Trade and Trade Policy Outlook 2023

January 10, 2023

PAER-2023-02

Russell Hillberry, Professor of Agricultural Economics

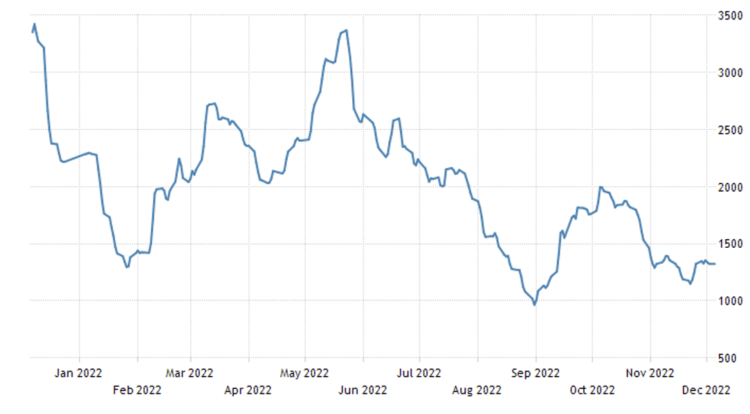

Last year’s trade and trade policy outlook discussed the supply chain problems that had emerged in the prior year (Hillberry, 2022). A key metric for agricultural supply chain disruption in 2021 was bulk freight rates, which are most often summarized by the Baltic Dry Goods Index. By December of 2021, the index had fallen by more than half from their October 2021 peak. Freight rate volatility continued in 2022, though the index moved downward over time. Bulk shipping rates were cut by more than half during 2022. See Figure 1.

Figure 1. Baltic Dry Goods index, 2022

Source: MarineVesselTraffic.com (series updated daily at the link)

Russia – Ukraine war

The event that most affected international agricultural markets in 2022 was not foreseeable at this time last year. Russia’s late February invasion of Ukraine substantially disrupted global markets for both inputs and outputs of commercial agriculture. Ukraine’s own agricultural exports were disrupted by the war. Ukraine is a large producer of sunflowers and other oilseeds (including soybeans), corn, barley and wheat. It plays an outsized role in global exports of these commodities, as many countries that are larger in terms of production consume a higher share of their own output. Wheat was the commodity with the largest impact of the invasion on its price (Legrand, 2022).

Russian exports – both of agricultural products and of fertilizer – have not been targeted by an otherwise crippling sanctions program. It nonetheless seems that other parts of the sanctions program have had an impact on Russia’s production and export of these commodities (Glauber and Laborde, 2022). Russia’s wheat exports have recovered after an initial shock. Exports of anhydrous ammonia, potash and urea are down substantially from this time last year. Russia has also imposed taxes and other restrictions on its exports, which has contributed to the reduced supply of its commodities on global markets.

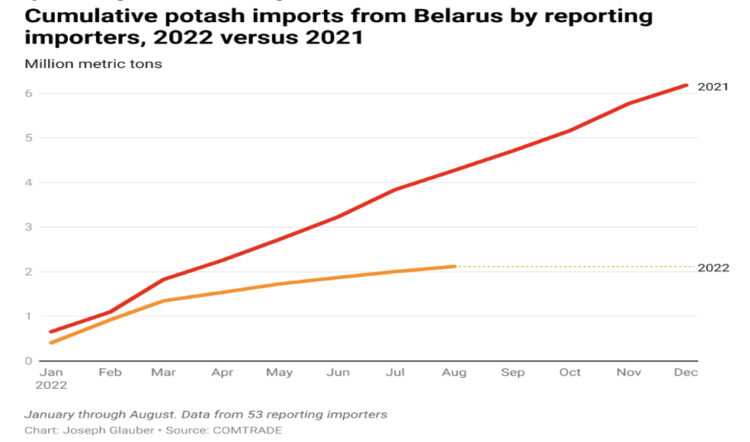

Belarus – an ally of Russia that allowed its territory to be used as a launching pad for the invasion – depends heavily on exports of potash, so potash has been included in the sanctions package on Belarus. Although most agricultural commodities and fertilizers are exempt from the sanctions imposed on Russia, these sanctions also include potash, an attempt by western countries to avoid the possibility that Belarusian exports would move through Russian ports. Using other countries’ import data to track Belarusian exports, Glauber and Laborde (2022) calculate that year-to-date exports of Potash from Belarus in 2022 were half the value of the counterpart figure for 2021. See Figure 2.

