Last month, I wrote about the recognition-action gap in our industry and how widespread awareness of Food as Health hasn’t translated into strategic commitment. The data painted a picture of an industry that understands where the future is heading but hasn’t yet committed to shaping it. Now, with deeper consumer research in hand, that hesitation begins to look less like strategic paralysis and more like market intelligence.

The story that emerges from combining industry and consumer data, derived from the Agrifood Economy Index and the Consumer Food Insight surveys, respectively, is more nuanced than either dataset reveals alone. It suggests that the collective caution we observed may actually reflect a deep understanding of market realities that aren’t immediately apparent from surface-level consumer research. More importantly, it reveals why the companies that do move decisively now may find themselves with sustainable competitive advantages.

The Consumer Confidence Paradox

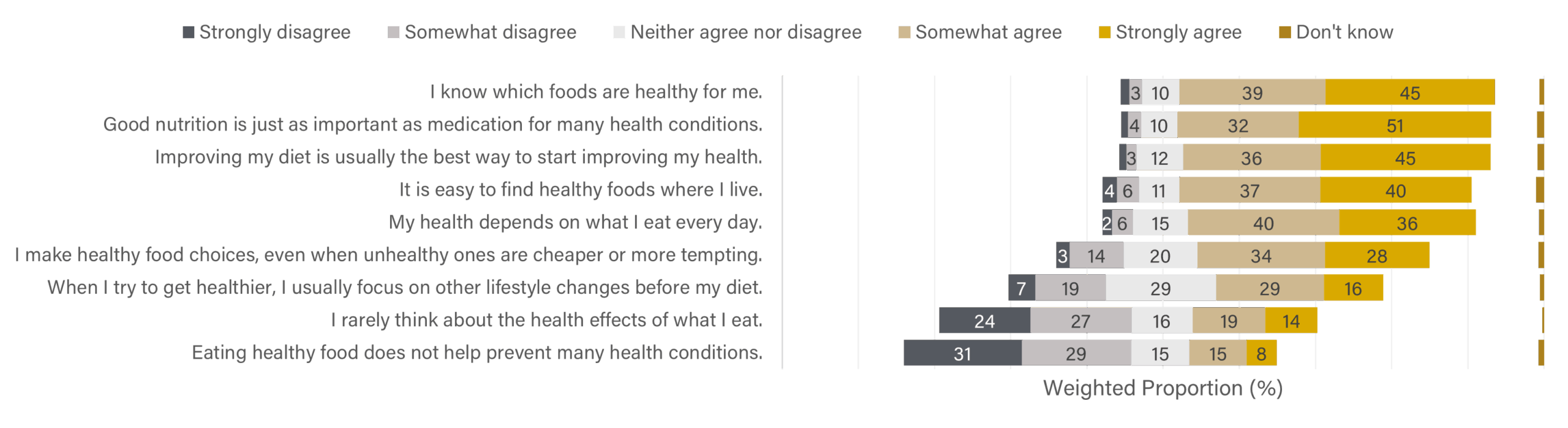

Consumer research reveals something that helps explain our industry’s uncertainty about market signals. While 84% of consumers believe they know which foods are healthy, and 83% view good nutrition as critically important as medication, a significant perception-reality gap emerges when we examine actual behaviors and dietary outcomes.

Consumers consistently overestimate the quality of their own diets when compared to objective nutritional assessments. This isn’t consumer irrationality— it’s human nature. But it creates a market dynamic where confident consumers may be making suboptimal choices while believing they’re on track. This explains much about why the industry struggles to interpret demand signals, even amid apparent consumer interest in health-focused products.

The implications extend beyond product development into fundamental questions about market sizing and consumer segmentation. When consumers express strong health intentions but demonstrate persistent gaps between stated preferences and purchase behaviors, traditional market research approaches may systematically overestimate demand for premium health positioning.

