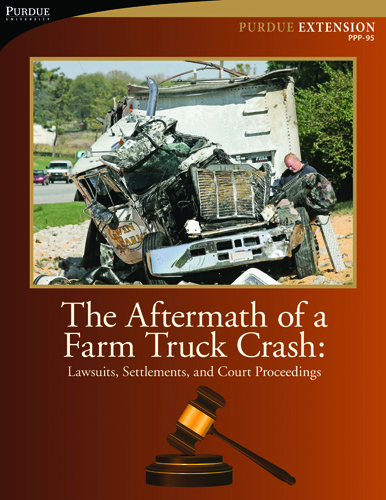

Learning From Truck And Equipment Collisions

Fred Whitford, Director, Purdue Pesticide Programs

Brian Drummy, Attorney, Bunger & Robertson

John Earnest, Jr., Collision Reconstructionist, Princeton Kentucky Police Department

Mike Templeton, President, Surface Transportation Consultant

Trent Johnson, Insurance Agent, State Farm Insurance

Then It Happens to You

Understanding Negligence and Fault

The Three Elements of Negligence

The Question of Fault

Who Pays for What

Finding Fault in a Courtroom

Case Reviews of Real Collisions

Case 1: Truck Crashes Into an Ammonia Tank

Case 2: Car Turns in Front of Fuel Truck

Case 3: Vehicle Pulls Out in Front of Feed Truck

Case 4: Fuel Truck Driver Runs Stop Sign

Responding to and Collecting Information at the Crash Site

Exchange Information

Call the Police First

Make Sure Law Enforcement Files a Report

Tell Your Drivers to Keep Quiet 21

Send a Supervisor to the Crash Scene

Take Lots of Photos

Have Drivers Write or Record What They Remember

Test Your Drivers for Alcohol and Drugs

Notify Your Insurance Carrier As Soon As Possible

Learning Valuable Lessons From Tragedies

Know When to Consult Your Own Personal Attorney

When to Hire a Collision Reconstructionist

Save the Event Data Recorder

Take Pre- and Post-trip Reports Seriously

Conduct Annual Third-Party Inspections

Keep Maintenance Files on Each Truck and Trailer

Stay Legal with Weight Limits

Conduct Random Drug and Alcohol Tests

Monitor Hours Behind the Wheel

Install Front and Back Cameras

Drive the Speed Limit

Make Sure Equipment Markings Are Legible

Screen Drivers Before Hiring Them

Have Employees Report Violations After Hiring Them

Keep Your Insurance in Order and Up-to-Date

Limiting Exposure With Separate Business Entities

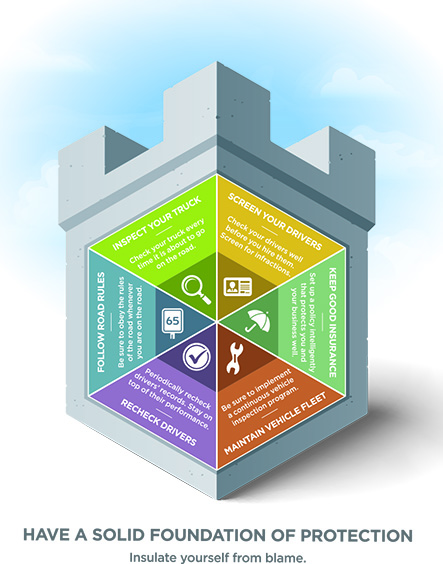

Conclusions

Acknowledgments

Disclaimer

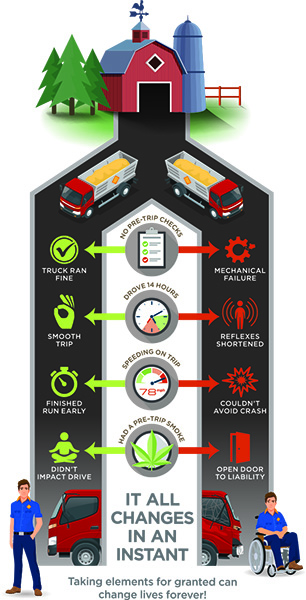

Then It Happens to You

Every time we leave our homes and farms we assume (and take for granted) that other drivers will be safe and responsible. We assume that the hundreds of cars and trucks we encounter every day are operated by responsible drivers who have valid driver’s licenses, carry adequate insurance, focus on their driving, are not under the influence of drugs and alcohol, and are not distracted by phones or other devices.

But as we know from our everyday driving experiences, this is often wishful thinking.

Then it happens to you.

One minute you’re driving your semi, and the next, you’re involved in a serious collision through no fault of your own. You approach an intersection and see a car going way too fast. You slam on the brakes anticipating the car is going to run the stop sign, but you’re broadsided.

In that moment, you are involved in an ordeal that may take several months or years to resolve. Hopefully, you’re not injured, but your equipment is damaged. The occupants in the other vehicle are injured.

Right after the collision emergency, vehicles begin arriving at the scene. As you look around, you see the crash scene is congested with emergency responders dealing with the injured, containing a fuel spill, and diverting traffic onto side roads.

A law enforcement official begins asking you questions and writing down your statements. You look over to see a passenger from the other vehicle being loaded into an ambulance. The seriousness of the collision sets in when you see another passenger laying on the road covered with a sheet.

You answer all of the police questions, then go to a hospital for a drug and alcohol test. The state police impound your vehicle and completely inspect all its components, including the braking and steering systems.

For the next six months, that fatal and tragic day consumes your life. The two surviving victims and the family of the deceased sue you. You meet often with your lawyers to review the status of the lawsuit filed by the plaintiffs’ attorneys. They continually ask you for more information related to your truck, your maintenance records, and your policies and procedures. You don’t understand why you have been sued when you did nothing to cause the collision.

At a deposition, the lawyer asks you to answer questions about your past driving record, how well you maintain your semi, whether it had the proper lighting and safety equipment in place, the weight being carried in the trailer, whether you were part of a drug testing program, the speed you were driving, when the braking system was last inspected and maintained, and whether there was anything you could have done to avoid the collision. It is clear that the plaintiffs’ attorneys are trying paint a picture that you had at least some responsibility for the tragic consequences that day.

Your attorney meets with the opposing lawyers, and they discuss monetary damages. Your lawyer, who is likely paid by your own insurance company, makes a counter offer. Each side negotiates thinking they have the legal facts to get what they are demanding.

After six months, the lawsuit is settled out of court. Although there were a few things wrong with the truck and your driving record wasn’t perfect, it doesn’t change the fact that the other driver completely disregarded the stop sign. The process seemed unfair, and to add insult to injury, your insurance company dropped you and no one paid you for the loss of use of your truck and equipment. As you search for new insurance, you discover that the collision made you a high-risk driver, which significantly increases your premiums.

Truck crashes happen and, like the case you just read, can affect those involved in the collision for a long time. While nobody likes to think about tragedy, you can protect yourself and your business by being prepared for the worst.

This publication studies four real life-events to demonstrate some things you can learn from the mistakes that were made, the lives that were lost, and the lawsuits that were filed. From these situations we offer recommendations, best practices, and strategies that will help keep you safer and help protect you, your family, and your business or farm’s interest in case of a serious traffic collision or injury.

Understanding Negligence and Fault

Applying negligence laws in the real world can have unforeseen consequences for those involved in traffic collisions — even if they are not at fault. Traffic collisions often seriously injure people and significantly damage property. While insurance settlements immediately clear up some collisions, others can last for years while the case moves through the court system.

After a collision, lawyers for the plaintiffs and defendants review the facts and analyze how the evidence strengthens or weakens their positions. Collisions that significantly injure someone often result in a plaintiff filing a lawsuit against the potential at-fault parties.

