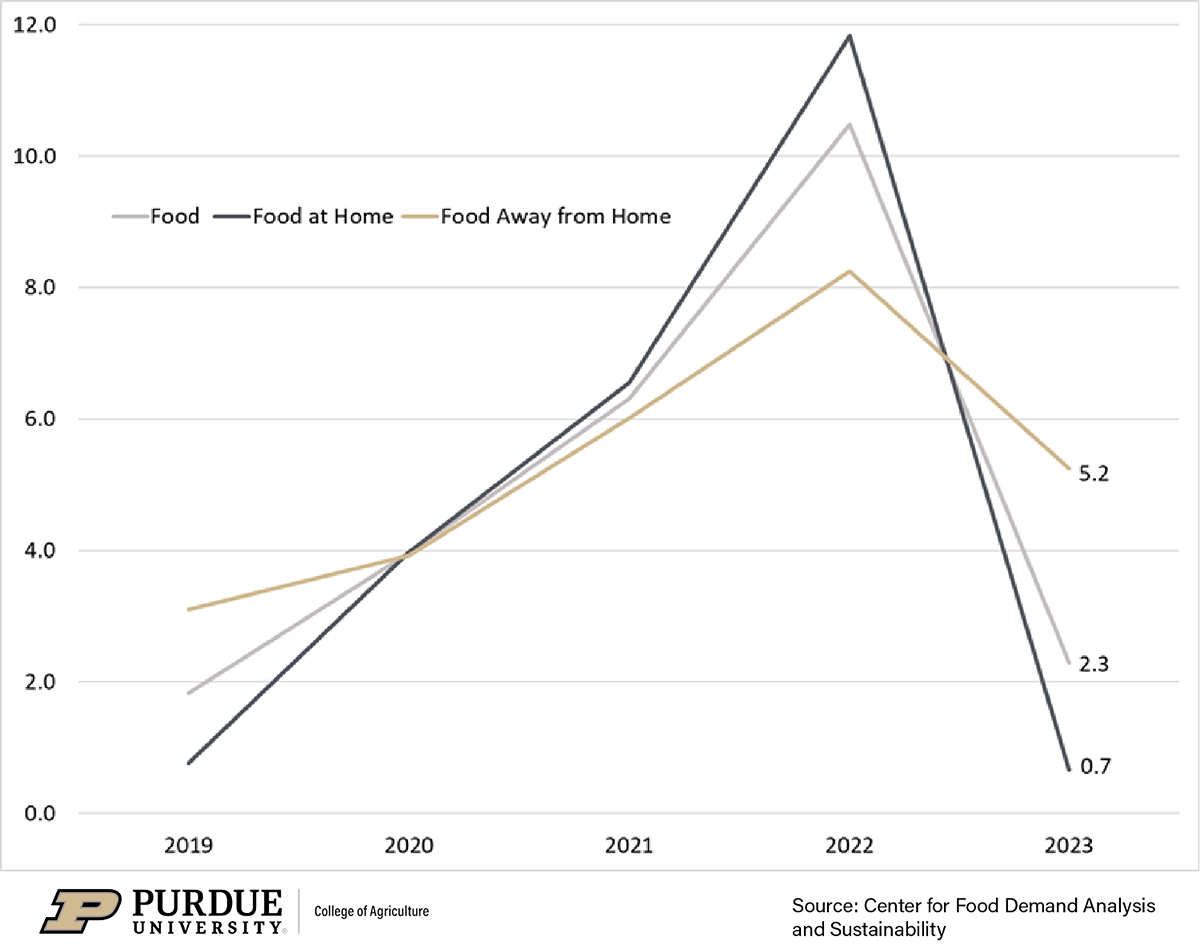

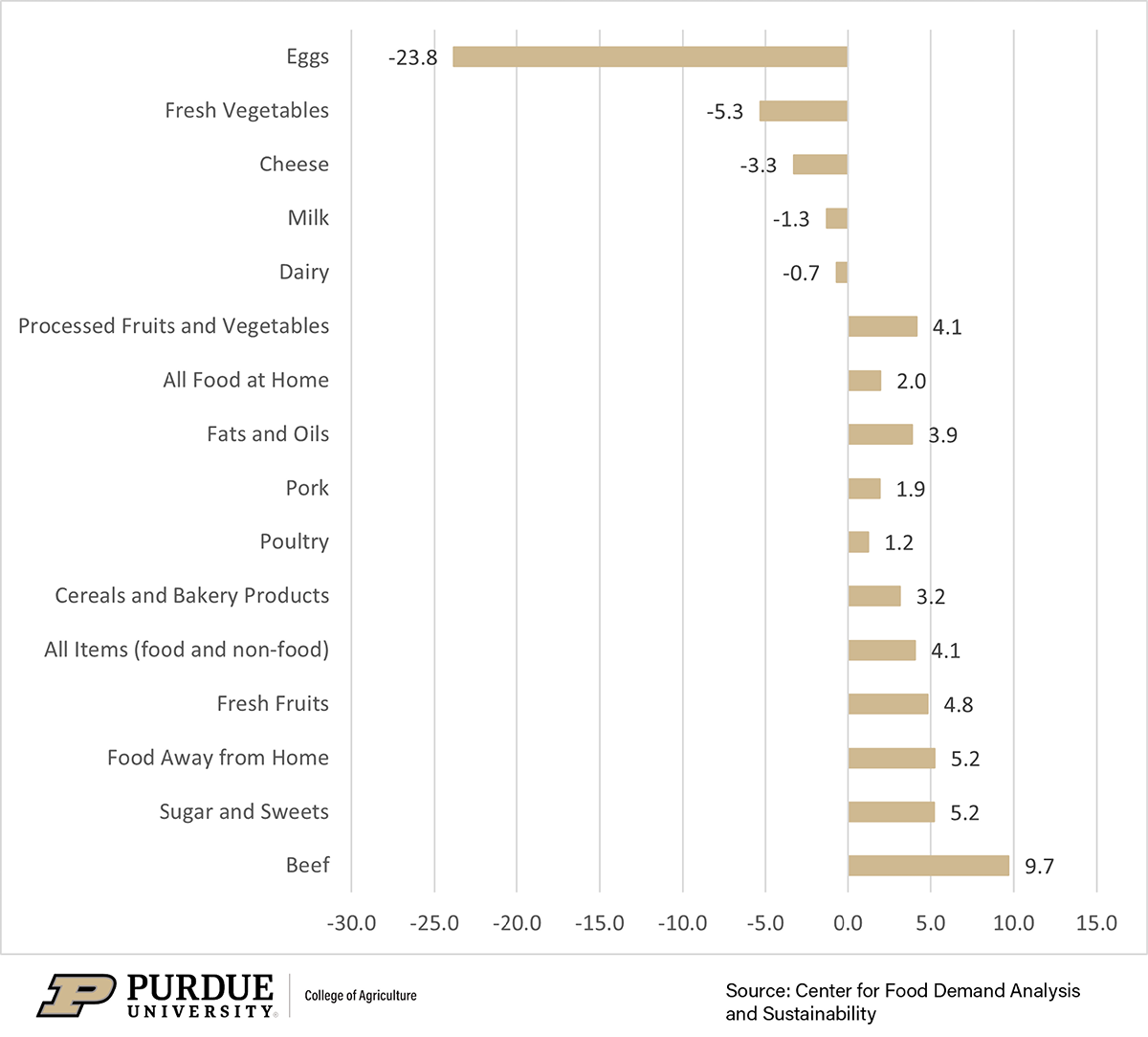

Happy New Year, readers! In December, we talked about economic gloom and overall low consumer sentiment related to the economy. In this post, we will briefly summarize food prices in 2023 and predict food prices over the next year and the potential impact on American wallets. To recap, food price inflation slowed in 2023, rising by 2.3% over the course of the year (see Figure 1). That was the slowest growth in food prices since 2019, before the onset of the COVID-19 pandemic and related disruptions to the economy. Prices of Food at Home (FAH, or groceries) rose by 0.7%, while prices for Food Away from Home (FAFH, or food service, including restaurant meals) rose by 5.2%.

