First-quarter Agrifood Economy Index shows acute downturn in industry confidence

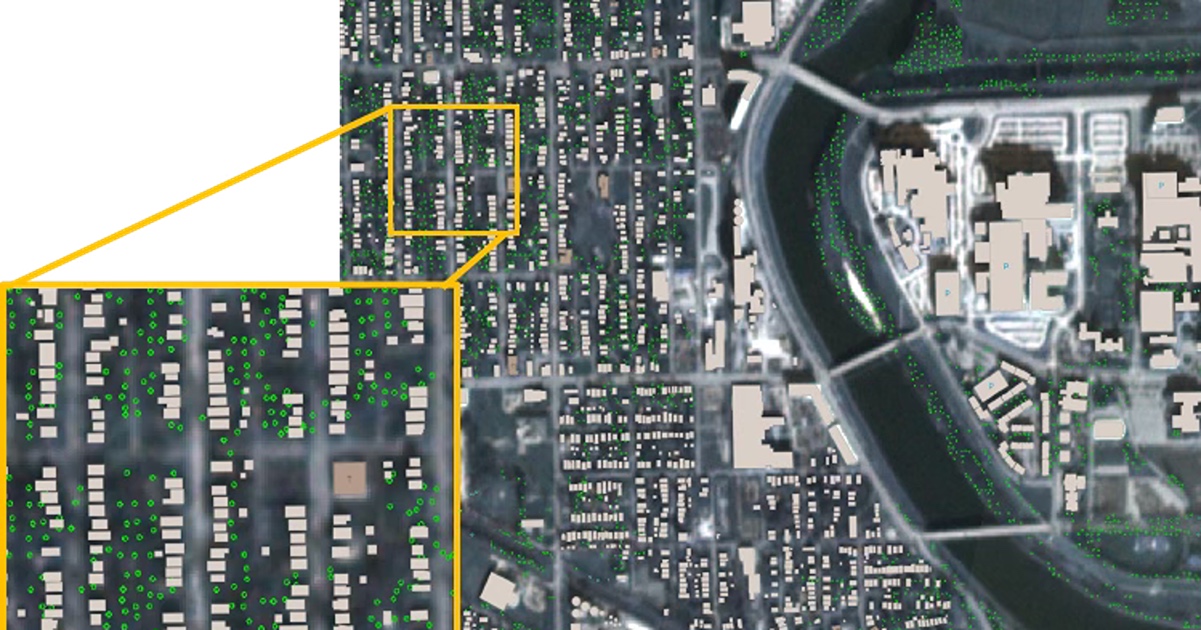

The overall Agrifood Economy Index for the first quarter of 2025 has dropped to 82, with rising uncertainties around macroeconomic forces, according to the latest data released by Purdue DIAL Ventures. Food manufacturing is one of six agrifood segments measured in the index. (Purdue Agricultural Communications Photo/Tom Campbell)

The overall Agrifood Economy Index for the first quarter of 2025 has dropped to 82, with rising uncertainties around macroeconomic forces, according to the latest data released by Purdue DIAL Ventures. Food manufacturing is one of six agrifood segments measured in the index. (Purdue Agricultural Communications Photo/Tom Campbell)

WEST LAFAYETTE, Ind. — The March edition of the Agrifood Economy Index reveals a pronounced downturn in industry confidence, marking the lowest sentiment level recorded since the survey’s inception in October 2023.

“Compounding economic pressures — ranging from inflation and interest rate hikes to labor shortages and political uncertainty — are reshaping expectations and influencing investment decisions across the agrifood value chain,” said Lourival Monaco, a DIAL Ventures research manager and research assistant professor in agricultural economics at Purdue University.

Purdue’s DIAL Ventures designed the Agrifood Economy Index as a strategic tool to measure economic sentiment across the agrifood industry. It gathers insights from key decision-makers across six core industry segments. Conducted quarterly, the survey tracks current conditions, future expectations and investment outlooks, providing data to help industry leaders navigate market dynamics.

The March survey gathered responses from 220 agrifood professionals representing all six segments of the value chain: agricultural input manufacturers, distributors, producers, processors, food manufacturers and support service providers.

The overall Agrifood Economy Index fell sharply to 82 in March, down from 94 in December 2024 (anything above 100 signals positive sentiment). This marks the lowest score since the index began and reflects widespread pessimism across the industry. Both current and future sentiment indices declined this quarter. The future sentiment index dropped 20 points to match the overall score of 82.

“This rare convergence of pessimism in both near-term and long-term outlooks points to a shared unease among respondents about where the industry is headed,” said Monaco, a co-author of the report.

While the outlook remained largely negative, the investment index rose slightly from 92 to 93. “Although modest, this increase suggests that some companies continue to cautiously evaluate capital opportunities, even as broader confidence remains subdued,” he said.

Within individual segments, shifts in sentiment were mixed, though generally negative. The agricultural input manufacturing segment index dropped to 91. “This change was driven largely by a steep decline in future expectations, which fell from 97 to 85,” Monaco said.

“Although the segment’s current outlook remained unchanged from the previous quarter, concerns about geopolitical risks, regulatory challenges and supply reliability appear to be creating long-term uncertainty.”

