May 8, 2004

Strategic Planning: Scanning the Horizon

by Craig Dobbins, Allan Gray, Michael Boehlje, Alan Miller, and Cole Ehmke

Any planning activity involves thinking about the future. However, the focus of strategic planning is not on predicting the future, but instead on making better decisions here and now in order to reach a desired future. Because the future cannot be known with certainty, farm business managers must make certain assumptions about what the future will hold. An important part of the strategic planning process is to recognize and explicitly state any key assumptions about the future business environment or markets. To be successful, the farm business manager must find a fit between what the market wants and what the farm provides, as well as between what the business environment or markets will provide and what the farm needs.

Strategic planning requires that, in thinking about the future, managers have information about both the external economic environment in which the farm business operates and the internal characteristics of the farm business. This publication provides information on how to assess the external environment. It includes two worksheets to help you assess the external business environment, “Applying the Five Forces Model” and “Assessing Opportunities and Threats.” The information developed as part of the assessment process will provide data for the development and evaluation of alternatives.

In conducting a market assessment, the farm business manager reviews and evaluates information from the external business environment. The focus is on expected market and business changes over which the manager has little or no control. There are two facets of this outside review: 1) the social environment and 2) the industry environment, on which this publication concentrates.

Social Environment

The social environment includes those general forces that do not directly touch on the short-term activities of the organization but that can, and often do, influence long-term decisions. These forces include economic factors; technology drivers; changes in political-legal forces (government policy and regulations); and sociocultural developments.

Trends in the economic factors can have obvious implications for the farm business. A strengthening of the U.S. dollar relative to other currencies can reduce U.S. export demand. This in turn can lead to lower commodity prices and farm incomes for everyone in the industry. Rising incomes of consumers in developing countries is another example. With increased income, these consumers improve their diets. This in turn can lead to an increase in demand for animal protein sources and likely increased exports of U.S. meat products.

Changes in technology can also have a great impact. The evaluation and adoption of production technologies is an aspect of technological change familiar to farm business managers. However, other technological changes, such as in information technology, can lead to important changes for the farm business. The development of precision agriculture, the use of the Web to gather information or order supplies, and the increased ease with which we can communicate with farmers in other parts of the U.S. or the world are changing the farm business.

Trends in the political-legal area have important business implications. Most farmers think that there is too much regulation of activities in order to comply with society’s environmental concerns. However, many would like to see a more aggressive approach taken to enforce anti-trust laws in order to slow the consolidation of input suppliers or product buyers.

Sociocultural developments include such things as demographic trends. The demographic bulge in the U.S. population known as the “baby boom” affects many industries. As these people begin to retire but still desire to remain active, they could create a part-time labor pool that would provide seasonal labor for farming.

