Over the last few months, food price inflation and inflation in general have been slowing. Also, the U.S. has so far avoided a recession that some observers have been predicting for a year, and indeed GDP growth remains resilient. While risk of a recession remains, the data thus far have given me reason to be relatively optimistic about the U.S. economy.

Yet, many Americans are feeling gloomy about the economy. The University of Michigan’s Index of Consumer Sentiment hit a 50-year low in Summer 2022, and while it has risen since then, consumer sentiment still remains lower than it was at the height of the COVID-19 pandemic.

This poses the question: Why do some experts and consumers seem to disagree about the state of the economy? Are optimistic economists like me out of touch with the real struggles of American families? Are average Americans getting swayed by gloomy social media influencers with bad data, as “The Daily” podcast seems to suggest? I think a little bit of data and some simple economic logic might help resolve the dissonance.

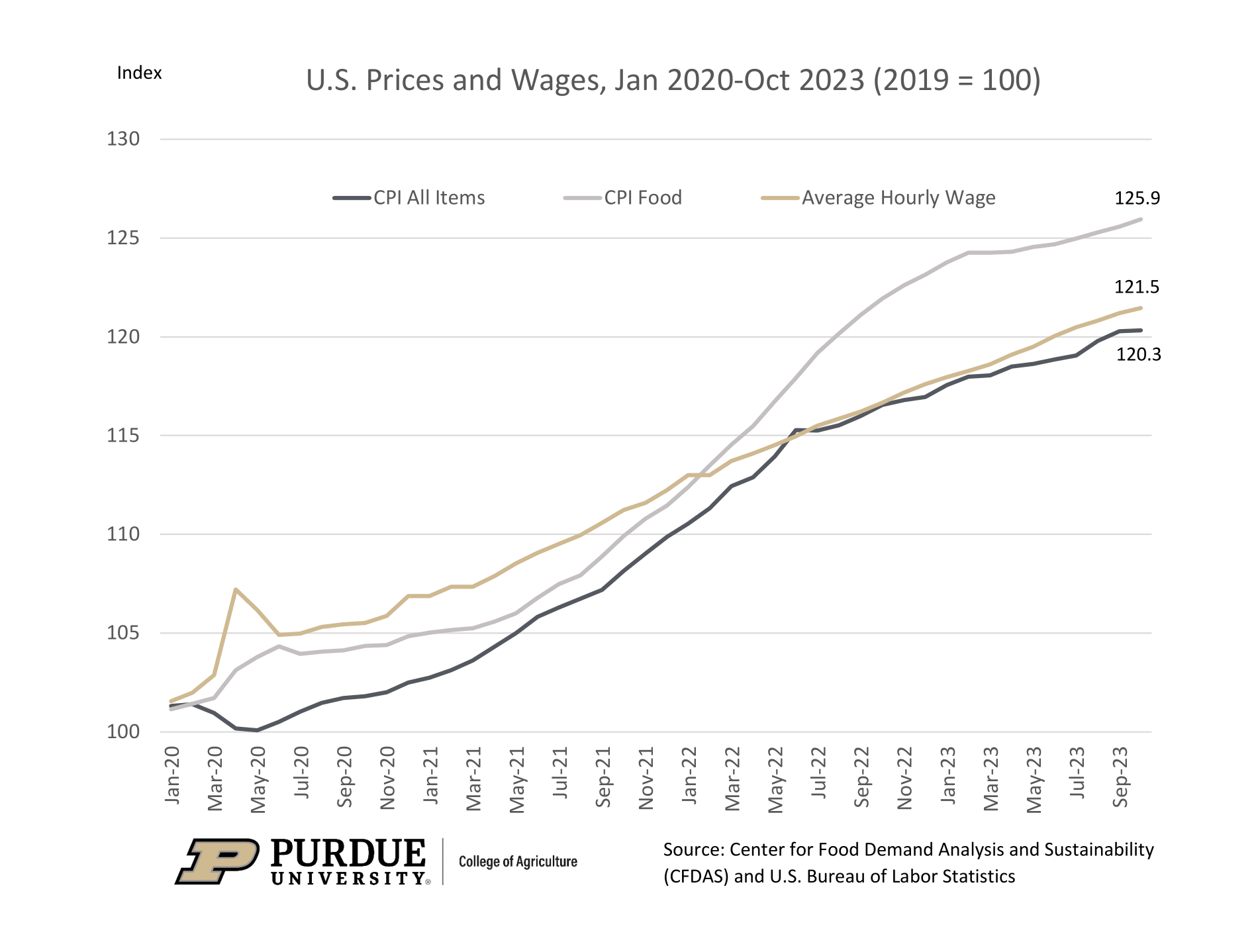

Of course, the big driver of the gloom is inflation. As anyone who has shopped for groceries knows well, food prices have skyrocketed in the past three years. The Consumer Price Index (CPI) for food (a measure of food prices, in general) was 26% higher in October than it was in 2019, before the start of the pandemic. Similarly, the CPI for all items (including food) was 20% higher in October than it was in 2019.