Most states permit plaintiffs to recover medical expenses, lost income, property damage, and pain and suffering. These damages can easily be several thousand dollars and can sometimes reach into the millions of dollars.

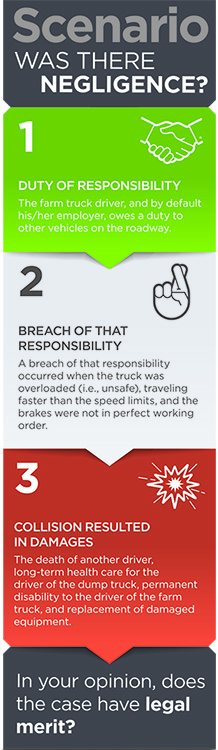

The Three Elements of Negligence

Civil lawsuits that spring from traffic collisions are generally filed as negligence suits. In order to have a successful negligence claim, the plaintiff is required to prove:

1.That the defendant owed a duty to the plaintiff

2.That the defendant breached that duty

3.That the breach caused the plaintiff’s injury

The plaintiff must prove all three elements in order to recover damages.

The Question of Fault

The question of “Who is at fault?” in a vehicle crash is often very complex. The answer involves determining the specific percentage of fault for each driver involved in the collision.

For example, let’s say that a passenger car ran a stop sign and crashed into a semi-tractor-trailer operated by a farm worker. The force of the impact pushed the farmer’s truck into the path of an oncoming dump truck. The three-vehicle pileup totaled the farmer’s semi, left the semi driver permanently disabled, and required long-term hospitalization for the dump truck driver. The driver of the passenger car was pronounced dead at the crash site.

On the surface, finding fault seems to be an open-and-shut case. In your view, the passenger car driver who ran the stop sign is 100-percent responsible for the collision and resulting damages.

Who Pays for What

The larger question becomes: who pays for what? More than 95 percent of all lawsuits settle by agreement before trial. Such settlements are often more efficient, quicker, and provide less uncertainty than jury trials. Lawyers who take their cases to trial know they can never be sure how jurors will react to the same set of facts — it often becomes a roll-of-the-dice despite a lawyer’s reasoned arguments.

As a general rule, employees cannot sue their employers for negligence under worker’s compensation. Medical, wage, and death benefits are the only compensation that employees can expect to receive from their employers based on worker’s compensation laws.

So, where does that leave the driver of a farm truck who suffers a permanent disability that will prevent him from ever working again? How will he support his four children? Who will cover their college costs?

Since the driver cannot sue his employer, then his lawyer may file a countersuit against the person who ran the stop sign, or possibly the county highway department (if brush partially obstructed the sign), or the dump truck company (if there is any evidence the driver was impaired or the truck lacked proper maintenance).

Who’s Who in Court

- Plaintiff — the individual or company who brings a case against another in a court of law.

- Defendant — the individual or company sued in a court of law.

Finding Fault in a Courtroom

If the plaintiff and defendant are unable to reach a settlement, then a trial will be necessary. After all of the evidence has been presented, the judge instructs the jurors to determine two things:

1.How much fault should be attributed to the plaintiffs and defendant

2.The amount of plaintiff’s damages irrespective of fault

It is important to realize that jurors will never be told about the existence or amount of insurance coverage that the parties have.

For example, the jury may find that the collision caused $6 million worth of damage, which includes the value of the lost life. The jurors found the passenger car driver was 40 percent at fault and the driver of the semi and his employer were 60 percent at fault. The semi driver and his employer are responsible for their percentage of fault: $6 million x 60% = $3.6 million; the passenger car driver would be responsible for 4 percent, or $2.4 million.

However, if the plaintiff (in this example the passenger car driver) is found to be more than 50 percent at fault, the plaintiff will recover nothing. In other words, if the person who brings a suit is found to be more than 50 percent at fault, then Indiana state law says that person is barred from recovering damages. This is one reason why many parties prefer out-of-court settlements because they can control the outcome through negotiations — as opposed to leaving the decision

to six strangers.

Case Reviews of Real Collisions

Traffic collisions are unique. Each has its own set of underlying facts that contribute to what happened — the time of day, weather conditions, fatigue, vehicle maintenance, drugs and alcohol, load weights, road conditions, and highway signage. The facts could also include distractions from texting, emailing, and GPS.

What’s important is not what makes collisions different, but knowing that they share similarities we can learn from. That is why we share these four reviews of actual collisions. By doing so, we hope we can avoid the mistakes others have made.

Case 1: Truck Crashes Into an Ammonia Tank

The driver of a tandem truck was hauling 1,000 gallons of herbicide to the field. As the driver (an employee of a commercial agricultural retailer) approached the intersection, he applied the brakes, but he knew immediately he was in trouble. With no brakes and the stop sign quickly approaching, the driver instantly decided to go straight ahead instead of veering to the right or left into adjacent fields.

Within seconds, the truck rammed into the side of an anhydrous ammonia tank belonging to a local farmer. The force of the impact knocked the tank off its base and breached the tank’s shell.

Fortunately, the ammonia tank was nearly empty. The tank released just enough vapor that the driver had to be hospitalized for a day after the crash. The agricultural retailer replaced the farmer’s ammonia tank.

Now let’s change the facts by assuming that the tank was completely filled with anhydrous ammonia at the time of the collision. Upon impact, the ruptured tank released the ammonia. The truck driver had no chance of escape and was pronounced dead at the scene from ammonia inhalation. The official coroner’s report listed the cause of death as pulmonary edema caused by excess fluid in the lungs.

Meanwhile, the driver of a car that happened to be on that road found himself driving through what he thought was fog, but was actually a cloud of ammonia. The ammonia severely and permanently damaged the driver’s lungs. Doctors indicated that the damage was so severe that he would not be able to work again.

In this hypothetical example, there were two victims: the truck driver and the automobile driver. The lawyer who was hired by the automobile driver who suffered permanent lung damage would ask a lot of questions of the company officials of the truck driver at a deposition including:

• Does the company have a maintenance program?

• When was the last time the truck was inspected?

• Did the company conduct pre-trip inspections?

• Were there any indications that the brakes were not working properly? Was there a maintenance report? A repair bill? Did the driver make notes?

• Were there any indications the truck driver knew the brakes were going bad before starting the day’s work or any evidence during the day’s travels?

• How many hours had the truck driver been working that day or that week?

• Why didn’t the truck driver veer to the left or right instead of going straight?

• Was the truck driver distracted by talking on a cell phone or sending or receiving text messages?

At a deposition and under oath, the driver’s logs indicate that he had worked 14 days straight and put in 14 to 16 hours each day. The smoking gun, however, was that the driver documented on a post-trip inspection report a week earlier that the brakes were “soft.”

Company officials told the driver the repairs would have to wait for a few more days until the backlog of fields were sprayed. This last fact — of putting off a repair — was a game changer. The ag retailer’s case just got a lot worse, which makes it more likely for them to have to pay a higher amount in order to settle the case.

A lawsuit is pending by the widow of the truck driver who died as a result of the crash. The driver left behind a 35-year-old wife and four young children. The widow’s lawyer knew that under Indiana Worker’s Compensation laws, she could not sue the employer for negligence. Although the company refused to make the necessary repairs and made him drive an unsafe vehicle, worker’s compensation laws prevent employees from suing their employers.

The attorney for the widow’s only option would be to place partial responsibility on the farmer for putting the anhydrous ammonia tank in an unsafe location.

The lawyer acknowledged that the farmer who owns the tank is not 100 percent responsible for the death of her client’s husband, but suggested that placing the tank in an improper location made the farmer 30 percent at fault. Outside of worker’s compensation benefits, this could be the only source of money for the deceased driver’s family.