Industry Environment

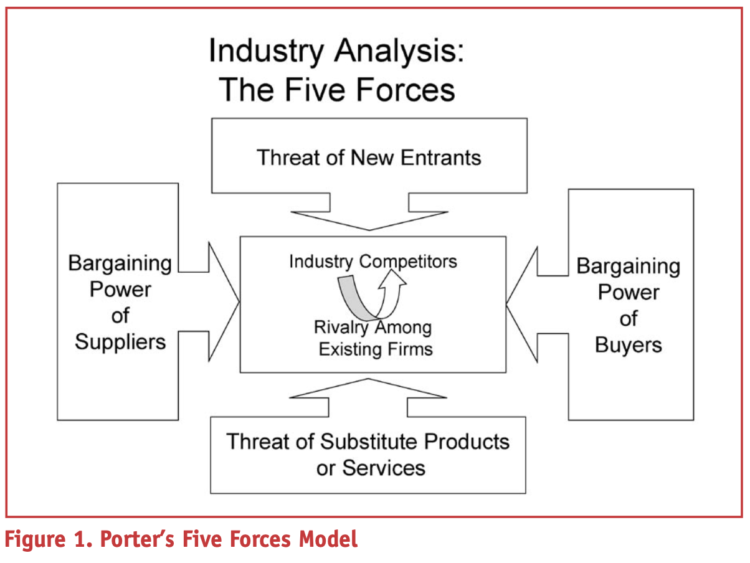

In conducting an external business scan, the farm business manager also must assess various industry forces. Michael Porter, an authority on competitive strategy, developed an important model to analyze a business’s relationship to its industry. It is based on the insight that a corporate strategy should meet the opportunities and threats in the organization’s external environment. He contends that there are five forces that should be considered in conducting an industry analysis. The five forces include the risk of new competitors entering the industry, threat of potential substitutes, the bargaining power of buyers, the bargaining power of suppliers, and degree of rivalry between the existing competitors (Figure 1).

An environmental scan using the five forces identifies external opportunities and threats that affect an industry’s overall attractiveness. “The collective strength of these forces,” he says, “determines the ultimate profit potential in the industry, where profit potential is measured in terms of long-run return on invested capital.” (M. E. Porter, Competitive Strategy, New York: Free Press, 1980, page 3.) Bear in mind as you assess your industry that your business may require changes in competitive strategy to alter the effects of these forces to your advantage. Under some circumstances, your assessment can indicate the decision to exit a business or an industry.

Threat of New Entrants

New entrants usually bring new capacity and competition for customers and resources. This is a threat to existing businesses in the industry. Unless the demand for agricultural goods is increasing, additional capacity holds customers’ costs down, resulting in less revenue and lower returns for an industry’s firms.

Remember as you consider the potential for new entrants that production agriculture is global. The new entrant may not be the neighbor’s son or daughter who is returning with a new college degree to join the family business. In Indiana, there has been a recent increase in dairy production. Part of the increase has been the result of dairies from the Netherlands locating in the state. There is no doubt that the entrance of South American farmers into soybean production is influencing that market. In today’s agriculture, entrants can come from anywhere in the world.

The threat of entry depends on the presence of entry barriers. Entry barriers make it difficult for another business to enter the industry. Examples of these barriers include economies of scale and capital requirements. Because these are large in farming, they prevent new firms from quickly entering the industry.

Other barriers to new entrants include product differentiation, switching costs, and government policy. In the production of agricultural commodities there is very little product differentiation. However, there are a few opportunities, such as the production of products with special traits or the provision of special services, for creating differences. Differentiating products or services raises customers’ cost of switching. Switching costs are the one-time costs customers incur when buying from a different supplier. An example might be losing frequent flier miles in switching airlines or having to learn a new interface with computer software. For most agricultural products, switching costs are low, providing no barrier to new entrants.

Licensing, permit requirements, and establishment of standards by governments

can control entry into some industries. Businesses such as real estate appraisal

and brokerage require certain licenses before you can enter the business. Similarly, producing organic products requires that specific production be used for at least three years prior to obtaining organic certification. These requirements will prevent some from entering these areas.

Threat of Substitute Products or Services

Substitute products are products that appear to be different but can satisfy the same need as another product. Chicken can be a substitute for beef in consumers’ diets. When switching costs are low, substitutes can place a price ceiling on products.

Market analysts often talk about “wheat capping corn.” This occurs because wheat and corn are substitutes in animal feed. If wheat prices are low, corn prices will also be low because, if corn prices rise, processors will quickly shift to wheat in order to keep ration costs low. This will reduce the demand and price of corn. In general, substitutes are a strong threat to the farm business when customers face few, if any, switching costs and when the substitute product’s price is lower or its quality and performance capabilities are equal or greater than those of the competing product.

Bargaining Power of Suppliers

Bargaining power of suppliers affects the industry by suppliers’ ability to raise prices or reduce the quality of goods and services. Suppliers are likely to be powerful if:

- They are few in number,

- Each individual farmer purchase represents only a small amount of the companies’ sales,

- There are not good substitutes for the product purchased, and

- The product or service is unique.