Figure 2. Imputed Belarusian exports of Potash, Year-to-date 2021 vs. 2022

Source: Glauber and Laborde (2022)

The war also caused substantial disruptions to global energy markets, though these effects have moderated substantially since the first weeks of the war. It is likely that the largest disruptions were to Europe’s regional market for natural gas. While the disruptions to the natural gas market have been largely offset by various market and policy changes, one of these changes has been to limit EU fertilizer production, which usually relies on imported natural gas to produce ammonia (Giles, 2022).

The war also disrupted global oil markets, which saw enormous price spikes in early 2022. Prices of petroleum-based energy rose as well, but have fallen more recently. Retail prices for diesel fuel peaked in June and have slowly drifted lower, while remaining elevated relative to lows observed in 2020 and 2016. See Figure 3.

Figure 3. Retail Price of Diesel Fuel (on Highway), in Dollars per Gallon.

Source: Federal Reserve Bank of St Louis FRED database, using Energy Information Administration data

Outlook

It is difficult to project either the duration or outcome of the war. Whatever developments occur, it seems likely that sanctions on Russia and Belarus will endure for several years to come. While grain and oilseed markets might be expected to stabilize eventually, it would seem unlikely that this will occur in the upcoming year. Fertilizer markets (especially Potash) may be disrupted until sanctions on Russia and Belarus are lifted, an event that is unlikely in the next several years. The effects of initial shocks to oil markets appear to be receding, though costs of diesel fuel remain at elevated levels.

Global currency markets

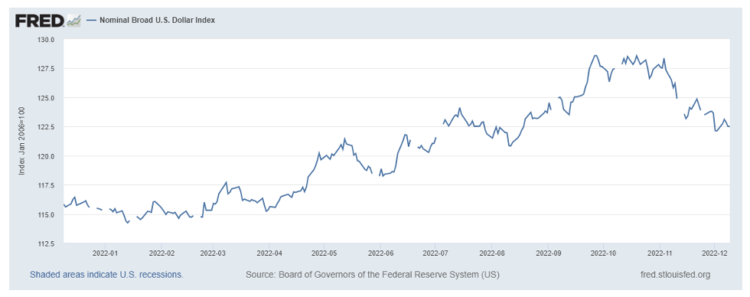

The increase in prices of fuels, agricultural commodities and fertilizers after the outbreak of the war magnified already existing inflationary pressures in the U.S. and global economies. Following an inflationary spike early in 2022, many central banks raised interest rates. These moves are relevant for international trade because they affect the relative value of different countries’ currencies. Partially due to higher interest rates, and partially due to its role as a safe haven currency in a crisis, the U.S. dollar rose against most currencies. Figure 4 shows a U.S. nominal dollar index reported by the St Louis Federal Reserve Bank. The U.S. dollar rose by roughly 10 percent from January to October, though half of that gain had been erased by December.

Figure 4. U.S. dollar Index, 2022

Source: Federal Reserve Bank of St Louis FRED database, 2022

Fluctuations in currency markets affect international trade outcomes because they affect the short-run US dollar prices of inputs and commodities sourced from, and sold to, foreign markets. A stronger U.S. dollar makes goods produced by other countries appear relatively cheaper in U.S. dollar terms, while products produced in the U.S. become more expensive in foreign currency terms. Holding fixed other forces that affect prices, a rising dollar allows inputs to be purchased more cheaply. A strong dollar also makes U.S. exports less competitive in foreign markets.

Outlook

Forecasting developments in currency exchange markets is extremely difficult. That said, a guess about developments in 2023 is useful for setting expectations. There are signs that U.S. inflation is subsiding, which may lead the U.S. Federal Reserve to ease monetary policy, at least relative to monetary policy made by other countries’ central banks. If this occurs, one would expect the U.S. dollar to fall back, as it has begun to do already. Such moves would make imported inputs (such as fuels and fertilizers) more expensive in US dollar terms, even as it enhanced the competitiveness of U.S. produced commodities on foreign markets. It does seem likely that the 2023 will see continued volatility in US dollar exchange rates, as central banks are unlikely to be coordinate their actions in a way that limits fluctuations in currency markets.

