July 12, 2019

Impact of Higher Corn Prices On Feeding Cost of Gain for Cattle Finishing

by Michael Langemeier

Corn price futures for the December 2019 contract increased from $3.79 per bushel for the week ending May 10 to $4.55 for the week ending June 28. Even though corn futures prices weakened after the release of the June crop acreage report, using the iFarm price distribution tool (here) there was still a 13 percent chance on July 1 that corn futures prices will be above $5.00 per bushel. Moreover, due to continued questions related to U.S. corn acreage in 2019, there is tremendous uncertainty regarding corn prices during the rest of the year. To address this uncertainty, this article examines the impact of potentially higher corn prices on feeding cost of gain for cattle finishing.

Feeding Cost of Gain

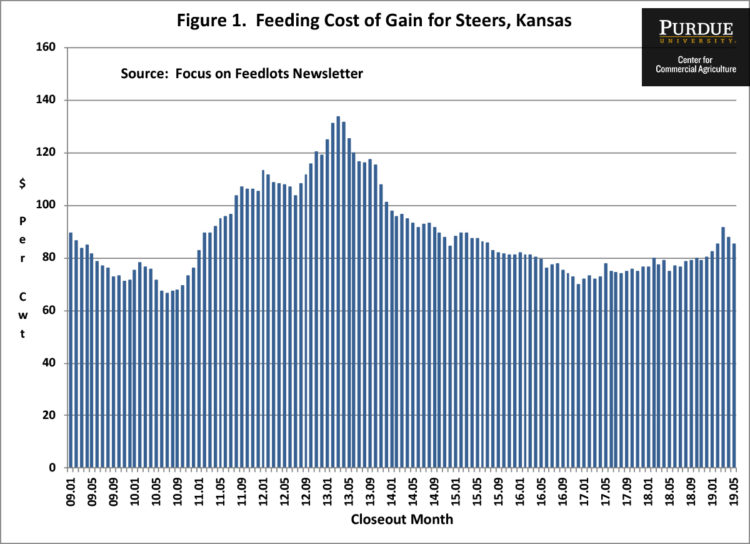

Feeding cost of gain is sensitive to changes in feed conversions, corn prices, and alfalfa prices. Information on these items are available from monthly issues of the Focus on Feedlots newsletter (here). Figure 1 illustrates feeding cost of gain from January 2009 to May 2019. In May 2019, corn and alfalfa inventory prices were $3.91 per bushel and $184 per ton, respectively. Feeding cost of gain since January has ranged from $82.35 in January to $91.67 in March and averaged $86.50 per cwt. Feed conversions for the first five months of 2019 were approximately 9.0 percent above their seasonal averages resulting in a feeding cost of gain that was approximately $8.00 per cwt. higher than projections. The estimated feeding cost of gain in the May issue of Focus on Feedlots for placements in May was $87 per cwt. It is important to note that this estimate was made before the recent increase in corn prices. Estimates of feeding cost of gain for the rest of 2019 can be found below.

To determine the sensitivity of feeding cost of gain to changes in corn prices, alfalfa prices, and feed conversion, a regression using data for the last ten years was estimated. Results are as follows: each 0.10 increase in feed conversion increases feeding cost of gain by $1.43 per cwt., each $0.10 per bushel increase in corn prices increases feeding cost of gain by $0.87 per cwt., and each $5 per ton increase in alfalfa prices increases feeding cost of gain by $0.55 per cwt.

As of July 1, there was a non-trivial probability that fall corn futures prices could be below $3.50 (14 percent) or above $5.00 (13 percent). The midpoint futures price using the iFarm price distribution tool was $4.16. Our projections will focus on futures prices towards the upper end of the distribution. If corn prices for the last six months of 2019 are $4.50 and feed conversions are 5 percent above their seasonal averages, feeding cost of gain for the third and fourth quarters are expected to range from $84 to $87 and from $87 to $91, respectively. If corn prices are $5.00, feeding cost of gain is expected to range from $89 to $92 in the third quarter, and from $92 to $96 in the fourth quarter.

Cattle Finishing Net Returns

In addition to feeding cost of gain, cattle finishing net returns are sensitive to the feeder to fed cattle price ratio. The feeder to fed cattle ratio during the last ten years averaged 1.20. The projected ratios for the third quarter range from 1.30 to 1.35 and for the fourth quarter range from 1.17 to 1.21. The relatively high ratio for the third quarter does not bode well for net return prospects. An earlier article (here) examined breakeven prices and cattle finishing net return prospects for 2019. Updated estimates are provided below.

For the first five months of 2019, cattle finishing losses ranged from $12 in April to $55 in February and averaged $40 per head. Breakeven prices are expected to range from $119 to $122 in the third and fourth quarters. These breakeven prices, particularly for the third quarter, are well above expected cash prices. Consequently, cattle finishing losses are expected to range from $150 to $225 in the third quarter and from $25 to $75 in the fourth quarter. Higher corn prices have helped lower feeder prices, but not enough to prevent losses.

Summary and Conclusions

Corn prices have increased since mid-May and are expected to be quite volatile for the rest of the year. This article examined the impact of higher corn prices on feeding cost of gain for cattle finishing. Each $0.10 increase in corn price results in an increase in feeding cost of gain of $0.87 per cwt. Using this information, corn prices of $4.50 and $5.00 would result in feeding cost of gain increases ranging from $3 to $8 per cwt. depending on how much corn prices increase and whether feed conversions stay above their seasonal averages.

References

Focus on Feedlots, Animal Sciences and Industry, Kansas State University, www.asi.k-state.edu/about/newsletters/focus-on-feedlots , accessed July 1, 2019.

Langemeier, M. “Net Return Prospects for Cattle Finishing in 2019.” Center for Commercial Agriculture, Purdue University, February 2019.

Livestock Marketing Information Center, www.lmic.info, accessed July 1, 2019.

TAGS:

TEAM LINKS:

RELATED RESOURCES

AgLease101.org helps both land owners and land operators learn about alternative lease arrangements and includes sample written lease agreements for several alternatives. Ag Lease 101 was created by and is maintained by the North Central Farm Management Extension Committee (NCFMEC).

READ MOREUPCOMING EVENTS

We are taking a short break, but please plan to join us at one of our future programs that is a little farther in the future.