When External Barriers Align

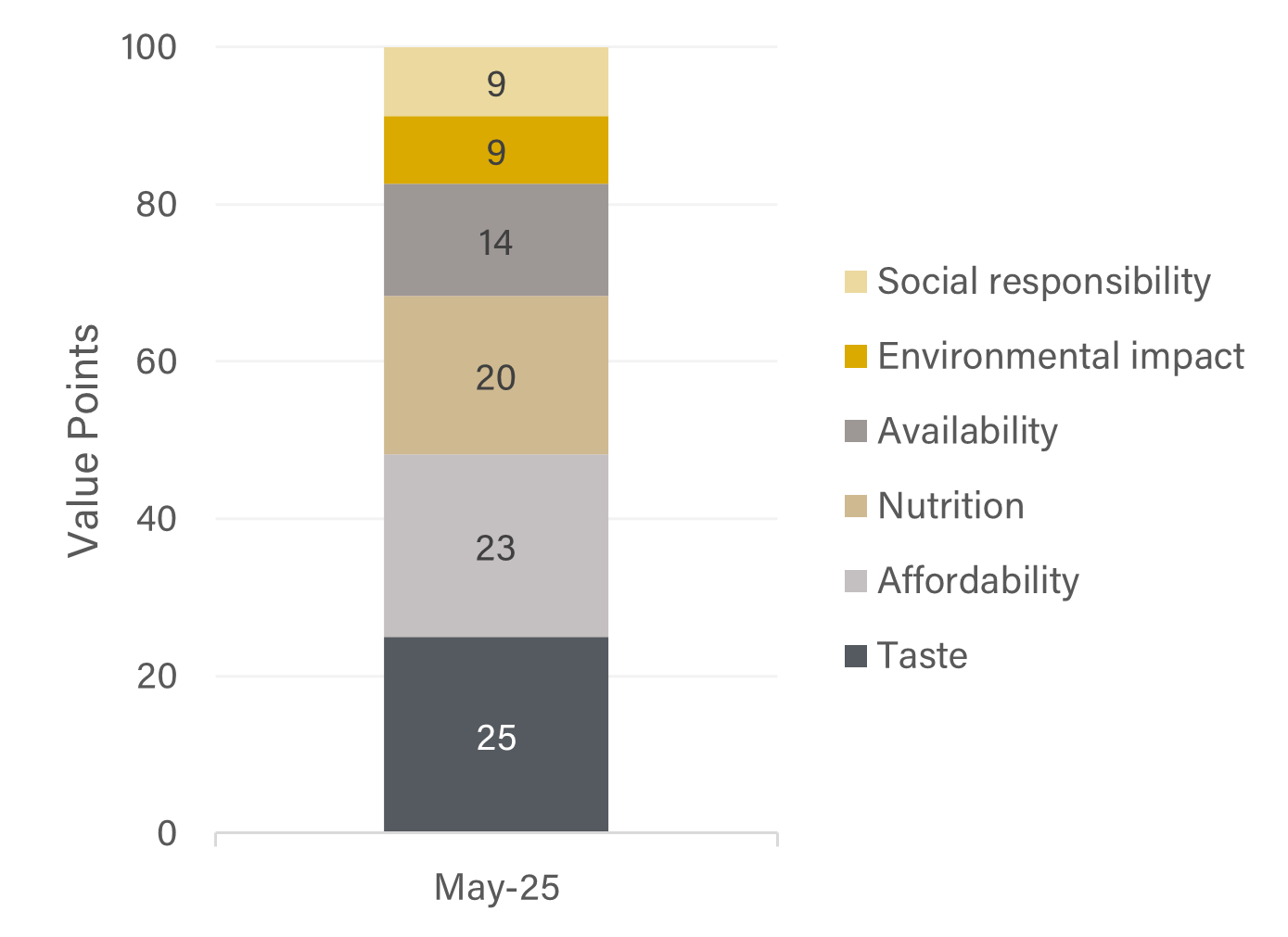

The 46% of industry executives citing uncertain consumer demand as a primary barrier weren’t imagining obstacles; they were detecting real market complexity. Consumer data validates this uncertainty, showing that even health-conscious consumers prioritize practical considerations when making actual buying decisions.