In addition to higher prices for FAFH, the items with the largest price increases were beef, sugar and sweets. Beef prices were 9.7% higher this December than they were a year ago, driven by strong demand and low cattle inventories. Sugar prices were 5.2% higher than a year ago, as droughts in key producing areas around the world, including the U.S. South, limited sugar production.

Meanwhile, prices for some food staples fell in the past year. Egg prices fell by 23.8%, as the incidence of the highly pathogenic avian influenza (HPAI) faded through the last half of the year. Prices of fresh vegetables fell by 5.3%, and prices of cheese products fell by 3.3%.

While food price inflation eased in 2023, the combined effect of inflation over the past several years has left food prices significantly higher than they were pre-pandemic. Food prices are 25% higher than they were in 2019, before the onset of the COVID-19 pandemic. Those price increases, together with higher prices in general, have eroded consumer purchasing power. As a result, consumer confidence in the economy is lower than it was even at the height of the COVID-19 pandemic.

But economic conditions started to improve in the last half of 2023. Historic interest rate hikes by the Federal Reserve starting in Spring 2022 seem to be having their intended effect of slowing inflation. Inflation has slowed for food prices and across the rest of the economy. Energy prices have fallen 2% in 2023 and core inflation (that is, prices of all items excluding food and energy), while not yet at the Federal Reserve’s 2% target rate, is moving in that direction. Core inflation was 3.1% through December 2023, and had slowed in the last half of the year.

At the same time, overall economic growth has contributed to increased incomes. Average wages rose by 4.1% in 2023, more than offsetting inflation. This marks the first year since 2020 that consumer purchasing power has increased.

So, what’s on the horizon for 2024?

Macroeconomic uncertainty will continue through 2024. The Federal Reserve is focused on bringing inflation down, so hopefully the worst of inflation is behind us. However, higher rates may also slow economic growth, causing higher unemployment and slower wage growth. We have avoided the recession that some economists have been predicting for more than a year, but it remains to be seen whether the Federal Reserve can pull off the so-called “soft landing.”

In food market news, the HPAI has shown some signs of re-emerging, resulting in the loss of 1.5 million birds in December 2023. Should this resurgence continue, we could see higher poultry and egg prices, like what was seen in 2022. Note: To keep up to date on egg prices, visit the related dashboard published by the Center for Food Demand Analysis and Sustainability.

The U.S. Department of Agriculture Economic Research Service is forecasting that food prices will continue to “decelerate” or slowdown in 2024. Food prices are expected to increase by 1.2%, specifically with Food at Home (FAH) prices decreasing by 0.6% and food away from home prices predicted to increase by 4.9%. ERS predicts the highest price increases in beef and veal (4.8% increase) and sugar and sweets (4.9% increase) for 2024.

Respondents to our recent Consumer Food Insights (CFI) survey also expect a decline in the rate of food inflation during 2024. In December 2023, consumer inflation expectations for the next 12 months (3.5%), was 0.6% lower than the 12-month expectation in December 2022. A recent decrease in consumer food inflation expectations from our CFI survey suggest a similar outlook to the ERS report.

Whether or not these forecasts will play out to be true remains to be seen, but we are optimistic that with the increase in overall income and purchasing power over the next year, it will hopefully lead to consumers seeing relief on their wallets.

For questions and/or inquiries related to this topic, you can contact us through this form or email chubbell@purdue.edu.

Footnote:

- An earlier version of this data, collected through November 24, 2023, was recently published in the Purdue Agricultural Economics Report (PAER). The data discussed in this Chew On This! blog post was collected through December 2023.