Gender differences in food choices are surprisingly small

Whether buying organic, checking nutrition labels or recycling, the preferences of men and women display striking similarities, according to the monthly Consumer Food Insights Report.

The survey-based report out of Purdue University’s Center for Food Demand Analysis and Sustainability assesses food spending, consumer satisfaction and values, support of agricultural and food policies, and trust in information sources.

“In this issue, we break down our results across male/female and married/unmarried respondents. We wanted to explore gender gaps in food consumption and the effect of marriage choices,” said Jayson Lusk, the head and Distinguished Professor of Agricultural Economics at Purdue who leads the center.

“We often focus on differences in these reports, but the similarity between men and women in some of our data is notable. Some might think that men and women go about their shopping in different ways with different priorities,” Lusk said.

If so, the center’s latest report might surprise them.

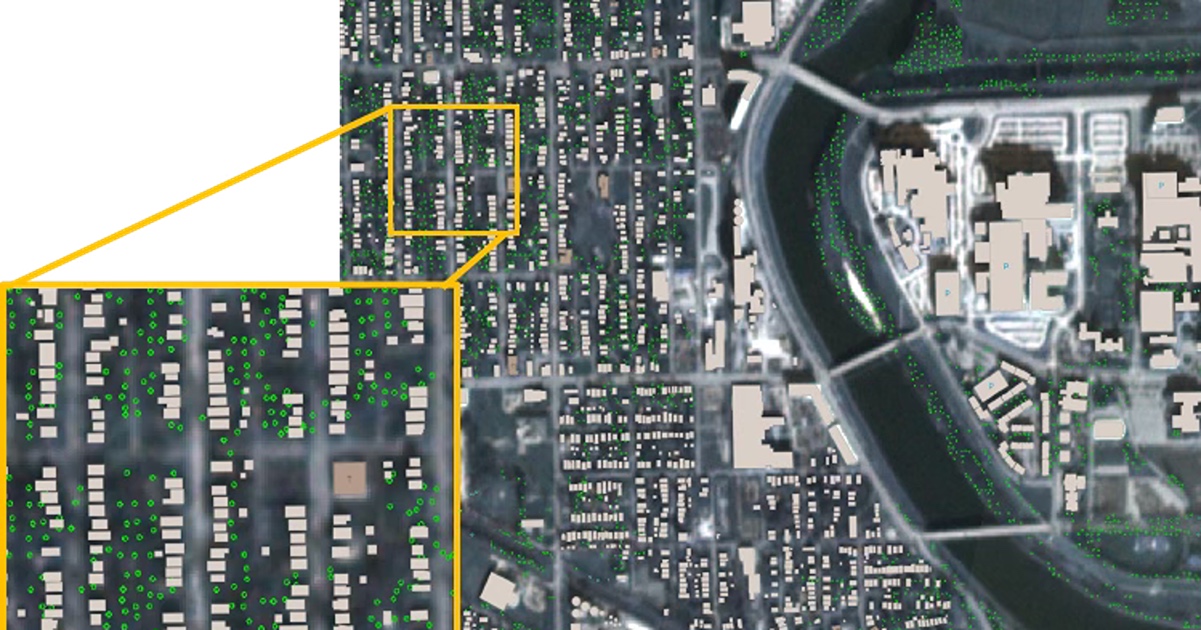

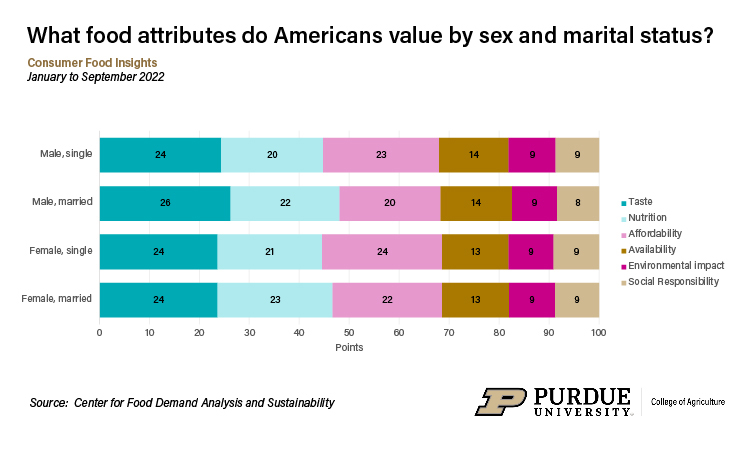

All four categories of respondents stated that they sometimes choose generic foods over brand-name foods, for example. All four groups also said they rarely choose plant-based proteins over animal products. And the four groups ranked six categories of food attributes almost exactly the same from top to bottom. The six attributes they rated in order of importance when they shopped for food were taste, nutrition, affordability, availability, environmental impact and social responsibility.