Input distribution, on the other hand, showed modest improvement. The segment’s index climbed to 88, continuing a recovery trend from late 2024. This gain resulted mostly from assessments of current conditions, though future sentiment declined slightly, Monaco noted. “This cautious optimism may reflect stabilizing grower demand, even as long-term planning remains constrained by input price volatility and economic headwinds.”

Sentiment in the agricultural production segment declined to 94, reversing the optimism seen at the end of 2024. Both current and future outlooks worsened, with the latter falling more sharply. “Producers cited ongoing pressure from low grain prices, rising costs and seasonal risks, contributing to a renewed sense of caution about their financial prospects,” Monaco said.

Processing and handling businesses reported a notable decline in sentiment, with the index falling to 81. This marks a significant drop from prior quarters, driven by simultaneous declines in both current and future indices. “Declining margins and volatility in grain movement may be eroding confidence in this part of the value chain,” Monaco said.

In contrast, food manufacturing showed some improvement, climbing to 93. The current conditions index reached 100, buoyed by factors such as stabilized supply chains and stronger seasonal demand. However, long-term sentiment fell to 83, suggesting continued concerns around inflation, changing consumer behaviors and regulatory uncertainty.

Support services and products recorded the sharpest decline this quarter, with the index falling from 95 to 82. After several quarters of relative stability, sentiment within this group has deteriorated meaningfully, Monaco noted. “Respondents cited budget constraints, delayed purchasing decisions and general macroeconomic unease as drivers of both current and future pessimism.”

This quarter’s survey included a section that explored how broader economic forces are influencing business decisions in the agrifood sector.

Interest rates emerged as a major factor affecting investment planning. Increased financing costs were reported by 39% of respondents. Another 32% said they had adjusted investment timing to account for borrowing conditions. A smaller portion indicated postponing or scaling back investments altogether. “These responses align with the conservative tone observed in the broader index,” Monaco said.

Inflationary pressures also remained top of mind. Nearly three-quarters of respondents indicated their operational costs had risen over the past year, with 49% reporting a moderate increase. Another 23% cited a significant increase. “Inflation appeared to be felt most acutely by those in agricultural production, food manufacturing and processing, reflecting the high cost of operation and production,” Monaco said.

Political instability continues to weigh on long-term planning. Political and regulatory uncertainty had at least a moderate effect on the strategic outlook of 63% of those surveyed. Input manufacturing leaders reported the greatest concern, likely because of exposure to global trade and regulatory dynamics. Input distribution professionals appeared less concerned.

“Labor availability remains a challenge across the industry, though not an acute one,” Monaco said. About 65% of respondents noted at least slight difficulty in hiring and retention. “The issue appeared most pronounced in food manufacturing and input distribution, while support services and input manufacturing reported comparatively lower impacts,” he noted.

Market uncertainty is slowing major investment decisions. “Only 9% of businesses are proceeding with investment plans without any changes,” Monaco said. Nearly half are reevaluating strategies or delaying projects. This suggests that firms are taking a more deliberate, cautious approach amid a shifting economic landscape.

Tariff-related uncertainty continues to present challenges, as well. “Respondents ranked increased input costs and contract pricing uncertainty as the most disruptive effects of tariffs,” he said. “Long-term concerns like trade competitiveness and supply chain disruption were viewed as secondary.”

About Purdue Applied Research Institute

The Purdue Applied Research Institute (PARI) is a nonprofit entity that extends the reach and impact of Purdue University’s deep research strengths and top-ranked academic programs in engineering, agriculture, science and technology. PARI works to improve national security, global development and infrastructure solutions and to accelerate critical technologies. Through applied research and program personnel, state-of-the-art facilities, and infrastructure, PARI enhances Purdue’s ability to translate discoveries into innovative solutions and services for mission-oriented government, industry, NGO and foundation partners. PARI is an incubator for advanced development and transition of leading ideas and technology with potential for significant impact through large-scale prototypes, pilots and startups. https://pari.purdue.edu/

About DIAL Ventures

DIAL Ventures, the agrifood innovation arm of the Purdue Applied Research Institute, tackles big problems facing the U.S. and the world such as food safety, supply chain shortages, sustainability and environmental impact. DIAL Ventures creates new companies that drive innovation in the agrifood industry, which, in turn, makes a positive impact in our lives and lifestyles for years to come. Learn more at dialventures.com.

About Purdue University

Purdue University is a public research university leading with excellence at scale. Ranked among top 10 public universities in the United States, Purdue discovers, disseminates and deploys knowledge with a quality and at a scale second to none. More than 107,000 students study at Purdue across multiple campuses, locations and modalities, including more than 58,000 at our main campus in West Lafayette and Indianapolis. Committed to affordability and accessibility, Purdue’s main campus has frozen tuition 14 years in a row. See how Purdue never stops in the persistent pursuit of the next giant leap — including its comprehensive urban expansion, the Mitch Daniels School of Business, Purdue Computes and the One Health initiative — at https://www.purdue.edu/president/strategic-initiatives.

Writer: Steve Koppes

Media contact: Devyn Ashlea Raver, draver@purdue.edu

Sources: Lourival Monaco, lmonacon@purdue.edu

Agricultural Communications: Maureen Manier, mmanier@purdue.edu, 765-494-8415