But how could the farmer be responsible for something he had nothing to do with?

The legal arguments would center on whether he had a responsibility to place the tank in a more suitable location on his property or to better protect it from being hit by vehicles and implements. The lawyer representing the driver’s widow would try to maximize the farmer’s fault in order to minimize the amount of fault from people he couldn’t recover against (namely, the employer).

Obviously, the farmer’s lawyer would counter and strongly argue that the farmer did not have any legal duty to protect drivers (who are using a public road) from running into his tank, which was not on the roadway. Many people would probably agree that the farmer had no responsibility. However, could the widow’s lawyer persuade a jury to side with the widow and children based on emotion rather than facts? That’s the risk trials present, which is one reason most cases settle by agreement.

At the end of the day, the farmer’s insurance company agreed to pay compensation to the widow in order to close the matter. As part of the settlement, the insurance company agreed to pay under the conditions that they were not admitting guilt and that the wife could not bring a suit against them in the future.

The farmer vehemently disagreed with his insurance company. “What did I do wrong?” he asked. “All I did was have a tank next to the road. I’m not at fault.”

The lawyer for the wife and children knowing that their case had weaknesses, might accept a lesser settlement amount instead of taking a chance of getting nothing in court.

Case 2: Car Turns in Front of Fuel Truck

The driver of a passenger car was traveling eastbound on his way to watch his son compete in a high school basketball game. The driver glanced at his watch and noticed that he was going to be late. He made a late decision to take the first road to the north, because it has much less traffic.

The problem was that the driver decided to take that road at the last possible moment. While turning left across the road, he seemed oblivious to a fuel truck and other traffic that was heading in the opposite direction (westbound). Both drivers only had three-tenths of a second before the car and fuel truck collided. There just wasn’t enough time for the fuel truck driver to react.

As the car turned into fuel truck’s lane, the fuel truck driver instinctively applied the brakes as hard as he could when he realized he was going to hit the car.

The fuel truck driver felt the impact as the front of the truck lifted up, then he lost control of the steering. When the fuel truck driver opened his eyes moments later, he was still alive and the truck was facing the ditch.

The passenger car had taken the entire brunt of the collision. The car’s driver was pronounced dead at the scene from massive head and chest injuries. Neither driver had any traces of alcohol or controlled substances in their systems. Nor did the drivers have any health conditions or physiological factors that could have contributed to the collision.

A sheriff’s deputy transported the fuel truck driver to a local hospital for alcohol and drug testing. Federal law requires that when a commercial motor vehicle is involved in a fatal collision that the driver be tested for drugs and alcohol. In this case, the hospital-administered blood test was negative for alcohol, methamphetamine, marijuana, opiates, and barbiturates.

With drugs and alcohol ruled out, the federal motor carrier investigators and third-party consultants closely scrutinized the fuel truck driver’s hours of service, training records, driving records, and truck maintenance files. The fuel truck driver had ample time off the day before, the truck’s maintenance files were current, the driver’s job-specific training was well-documented, and the truck driver’s driving record did not have a single blemish. The driver and the truck passed the federal investigation with flying colors.

Did the driver turn into the path of the fuel truck?

Absolutely, he did. But the question is whether the fuel truck could have avoided the collision. The reason lawyers go through the discovery process (of finding and sharing facts) is because the evidence sometimes can swing the case back to their client’s favor.

For instance, what if the plaintiff’s lawyer could prove the truck was going 50 mph in a 30-mph zone? Would that change the outcome of the case? The plaintiff’s lawyer could argue that if the truck driver had been going the speed limit, he could have stopped in time, and possibly the collision could have been avoided.

The answer in this case was that the driver and truck had no responsibility for the collision. The traffic collision was caused by the passenger car being driven into the path of the fuel truck. Unfortunately for the car driver and his family, the decision to make that left turn cost him his life.

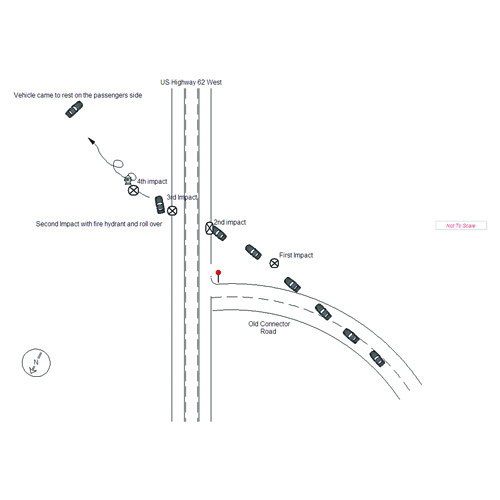

Case 3: Vehicle Pulls Out in Front of Feed Truck

A couple was driving a full-size car and came to a stop at an intersection. Before the stop sign there was another sign that warned drivers that cross-traffic does not stop. Thinking the path ahead was clear, the driver pulled out into the intersection. But the car driver did not notice a feed truck rapidly approaching the intersection from the car’s right.

The driver of the feed truck saw the car stop briefly at the intersection. When the passenger car pulled out into the intersection, the driver took stock of his escape options.

Had the car pulled out into the intersection quicker, the feed truck driver might have veered to the left. But the car was only traveling 15 mph, which closed the door to that escape route.

Swerving to the right was not an option either, because the truck would have broadsided another vehicle that was stopped on that side of the intersection. The only option was for the driver to apply the brakes as hard as he could and hopefully lessen the impact. The 54,000-pound truck traveling at 52 mph hit the car on the passenger’s side, which killed the couple in the car.

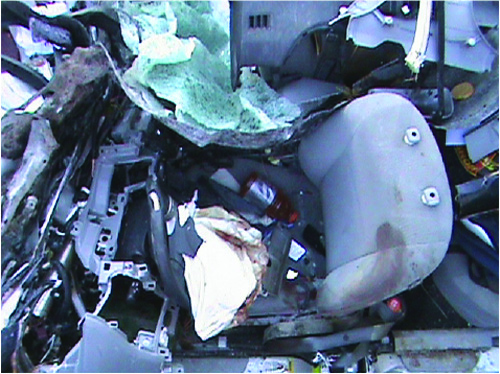

The photos above show the aftermath of the collision.

Crash Reports in Court

Generally speaking, the Standard Officer Crash Report cannot be entered into evidence in court. The law views each report as hearsay evidence, because the law enforcement official was not there to witness the crash. An exception to the rule is that an officer who is qualified as a reconstructionist and who actually performed a thorough analysis can offer an opinion as to the cause of the crash.

A post-crash investigation reported:

• The feed truck driver needed 135 feet to stop his vehicle, but there were only 32 feet left when the car pulled into the intersection.

• A third-party mechanic conducted DOT inspections and showed that the truck was in good working order.

• The truck’s vehicle maintenance records were complete.

• The truck driver was not violating the federal hours of service regulations.

The feed truck driver was taken to the hospital for an alcohol test, and he tested negative. However, the records do not indicate that he submitted to a drug test as required by the Federal Motor Carrier Safety Administration.

The apparent lack of a drug test would be legitimate grounds for a lawyer representing the couple to ask, “Why wasn’t he tested? Were you trying to hide something? Did he not react quickly enough because he was on drugs? Are there any other previous drug tests for the driver? Is the driver in a drug and alcohol testing pool? When was the last time he was tested?” not be entere

The last piece of information was that truck’s gross vehicle weight rating (GVWR) was 33,000 pounds. However, the records indicated that the truck weighed 54,000 pounds at the time of the collision. The argument is going to be made that the truck carrying an extra 21,000 pounds was not designed or equipped to carry or respond to the excessive weight it was hauling that day.