Suppliers of plants with specialized characteristics possess some of these features. The desired characteristics, such as herbicide resistance, is unique, with no good substitute. The technology for producing the characteristic in the crop is available from one or very few suppliers. In addition, a single farmer represents only a small amount of the seed supplier sales. As a result, the suppliers of these products are able to charge a higher price for their inputs.

Another example where the supplier is weak would be a small parts supplier selling to a large machinery manufacturer. The major machinery makers may be in a very strong position with respect to the thousands of suppliers and can use this to gain concessions in ways that support their own strategies (lower price, higher service, or higher quality at the same price). On the other side, the machinery maker may have a weaker position with respect to some inputs, for instance, steel, and its own ability to compete will depend on the prices negotiated with the major steel suppliers. If, for example, the supplier raised prices, the buyer may have little option but to carry that cost.

Bargaining Power of Buyers

Bargaining power of buyers affects the industry through the buyers’ ability to force down prices, bargain for higher quality or more services, and play competitors against each other. Buyers are likely to have power if:

- A buyer purchases a large part of the seller’s product,

- Alternative suppliers are plentiful because the product is undifferentiated,

- The buyers earn low profits and are sensitive to cost differences, and

- The purchased product is unimportant to the final quality or price of the buyers’ products.

Changes taking place in the food industry illustrate the power of customer groups. Concerns by many consumers about food safety, excessive processing, and use of pesticides have contributed to making organic production one of the fastest growing segments of the food industry. Concerns about animal welfare have prompted companies such as McDonald’s to request changes in the production practices of suppliers. Although these changes are likely to result in higher production costs, they are being made.

Rivalry Among Existing Firms

Rivalry among existing firms is the amount of direct competition in an industry.

Industries that have intense competition are characterized by:

- Many competitors that are roughly equal in size,

- Slow rates of industry growth,

- The production of commodities,

- High fixed costs, and

- High exit barriers arising from investments in specialized equipment.

While competition among farm businesses is not discussed as openly as Ford competing with General Motors, that does not mean that competition does not exist. The widespread adoption of new technologies such as no-till production practices, Round-Up Ready soybeans, and crops with special traits illustrates that farm business managers are closely watching each other to gain an advantage in the market. Having a large group of diverse competitors also makes it more difficult to identify the industry’s competitive patterns. Some farms may decide to compete by providing additional services; others may decide to compete by accessing consumers directly; and others may compete with price, especially in the land rental market.

The overall growth rate of the industry also influences rivalry. When a market is growing, businesses have access to an expanding customer base. This reduces the pressures on businesses to take customers from competitors. As growth rates decline, the battle for customers becomes more intense.

The high degree of rivalry in production agriculture stems in part from it having high fixed costs and high exit barriers. When fixed costs account for a large part of total costs, it is important for the business to maximize the use of productive capacity. This allows the business to spread costs across a larger volume of output.

However, when many businesses attempt to maximize productive capacity, excess capacity can be created for the industry. The price of industry products will fall. These declining prices indicate that resources should be shifted to other industries. However, many of the assets are highly specialized and have no value in other industries — hence high exit barriers. The best way to recover the investment in these resources is to continue using them for the purpose for which they were designed. This means that adjustments to overcapacity will occur only as these specialized assets wear out.

