Many consumers report high grocery prices; more households plan to produce their own food

WEST LAFAYETTE, Ind. — A vast majority (84%) of consumers describe current grocery prices in their area as “high” to some degree, with 18% saying they are “very high,” according to the Consumer Food Insights Report conducted in March.

The survey-based report out of Purdue University’s Center for Food Demand Analysis and Sustainability (CFDAS) assesses food spending, consumer satisfaction and values, support of agricultural and food policies, and trust in information sources. Purdue experts conducted and evaluated the survey, which included 1,200 consumers across the U.S.

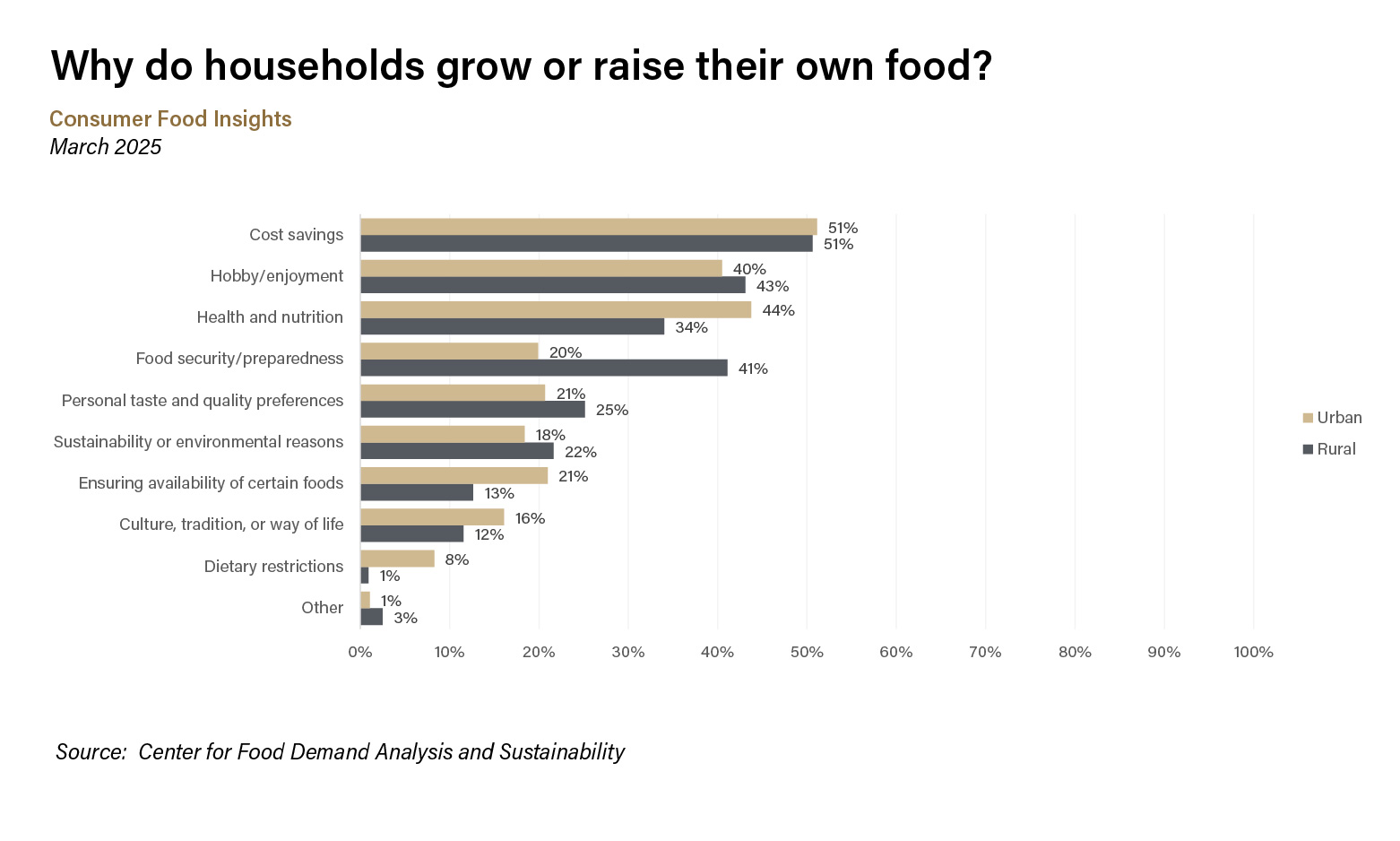

This month’s survey results revisit consumer experiences with food prices and home food production. The report also includes urban/rural classification as part of its demographic analysis this month. The analysis follows the U.S. Office of Management and Budget’s classification of rural and urban, which is commonly used by the U.S. Department of Agriculture’s Economic Research Service in social and economic research.

“Consumers continue to express frustration with inflation, as general inflation and the economy are cited by 36% of consumers as the main factors influencing food prices,” said the report’s lead author, Joseph Balagtas, professor of agricultural economics at Purdue and director of CFDAS.

“Consumers continue to express frustration with inflation, as general inflation and the economy are cited by 36% of consumers as the main factors influencing food prices,” said the report’s lead author, Joseph Balagtas, professor of agricultural economics at Purdue and director of CFDAS.

“Nearly a quarter are unsure what is influencing food prices. Around 13% of consumers attribute current grocery prices to specific supply chain, production and labor issues, and 8% say corporate greed or price gouging are to blame,” Balagtas said.