The company documented that the truck had been strengthened by qualified mechanics who added a tag axle under the bed to provide the extra strength for that truck to carry the heavier weights. The company also documented that they added brakes on all wheels, including the tag axle in the middle.

But the plaintiff’s lawyer will ask the driver, “Was the tag axle down at the time of the crash?” Can you guess how the case could have turned if the tag axle had been up?

The sheriff’s department reported that the passenger vehicle driver was at fault by failing to yield the right-of-way when he pulled in front of the feed truck. There was no evidence to point to the feed truck driver or his company being responsible for the collision.

Let’s again change the facts. This time, let’s say that the truck had not been modified but was still overweight.

The deceased family’s lawyers would have hired a collision reconstructionist to predict the stopping distances for a truck that weighed 54,000 pounds versus one that weighed 33,000 pounds. Using the testimony of other experts, the lawyer would point out differences in the construction of a 33,000-GVWR truck with a properly equipped heavier truck.

In such a case, the lawyer would argue that the feed company’s overweight truck valued making money over keeping people safe. The lawyer would argue that the company overloads its trucks, so they can make more money per run. They don’t care about safety. Vehicle rules exist to keep us safe, and the company is completely violating the law. It’s not like they accidentally overloaded their trucks as they have testified — they knew exactly how much they were putting on their trucks.

We hope you can better see how a lawyer could use an overweight truck to change the outcome of a case and settlement. The lawyers for the deceased couple could have argued that the driver and company had partial responsibility regardless of what the driver of the passenger car did that day.

There could still be one more party involved in a lawsuit stemming from this crash. While no one will ever know with any certainty, it was possible that traffic signs and utility poles along the roadway might have partially blocked the driver’s view of the oncoming feed truck. If this was the case, then a county, state, or other government entity could have been sued for failing to maintain a safe road environment. That was not the case in this example, but you can see how others can be brought into any case.

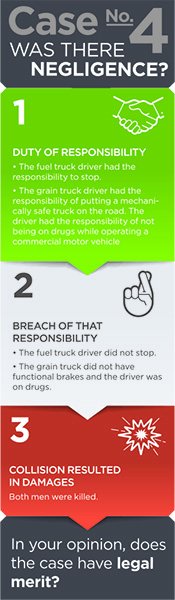

Case 4. Fuel Truck Driver Runs Stop Sign

A fuel truck driver is delivering diesel and gasoline to his farming clientele. The truck was loaded with 2,950 gallons of fuel, which weighed close to 24,850 pounds. The driver was eager to finish his route for the day, because he was about to start a weeklong vacation. He had a lot on his mind, thinking about what he had yet to do that evening to get ready for his vacation.

The fuel truck driver was traveling north toward a very familiar intersection. The truck driver knew that he had a stop sign and that the cross-traffic did not stop. Visibility was clear in all directions.

However, the fuel truck driver failed to stop for the stop sign. He also failed to notice a grain truck (which had the right-of-way) that was traveling west at an estimated 50-55 mph. At the last minute, the grain truck driver saw that the fuel truck was not going to stop, so he locked down the brakes.

The fuel truck and grain truck collided at the intersection. Upon impact, the grain truck hit the fuel truck broadside just behind the passenger compartment. The fuel tank ruptured and fire ensued, destroying both vehicles. Both drivers died in the blaze.

The police report indicated that the fuel truck driver, “disregarded a stop sign” and “failed to yield the right-of-way.” Who do you think was responsible for the horrific collision? Most would agree with the police report that the fuel truck driver was at fault.

The family of the deceased grain truck driver brought a multi-million-dollar lawsuit against the fuel truck company for negligence on the part of the employee (driver) for failing to stop. In order to have all of the facts, the lawyers for the fuel truck company hired their own private collision reconstructionist.

This crash completely destroyed both the grain truck and fuel truck, and both drivers were pronounced dead at the scene.

The report by the collision reconstructionist included a review of both the fuel truck and grain truck.

For the fuel truck, the facts were:

• There were no skid marks, which implies the driver never applied the brakes.

• The maintenance records were up-to-date.

• The driver had only been working four hours, so fatigue should not have been an issue.

• A post-mortem found no evidence of alcohol or drugs.

What was interesting was the information about the grain truck driver and his truck. A typical semi has 10 sets of brakes. As the grain truck driver locked down the truck by applying the brakes, the truck only left two skid marks on the roadway (see top right photo on page 17). One skid mark was on the right front of the semi-tractor; the other skid mark was made by one of the drive tires on the right-hand side. Based on the skid marks, the reconstructionist determined that only two of the 10 wheels had functional brakes. While it can’t be seen in the photograph, there was a total brake failure before the grain truck reached the intersection.

For the grain truck, the other facts were:

• There were no records of the grain truck ever being serviced.

• The semi tractor-trailer grain driver had a Class A CDL, but there was no indication that he was enrolled in an alcohol and controlled-substance testing program as required by federal and state laws.

• The coroner confirmed that the driver tested positive for marijuana.

What did we learn from this collision?

The fuel truck driver had the first responsibility to stop at the intersection. Both drivers should have recognized and reacted to the potential threat of an oncoming vehicle, and then stopped or slowed sufficiently to avoid an incident. While it’s true the fuel truck driver was primarily at fault, the facts of the incident lend support to the argument that the grain truck driver had fault as well.

The argument would be:

• If the driver was not under the influence of a drug, he would have been able to respond quicker as the collision unfolded in front of him. This is a reasonable assumption that can’t be proven.

• If the truck had full use of its brakes, the wreck may have been avoided altogether, or the impact may have been much less severe.

The case was settled out of court. The fuel truck company agreed to pay only a fraction of the original lawsuit. The lawyers for the grain truck driver along with his clients agreed to settle for a lesser amount, because they feared a jury would be less sympathetic to their cause.

Responding to and Collecting Information at the Crash Site

Evidence is fleeting — here one minute, gone the next. And in the immediate aftermath of a crash, emergency responders will always be pressured to triage and stabilize injuries, then transport patients to local hospitals for further medical care. Police need to collect information and evidence from the collision site, but they also need to clear the road of damaged vehicles, clean up roadway debris, and get traffic moving again.

If a farm or company wants to get accurate information about an accident, the sooner they can get to the collision scene, the better chance they will have to see what took place moments earlier. First-hand experiences will prove valuable after everyone forgets the details of the collision (except for the drivers, insurance companies, and lawyers involved in the case).

These tips may be helpful when observing the collision site:

Exchange Information

After a crash, always ensure that all parties exchange their names, addresses, phone numbers, and insurance carriers.

Call the Police First

When employees call to say there’s been a crash involving a company vehicle, make sure to ask the employees whether they called 911. If they haven’t, contact 911 to inform them of the collision.

Tell the driver you are on the way to the crash site. Remind them that they are to give their statement to the police and answer their questions, but should not offer opinions or speculate about who caused the crash. Remind them to stick to the facts and don’t admit wrongdoing.

Make Sure Law Enforcement Files a Report

No matter how minor the incident, ask law enforcement officials create a crash report. The crash report is a standard document that will contain important information about the crash, the parties involved, and any independent witnesses who identified themselves to the police. The crash report also lists who or what the investigating officers believe caused the collision.

After minor collisions with no injuries, it may not seem important to call the police or get a crash report. However, some insurance companies may refuse to cover a claim if there is no crash report. The inconvenience and hassle of calling and waiting on the police is worth it in the long run.

What’s more, stories often change once people leave the crash scene. For example, after the crash the other driver may have told you, “You know what, I ran the red light, but I have an important meeting in 20 minutes that I cannot miss. I know it’s my fault, so there’s no need to call the police. Here’s my phone number and information. You can call me later this afternoon and we’ll get it handled.”