While it is true that food price inflation and inflation in general has eased in recent months, current inflation is still much higher than pre-pandemic levels. Slower growth in prices does not erase the cumulative effect of a three-year spike in inflation. Prices are higher than they were before the pandemic, and still growing faster than they were before the pandemic. So, it is not surprising that approximately 40% of Americans report higher prices as the reason for deteriorating personal finances.

Prices are important because they are a major determinant of affordability. All else equal, food price inflation makes food less affordable. Similarly, general inflation makes life less affordable. But prices are not the only determinant of affordability. Another key determinant of affordability is income. Purchasing power is the amount of goods and services you can buy with your income and can be measured by dividing income by prices of goods. If income rises relative to prices, people can afford to buy more goods and services, meaning people are better off. If income falls relative to prices, people can afford to buy fewer goods and services, meaning people are worse off.

So, what has happened to incomes? In Figure 1 below, along with the two CPI series, I report an index of average hourly wages in the U.S., which is one measure of U.S. incomes. All three data series are reported relative to their 2019 levels. The figure shows that average wages are 21% higher than they were in 2019. Since 2019, average wages have grown slightly faster than general inflation (21% vs 20%), and not quite as fast as food price inflation (21% vs. 26%).

Getting back to the apparent disconnect between economic optimists (like me) and Americans who are reporting financial stress and gloom about the economy, I think focusing on purchasing power can help to reconcile these two perspectives.

