Farmer sentiment rises during commodity price rally; concern over production costs remains

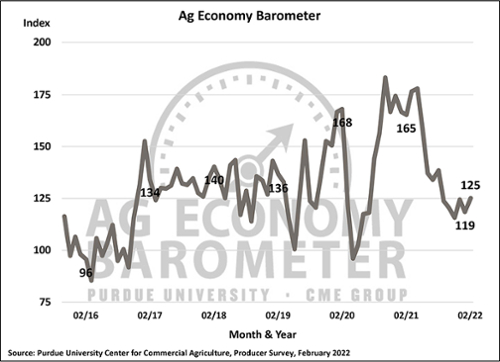

Farmer sentiment continues to fluctuate month-to-month as the Purdue University/CME Group Ag Economy Barometer rose 6 points to a reading of 125 in February, a mirror image of the previous month. The Index of Current Conditions was down 1 point to a reading of 132, while the Index of Future Expectations improved 10 points to a reading of 122. The Ag Economy Barometer is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey. This month’s survey was conducted Feb. 14-18, days before Russia’s invasion of Ukraine.

The Farm Financial Performance Index remained unchanged in February at a reading of 83. However, the sharp drop in the index, down 27% from late 2021 to 2022, indicates producers expect financial performance in 2022 to be worse than in 2021. The financial index is generated based upon producers’ responses to whether they expect their farm's current financial performance to be better than, worse than or about the same as the previous year.

“These survey responses suggest that concerns about the spike in production costs and supply chain issues continue to mostly outweigh the impact of the commodity price rally that’s been underway this winter,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture.

Higher input costs have consistently been the number one concern identified by farmers over the past six-months, according to results from the Ag Economy Barometer survey. To gain additional insight into the concerns of producers, this month respondents were provided with a more detailed set of possible responses when answering this question. While a majority still consider input costs as their number one concern (47%), it was followed by lower output prices (16%), environmental policy (13%), farm policy (9%), climate policy (8%), and COVID-19’s impact (7%).

Tight machinery inventories continue to be a problem. In February, over 40% of producers stated that low farm machinery inventories are holding back their investment plans. While plans for farm building and grain bin construction were more optimistic this month, 56% still said their plans for new construction are below the previous year.

Thirty percent of corn and soybean producers say they’ve had difficulty purchasing crop inputs from their suppliers. In a follow-up question posed to corn and soybean producers who said they experienced difficulty procuring inputs, herbicides are the most problematic input to source followed by fertilizer and farm machinery parts. To learn more about how crop producers are responding to surging fertilizer prices, corn producers were again asked if they plan to change their nitrogen fertilizer application rate in 2022 compared to the rate used in 2021. One-third of corn producers in this month’s survey said they plan to use a lower nitrogen application rate this year than in 2021, compared with 37% of corn producers who said they planned to reduce their nitrogen application rate when surveyed in January.

Each winter, the barometer survey asks producers to project their farm’s annual growth rate over the next five years. In 2022, 53% stated they either had no plans to grow or plan to retire/exit in the next five years, 19% expect their farm’s annual growth rate to range from 5%-10% and while 18% expect their farm’s annual growth rate to be less than 5%.

The need for better broadband coverage in rural areas has been highlighted in several legislative proposals at both the state and national level. The February barometer survey included a question asking respondents to characterize the quality of their farm’s internet access. Just three of 10 respondents said they had “high-quality” internet access, 41% said “moderate quality,” 16% chose “poor quality” on the survey, and 12% stated that they did not have internet access at all. Responses to this question suggest that nearly three of 10 farms in this month’s survey are unable to take advantage of many applications and services which require reasonable quality internet access.

Read the full Ag Economy Barometer report at https://purdue.ag/agbarometer. The site also offers additional resources – such as past reports, charts and survey methodology – and a form to sign up for monthly barometer email updates and webinars.

Each month, the Purdue Center for Commercial Agriculture provides a short video analysis of the barometer results. For even more information, check out the Purdue Commercial AgCast podcast. It includes a detailed breakdown of each month’s barometer, in addition to a discussion of recent agricultural news that affects farmers.

The Ag Economy Barometer, Index of Current Conditions and Index of Future Expectations are available on the Bloomberg Terminal under the following ticker symbols: AGECBARO, AGECCURC and AGECFTEX.

About the Purdue University Center for Commercial Agriculture

The Center for Commercial Agriculture was founded in 2011 to provide professional development and educational programs for farmers. Housed within Purdue University’s Department of Agricultural Economics, the center’s faculty and staff develop and execute research and educational programs that address the different needs of managing in today’s business environment.

About CME Group

As the world’s leading and most diverse derivatives marketplace, CME Group enables clients to trade futures, options, cash and OTC markets, optimize portfolios, and analyze data – empowering market participants worldwide to efficiently manage risk and capture opportunities. CME Group exchanges offer the widest range of global benchmark products across all major asset classes based on interest rates, equity indexes, foreign exchange, energy, agricultural products and metals. The company offers futures and options on futures trading through the CME Globex® platform, fixed income trading via BrokerTec and foreign exchange trading on the EBS platform. In addition, it operates one of the world’s leading central counterparty clearing providers, CME Clearing. With a range of pre- and post-trade products and services underpinning the entire lifecycle of a trade, CME Group also offers optimization and reconciliation services through TriOptima, and trade processing services through Traiana.

CME Group, the Globe logo, CME, Chicago Mercantile Exchange, Globex, and E-mini are trademarks of Chicago Mercantile Exchange Inc. CBOT and Chicago Board of Trade are trademarks of Board of Trade of the City of Chicago, Inc. NYMEX, New York Mercantile Exchange and ClearPort are trademarks of New York Mercantile Exchange, Inc. COMEX is a trademark of Commodity Exchange, Inc. BrokerTec, EBS, TriOptima, and Traiana are trademarks of BrokerTec Europe LTD, EBS Group LTD, TriOptima AB, and Traiana, Inc., respectively. Dow Jones, Dow Jones Industrial Average, S&P 500, and S&P are service and/or trademarks of Dow Jones Trademark Holdings LLC, Standard & Poor’s Financial Services LLC and S&P/Dow Jones Indices LLC, as the case may be, and have been licensed for use by Chicago Mercantile Exchange Inc. All other trademarks are the property of their respective owners.