Producer Sentiment and Resilience at the Purdue Top Farmer Conference

May 15, 2024

PAER-2024-15

Margaret Lippsmeyer, Graduate Research Assistant; Michael Langemeier, Associate Director of Center for Commercial Agriculture and Professor of Agricultural Economics; James Mintert, Director of Center for Commercial Agriculture and Professor of Agricultural Economics; and Nathan Thompson, Associate Professor of Agricultural Economics

Introduction

Each year in early January, Purdue University hosts the Top Farmer Conference, where academic speakers, agribusiness affiliates, and farmers convene to discuss current issues and trends in agricultural markets. Discussion at this year’s conference included an outlook of the U.S. economy, future impacts of biofuel on production agriculture, corn and soybean outlooks, and policy implications of the new Farm Bill. In addition to these discussions, we invited participants at this year’s conference to complete a brief survey assessing farm resilience, producer sentiment, and farm growth expectations.

Using survey instruments identical to those used to assess producer sentiment in the Purdue-CME Group Ag Economy Barometer and those used to assess resilience and farm growth in Lippsmeyer et al. (2024), we compared producer responses from the Top Farmer Conference to responses from the national surveys. The Purdue-CME Group Ag Economy Barometer uses a series of five questions to discern the attitudes and sentiments of agricultural producers regarding the status of the U.S. farm economy (Purdue University, CME Group, 2024). Lippsmeyer et al. (2024) investigates the interaction between producer sentiment, farm resilience, risk preference, managerial ability, and farm growth expectations, uncovering statistically significant relationships among these variables. At this year’s Top Farmer Conference, a total of 52 survey responses from agricultural producers were collected at the conference. We use t-tests to compare statistical differences in mean survey responses across groups.

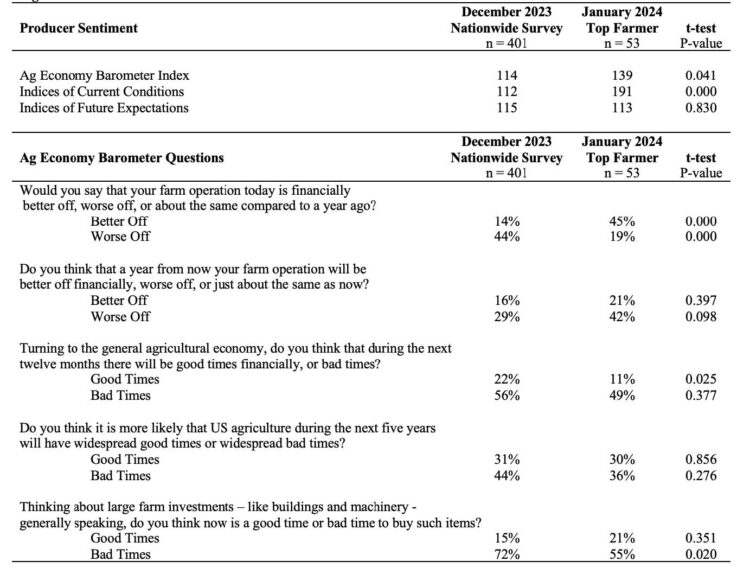

Producer Sentiment

In December 2023, the Ag Economy Barometer recorded a reading of 114, with the Index of Current Conditions slightly lower at 112 and the Index of Future Expectations slightly higher at 115 (Mintert and Langemeier, 2024). The Farm Capital Investment Index for December 2023 stood at 43, changing only by one point compared to the previous month. This index gauges respondents’ perceptions of the suitability of the current time for making large farm investments in things like machinery and buildings. The average value of the Farm Capital Investment Index over the past five years has been 52, which suggests that producers believe it has been a relatively unfavorable time to make large farm investments.

In contrast, the Farm Capital Investment Index for Top Farmer Conference attendees reported a value of 66. Responses show that although the current period might not be ideal for large farm investments, Top Farmer Conference attendees are significantly more optimistic compared to their counterparts in the nationwide survey, more so than most producers have been over the past five years. Similar trends are also apparent for metrics of producer sentiment, with producer participants at the 2024 Purdue Top Farmer Conference displaying a more optimistic outlook toward the state of the agricultural economy (Table 1). The Ag Economy Barometer Index for 2024 Purdue Top Farmer Conference participants had a reading of 139, with a notably higher Index of Current Conditions at 191. At 113, the Index of Future Expectations aligns with national levels.

