extensions of the farm bill to avoid expiration.

[1] The Thrifty Food Plan is one of four consumption baskets used to track costs by USDA’s Food and Nutrition Service. The four baskets represent different income levels of consumers so that the cost estimates match practical purchase patterns. The other three food plans tracked by USDA-FNS are ‘low-cost’, ‘moderate cost’, and ‘liberal’.