Q3 agrifood industry sentiment stabilizes near baseline as investment appetite returns

WEST LAFAYETTE, Ind. — This quarter’s Agrifood Economy Index (AEI) reveals that industry sentiment has stabilized near baseline levels, coupled with the first positive investment sentiment of 2025.

The third-quarter AEI survey, developed by DIAL (Digital Innovation Agri-Food Systems Laboratory) Ventures, gathered insights from over 170 agrifood executives across the value chain, revealing a cautious equilibrium punctuated by a renewed appetite for capital deployment and exploring cybersecurity preparedness across the industry. DIAL Ventures is part of Purdue Applied Research Institute and is dedicated to driving digital innovation in the food and agricultural industry.

The AEI declined modestly to 90 in the third quarter of 2025, down two points from June but four points higher than August 2024. “Current sentiment — 91 — and future sentiment — 90 — have nearly converged for the third consecutive quarter, reflecting a pragmatic industry outlook,” said Lourival Monaco, DIAL Ventures research manager and research assistant professor in Purdue University’s Department of Agricultural Economics. “Executives expect neither material improvement nor deterioration in sight."

“The quarter’s most significant development is the investment index rising to 101, marking its first reading above baseline in 2025. This signals renewed willingness among agrifood leaders to deploy capital despite persistent uncertainty.”

The AEI measures economic sentiment across six core agrifood segments: agricultural input manufacturing, agricultural input distribution, agricultural production, processing and handling, food manufacturing, and support services. Conducted quarterly, the survey tracks short- and long-term sentiment and investment outlooks, supplemented by a rotating thematic focus.

The agricultural production segment hit a record low after reaching record-high optimism in June. Producers reported deep pessimism as falling crop prices — particularly corn and soybeans — combined with elevated fertilizer, fuel and labor costs, eroded margins.

The input manufacturing segment recorded its weakest reading to date (84), down 18 points from the second quarter, reflecting declining farm demand, cost escalation in raw materials and concerns that growers are deferring purchases into 2026.

The input distribution segment held steady near 90, but investment sentiment plunged to 55, the lowest reading in AEI history, as distributors delayed branch upgrades, fleet renewal and technology investments while prioritizing cash preservation.

The processing and handling segment showed relative stability at 91, aligning with overall industry sentiment as companies adjusted to persistent cost pressures and reduced export flows.

Food manufacturing posted the strongest rebound, climbing well above baseline as the only segment with above-neutral confidence on all three indices. Investment sentiment surged to 168, indicating robust capital deployment in automation, packaging sustainability and digital traceability systems.

The support services segment rebounded modestly to 95 after reaching a series low in June, with investment sentiment improving 17 points to 95 as firms reengaged in digital systems and client-facing tools.

The third-quarter survey’s thematic section explored cybersecurity preparedness across the agrifood value chain, revealing an industry aware of digital threats but not yet fully mobilized to address them systematically, Monaco noted. Five key insights emerged.

First, traditional threats dominate attention. Companies focus overwhelmingly on phishing attacks and data breaches rather than attacks on connected equipment or supply-chain system risks. This reflects a narrow, information technology-focused view despite increasing digitization of farm machinery and logistics platforms, Monaco said.

Second, supplier risk management is the weakest link. Nearly half of the respondents conduct no formal cybersecurity assessments of vendors. Another third rely on one-time reviews. “Only 1 in 5 companies maintains ongoing, structured supplier security evaluations — a critical vulnerability as connectivity extends across the value chain,” he said.

Third, confidence varies widely across segments. Two-thirds of executives report being at least somewhat confident in managing cyber incidents. Support services and processing companies indicate the highest preparedness, while agricultural producers report the lowest confidence.

Fourth, organizational responsibility is emerging. “Almost half of agrifood organizations now have dedicated personnel or teams responsible for cybersecurity, a significant step forward,” Monaco noted. But 1 in 10 still has no explicit responsibility assigned.

And last, cost remains the primary barrier. Nearly half of respondents identify cost as the main obstacle to advancing cybersecurity practices, with more than one-third citing competing business priorities. Cybersecurity is still viewed as a cost center rather than as a value-protecting investment.