Table 1. Measurements of Producer Sentiment

There are several potential explanations for this disparity in producer sentiment. First, higher sentiment, particularly for the Index of Current Conditions, may be due to the higher-than-expected corn and soybean yields across the Midwest, particularly in Indiana and Ohio, despite early-season drought conditions. Drought conditions were present throughout Indiana between May and August 2023 (National Drought Mitigation Center, 2023), but yield reports from the 2023 season show record-high yields for both corn and soybeans (USDA NASS, 2024). Since the conference attendees are predominantly from the Midwest, their sentiment following a comparatively successful season is much more positive than that of producers who experienced less favorable growing conditions in 2023. Other possible explanations include some degree of selection bias associated with the sample from the 2024 Purdue Top Farmer Conference. Sulewski and Kłoczko-Gajewska (2014) find that producers who are more risk-seeking are those who engage cooperatively and join producer groups, providing reason to assume conference attendees who choose to engage in similar interactive settings may have lower risk aversion. Moreover, differences are likely apparent between the farming operations of conference attendees and respondents from the nationwide assessment in terms of farm size and income levels. These differences likely buffer producer sentiment of conference attendees relative to the national producer sentiment levels reported in the December 2023 Ag Economy Barometer survey.

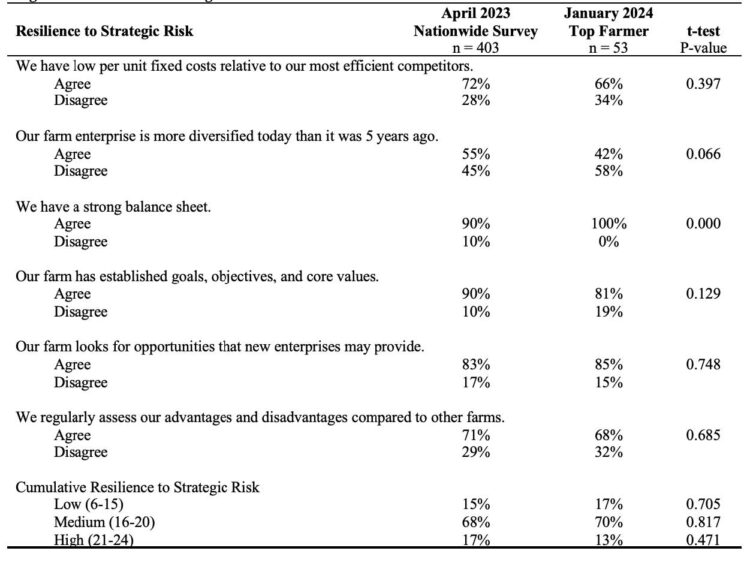

Resilience to Strategic Risk

Resilience to strategic risk reflects a farm’s capacity to adapt to changes and endure adverse market conditions. Our survey asked a series of six questions aimed at assessing resilience via a farm’s agility and absorption capacity. These questions were adapted from Sull (2009) and asked about the use of farm financial metrics, diversification, balance sheet strength, routine procedures, goals and objectives, and assessing new opportunities.

Agility and absorption capacity are often viewed as two distinct strategies through which farm managers build resilience to strategic risk. Agility encompasses a farm’s ability to spot and exploit changes in the market in a timely fashion, and absorption capacity is the ability to withstand changes or shocks in input and output markets (Sull, 2009). At the Purdue Top Farmer Conference, resilience to strategic risk was confirmed to be of significant interest, with 98% of survey respondents expressing either moderate or high interest in learning more about strategic risk, its impact on their operations, and strategies for building farm resilience.

In April 2023, the Purdue Center for Commercial Agriculture conducted a nationwide survey to better understand the average commercial producer’s resilience to exogenous market shocks. These survey results were used to assess producer resilience levels on a nationwide basis. The same survey questions were used to assess resilience levels of Top Farmer Conference attendees, yielding strikingly similar results (Table 2). Statistical tests comparing the resilience of the two groups found the aggregate measures of resilience to be virtually identical. However, nuanced differences are apparent when resilience is broken down by component survey questions. The most notable discrepancies were observed in responses regarding farm diversification and balance sheet strength.

Table 2. Resilience to Strategic Risk

From the April 2023 survey, 55% of respondents reported that their farm enterprises were more diversified than five years ago. In contrast, only 42% of Top Farmer participants indicated increased diversification in their enterprises over the past five years. Farm diversification is considered a key metric for resilience, as it reduces reliance on any single enterprise. By diversifying, farms reduce dependence on any singular revenue stream, thus reducing risk from any given enterprise. Yet, specialization remains an attractive business strategy for many, containing greater risk but boosting opportunities to garner economies of scale and increase profit margins. The lower diversification rate among Top Farmer Conference participants was relatively unsurprising given that attendees were primarily Midwestern farmers specializing in corn and soybean production.

