Agrifood Economy Index rebounds but remains below baseline

WEST LAFAYETTE, Ind. — The June Agrifood Economy Index (AEI) reflects a strong rebound from March’s lows in overall industry sentiment and includes a deep dive into how agrifood leaders view the emerging “food as health” trend.

The AEI, developed by Purdue DIAL Ventures, measures economic sentiment across six core agrifood segments: agricultural input manufacturing, agricultural input distribution, agricultural production, processing and handling, food manufacturing, and support services. Conducted quarterly, the survey tracks short- and long-term sentiment and investment outlooks, supplemented by a rotating thematic focus.

The second-quarter survey gathered insights from over 220 executives across the value chain, tracking shifts in current and future sentiment, investment appetite, and thematic perspectives on health-driven strategies.

“The AEI rose 10 points to 92 in the second quarter of 2025, the largest gain since the survey began, recovering from the March score of 82,” said Lourival Monaco, DIAL Ventures research manager and research assistant professor in Purdue University’s Department of Agricultural Economics. “While this marks a broad-based improvement, the index remains 13 points below June 2024 levels and 8 points below neutral.”

Notably, current sentiment (92) and future sentiment (91) are now nearly identical, reversing a yearlong trend of greater optimism about long-term conditions. “This alignment likely signals cautious expectations for a slow-paced recovery rather than renewed confidence,” Monaco said.

Four of six value-chain segments improved this quarter, led by agricultural production, which reached its highest index on record. Input manufacturing, input distribution, and processing and handling also posted gains. Food manufacturing and support services, however, fell to series lows.

“Investment sentiment remained flat at 92-93 for the third consecutive quarter, indicating continued hesitance in committing capital for large-scale expansion,” Monaco said.

Agricultural production saw the largest quarterly increase, driven by favorable commodity prices, eased input constraints and seasonal strength. Processing and handling rebounded from first-quarter lows, with current sentiment approaching neutral. Input manufacturing regained short-term stability, though future expectations remain subdued.

Input distribution, meanwhile, continued its steady climb toward neutral sentiment, reflecting resilience in supply relationships. Food manufacturing recorded the steepest decline, with sentiment dropping 29 points to an all-time low. Support services fell for the second straight quarter, setting a new low for the segment.

The June survey’s thematic section explored the “food as health” concept. This concept addresses how food systems can be designed to promote human health through nutrition, sustainability, access and supportive services.

Awareness of the idea is high but shallow. Nearly three-quarters (72%) of respondents reported moderate to high familiarity. Only 7% said they were “extremely familiar.” Over 60% of those surveyed view “food as health” as a long-term opportunity or emerging trend. Only 13% treat it as a core strategic priority.

Data systems lead expected operational change. Data, traceability and performance metrics were cited as the most affected areas, ahead of sourcing criteria (50%) and strategic partnerships (49%). External uncertainty stands as the top barrier. Unclear consumer demand (46%) and regulatory guidance (46%) outranked cost, data and expertise as obstacles to action.

Perceptions of “healthy” focus on absence, not addition. Industry leaders believe consumers associate healthiness most with foods that are “free from artificial additives” (68%) and “low in sugar/sodium/fats” (56%).

And finally, labels matter but rarely close the sale. Nearly half of respondents (45%) rated “healthy” labels as moderately influential. Upstream players, such as input manufacturers and processors, perceive greater impact than downstream peers in support services.

About Purdue Applied Research Institute

The Purdue Applied Research Institute (PARI) is a nonprofit entity that extends the reach and impact of Purdue University’s deep research strengths and top-ranked academic programs in engineering, agriculture, science and technology. PARI works to improve national security, global development, infrastructure solutions and to accelerate critical technologies. Through applied research and program personnel, state-of-the-art facilities, and infrastructure, PARI enhances Purdue’s ability to translate discoveries into innovative solutions and services for mission-oriented government, industry, NGO and foundation partners. PARI is an incubator for advanced development and transition of leading ideas and technology with potential for significant impact through large-scale prototypes, pilots and startups. https://pari.purdue.edu/

About DIAL Ventures

DIAL Ventures, the agrifood innovation arm of the Purdue Applied Research Institute, tackles big problems facing the U.S. and the world such as food safety, supply chain shortages, sustainability and environmental impact. DIAL Ventures creates new companies that drive innovation in the agrifood industry, which, in turn, makes a positive impact in our lives and lifestyles for years to come. Learn more at dialventures.com.