The annual food inflation rate over the past year is 2.6%. This is much lower than what consumers experienced between 2021 to 2023, when food inflation reached double digits for a few months. However, prices continue to rise, and many consumers are adapting their grocery shopping as a response.

Around 30% of consumers say they sought out more sales and discounts over the past year, and 26% say they began switching to cheaper brands. The latter number is up from 20% who said the same when the survey last asked this question in May 2024. Around 26% say they made little or no change to their grocery shopping in response to the rising cost of food.

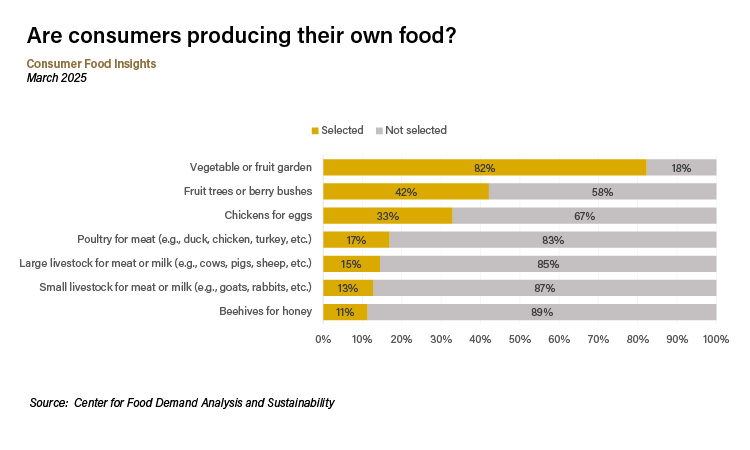

“As we approach warm spring weather with eager anticipation, we wanted to explore households’ plans for home food production,” Balagtas noted. Nearly half of households (44%) say they currently produce or are planning to produce their own food, with vegetable and fruit gardening as the most popular (82%) production activity.

“One-third of households that produce their own food have or plan to have egg-laying hens,” he said. “With the ongoing egg shortage caused by avian flu, administering this question in future months could give us insight into whether more consumers are turning to producing their own eggs to fulfill their demand.”

Among those producing their own food, few raise livestock for meat or milk (15%) or maintain beehives for honey. Many of these methods of home food production typically require a large up-front investment, time, knowledge and resources. Over 40% of rural households selected food security and preparedness as a primary reason for producing their own food compared to only (20%) of urban households.