But when you call the driver a few hours later, you are surprised to hear, “I didn’t run the red light. You ran the light.”

So, what now?

Let’s look at another real story where the police were called to the scene.

A truck was in the left turn lane when the light turned red. The truck driver realized that he is stopped too far in the turn lane, so he backs up. In the process, he backs into a car that was behind his truck.

The driver of the car called his insurance company, and the agent told the driver to call the police. But the driver said, “It’s really only minor, but I’ll call if you are telling me I have to.”

The police arrived shortly thereafter and took statements from both drivers. The driver in the truck readily admits that he backed into the other driver. But when the truck driver called his insurance company, he told a different story. He claimed that it was the passenger car that hit him from behind. Had that police officer not been there to gather statements from both drivers, then the question of who was responsible for the collision would have been in question.

Protect Yourself

A gentleman’s agreement after a crash can often become, “I never said that to you.”

Always have law enforcement look at the collision. This will protect you from “he said, she said” arguments down the road.

Tell Your Drivers to Keep Quiet

There will be a period of time — just after a collision and right before law enforcement arrives at the scene — that can be disastrous to any future claim. Regardless of who is at fault, make sure your driver understands it is best not to talk to and exchange ideas with the other driver.

It is OK to make sure others are not injured, but it is best to wait for the police to arrive before drivers give their versions of the events. Let the other driver know that the police will be there to take everyone’s statement of what they believed happened. Certainly don’t admit fault to the other driver or with the police even if it appears that you are 100 percent at fault. The facts of the case and who becomes the liable party will come out in due course.

Send a Supervisor to the Crash Scene

A driver who is not seriously hurt will still be under a great deal of stress at the crash site. Tell your drivers that they should be patient and use tact when they interact with law enforcement and first responders.

Your driver will appreciate a friendly face, and be happy to know someone is there to support them, which is a good reason to send a supervisor to the crash scene. The supervisors also can be there when the drivers give their statements to police.

Furthermore, seeing the collision scene first-hand complements and ties together the comments your driver made and the facts written on a police report. But remember, the police are trying to accomplish the same things you are attempting to do. Understand and appreciate that police have a job to do, so don’t interfere with the collection of evidence.

Another good idea is to return to the collision scene after the road reopens. This is critical if the collision occurred at night and physical evidence was easily missed. When you return to the scene, use caution when parking and walking on the road. If the collision occurred on a busy highway or interstate, you may not be permitted to park and walk on it. The law enforcement agency that is investigating the collision may be able to provide traffic control at the scene if you request it. You do not want to become another collision statistic.

Take Lots of Photos

You have a limited opportunity to capture untainted visual evidence as it is at existed at the time of the crash — before the vehicles are repositioned or removed. There is no second-guessing quality photographs.

A common mistake people make is only to take close-up photos. Be sure to take pictures from every angle. Start broad, and then close-up zoom in to certain things as you take more photos. A systematic approach will ensure that you miss nothing.

Photographers often leave a lot of evidence on the road when they only show the close-ups of damaged vehicles, sprayers, and tractors. The first photographs you should take are of the other vehicles’ license plate numbers — just in case they get nervous and take flight.

Shoot photos from 100 to 200 feet away in all directions. Include license plates, road signs, the roadway itself, and damage on every vehicle involved from all directions. Also shoot the people in and around the accident scene, structures, intersections, obstructions, skid marks, the debris field (before first responders sweep it away), approaches from the perspective of both drivers. In the months that follow, the photos of that roadway debris may provide important clues as lawyers debate the evidence. You can’t have too many photographs.

Also, be on the lookout for security cameras that may have captured the collision. This information can be invaluable in determining exactly what happened in the collision. Along these lines, you could consider installing dashboard cameras in your vehicles to capture what the driver observed and to monitor the driver’s driving habits. Cameras also can provide an unbiased, objective account of a collision that humans might not be able to provide.

What happens if the drivers or police take no photographs? The insurance company may send someone to the crash scene to document the collision. What they will see is a sanitized accident scene after the vehicles have been removed and the scene cleared of evidence. This may result in an incorrect determination of what actually occurred.

Have Drivers Write or Record What They Remember

As soon as absolutely possible, record your driver’sstatement without influence, discussion, or coaching.

Studies show that our memories of how events unfolded change over time. When this happens, the raw data — your memory — becomes contaminated and corrupted. For this reason, making written notes shortly after the incident can help capture your driver’s thoughts and memories when they are freshest in his or her mind. Note that these written thoughts could be used as evidence in any lawsuit related to the crash.

Have the driver write down what happened as soon to the time of the accident as possible. But understand that a serious injury may mean you have to wait for the statement days or weeks after the collision. Don’t worry about filtering the facts or about how grammatically correct a written statement is. When you are done, have the driver sign and date the written notes. The notes from the day along with the photographs will help to recreate the wreck months or years later.

In case injuries make it impossible for your driver to write, a voice recording will suffice.

Another option is to record a video with your smart phone. The advantage of this approach is that it is often easier for people to talk than to write down notes.

When drivers create written or recorded descriptions of the events, those recordings can clarify the collection of photos and prepared reports. They’re also a good way to refresh the drivers’ memory at a deposition when attorneys ask them to recall the events of that day. A deposition can occur six months to a year after an incident. If you have notes, you can say with certainty what happened that day.

What would you rather have drivers say at a deposition: “I don’t remember much from that day”? Or “It was a foggy day, but I remember right before the crash that I noticed the other driver did not have their lights on. I wrote this down shortly after the accident”?

Remember that everything you or your drivers write down or record could be discoverable if the accident is litigated, even if those recordings can damage your side of the case.

Test Your Drivers for Alcohol and Drugs

With most serious collisions, the question will always arise whether either driver was driving under the influence. Remember that under federal law commercial motor vehicle drivers must submit to drug and alcohol screening within six hours after a crash involving fatalities or serious injuries. This seems like an appropriate practice for any drivers involved in a collision — even if they are not driving a commercial motor vehicle.

Notify Your Insurance Carrier As Soon As Possible

The obligation in your insurance policy requires you to notify the insurance company of any potential claim as soon as it is practical to do so. Some policies give their clients up to a year to report an incident. Be aware that if you don’t notify the insurance company within the time period specified in your policy, the insurance company may be under no obligation to cover your claim.

Most insurance agents and attorneys agree that you should report any incidents the same day they happen. This is especially true for serious collisions, because you want the insurance carrier to know so they can begin the claims process and potentially hire an attorney to protect your interests.

When you file a claim, insurance agents will create an entry in their reporting system. If the other side calls three months later, you might have forgotten the day or the time when the collision took place. But because you notified the insurance company, their agents will have all of this officially documented. The sooner you notify the claims department or insurance adjustors, the sooner they can get involved, the faster they can process the claim, and the sooner they can bring in support staff like attorneys and accident reconstructionists.

It is your responsibility to file the police collision report with the insurance company. The insurance company will not find out there’s been an incident unless you call it in or another party’s agent contacts your agent. The insurance company may say that because the police report put the blame on the other party, that they will not make any claims against your policy at this point. Your insurance agents or claims adjustors will help you work with the other drivers’ insurance carriers to fix or replace your vehicles.

When the police are called to collision sites and clients call in their claims, insurance agents are required by law to electronically send certificates of insurance to the Indiana Bureau of Motor Vehicles to prove that you had insurance at the time of the collision.

If you don’t notify your insurance agent, the state will start sending you notices that you have 10 days to provide proof of insurance. If you don’t respond, your driver’s license will be automatically suspended.