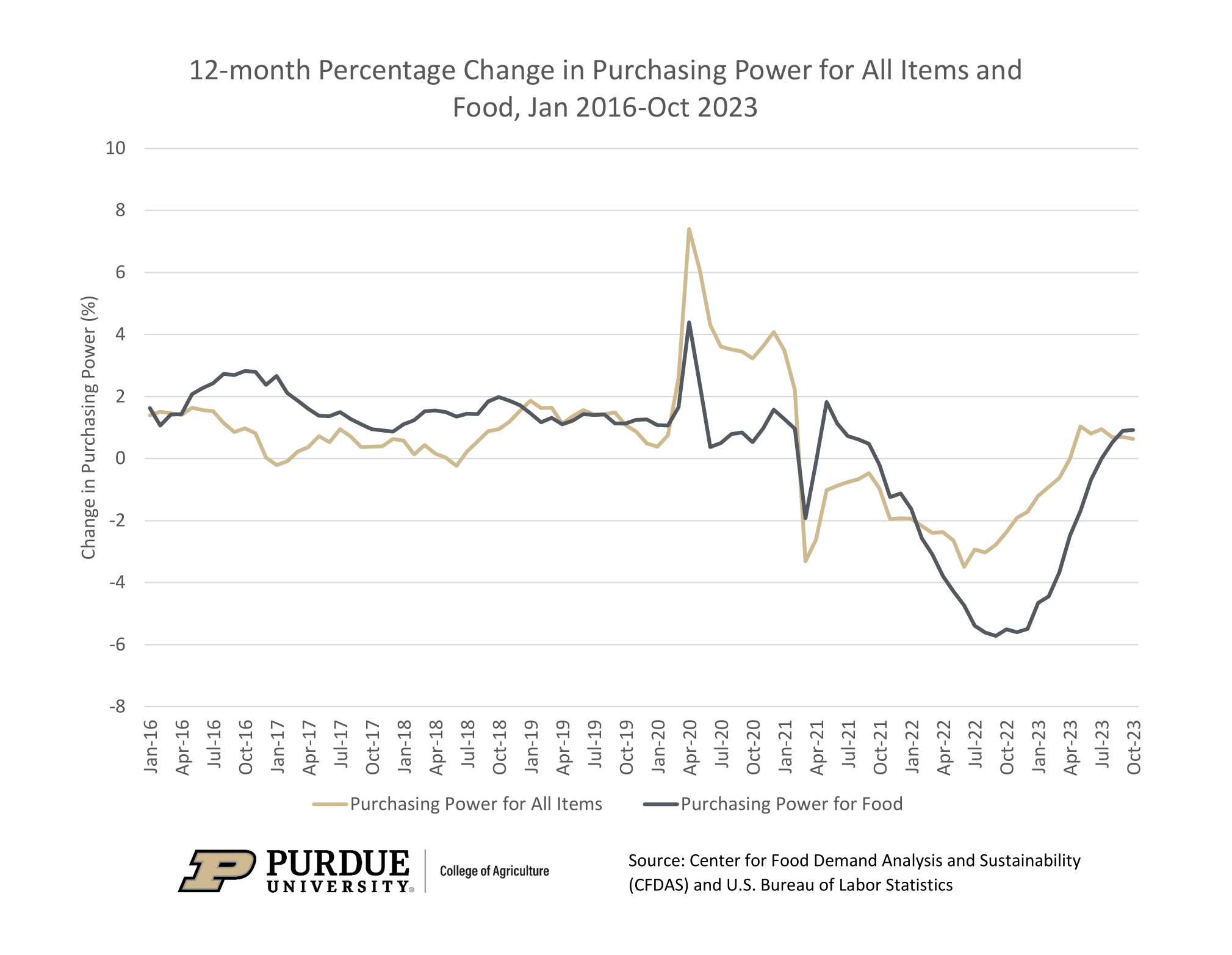

Changes in purchasing power (in percentage terms) can be calculated as percentage growth in income or wages less percentage growth in prices, aka inflation. I make that calculation, using all prices and food prices, and plot the results below in Figure 2, from January 2016 through October 2023. What we see is that from January 2016 through December 2019, purchasing power and food purchasing power were both regularly growing. Purchasing power grew at an average annual rate of 0.8% during that period, and food purchasing power by 1.6%.

In contrast, since January 2021, purchasing power has fallen at an average annual rate of 1.1%, and food purchasing power has fallen by 2.0%. That is, after years of economic progress, with wage growth generally exceeding inflation, we have just gone through nearly two years of economic decline, with prices rising faster than incomes. These annual changes accumulate and losses in purchasing power in recent years wipe out gains in the years running up to COVID-19. In the nearly four years since January 2020, purchasing power has grown by a total of 1.2% and food purchasing power has fallen by 4.4%.

The slow progress in purchasing power and stagnation in food purchasing explains why many Americans report a gloomy economic outlook. People know that their incomes are not growing relative to prices like they were in the years leading up to the pandemic. People also know that food prices have been growing faster than their incomes.

If Americans’ purchasing power is deteriorating, why are some economists optimistic about the economy? My optimism stems from the economic data that suggest that things may be getting better, not worse. The cooling of inflation–if it continues–means that inflation will not undermine purchasing power as it has over the past two years. General economic growth and a strong labor market, if they continue, will contribute to continued growth in incomes. Together, rising incomes and slowing inflation will increase purchasing power, making people materially better off.

For questions and/or inquiries related to this topic, you can contact us through this form or email balagtas@purdue.edu.

Footnote(s):

- As a measure of incomes, we use Average Hourly Wage for Private workers. From that series, we create an index of wages relative to 2019.

- See the CFDAS Consumer Food Insights Report for more information on the consumer price index over the last year.