U.S. Trade policy developments

In recent years, U.S. trade policy developments have been a centerpiece of this review. Unlike most recent presidential administrations, the Biden administration has deemphasized trade policy as an area of priority. In one form or another, Presidents Reagan, Bush Sr., Clinton, Bush Jr. and Obama pursued trade liberalization by negotiating preferential trade agreements with willing partner countries. President Trump took a different path, but protectionist trade policy was nonetheless a highly visible part of his foreign policy. While trade policy has taken a back seat to other matters in the Biden Administration, there are still trade relevant developments worth discussing.

The Biden Administration’s Russian sanctions policy is first and foremost an international security policy, but nonetheless has obvious links to trade policy. In the early stages of the policy, financial restrictions were the most consequential. But restrictions on sales of most manufactured products to the Russia – both by the US and by its allies – appear to be damaging Russia’s ability to produce advanced weaponry (Sytas, 2022). An ongoing project at Yale University is tracking the deleterious effects of sanctions on the broader Russian economy (Sonnenfeld, 2022). Russia has stopped publishing most of its economic statistics, and this project is tracking other information that informs our understanding of how sanctions are affecting the Russian economy. It seems that the sanctions are producing significant economic damage there.

In a related set of policy moves, the Biden Administration has begun to impose export controls on high technology goods (especially advanced semi-conductors) that are destined for China (Tewari and Josephs, 2022). These actions seem to be motivated both by longer run national security concerns and by an attempt to use industrial policy to re-shore production of high-tech goods in the United States. The Chinese have appealed to the World Trade Organization, which the Biden administration argues is an inappropriate forum for adjudicating the dispute. It seems plausible that this policy poses a short-term risk for export-oriented agriculture, since the Chinese may choose to retaliate with tariffs on U.S. agricultural products. The deterioration of the WTO as a forum for mediating trade distributes also poses a longer run challenge for export-oriented US agriculture.

The restrictions on China, together with large subsidies for electric vehicle production in the U.S. is also affecting US relationships with its traditional allies, especially those in Europe. Export controls on advanced semiconductors are also being imposed on foreign firms (firms based in the Netherlands and Japan, for example), using those firms’ desire to access to the U.S. market as leverage. The large subsidies on electric vehicle production were part of the Inflation Reduction Act of 2022. The goal of the subsidies was to encourage US production of electric vehicles, relative to China. But the policy has also ruffled feathers in Japan, Korea and Europe, with potential implications for further foreign policy cooperation and for the strength of multilateral institutions such as the WTO (Feingold, 2022)

Outlook

Both the export controls and the electric vehicle subsidies implemented by the Biden Administration are forms of industrial policy that aim to support development of particular sectors. Economists are usually skeptical of such efforts, while acknowledging that there can be a role for trade policy in pursuing national security goals. In terms of the prospects for U.S. agricultural exports, past trade policy outlooks have lamented the ongoing weakening of multilateral trade institutions, especially the WTO. The weakening of the WTO poses a long-run problem for export-oriented agriculture. The rise of China, makes policy making difficult, no doubt; but the apathy of the Biden Administration towards multilateral institutions, in the wake of outright hostility by the Trump Administration, is reason for real concern about the future of both multilateral trade negotiations and rules-based adjudication of international trade disputes.

References

Feingold, Spencer (2022) “What the world thinks about the new US electric vehicle tax plan,” World Economic Forum Blog Post, November 16.

Giles, Chris (2022) “The end of Europe’s energy crisis is in sight,” Financial Times, October 27, https://www.ft.com/content/8c4f9b6f-7770-490e-83e8-3fdd12f7a99f

Glauber, Joseph and David Laborde (2022) “How sanctions on Russia and Belarus are impacting exports of agricultural products and fertilizer” International Food Policy Research Institute Blog post, Nov 9, 2022.

Hillberry, Russell (2022) “Trade and trade policy outlook, 2022”, Purdue Ag Econ Report: Agricultural Outlook for 2022 https://ag.purdue.edu/commercialag/home/paer-article/trade-and-trade-policy-outlook-2022/

Legrand, Nicolas (forthcoming) “War in Ukraine: The Rational “Wait-and-See” Mode of Global Food Markets,” Applied Economic and Policy Perspectives

Sonnenfeld, Jeffrey (2022) “Business Retreats and Sanctions Are Crippling the Russian Economy,” Russian Economic impact Slide Deck, August 2022 v6.pdf, Yale University.

Sytas, Andrius (2022) “Sanctions hamper Russia’s ability to make advanced weapons, NATO says,” Reuters, September 16.

Tewari, Suranjana and Jonathan Josephs (2022) “US-China chip war: How the technology dispute is playing out,” BBC News, December 16.