Things You Should Never Do

- Never Make Deals With Other Drivers

You take a serious risk if you make out-of-pocket settlements without contacting your insurance agent.

Consider this: “I’m so sorry I hit your truck. You’ll be sore tomorrow. Let me take care of all the damages to your vehicle, because I don’t want my insurance rates to go up. I’ll give you $250 for time off work or for any hassles you have to go through to get your car restored. Will that work for you?”

If this deal goes bad, then what?

Also, there is a good chance your insurance rates will go up. Unless your agreement with the other driver is drawn up by an attorney and you both sign a release agreement, you are still on the hook for future litigation.

- Never Tell Other Drivers Your Insurance Will Cover It

You cannot speak for your insurance company nor commit them to any actions now or in the future. If the collision was severe enough that it exceeded your coverage limits, then your promises are meaningless.

The best response after a collision is to tell the other party, “I’ll notify my insurance carrier and let them handle the matter.” Any and all settlements will originate with the attorneys for the insurance company and the plaintiff’s attorney. You are not part of that decision-making process.

- Don’t Talk to the Other Insurance Company Unless Your Agent Tells You To

You should never take it upon yourself to contact the other insurance company or deal directly with the other driver or their attorney. Your insurance company’s claims department will handle and adjust the claim on your behalf. Remember that the other party’s insurance company and lawyers are looking out for their own interests, not yours.

When the other driver tells your insurance company representative, “I’ve hired an attorney,” then your insurance company’s claim office will no longer talk directly with that driver. Instead, their conversations will be with the other driver’s attorney as both parties work toward reaching a mutually agreeable settlement.

In this section, we describe some lessons we learned from studying past collisions. These lessons are worth learning from to avoid repeating the mistakes.

Know When to Consult Your Own Personal Attorney

The insurance company is obligated to defend and indemnify you in the event of a covered loss. There are, however, circumstances when the insurance company may take the position that your loss is not covered or they choose to defend a claim that puts you at risk of a judgment in excess of your insurance policy limits.

For example, if a non-listed driver was operating a vehicle at the time of the collision, the insurance company may take the position that there is no coverage. Your insurance company may notify you of these potential issues by sending you a “Reservation of Rights” letter. If you receive this type of letter, you should consult with your own private attorney — even if your insurance company has hired a lawyer to defend the claim.

In most circumstances, hiring a personal attorney is unnecessary. However, if you receive a reservation of rights letter, there is a coverage dispute, or your losses exceed your policy limits, then you should strongly consider hiring your own private attorney to look after and protect your rights and interests.

If you decide to hire an attorney, you will need to find one who has experience representing defendants in significant personal injury matters, as well as experience with insurance coverage issues. The insurance company’s attorney will work with your attorney to make sure you are getting the best representation possible and to ensure that all of your interests are being looked after.

Complying with State and Federal Regulations

Federal DOT regulations are recognized as the minimum safety standard for operating commercial motor vehicles across the United States. There are serious consequences when collisions involve commercial motor vehicles and drivers that do not comply with DOT regulations.

Violating federal or state laws is negligence.

Consider an incident in which a legally drunk driver who is speeding rear-ends a farmer’s tractor that does not have a slow-moving vehicle sign attached to the back. The drunk driver’s insurance company may file a lawsuit alleging that that the accident was partially caused by the farmer’s negligence for failing to notify other drivers that they were approaching a slow-moving vehicle.

It doesn’t make the farmer 100 percent at fault for the collision, but the lack of a slow-moving vehicle sign gives the plaintiff’s lawyer ammunition to argue that you owe something for failing to follow the required regulation.

When to Hire a Collision Reconstructionist

Law enforcement professionals who respond to incidents might be tasked with reconstructing collisions. The level of detail and investigation law professionals provide will vary with their experience and training and their first impressions of the nature and severity of the injuries.

When appropriate, your insurance company or attorney may hire a third-party accident reconstructionist. The reconstructionist can carefully measure skid and gouge marks on the pavement, map and analyze the debris pattern of remaining debris, determine the coefficient of friction of the road surface, and take detailed measurements and weights of the vehicles in order to make speed calculations. This detailed information will allow the reconstructionist to offer opinions at trial related to the causes of the collision and approximate speed of each vehicle at the time of impact.

Save the Event Data Recorder

Depending on year and make, some vehicles may be equipped with a “black box” that records the last 5 seconds to 60 seconds of a crash. Depending upon the model and age, these event data recorders (EDRs) can record information such as the vehicle’s speed leading up to the collision, percent of throttle that was being applied, braking input, steering input, cruise control status, and various other information that can help to determine the cause of a collision. Did you change lanes prior to the crash or speed up to beat the light? The EDR will help to confirm or deny these types of things.

This is a synopsis of a true story.

A semi-truck slammed into a passenger car at a stoplight, which killed a young family. The truck driver claimed the car’s driver swerved in front of him and slammed on her brakes as the light turned red.

The EDR told a much different story. The car had been stopped for 3 seconds with no steering input, and the brakes were working normally for a stopped car. This evidence completely destroyed the driver’s claim and defense that the person in the passenger car was at fault.

Take Pre- and Post-Trip Reports Seriously

The DOT requires commercial motor vehicle drivers to create pre-trip and post-trip inspection reports to identify and document items that need a mechanic’s immediate attention. Even if you don’t have commercial motor vehicles in your fleet, having a reporting mechanism (and a paper trail that a vehicle had repairs fixed before the vehicle is placed back into service) is critical.

At a minimum, make sure to check each day that the lights and turn signals are working, that the tires have sufficient tread, that they are inflated to their proper pressure, that there are no cuts in sidewalls, and that wipers can remove rain and dirt from the windshield. You can purchase driver vehicle inspection report forms online to help you document these inspections.

Conduct Annual Third-Party Inspections

All commercial motor vehicles are required to undergo an annual inspection conducted by a qualified company or third-party mechanic. Regardless of whether your vehicles fall under federal and state regulations regarding annual inspections, these inspections become critical in any defense after a collision or crash.

While qualified company or farm mechanics are well-equipped to perform annual inspections, it may be a good idea to hire a third-party mechanic to inspect trucks and trailers that your mechanics inspect each year. Hiring a third-party provides an independent opinion as to the roadworthiness of your fleet. Furthermore, a third-party mechanic may catch things that you or your employees would not have caught. It also shows that the trucks and trailers your mechanics service can pass an inspection by an independent third party. These are all things that could help you in the event of a lawsuit.

So, if you have five semi-tractor trailers or straight trucks, take a different one each year to an outside garage for the annual inspection while continuing to inspect the other equipment annually.

Keep Maintenance Files on Each Truck and Trailer

If you do not already do so, create a maintenance file on each truck and trailer that you own starting today. The file should include every aspect of maintenance, including bills for oil changes, windshield wiper blade changes, and really anything that you do to the equipment. There is nothing too minor that you should not document it. If it’s not written down and can’t be retrieved, then it’s assumed that it never took place.

The collisions we’ve discussed in this publication clearly demonstrate how important it is to document your vehicle maintenance program. It shows the court and the lawyers that you were organized, paid attention to details, and that you are focused on (and care about) safety.

Think about your position at a deposition or in front of a jury when you can say: “Here is my maintenance file. The brakes were checked two months ago. It’s unfortunate that the brakes failed. The driver had no indication the brakes were going bad based on his inspection reports. The maintenance records on our vehicles show I do what’s right. We have a process every vehicle goes through. The brakes failed, for which we are sorry, but not because we ignored them.”

Without the maintenance records for each vehicle and trailer, the plaintiff’s lawyer might argue, “Maybe he was at fault since he cannot show the he inspected the brakes. Maybe his brakes were faulty because he was negligent by not having them inspected. A reasonable and prudent operator would have inspected and maintained the brakes on a regular basis.”

