Managing the Risk – Capturing The Opportunity in Crop Farming

November 16, 2011

PAER-2011-22

Michael Boehlje and Brent Gloy

Farming has always been a risky business, with the returns to reward that risk available for only brief periods of time. The risk in agriculture today, particularly in crop production, is greater than it has been in the past, but there is opportunity to be rewarded for taking that risk. This brief article focuses on several management strategies farmers can implement in these increasingly turbulent times.

The Risk & The Rewards

The risk for a farming operation generally comes from two sources–operations and financing. Operational risk results from price, cost, and yield fluctuations, whereas financial risk is created by interest obligations on debt funds used to finance the business. Each of these sources of risk is discussed in turn.

As to operating risk, output price volatility has increased dramatically in recent years. By any measure, output prices have become quite variable–perhaps double what they were 5-10 years ago. Yield variability depends largely on weather conditions, and many farmers have experienced significant variability across counties and even within the same field.

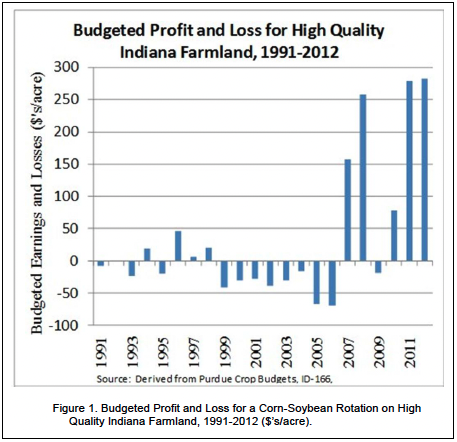

In addition to output price variability, input prices have also been quite variable. The fluctuations in fertilizer and energy costs have been the most dramatic. To date, seed, chemical, equipment, and land costs have not fluctuated as much, but have been in strong upward trends. The resulting volatility in profit margins (price minus total cost) has been even more dramatic than that of prices, costs, or yields. In general, volatility in margins has more than doubled, and some have argued that they have increased by as much as 3 to 4 times compared to the past. There is no doubt that the operating risk in grain farming has increased dramatically in recent times, especially when measured in dollars per acre. The variability in profit margins can be clearly seen in Figure 1 which shows the budgeted or expected margins per acre for a corn-soybean rotation on high-quality Indiana farmland over the last 20 years. The variability in margins shown in Figure 1 is largely a function of changes in input and output prices. Recently, the expected margins from farming have been extremely high. Some would argue that these years of strong profitability provide a substantial cushion for row-crop producers. However, on must be careful about assuming that these levels of profitability will be sustained over the long-term. In the last 20 years, profitability has exceeded $50 per acre only four times.

Figure 1. Budgeted Profit and Loss for a Corn-Soybean Rotation on High Quality Indiana Farmland, 1991-2012 ($’s/acre).

While four of the largest budgeted returns have occurred in the last 5 years, the magnitude of the changes in budgeted margins is striking. For instance, the expected returns swung from a budgeted loss in excess of $50 per acre in 2006 to a budgeted profit in excess of $150 per acre in 2007. They then climbed to over $250 per acre in 2008 and fell dramatically to a budgeted loss in 2009. Swings in the profitability of farming of this magnitude are unprecedented in the last 20 years. This makes developing sound risk management strategies a critical job of the farm manager.

What about the financial risk? Financial risk arises when farm businesses use debt to fund their operations. Because debt must be repaid, this creates a risk that operating receipts will not be sufficient to fund the costs of debt (interest costs) and meet principal repayment obligations. There are two key factors that influence financial risk, the overall level of debt that the farm utilizes and the price/cost of the debt (the interest rate). Recently, a combination of reduced debt utilization for many farm businesses and historically low interest rates has resulted in much lower financial risk for most farming operations than in the past.

Thus, while operating risk has increased, the total risk from both operations and financing faced by most farm businesses has not been compounded by high debt loads and interest rates, as occurred during the 1980s. But one should again be cautious because current interest rates are seductively low, and some farmers have a significant proportion of their debt on variable rate terms. Thus when interest rates increase, the cost of funds and financial risk will increase as well. Some farmers have been aggressive in expanding their businesses in the past decade using historically low cost debt as they have rapidly grown their farms. This is particularly the case for younger farmers and farms with sales over $1 million, as documented in a recent study by the Kansas City Federal Reserve Bank.

