I would venture to guess that we have all purchased eggs at some point in our lives, whether for our morning breakfast sandwich, friend’s birthday cake or for our kids to decorate. Eggs are a staple in American diets. And while once criticized for their high cholesterol, eggs continue to be widely consumed for their high protein and healthy vitamin content. The average U.S. egg and egg product consumption rate nears 280 eggs per capita per year in 2022.

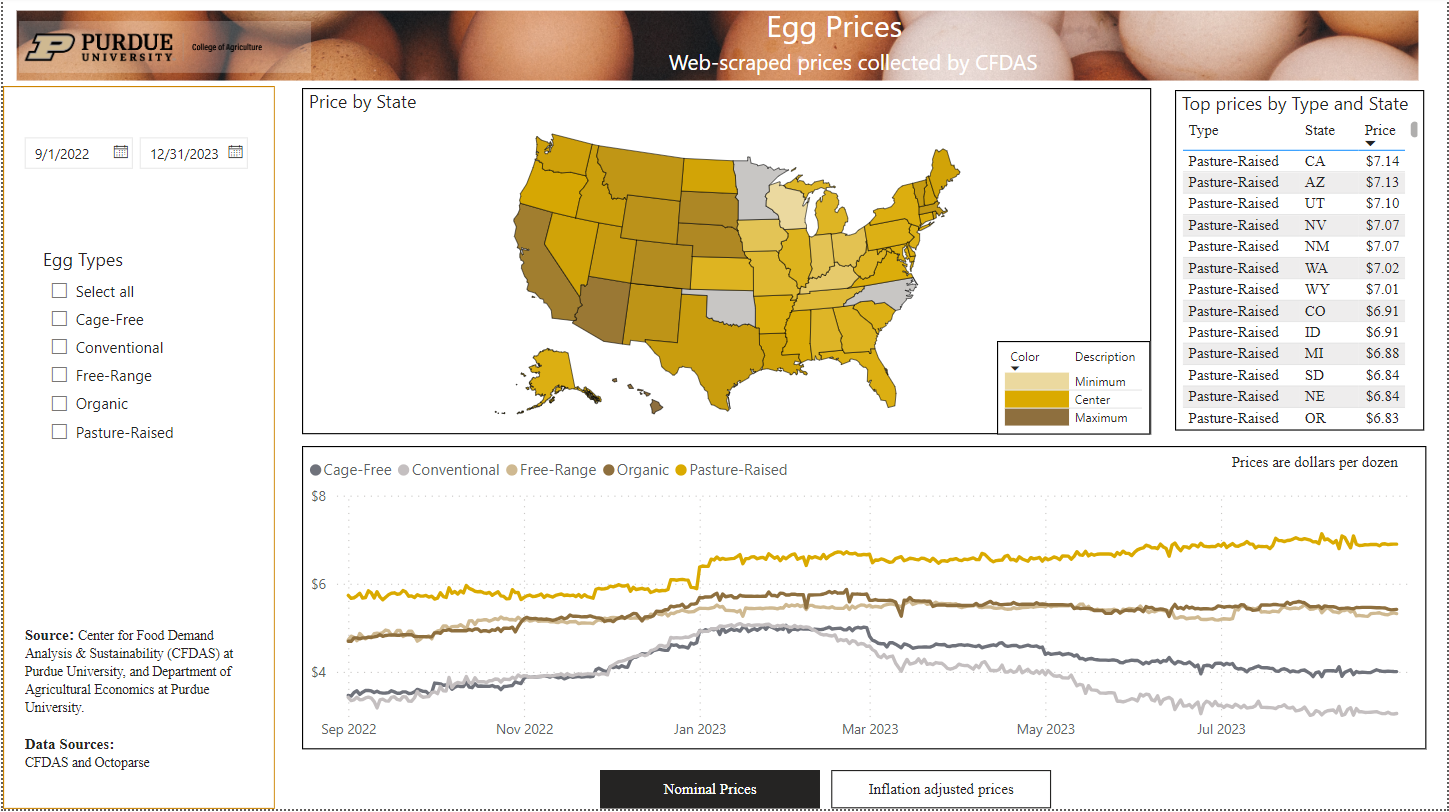

Considering the importance of eggs as a source of protein, the ongoing dramatic price swings over the past year have important implications for consumers and the firms along the egg supply chain. The Center for Food Demand Analysis and Sustainability (CFDAS) has built a new data dashboard that will help consumers, the egg and food industries and policy makers track the performance of the egg market. The CFDAS Egg Prices dashboard reports retail egg prices daily, starting from September 2022 and updated regularly, and will provide needed information on U.S. egg markets.

Economic research has shown demand for eggs to be “inelastic,” meaning consumers tend not to be very responsive to changes in price. One reason for this is that eggs do not have many direct substitutes and no other food has quite the same nutritional portfolio. Whether the price of eggs goes up or down, consumers will likely still buy the number of eggs they intended to buy for the week.