Given that resilience scores are cumulative, and diversification was lower for Top Farmer participants, yet overall resilience levels were consistent across groups, producers must excel in another metric of resilience. That metric was financial performance, measured by balance sheet strength. Notably, 100% of attendees at the Purdue Top Farmer Conference indicated they had a strong balance sheet in a self-assessment question.

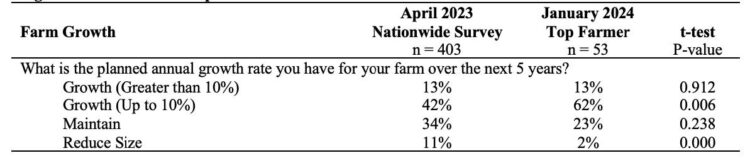

Farm Growth Expectations

In conjunction with questions on resilience and producer sentiment, participants were asked about their annual farm growth expectations. Responses to this question from Top Farmer Conference attendees were compared to responses from the Purdue CCA resilience survey conducted in April 2023 (Table 3). Of the respondents, 11% from the nationwide survey indicated plans to reduce farm size, 34% intended to maintain their farm size, and 55% aimed to grow their operations in the next five years. Of the 55% expecting to grow their operation over the next five years, 42% expect to grow their operations up to 10% annually, and 13% expect to grow at a rate greater than 10% annually. In contrast, at the Top Farmer Conference, a mere 2% of participants planned to reduce the size of their farms, 23% intended to maintain their current size, and 75% planned to expand their operations in the coming five years. Of the 75% expecting to grow their operation over the next five years, 62% expect to grow up to 10% annually, and 13% expect to grow at a rate greater than 10% annually. These trends show that not only do producers attending the Top Farmer Conference exhibit a greater propensity to continue farming, but a significantly larger proportion of this group expects their operation’s size to grow compared to counterparts in the nationwide survey.

Table 3. Farm Growth Expectations

Conclusions

Producer sentiment of Top Farmer Conference attendees had extremely optimistic readings, with the Index of Current Conditions at 191. In comparison, the nationwide Index of Current Conditions for December of 2023 (just a few weeks prior) was 115. These results show that producers at the Purdue Top Farmer Conference had much more optimistic outlooks toward the state of the agricultural economy relative to the nationwide sample.

Differences in the Farm Capital Investment Index were also apparent between groups, with an index value of 66 for attendees at the Top Farmer Conference in December 2023 versus the nationwide December 2023 index value of 43. Based on index values, producers at the Top Farmer Conference have much more positive perceptions of the suitability of the current time for making large farm investments. Similar trends were apparent for farm growth expectations, with 75% of producers at the Top Farmer Conference expecting to grow their operation over the next five years versus only 55% of producers expecting to grow their operation based on responses from the nationwide survey.

The consistency in resilience levels across producer groups can be largely attributed to the lower diversification levels observed among conference attendees. While diversification can mitigate risk, specialization can also be a strategic business approach. Specialization may lower operational fixed costs, enhance production efficiencies, and improve profitability. Therefore, a slight decrease in resilience might be a trade-off that producers are willing to accept, adopting a business strategy that entails higher risk for the possibility of higher returns.

References

Lippsmeyer, M., Langemeier, M., Mintert, J. & Thompson, N. (2024). Farm Resilience, Management Practices, and Producer Sentiment: Segmenting U.S. Farms Using Machine Learning Algorithms. Paper presented at the Southern Agricultural Economics Meetings, Atlanta, Georgia, February. https://ag.purdue.edu/commercialag/home/wp-content/uploads/2024/04/20240404_SAEA-Conference-Paper-Final-MLipp.pdf

Mintert, J. & Langemeier, M. (2024). U.S. Farmer Sentiment Stable As Inflation Expectations Subside, s.l.: Purdue Center for Commercial Agriculture. https://www.purdue.edu/newsroom/releases/2024/Q1/u.s-farmer-sentiment-stable-as-inflation-expectations-subside.html

National Drought Mitigation Center. (2023). U.S. Drought Monitor, Lincoln: University of Nebraska-Lincoln.

Sulewski, P. & Kłoczko-Gajewska, A. (2014). Farmers’ Risk Perception, Risk Aversion and Strategies to Cope with Production Risk: An Empirical Study from Poland. Studies in Agricultural Economics, pp. 140-147. https://doi.org/10.7896/j.1414

Sull, D. (2009). The Upside of Turbulence: Seizing Opportunity in an Uncertain World. New York: Harper Collins Publishers.

USDA NASS. 2024. Indiana Agriculture Report, East Lansing: United States Department of Agriculture.