CFDAS economists have yet to observe a substantial change in the sustainable food purchasing index over time. This shows that consumers’ purchasing decisions seem to be unwavering about the core components that make up a sustainable diet, said Elijah Bryant, a survey research analyst at CFDAS and a co-author of the report.

“Most consumers focus on buying enough foods that satisfy their taste preferences at an affordable price. Fewer consumers are making intentional purchasing decisions that align with environmental and social sustainability,” Bryant said.

The overall American diet quality remains unchanged from last month. Americans continue to score at the low end of the “intermediate” diet classification. “As the landscape of nutrition and health changes, will consumers change with it? Our data say that consumers will continue to follow their taste buds and wallets first.”

Average weekly household spending is around $20 higher among urban households compared to rural households. The main difference between consumers in these areas is the amount of money spent on food away from home.

“Given that urban consumers tend to have easier access to a wider variety of restaurants and other food service establishments, we see that these households tend to spend more and purchase more meals at these places,” Bryant said.

Participation in the Supplemental Nutrition Assistance Program (SNAP) among rural households has consistently remained higher (slightly over 20%) than urban households (16%) over time. With a larger share of rural households living in poverty compared to urban households, rural households are more likely to rely on assistance programs like SNAP to supplement their diets.

Access to grocery stores and other food retailers in remote, rural places can also be more limited, requiring longer travel times and limiting the variety of food options to pick from, Bryant noted.

Rural and urban consumers generally navigate their food environment similarly. They often check labels, discard expired food and take steps to reduce food waste. “However, urban consumers are more likely to choose nonconventional foods, such as cage-free eggs, organic foods and plant-based proteins, over their conventional counterparts compared to rural consumers,” Bryant said.

“Another interesting difference is in the frequency at which these households recycle. Urban consumers say they ‘often’ recycle their food packaging while rural consumers ‘sometimes’ do the same,” he said. “The difference we see here is more likely due to differences in availability of recycling services between more populated urban areas and remote, rural locations.”

The Center for Food Demand Analysis and Sustainability, funded through Purdue’s Next Moves, uses innovative data analysis shared through user-friendly platforms to improve the food system. In addition to the Consumer Food Insights Report, the center offers a portfolio of online dashboards.

About Purdue Agriculture

Purdue University’s College of Agriculture is one of the world’s leading colleges of agricultural, food, life and natural resource sciences. The college is committed to preparing students to make a difference in whatever careers they pursue; stretching the frontiers of science to discover solutions to some of our most pressing global, regional and local challenges; and, through Purdue Extension and other engagement programs, educating the people of Indiana, the nation and the world to improve their lives and livelihoods. To learn more about Purdue Agriculture, visit this site.

About Purdue University

Purdue University is a public research university leading with excellence at scale. Ranked among top 10 public universities in the United States, Purdue discovers, disseminates and deploys knowledge with a quality and at a scale second to none. More than 106,000 students study at Purdue across multiple campuses, locations and modalities, including more than 57,000 at our main campus locations in West Lafayette and Indianapolis. Committed to affordability and accessibility, Purdue’s main campus has frozen tuition 14 years in a row. See how Purdue never stops in the persistent pursuit of the next giant leap — including its integrated, comprehensive Indianapolis urban expansion; the Mitch Daniels School of Business; Purdue Computes; and the One Health initiative — at https://www.purdue.edu/president/strategic-initiatives.

Writer: Steve Koppes

Media contact: Devyn Ashlea Raver, draver@purdue.edu

Sources: Joseph Balagtas, balagtas@purdue.edu; Elijah Bryant, ehbryant@purdue.edu

Agricultural Communications: Maureen Manier, mmanier@purdue.edu, 765-494-8415

Journalist Assets: Publication quality charts and images image can be obtained at this link