Another implication of inelastic demand for eggs is that any unexpected change in supply will cause a large swing in the price. We saw this story play out, true to a textbook case, over the last year. Beginning in February of 2022, avian influenza cases required U.S. farmers to euthanize thousands of egg laying hens to contain the outbreak. By January of 2023, nearly 45,000,000 egg laying hens were lost during this outbreak.

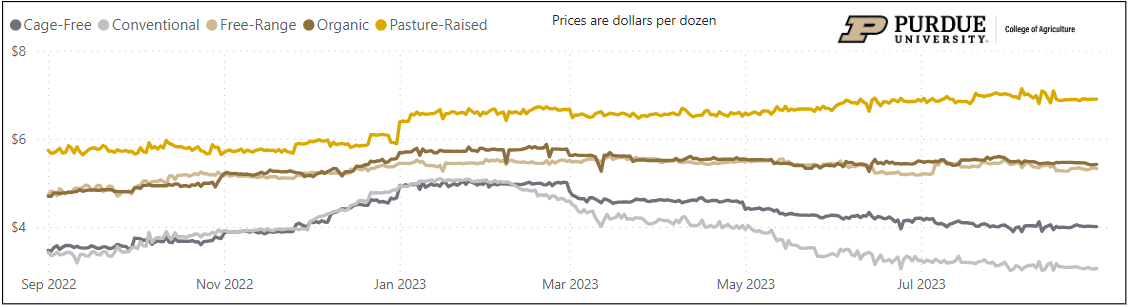

The 15% reduction in egg production resulted in a significant (near 66%) increase in the price of eggs. (See blog post by former CFDAS Director, Jayson Lusk.) By March 2023, prices finally began to drop for conventional and cage free eggs as supply began to recover. Now, the price of conventional eggs is back below what it was this time last year.

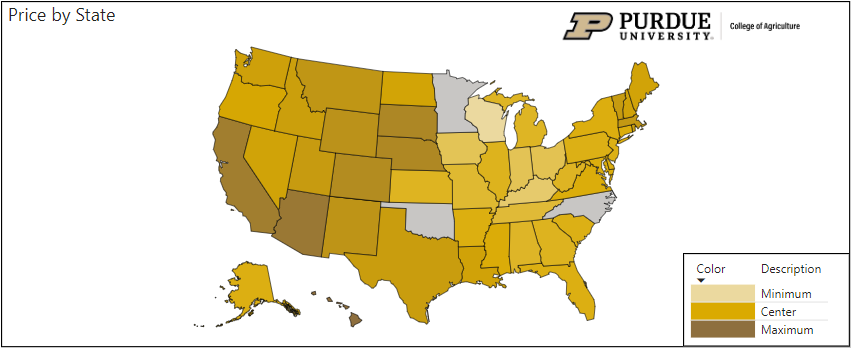

The dashboard reports data on retail prices of eggs scraped from the web sites of large grocery store chains. The dashboard plots prices over time for different production methods (conventional, free range, cage-free, etc.) for the U.S. and for each U.S. state.

The Egg Prices dashboard shows the well-documented increases in prices starting in fall 2022, peaking in early 2023, and returning to pre-spike levels by July 2023. The dashboard also reveals some new insights. For example, the largest price hike occurred for cage free and conventional eggs, as these egg-laying hens were the most impacted by the avian influenza.

Prices for organic, free-range, and pasture-raised eggs started at a higher level and didn’t rise as much as conventional eggs. But prices for these premium eggs have not fallen back to year-ago levels. The different egg-price trends means that the 2022-23 egg price episode played out differently for consumers and sellers of different types of eggs.

Our Egg Prices dashboard also provides a state-by-state comparison of egg prices. Hawaii has the highest price of conventional grade A, large eggs at $8.92/dozen and Missouri has the lowest at $1.96/dozen. Conventional egg prices tend to be lower in the southeast region and the east north central Midwest, than in the west. Going forward, this type of data could be important when evaluating supply chain disruptors, such as the avian influenza.

The holiday season is fast approaching, and historically, during these months, we observe that the demand for eggs increases. We can expect the price of conventional eggs to increase slightly should supply continue to remain constant.

If you are interested in egg prices, keep an eye on our Egg Prices dashboard and be sure to stay tuned by following our social media accounts for future dashboard releases. We seek to cover more food and beverages trends relevant to both industry insiders and consumers, and will continue to expand our web-scraped data portfolio.

For questions and/or inquiries related to this topic, you can contact us through this form or email chubbell@purdue.edu.

Footnote(s):

- We identify grocery stores chains that do not prohibit web-scraping. These chains have stores in all but three U.S. states: MN, OK and NC.