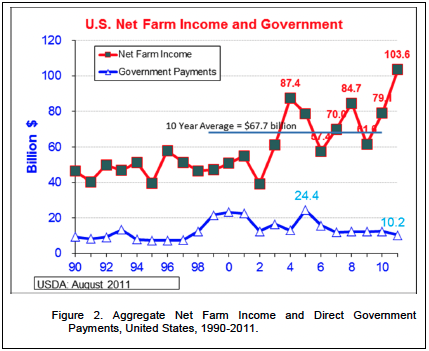

The “bottom line” is clear however-even for those farmers who have not used leverage and debt capital extensively, the total operating and financial risk has increased in recent years. But what about the returns–have farmers been rewarded for these increased risks by the potential of higher returns in grain farming? The evidence favors the answer of “yes” to this question. At the aggregate level, net farm income is more volatile than in the past, as illustrated in Figure 2, but the average for the past 8-10 years appears to be higher than in the previous decade.

Margins per acre in recent times appear to also exhibit more volatility but higher levels in general, as reflected in Figure 1. So there is at least some evidence that rewards in the form of higher potential returns are available to compensate for the additional risk in the grain farming sector. But the volatility in these returns or margins, as illustrated in Figures 1 and 2, present an important implication–these higher returns are clearly not stable. This causes one to question whether there are strategies that can be implemented to capture the higher returns now available.

Figure 2. Aggregate Net Farm Income and Direct Government Payments, United States, 1990-2011.

Strategic Implications

So what are the implications for a farmer’s strategy today? We propose nine practical strategies that can be used to protect current margins and successfully position your business against the extreme uncertainty present in today’s agricultural marketplace.

1. Lock in margins–Figure 1 clearly indicates that the expected margins for corn/soybean production are positive and near all-time highs. In fact, it shows that expected margins have only been this large twice in the last 20 years. These margins can be protected by using futures markets or contracting to lock in selling prices and contracting input prices for fertilizer, seed, and chemicals. (see http://www.agecon.purdue.edu/extension/programs/marginrisk.asp for a discussion of specific strategies to protect margins).

2. Buy crop insurance–Locking in output and input prices manages two of the important determinants of operating risk in crop production, but what about the third critical source of risk-yield? Using recommended fertilizer, seed, and pest control strategies can help reduce yield variability and should be standard practice, but another favorable strategy is to use crop insurance to indemnify against reduced yield and/or low prices if gross revenue insurance is purchased. Two brief comments concerning crop insurance. First, the increased cost of purchased inputs suggests that higher levels of crop insurance coverage (80 to 85%) may be required to cover cash costs and living expenses. This higher coverage comes at a cost, but one way to reduce this cost is to choose “enterprise” coverage which can substantially reduce insurance rates. Second, buying crop insurance is also beneficial in support of the strategy of locking in margins. One reason farmers frequently give for not forward pricing their crop sales is because they do not know what their crop yields will be. Purchasing crop insurance provides some “yield protection,” so they can have a higher comfort level in locking in prices and margins for that level of “protected yield.”

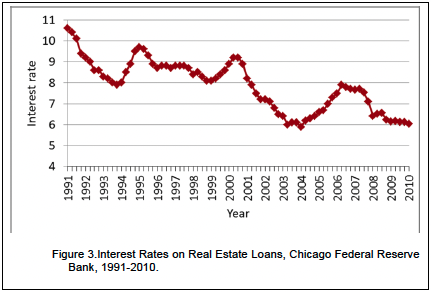

3. Fix interest rates on some long-term debt-Interest rates have been in a long downward trend during the past 20 years, as shown in Figure 3, and they are at uniquely low rates at the current time.

Figure 3. Interest Rates on Real Estate Loans, Chicago Federal Reserve Bank, 1991-2010.

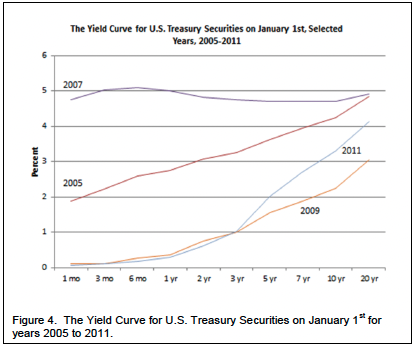

While longer term interest rates are low, short-term rates are also very low, so fixing interest rates will involve cost. The shape of the yield curve is an indicator of the cost of moving from variable to fixed rates.

Figure 4 shows the yield curve for U.S. Treasury securities on January 1 for the last 7 years. This curve clearly shows the low short-term interest rates of recent times. It also illustrates that the current yield curve is steep with rates rising sharply as maturities increase beyond three years.

Figure 4. The Yield Curve for U.S. Treasury Securities on January 1st for years 2005 to 2011.