Stay Legal with Weight Limits

Trucks and trailers have a gross vehicle weight rating (GVWR) that manufacturers assign to them. The manufacturers build and equip their vehicles and trailers to accommodate specific weights, for which they were designated and certified. An overloaded truck or trailer may constitute negligence, which makes it easier for a plaintiff’s lawyer to argue that you were at least partially at fault for the collision.

The plaintiff’s lawyer could argue, “I understand that my client ran the stop sign, but had your truck not been overloaded you would have been able to stop in time to avoid the collision and the resulting injuries.” The lawyer could also paint a picture that you care more about profits and productivity than about safety.

Conduct Random Drug and Alcohol Tests

Drivers can put everything you own at risk when they decide to drive impaired. There already is enough risk in driving without being impaired by alcohol or drugs. Require employees, as part of their continued employment for the farm or business, to submit to a random drug and alcohol testing program.

Set up a program where the hospital or occupational clinic will randomly select names from the pool of drivers who will then be subject to testing. It might deter drivers from using if they know they may be called to provide a urine or blood sample. In addition, make it clear in your policies that testing will take place in the event of an accident.

Be Aware of Prescriptions, Too

Some prescription drugs cause the same effects as recreational drugs or alcohol. Encourage drivers to talk with their doctors about the effects that prescriptions will have on them.

Post-accident investigators may gain access to this information and use it against drivers who attempt to hide their use.

Monitor Hours Behind the Wheel

A line of questioning that lawyers will follow is whether the driver was alert at the time of the collision. Federal law says that under no circumstances can drivers of commercial motor vehicles drive more than 11 hours per day without 10 hours off. This is a good guideline to follow even for companies that are not regulated by DOT. Following this guideline would provide a legal defense that drivers (and companies) were following the more stringent rules.

Install Front and Back Cameras

Today’s vehicles are electronic wonders. Some have front cameras that can record and replay an entire trip. You can see every traffic light, stop light, intersection, and car the driver passed.

It’s hard to dispute images captured by rear- and front-mounted vehicle cameras. They record exactly what happened at the scene so nobody has to decide which driver’s version of the facts is right. While it might be necessary to show the footage to a law enforcement officer, you should never surrender video footage unless legally required to do so. You have a legal obligation to preserve and maintain the footage.

Drive the Speed Limit

If you drive above posted speed limits, you are at greater risk if there is an incident. Just like weight limits, driving in excess of the speed limit might lead a jury finding you partially at fault.

Once again, a plaintiff’s lawyer could reasonably argue that if you had not been speeding, you would have had time to lessen the impact of the collision. Equipping your fleet with speed governors is another way to ensure that your drivers drive at reasonable speeds and shows that your focus is on the safety of your drivers and others.

Make Sure Equipment Markings Are Legible

Slow-moving signs are meant to give other drivers ample warning about what they are approaching on the roadway. Failure to include slow-moving signs on your equipment can violate the law. Therefore, no sign means that you were at least partially at fault for the incident. Always be certain that the signs are not just present, but clearly visible to other drivers.

Screen Drivers Before Hiring Them

Insurance companies may perform background checks on drivers that you want to add to your insurance policy. Be concerned about hiring a driver who has had reckless driving violations, a DUI, and speeding tickets. Insurance agents will point out that an individual’s past driving record is a good predictor for future driving behaviors. A bad driving record might mean that an insurance company will not cover the driver.

Have Employees Report Violations After Hiring Them

Make it a requirement for continued employment that drivers report any moving violations or driving under the influence whether they are on or off the job. It might be useful to recheck the driver’s record each year in the event they fail to tell you about a problem they were cited for while driving.

As with any procedure or policy, don’t implement it if you aren’t going to follow up. Failing to follow through on policies and procedures can be worse than not having the policy or procedure in the first place.

KEEP YOUR INSURANCE IN ORDER AND UP-TO-DATE

Many people falsely believe that by paying the insurance bill they are covered. But insurance is more than writing out the check and saying, “I’m covered.” Your insurance policy and what it covers is your backstop in protecting you against the liabilities that arise out of a traffic incident. We all want insurance at the lowest cost, but if you buy cheap insurance that doesn’t cover all your actual needs, then you are, in fact, wasting money and putting your financial future at great risk.

The only way to know what your policy covers is to read the policy language. The law presumes that you have read the policy — even though many companies only provide the policy language upon request.

For most people, the big stumbling block of knowing what their policies actually cover is that it is difficult to readily understand detailed insurance policies if you are not involved in the insurance business. It is important to have an insurance agent or personal attorney who understands your business and risk exposures to make sure you are adequately covered.

Insurance policies are complex legal contracts that have many exclusions and limitations. Unfortunately, most people don’t read or understand their policies until after tragedy has struck. Don’t just take the insurance agent’s word for it. Confirm what they tell you in writing, and then ask for the policy provision that backs up what they are telling you.

Your Answers Will Vary

The questions we ask in this section (and their answers) will vary depending on your insurance policy. You need to know the answers to them. Without knowing for sure, you are “knocking on wood” as the popular television ad continues to tell us.

The time to decide whether your current policy covers your liabilities is before you are involved in an accident or loss. When you meet with your agent, come prepared to ask questions about the risks you face and to go over the coverages listed on the policy. Make sure your insurance backstop is not an open door where the policy does not cover what you think it should.

Here are a few questions worth asking your insurance agent:

What happens if an uninsured or underinsured motorist hit my vehicle?

This is an important question when you consider that some estimates conclude that a staggering 40 percent of drivers lack insurance or carry only the bare minimums required by the state. What makes this more difficult is that, generally speaking, drivers do not understand how important this part of their policy is for protecting their families, properties, and businesses.

The cap for an uninsured/underinsured motorist portion of the policy is determined by the amount of your liability coverage. For example, if you have $250,000/$500,000 liability limits, the most you could recover for an uninsured/underinsured is $250,000/$500,000. You could lower the liability limits, but the uninsured/underinsured limits cannot be higher than the liability you carry on your vehicle.

Assuming you have uninsured coverage, your policy is available to pay your medical charges, pain and suffering, and lost wages up to the listed limits. When the collision involves an underinsured motorist, your insurance company will pick up where the fault driver’s policy left off and will pay up to the limits of your policy.

If the amount of damages caused by an uninsured or underinsured motorist exceeds your policy limits, you are likely out of luck. The insurance company may try to recoup some of the money it spent on your claim from the uninsured driver through garnished wages, court decrees, or other means.

Be aware that the property damage portion of your uninsured or underinsured policy works a little differently than the medical coverage. It is common for property damage limits under the uninsured and underinsured sections to pay claims at a fixed amount between $10,000 and $25,000. This is not enough to pay to repair or replace newer farm equipment, trucks, or semi-tractor trailers.

The good news is that once the maximum of the uninsured/underinsured damage limits are met, the collision portion of the policy covers the costs up to the limits of the policy. If you don’t have collision coverage, then you will pick up those costs.

Look at the limits for the medical portion of the underinsured and uninsured to see if you have enough to cover a tragic accident. You can buy higher limits of coverage if necessary. You cannot change the property damage under the uninsured or underinsured section. Thus, it’s really important to look at the extra cost of the premium for collision coverage relative to what it brings toward protecting vehicles and equipment when hit by an uninsured or underinsured motorist.

Does my policy cover both property damage to my vehicle and any bodily injuries that I sustain if I am hit by an uninsured or underinsured driver?

Many people are unaware that their insurance policies may carry liability-only coverage and not cover property damage or your bodily injuries. In Indiana, these are optional coverages on the insurance policy. Most experts agree that both should be part of the coverage.