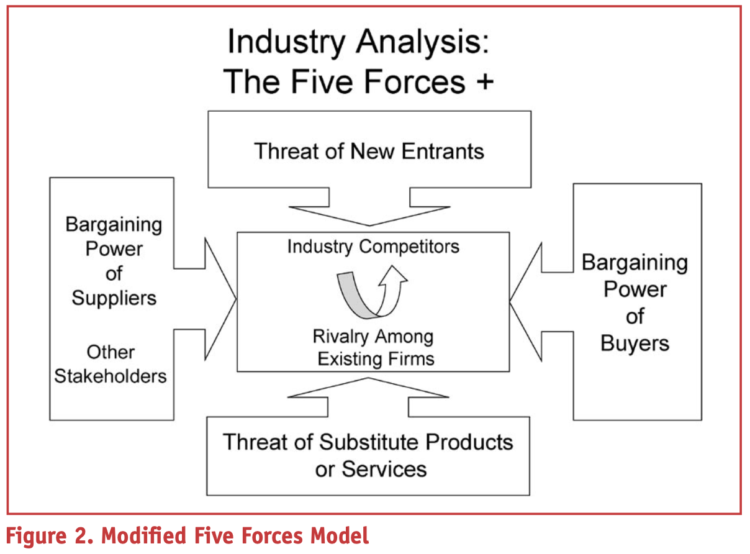

Other Stakeholders

Since the introduction of this five forces model for industry analysis, others have suggested that a sixth force should be included. This is the force of other stakeholders. These stakeholders include federal, state, and local governmental units. These units of government can impose various limits on the actions that businesses can take. In Indiana, the desire for greenspace in and around communities has resulted in various types of land-use regulations. Other stakeholders also influence cost of inputs. These stakeholders can include creditors, special-interest groups, the government, and local community organizations. Figure 2 includes this additional force to make the model more complete.

Final Comment

Planning requires a careful look at the future. In developing a new strategy or recommitting to your current strategy, the farm business manager must evaluate the social and industry environment. To help organize your thoughts about the future business environment, two tools are provided: “ Applying the Five Forces Model” and “ Assessing Opportunities and Threats.” Suggested procedures for using these tools are presented below.

Perhaps the most important thing to keep in mind is the inverse relationship between profit potential and the intensity of competition: as the intensity of competition goes up, profit potential is driven down. The objective of business strategy should be to respond to these competitive forces in a way that improves the position of

the organization. Based on the information collected from a five forces analysis, management can decide how to influence or to exploit particular characteristics of their industry.

Applying the Five-Forces Model

In completing the “Applying the Five-Forces Model,” you assess the various aspects of these forces in production agriculture. If your management team has multiple members, each individual should complete the form, and then you should compare assessments.

Assessing Opportunities and Threats

The review of the external business environment will likely identify a number of external factors important to the business. Your analysis of these factors can be refined by dividing these factors into opportunities and threats. These can be listed in the “External Factors” column. For each opportunity or threat, you need to indicate the relative importance of the item to your business. Then you need to assess how well your business can respond to each factor. See the instructions below for additional information about completing this form and the calculation of the weighted score for your business.

- List opportunities and threats that your farm faces (6 -10 items) in the External

Factors column. - Weight each factor from 1.0 (Most Important) to 0.0 (Not Important) in the Weight column based on that factor’s probable effect on the farm. The total weights for all items must equal 1.00.

- Rate each factor from 5 (Outstanding) to 1 (Poor) in the Rating column based on how well your farm is positioned to take advantage of the opportunity or to deflect the threat.

- Multiply each factor’s weight times its rating to obtain each factor’s weighted score in the Weighted Score column.

- Use the Comments column to list the rationale used for each factor.

- Add the weighted scores to obtain the total weighted score for the farm in the Weighted Score column. The total weighted score tells how well the farm is responding generally to the factors in the external business environment.

The better positioned your farm resources are, the higher the total weighted score will be. A total weighted score of 3 would indicate that your farm business is neither well nor poorly positioned, just average. A number higher than 3 would mean that the business is doing well. A business with an overall rating of 5 would be responding to the respective environment in an outstanding way. Note that your business does not benefit from doing an activity well or having a skill or resource if that activity/skill/ resource is not important.

DOWNLOAD THE WHOLE PUBLICATION, WITH WORK EXERCISES!

This publication is part of a series on applying strategic thinking to your farm. Each publication has a unique focus, enabling you to select those topics of greatest interest to you. Other publications help build a guiding vision for your farm business (EC-720), assess the strengths and weaknesses of your business (EC-721), and identify the important trends in the industry (EC-717).

TAGS:

TEAM LINKS:

RELATED RESOURCES

UPCOMING EVENTS

We are taking a short break, but please plan to join us at one of our future programs that is a little farther in the future.