The concept of “Food as Health” has entered the everyday language of agrifood. Executives across the value chain discuss it, consumers signal growing interest in healthier food choices, and regulators are beginning to weigh in. But recognition and action are not the same. The latest Agrifood Economy Index reveals that although the concept is widely acknowledged, few companies have taken the step of making it a true strategic priority.

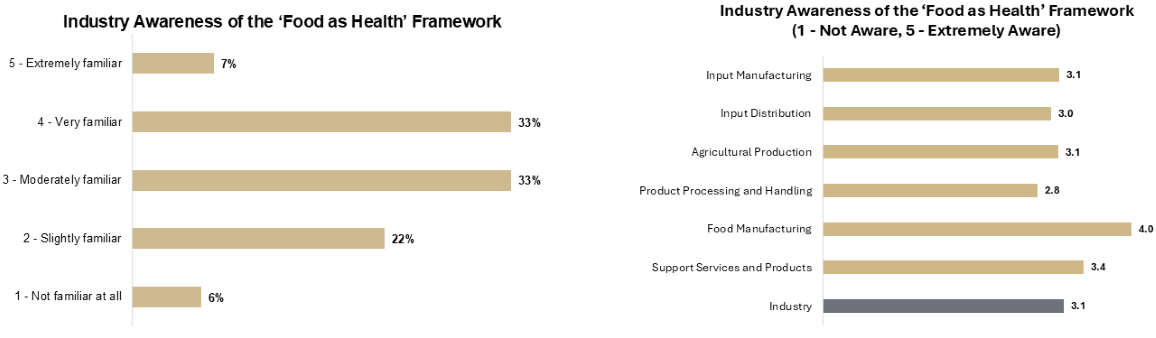

This hesitation shows up in several ways. Most executives, nearly three-quarters of those surveyed, say they are at least moderately familiar with Food as Health. Yet only 7% describe themselves as extremely familiar, showing that breadth of awareness has not translated into depth. The differences across the value chain are also telling. Food Manufacturing executives report the strongest familiarity (4.0 out of 5), while Processing and Handling lags at 2.8. The closer a company is to the consumer, the greater the pressure to engage with the nuances of health-driven demand.

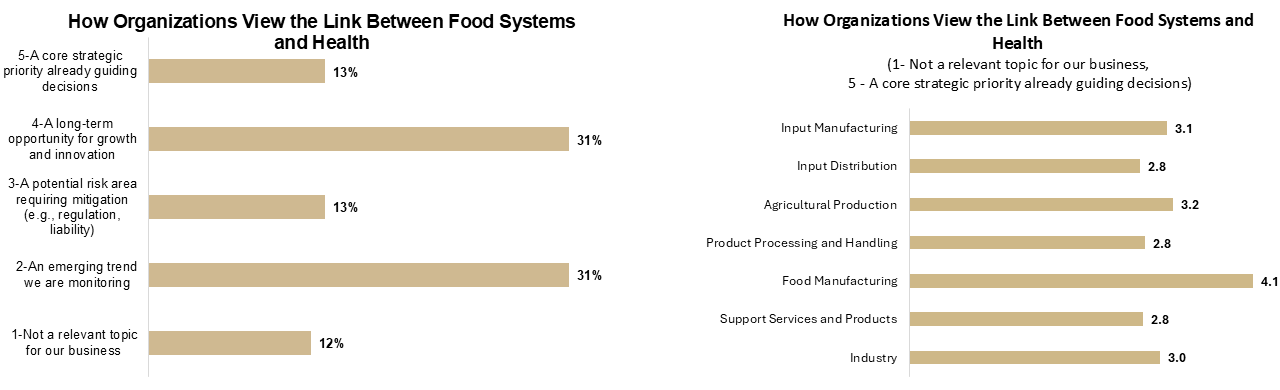

That uneven familiarity carries over into strategy. When asked how they view the concept, 31% of executives identified Food as Health as a long-term growth opportunity; another 31% said it is an emerging trend worth monitoring. In contrast, only 13% currently treat it as a core strategic priority. Once again, food manufacturers stand apart, scoring 4.1 on prioritization, while most upstream and support segments fall below 3.0. The pattern is clear: Companies recognize the importance of Food as Health, but most are not yet willing to integrate it into their day-to-day decisions.