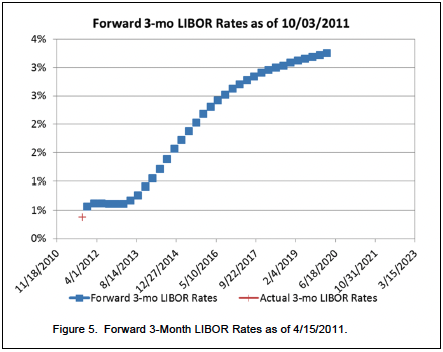

When compared to periods when the yield curve was flatter such as 2007, the cost of moving from short-term to longer term rates is high. For instance, in 2007 the Treasury would have paid roughly the same rate for borrowing on a 5-year fixed rate as on a 3-month fixed rate. In 2011, fixing rates for 5 years would cost an additional 200 basis points (2%) over the 3-month rate. While this may seem like a large premium to fix rates, one must also consider the overall magnitude of the rates. From the Treasury’s perspective the interest rate on 5-year debt is currently quite low (2%) relative to many other periods in history. When the cost of shifting to longer term rates was low, such as in 2007, the benefit was also low because the 5-year rate was relatively high. That is not the case today. In fact, the forward 3-month London Interbank Offered Rate (LIBOR) shown in Figure 5 indicates that market participants expect short-term interest rates to rise in the future. While it is difficult to predict interest rates, one should ask whether having your entire “portfolio” of debt on variable rates is a sound risk management strategy. Instead, it might be prudent to diversify by changing some variable rate debt to fixed rates.

Figure 5. Forward 3-Month LIBOR Rates as of 4/15/2011

4. Deleverage (pay down debt)–Expected crop returns are near recent highs, and using some of these earnings to reduce the level of debt in the operation will reduce financial risk and offset some of the increased operational risk. Paying down debt with excess cash flow can be a very sound risk–management strategy. The current yield curve combined with futures markets indications of future interest rates suggests that after 5 years, short-term interest rates will be higher than they are today. For those firms that have grown aggressively and have used increasingly lower cost debt to finance that aggressive growth, the prospects of higher interest costs suggests that it may be difficult to safely use aggressive amounts of debt capital in the future. Consequently, with strong current cash flows, firms should consider de-leveraging their operation over the next few years.

From the perspective of managing the short, and long-term financial risk of the farm business, this is a very unique time. The current yield curve allows farmers to lock in relatively low interest rates for the next 5 years. Current prices for commodities allow farmers to lock in high margins for 2012. And these high margins can be used to pay down debt so that if margins are lower and financing cost higher in future years, as is highly likely, the financial risk to the business is reduced substantially.

5. Hold financial reserves–In periods of high margin volatility, the first line of defense against financial stress is financial reserves. More working capital, higher cash or liquidity positions, and reduced current debt obligations provide a greater financial cushion to buffer against the potential for financial reversals resulting from higher cost, lower prices, lower yields, or higher interest rates.

6. Conservative buying/bidding–The current high margins encourage aggressive buying and bidding behavior. Producers should be cautious in bidding for farmland purchases and especially for cash rents. This is particularly true when offers are made that carry implications several years into the future, such as long-term cash lease obligations or land purchases. As indicated earlier, history suggests that margins in the future are more likely to be lower than higher, and one must be careful to not suffer “bidder’s remorse” or “the winners curse” from over-bidding in the land purchase or rental market.

7. Slow growth/fund with equity–The increased risk in the marketplace suggests that capital costs will be higher in the future. This means that growth will be funded at higher cost capital. Consequently, farmers who have been encouraged to grow relatively rapidly because of a low and declining cost of capital may want to alter their growth strategy. Growth in the future with higher capital costs should likely be slower than in the past, be focused on acquiring assets more through rental arrangements and less through ownership, and be funded with less debt and more equity.

8. Invest in operational excellence and cost control–One of the best strategies that farmers can use to protect against unexpected price swings is to establish a business with a low cost of production. Focusing on driving unnecessary costs from the operation and exercising cost discipline are critical to executing this strategy. At present, returns are high, and there is a natural tendency to relax cost control and management strategies when profits are strong.

9. Invest carefully–Making prudent capital investment decisions that increase efficiency and lower costs are good investments. Unnecessary, luxury, convenience, or tax-motivated purchases may turn out to be a costly use of financial reserves and can adversely affect cost structure should margins change for the worse. Grain farmers may currently have strong cash positions, but now may be the time to conserve/maintain that cash rather than deploy it in capital investments or less than productive spending behavior.

Summary

Today’s agricultural marketplace is characterized by wide price swings and currently high margins. The expected margins for grain production are as high as at any time in recent history. There are a number of practical management strategies that farmers can implement to capture some of these projected high returns. These include options like locking in input and output prices and using crop insurance products. Additionally, farmers should carefully consider the amount of debt that they use in their operation. If output prices go down, farms with large amounts of leverage may experience financial stress. Finally, farmers should work to maintain cost control and efficient production practices even in this period of high expected profitability.