About Purdue University

Purdue University is a public research university leading with excellence at scale. Ranked among top 10 public universities in the United States, Purdue discovers, disseminates and deploys knowledge with a quality and at a scale second to none. More than 107,000 students study at Purdue across multiple campuses, locations and modalities, including more than 58,000 at our main campus in West Lafayette and Indianapolis. Committed to affordability and accessibility, Purdue’s main campus has frozen tuition 14 years in a row. See how Purdue never stops in the persistent pursuit of the next giant leap — including its comprehensive urban expansion, the Mitch Daniels School of Business, Purdue Computes and the One Health initiative — at https://www.purdue.edu/president/strategic-initiatives.

Writer: Steve Koppes

Media contact: Devyn Ashlea Raver, draver@purdue.edu

Sources: Lourival Monaco, lmonacon@purdue.edu

Agricultural Communications: Maureen Manier, mmanier@purdue.edu, 765-494-8415

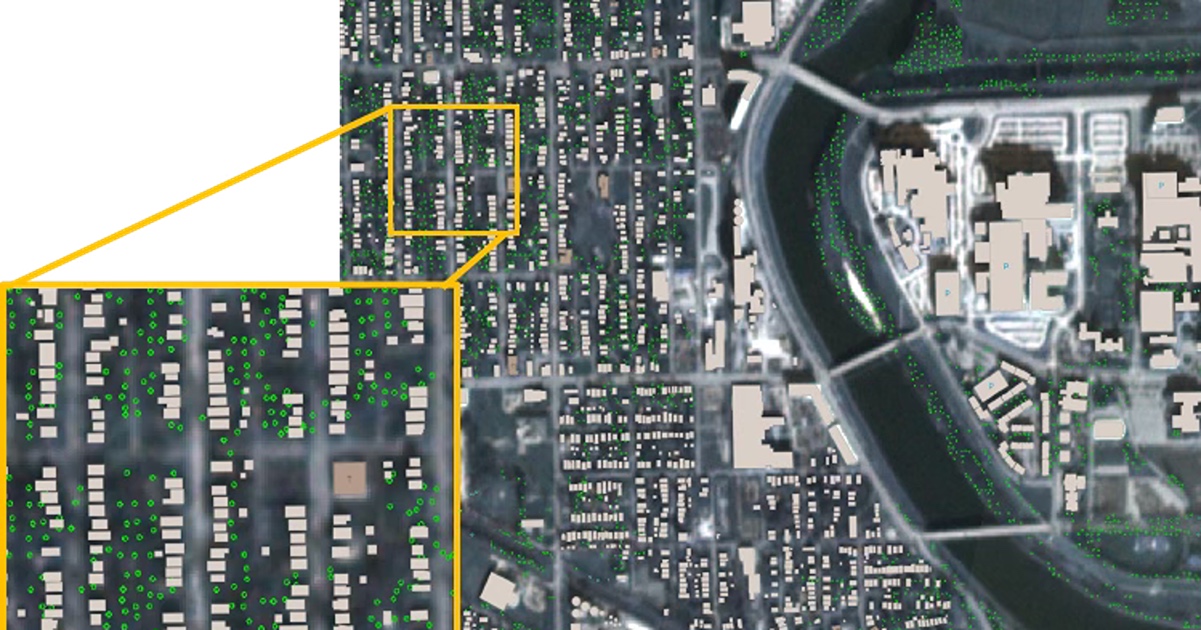

Journalist Assets: Publication quality charts and images image can be obtained at this, link