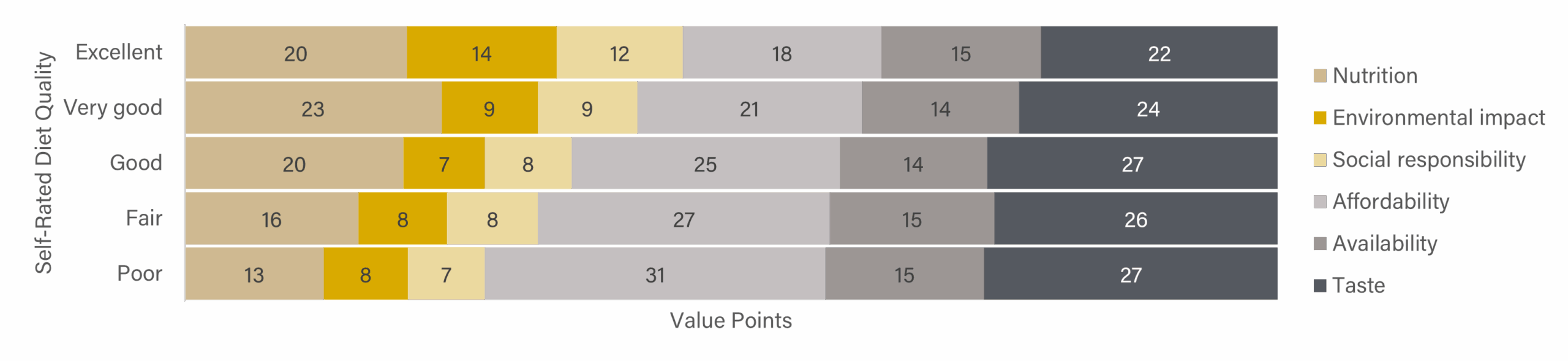

Taste and affordability consistently outweigh nutrition across consumer segments, including those who rate their diets as excellent. This creates exactly the uncertain demand-environment that tops our industry’s barrier list. The alignment between industry hesitation and consumer behavior patterns suggests that the industry’s collective caution reflects good market reading rather than strategic timidity.

However, this alignment also reveals where competitive advantage may be available. Rather than waiting for consumers to reprioritize nutrition over taste and cost, which may not happen, the opportunity lies in delivering genuine health benefits within existing consumer constraint parameters. Companies that can make healthy options more affordable and better-tasting than current alternatives may discover more receptive markets than premium positioning typically achieves.

The Infrastructure Investment Pattern

Despite strategic uncertainty, our industry data revealed that when companies do invest in health-focused capabilities, they consistently prioritize operational foundations over product innovation. Data systems, supply chain relationships and strategic partnerships lead investment priorities while product development and marketing receive less immediate attention.

