Recent data from the Consumer Food Insights Survey, conducted by Purdue University’s Center for Food Demand Analysis and Sustainability, reveals fascinating trends in how Americans perceive and predict food inflation. The findings highlight not only the gap between official estimates of inflation and what consumers experience in the marketplace but also show how political ideology shapes these perceptions.

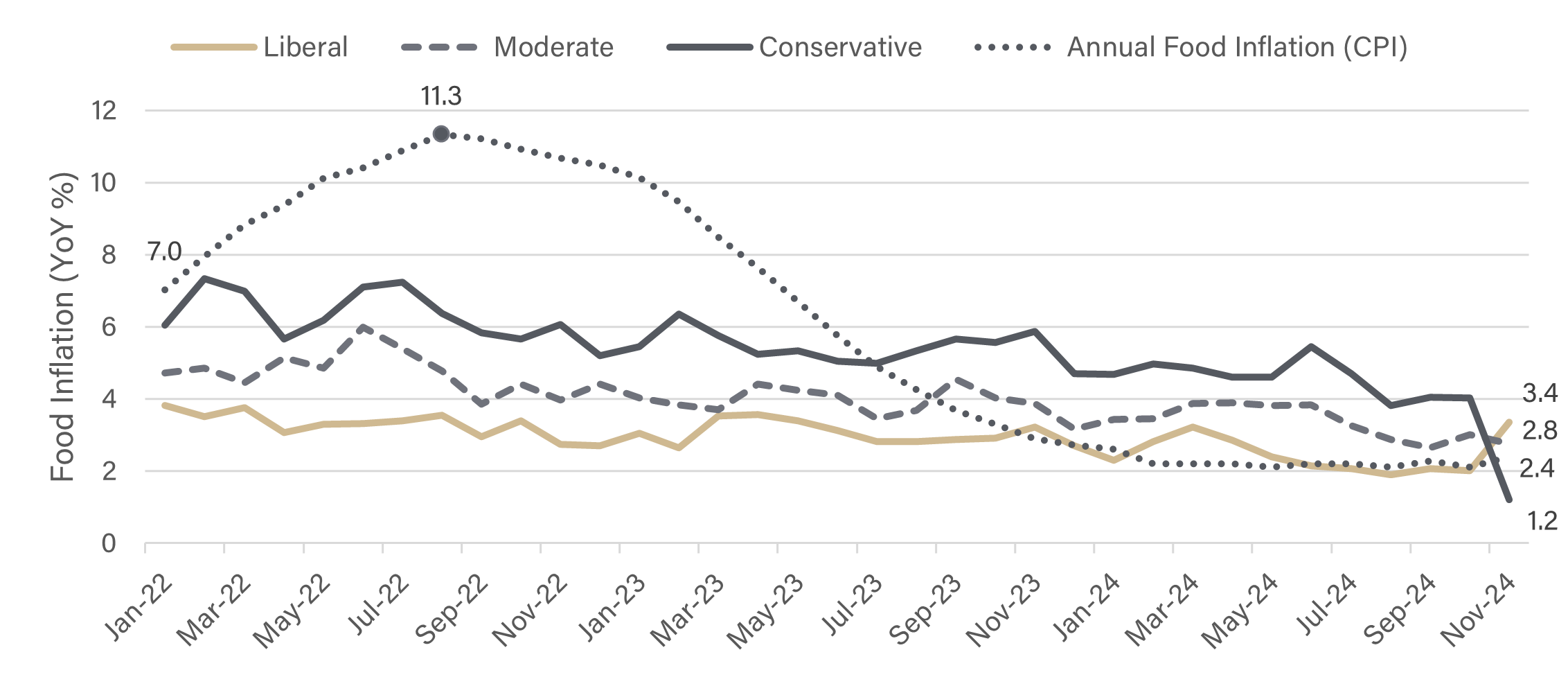

Food inflation as measured by the consumer price index (CPI) has hovered around 2.4% for most of 2024 and is down substantially from its peak of 11.3% in August 2022. However, consumer perceptions have not always aligned with these figures (Figure 1). During the initial period of high inflation through 2022, consumers typically reported lower inflation rates than official estimates. Interestingly, this trend reversed in summer 2023, with consumers generally overestimating inflation even as actual rates returned closer to historical norms.

Despite this stabilization in the rate at which food prices are increasing, food prices are nearly 25% higher than they were back in 2020 when food inflation first jumped before accelerating in 2021. This drastic increase is likely contributing to the gap in experienced versus official food inflation estimates as consumers slowly adjust. While consumer estimates of food inflation did not shift as drastically as the actual CPI food inflation rate, consumers show they are able to pick up on the direction of the downward trend.

Looking ahead, consumers are more optimistic about the future of food prices, predicting lower levels of future food inflation than their estimates of past inflation. Figure 2 summarizes average food inflation expectations, as predicted by consumers, compared with the CPI food inflation rate. Much like consumer estimates of past changes in food prices, consumer food inflation forecasts were higher than observed inflation over the past year, though the gap is smaller. Looking twelve months ahead, consumers predict food prices will be approximately 2.5% higher than in November 2024, matching USDA Economic Research Service’s prediction for annual food price increases in 2025.

In light of the recent 2024 election and the heavily politicized nature of inflation, we thought it important to understand how political ideology does or does not impact consumers’ perceptions and estimates of food inflation. Our analysis reveals a consistent pattern in how political ideology influences inflation perceptions. In every month that we’ve collected these data, beginning in January 2022, self-identified conservative consumers have reported higher inflation than self-reported liberal consumers (Figure 3). This difference is consistent with a political bias in consumers’ perception of the economy. Conservative consumers perceive higher inflation and blame the Democratic president for it. Liberal consumers perceive lower inflation and give credit to the Democratic president for it. We will continue to monitor this pattern to see if these biases flip when the Trump administration enters office in January. It’s a pattern that highlights how our broader views can shape our everyday economic perceptions. This alignment of economic perceptions with political ideology is not unique to changes in food prices – similar patterns appear in consumer sentiment and expectations for the economy in the University of Michigan‘s broader Survey of Consumers.

Results from our November survey also provide evidence of how consumers’ politics influence how they view the economy. The data in Figure 4 shows a dramatic reversal in inflation expectations along political lines after Donald Trump’s win in the 2024 presidential election: conservative consumers became significantly more optimistic about future food prices, while liberal consumers forecast an acceleration in food prices over the next year. This mirror-image reaction highlights how political transitions can rapidly reshape economic expectations.

As we look toward 2025, several factors could influence food prices and inflation. The incoming administration’s policy pronouncements suggest potential changes in trade policies that could affect food imports. While the full impact remains uncertain, there are concerns about possible upward pressure on imported food prices.

The disparity between perceived and actual food inflation, combined with sharp political divisions, suggests a complex environment ahead. What’s clear from the data is that Americans’ expectations about food prices are shaped not only by their experiences at grocery stores and restaurants but also by their political perspectives – a pattern that appears likely to continue as we move into 2025.