What happens if a driver not listed on my policy is involved in a wreck?

This is an important question in the event that you hire someone to help or if a friend or relative offers to help. Would this person be covered if they are in a crash? Are your assets protected if they are in a crash? Ask your agent to price out a coverage plan that includes “all employees or agents,” named or not.

What happens when the truck I loaned out is in a crash?

Most insurance policies follow the vehicle, but there are some policies that do not. It is important to know the answer to this question before you loan out your equipment. While the driver will not be able to escape all liabilities, the most important thing is that the person who loaned out the truck or equipment could be on the hook for damages even if that person is not the driver.

What happens if my trailer comes unhooked from my truck?

Insurance covers the liabilities of the pulling vehicle (that is, the covered vehicle). Usually, the policy will cover a trailer as long as the trailer remains attached to the insured vehicle. Once it detaches and is freely moving on its own, it is no longer part of the covered vehicle, which means there is no coverage for the damages it may cause.

Most insurance companies will ask to write a separate liability policy for the trailer or to add an endorsement that covers the trailer in case it detaches. Considering that nearly 30 percent of trailers come off their hitches, it is good to ask: “Will my policy cover me if my trailer comes off and slams into another car?”

How does an umbrella policy provide additional coverage to my policy?

The umbrella policy usually provides limits in excess of the underlying general liability, vehicle liability, and employer liability policies under worker’s compensation. The umbrella policy provides supplemental liability insurance for a nominal premium increase. Its limits apply after the primary insurance limits have been reached.

A True Story

Pay attention to this real story from a business owner.

“Looks like I really messed up. I failed to add a driver to my policy, and it looks like I have to take a total loss on my bucket truck. My driver wandered off the road 100-plus feet before hitting a 4-foot-plus ditch culvert. After impacting the culvert, the 24,000-pound truck ricocheted back onto highway. It was a total loss of $20,000. Fortunately, there were no injuries, and no other cars or vehicles where struck.”

Imagine how different the story would be if someone had been injured or property damaged. With no coverage, the claim could have bankrupted the company.

Think of an umbrella policy this way. You have a $100,000 liability policy but find yourself in a lawsuit for $700,000. When asked how much you want your insurance to pay, you say, “All of it, of course.”

The agent responds they will only play up to $100,000 for the claim. But, if you have a $1 million umbrella policy, the next $600,000 will come out of that policy. Without the additional coverage, you could be personally responsible for the $600,000 claim. This is why your conversation with your agent often begins by listing assets and identifying coverage limits that may need to be increased.

Does the umbrella policy cover an accident from an uninsured or underinsured driver?

The umbrella policy does not cover any uninsured and underinsured liabilities that you incur unless it has a specific endorsement that provides this type of coverage. Your coverage is limited to whatever the basic policy covers.

The consequences of vehicular collisions are among the most frequent and potentially severe situations that business owners must insure themselves against. Whether you own one truck or a whole fleet, your business and farm may be at risk.

Each incident — whether a fender bender with no injuries, a major crash that disables someone, or a collision that kills someone — carries the potential for serious consequences. However, business owners and farmers have little choice but to put drivers behind the wheel of a pickup, tractor, or semi if they expect work to get done.

Crashes can also significantly interrupt your business activities. For example, if your combine is damaged during harvest season, it could significantly affect your bottom line.

There is a lot riding on having the right insurance coverage. But it’s typical that you receive the insurance bill, shake your head, utter a few words about the premium, and then pay the bill.

Get Papers To Your Agent Quickly

If, after a serious collision, the other driver’s attorney serves you papers for a lawsuit, then get them to your insurance agent that day or, at the latest, the following day. Doing so allows the claims department to assign an attorney to your case and to start the process of representing you in further legal matters.

LIMITING EXPOSURE WITH SEPARATE BUSINESS ENTITIES

Contingency planning means you should think about what you need to do before one of your trucks is involved in a collision. To account for that possibility, you adjusted your insurance policy to cover unforeseen truck and equipment incidents. You also adjusted your vehicle maintenance and upkeep practices by documenting everything you do. That’s good.

But to maximize your protection, you also may need to consider how you structure your business and farm. When organized correctly, a business entity is designed to protect your personal assets in the event you are involved in a serious collision.

Find Out More

Creating a corporation or LLC to deal with the risk posed by highway incidents may be an important part of your contingency planning and managing transportation risks. Whether you have a farm or business, consider reading more about this topic in two other Purdue Pesticide Programs publications:

BOTH PUBLICATIONS ARE AVAILABLE FROM THE PURDUE EXTENSION EDUCATION STORE: EDUSTORE.PURDUE.EDU

CONCLUSIONS

Mile after mile of interstate are lined with billboards advertising lawyers offering to help people who have been seriously injured in truck and automobile accidents. Clearly, lawyers wouldn’t spend the money on expensive billboards if highway accidents didn’t generate income for them and they were unable to recoup losses for their clients. Traffic incidents are a risk we all face.

Collisions even happen to those who put safety first. Too many people assume that collisions are most often caused by mechanical failures such as brakes out of adjustment. But the truth is that most collisions are due to driver inattention and distraction. Most drivers don’t appreciate that a few seconds of taking your eyes of the road can carry you the length of a football field. When this happens, lawsuits, depositions, mediation, and trials will take years to get resolved.

Be prepared to the best of your ability to deal with a collision that brings you to a deposition and face-to-face with the plaintiff’s attorney or in court. With that in mind, incorporating a few of the contingency measures outlined in this publication might help you better deal with the legal complexities that often follow highway collisions. They will also likely make you, your employees, and your vehicles safer on the roadways.

Remember, it’s not a question of if you will have an accident, but when.

Will you be able to protect your interests? The measures you put in place today provide you an opportunity to prove you are a reasonable and caring person instead of a careless and negligent driver or company. Which side would you rather be on: reasonable and caring or careless and negligent?

ACKNOWLEDGMENTS

Thanks to Dawn Minns for graphic design. Thanks also to the following individuals who provided valuable comments and suggestions that improved this publication.

Jeffery Ling, Arborwise, LTD.

Brian Miller, Miller Risk Management, LLC

Jud Scott, Jud Scott Consulting Arborist, LLC

John Shoup, Indiana Agricultural Law Foundation

Mark Thornburg, Indiana Farm Bureau

Don Weedman, Kentucky State Police (ret.) and Princeton Kentucky Police Chief (ret.).

Disclaimer

This publication is intended for educational purposes only. The authors’ views have not been approved by any government agency, business, or individual and cannot be construed as representing a perspective other than that of the authors. The publication is distributed with the understanding that the authors are not rendering legal, insurance, and/or other professional advice to the reader, and that the information contained herein should not be regarded or relied upon as a substitute for professional consultation. The use of information contained herein constitutes an agreement to hold the authors, companies or reviewers harmless from any and all liability, damage, or expense incurred as a result of reference to or reliance upon the information provided. Mention of a proprietary product or service does not constitute an endorsement by the authors or their employers. Descriptions of specific situations are included only as hypothetical case studies to assist readers, and are not intended to represent any actual person, business entity or situation. References to any specific commercial product, process, or service, or the use of any trade, firm, or corporation name is for general informational purposes only and does not constitute an endorsement, recommendation, or certification of any kind by Purdue University. Individuals using such products assume responsibility that the product be used in a way intended by the manufacturer and misuse is neither endorsed nor condoned by the authors nor the manufacturer.

Purdue Pesticide Programs offer a number of publications on related topics to help you manage your operations better. All publications are available from the Purdue Extension Education Store: edustore.purdue.edu 765-494-6794