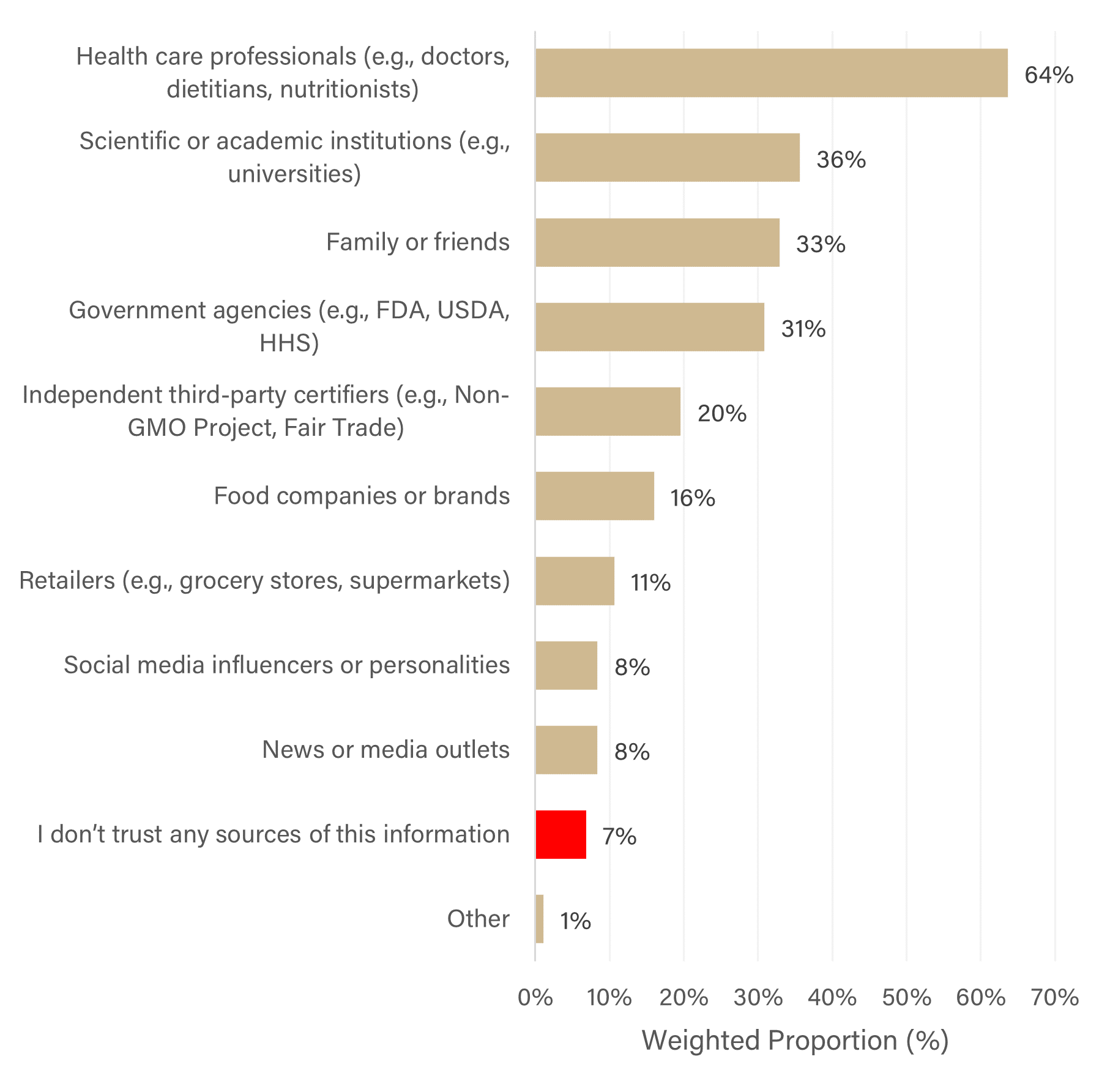

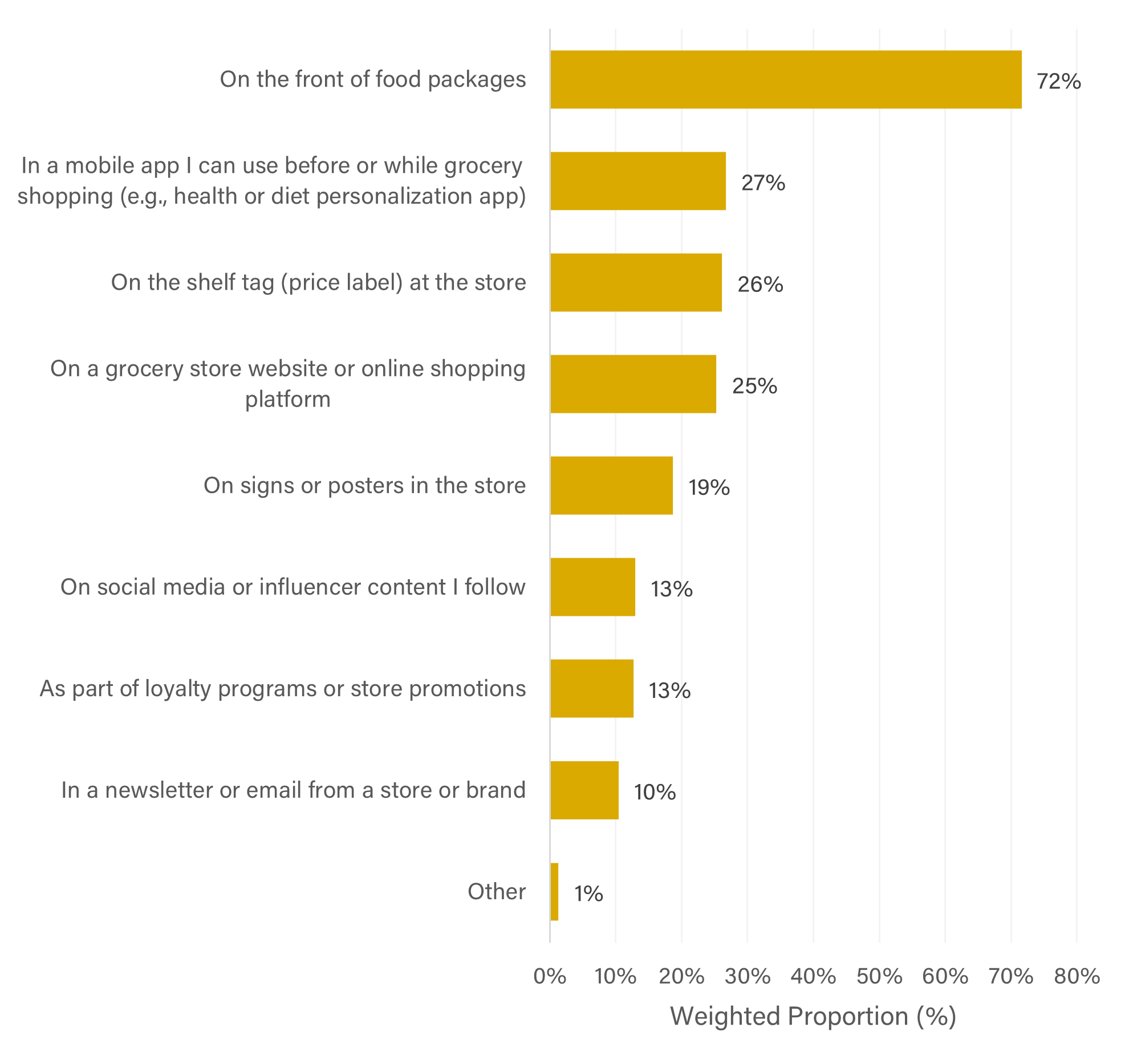

This infrastructure-first approach now appears particularly sophisticated when viewed alongside consumer trust and information preferences. Consumers overwhelmingly trust healthcare professionals and scientific institutions for nutritional guidance (64% vs. 16% for food companies), yet they want this trusted information delivered through product packaging during shopping experiences.

The companies investing now in comprehensive transparency systems, enhanced traceability and authentic communication capabilities are building exactly the infrastructure needed to bridge this credibility gap. Rather than betting on specific product directions or marketing messages, they’re creating operational foundations that enable authentic health positioning regardless of how specific regulatory or market pressures develop.

The Hidden Opportunity in Complexity

The convergence of industry hesitation and consumer complexity creates a counterintuitive strategic opportunity. While most companies wait for clearer signals, the market dynamics that create uncertainty also create competitive moats for companies willing to solve real problems rather than chase idealized positioning.

Consider cost barriers, which 54% of consumers cite as the primary obstacle to healthier eating. This isn’t a constraint that better marketing can overcome; it requires operational innovation that delivers genuine health benefits at accessible price points. Similarly, the 23% of consumers who find it hard to know which foods are healthy aren’t seeking more promotional claims; they want simplified, credible guidance at the point of purchase.

Companies building capabilities to address these practical barriers may discover that consumer demand for health-focused products is actually less uncertain than our industry believes—it’s just more constrained by real-world considerations than traditional market research typically captures.

Beyond Premium Positioning

Perhaps most importantly, the combined data suggest the industry may be approaching health positioning with assumptions that limit market potential. The focus on premium health claims mirrors consumer skepticism about company communications while potentially missing larger opportunities for mainstream health improvement.