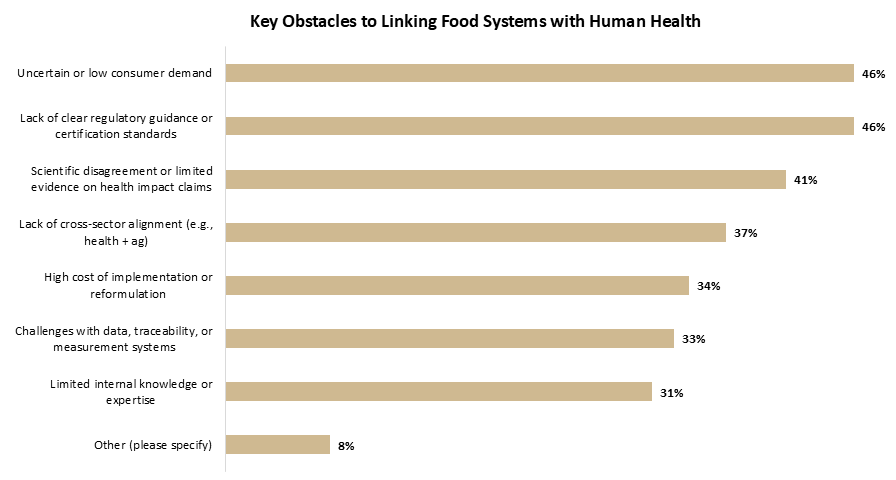

Why the reluctance? The explanation lies less in what companies can do and more in what they believe the environment will allow them to do. When asked about barriers, executives pointed first to external uncertainties: Uncertain consumer demand (46%) and a lack of regulatory clarity (46%) topped the list. On the consumer side, this uncertainty is warranted. Our data show that Taste and Affordability have consistently ranked at the top of the food attributes list from a consumer perspective, with Nutrition appearing in third position. Scientific disagreement (41%) and limited cross-sector alignment (37%) added to the hesitation. By contrast, internal hurdles such as cost (34%), data challenges (33%), and limited expertise (31%) ranked lower. These responses suggest that the industry is not frozen because it lacks capacity, but rather because it lacks confidence in the direction the market is heading.

Taken together, these findings show an industry that knows where the future is heading but has not yet committed to shaping it. The concept of Food as Health is widely recognized, but it has not become central to strategy across most of the value chain. That gap creates a disconnect: Executives agree it will matter, yet few are taking the steps that would allow them to turn recognition into advantage.

For agrifood leaders, this disconnect carries real consequences. Waiting may seem prudent in the face of uncertain demand and regulatory ambiguity, but delay also comes at a cost. Companies that stand back will eventually have to adapt to standards defined by others, whether those are set by competitors, policymakers, or consumer expectations. By contrast, those who choose to engage now can do more than anticipate change— they can shape it.

Acting early does not mean overhauling the business overnight. It means using the current period of uncertainty to build a position. That could involve running small pilots that test consumer response to health-driven offerings, investing in stronger internal expertise so strategy is informed by evidence rather than assumption, or engaging in coalitions that work to align industry and policy. These steps reduce risk by generating clarity, but they also build credibility—signals to the market that a company is prepared to lead rather than follow.

The barriers identified in the survey—uncertain demand, regulatory ambiguity, scientific debate—are often framed as reasons to wait. In reality, they highlight where leadership is most valuable. Answering consumers’ informational demands, supporting rigorous science, and contributing to emerging standards are not distractions from strategy; they are investments in creating the conditions for growth. Companies that lean into these areas will not only strengthen their own readiness but also influence the playing field on which others will eventually compete.

This transitional stage will not last long. As evidence accumulates, demand signals sharpen, and regulatory guidance takes shape, the pace of change will accelerate. Companies that have already built familiarity, tested models, and engaged externally will be ready to scale quickly. Those who have sat back will find themselves reacting to a market defined without them.

Food as Health will become a defining feature of the agrifood economy. The question is whether companies will be prepared to lead its development or be left adjusting to the standards and expectations set by others. If your organization is ready to start moving from recognition to action, we invite you to reach out. Together, we can explore how to turn these insights into concrete steps that position you to lead as this future unfolds.