Additional key results include:

- Food spending remains near its 2022 peak.

- Women face higher food insecurity than men, but married women are faring much better.

- Food satisfaction is highest among married men and lowest among unmarried women.

- Women and unmarried people broadly express more progressive food politics.

- Consumers eat less seafood than recommended by Dietary Guidelines for Americans.

Share of 100 Points Allocated to Food Attributed by Sex and Marital Status, Jan. - Sept. 2022

Share of 100 Points Allocated to Food Attributed by Sex and Marital Status, Jan. - Sept. 2022 The September report includes a new question about how people define the term “regenerative,” which is currently a hot buzzword in food and agriculture.

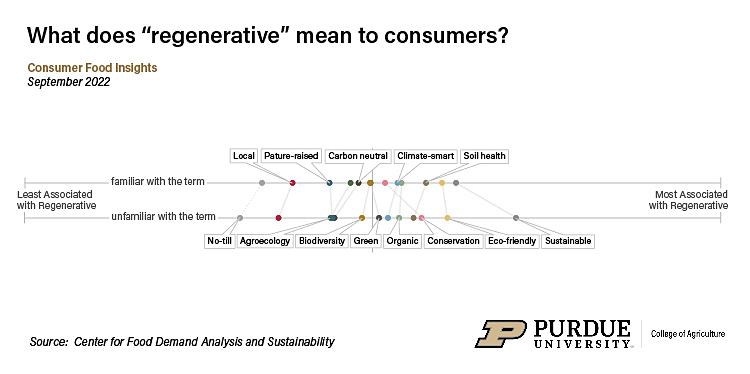

“Based on our results, ‘regenerative’ seems to be synonymous with ‘sustainable’ in the minds of many consumers,” Lusk said. “Interestingly, some practices that typically fall under ‘regenerative,’ such as no-till farming, are comparatively much less associated with ‘regenerative.’”

That may mean the term has yet to penetrate the public perception as a specific, cohesive approach for producing and consuming food, he noted.

Best-Worst Scale of Food and Agriculture Terms Associated With "Regenerative" Based on Self-reported Familiarity with the Term, Sept. 2022

Best-Worst Scale of Food and Agriculture Terms Associated With "Regenerative" Based on Self-reported Familiarity with the Term, Sept. 2022 Consumers’ expectations for annual food price inflation continued to decline, indicating their confidence that the rise in food prices will soon moderate. Official government data, however, show prices continuing to increase at unprecedented rates, said Sam Polzin, a food and agricultural survey scientist for the center and the report’s co-author.

“As of August, grocery prices are up 13.5% over last year, and experts suggest the factors driving food inflation, including labor and commodity costs, war, and extreme weather, will stick around,” Polzin said. “It is a waiting game to see if consumer intuition is indicative of the future or if their inflation expectations will go back up.”

The survey’s overall food insecurity number remained stable at 14% of households. Polzin finds this surprising given all the talk about high food prices. How to explain this remains elusive.

“We can only speculate that consumers have been able to cope via avenues like pandemic savings, government safety net programs, spending on credit cards and pulling back on other discretionary spending,” he said. “The disparity between married and unmarried people is striking, too. On this point, marriage directly provides small benefits, like feeding more people with fewer costs, but it is also correlated with other economic advantages.”

Lusk further discusses the report in his blog.

The Center for Food Demand Analysis and Sustainability is part of Purdue’s Next Moves in agriculture and food systems and uses innovative data analysis shared through user-friendly platforms to improve the food system. In addition to the Consumer Food Insights Report, the center offers a portfolio of online dashboards.