The moderate perceived influence of health labels across our industry (71% of surveyed industry professionals see them as moderately influential, and only 2% as extremely influential) suggests significant untapped potential. But realizing that potential may require moving beyond defensive “free from” positioning toward comprehensive approaches that address consumer constraints rather than just regulatory compliance.

The 60% of consumers who want to eat more fruits and vegetables, and the 38% who want to read nutrition labels more carefully, represent market segments seeking solutions to practical challenges rather than premium products with health claims. Companies that help consumers bridge the gap between health intentions and daily realities may find more receptive markets than those targeting the much smaller segment willing to pay premiums for health positioning.

Strategic Implications

The recognition-action gap I described last month now appears more strategic than it initially seemed. The industry’s hesitation reflects an accurate reading of complex market dynamics rather than simple risk aversion. However, this complexity also creates a competitive opportunity for companies that move beyond waiting for clarity toward building capabilities that address real consumer needs.

The infrastructure investments, transparency systems and authentic communication approaches that enable successful health positioning require time to develop and implement effectively. Companies beginning this work now will be positioned to capitalize rapidly when external signals do clarify, while those waiting for perfect market conditions may find themselves scrambling to build capabilities under compressed timelines.

Most importantly, the data suggest that sustainable competitive advantage in food-as-health positioning will come from solving practical problems such as cost, taste, and information clarity, rather than from superior marketing of idealized health benefits. The companies that understand this distinction and act accordingly may discover that the uncertain demand-environment actually provides more opportunity than the premium health market that most strategic frameworks typically assume.

The window for building these foundational capabilities remains open, but the pace of change across regulatory, consumer and competitive landscapes suggests it won’t remain so indefinitely. For organizations ready to move beyond hesitation toward strategic preparation, understanding how industry dynamics and consumer realities intersect can inform more confident decision-making.

Contact us to explore how these insights can shape your organization’s approach to the evolving food-as-health landscape.