About Purdue Applied Research Institute

The Purdue Applied Research Institute (PARI) is a nonprofit entity that extends the reach and impact of Purdue University’s deep research strengths and top-ranked academic programs in engineering, agriculture, science and technology. PARI works to improve national security, global development and infrastructure solutions and to accelerate critical technologies. Through applied research and program personnel, state-of-the-art facilities, and infrastructure, PARI enhances Purdue’s ability to translate discoveries into innovative solutions and services for mission-oriented government, industry, NGO and foundation partners. PARI is an incubator for advanced development and transition of leading ideas and technology with potential for significant impact through large-scale prototypes, pilots and startups. https://pari.purdue.edu/

About DIAL Ventures

DIAL Ventures, the agrifood innovation arm of the Purdue Applied Research Institute, tackles big problems facing the U.S. and the world such as food safety, supply chain shortages, sustainability and environmental impact. DIAL Ventures creates new companies that drive innovation in the agrifood industry, which, in turn, makes a positive impact in our lives and lifestyles for years to come. Learn more at dialventures.com.

About Purdue University

Purdue University is a public research university leading with excellence at scale. Ranked among top 10 public universities in the United States, Purdue discovers, disseminates and deploys knowledge with a quality and at a scale second to none. More than 106,000 students study at Purdue across multiple campuses, locations and modalities, including more than 57,000 at our main campus locations in West Lafayette and Indianapolis. Committed to affordability and accessibility, Purdue’s main campus has frozen tuition 14 years in a row. See how Purdue never stops in the persistent pursuit of the next giant leap — including its integrated, comprehensive Indianapolis urban expansion; the Mitch Daniels School of Business; Purdue Computes; and the One Health initiative — at https://www.purdue.edu/president/strategic-initiatives.

About Purdue Agriculture

Purdue University’s College of Agriculture is one of the world’s leading colleges of agricultural, food, life and natural resource sciences. The college is committed to preparing students to make a difference in whatever careers they pursue; stretching the frontiers of science to discover solutions to some of our most pressing global, regional and local challenges; and, through Purdue Extension and other engagement programs, educating the people of Indiana, the nation and the world to improve their lives and livelihoods. To learn more about Purdue Agriculture, visit this site.

Writer: Steve Koppes

Media contact: Devyn Ashlea Raver, draver@purdue.edu

Sources: Lourival Monaco, lmonacon@purdue.edu

Agricultural Communications: Maureen Manier, mmanier@purdue.edu, 765-494-8415

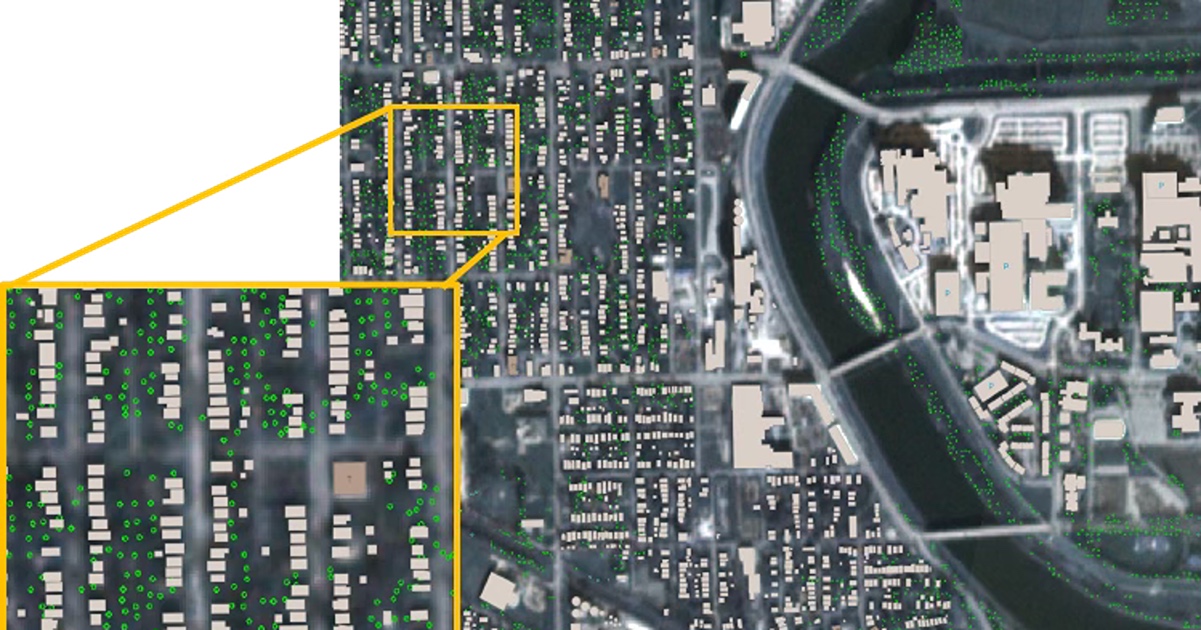

Journalist Assets: Publication quality images and charts can be found at this link