Producer sentiment improves with strengthened commodity prices, but high cost inflation worries farmers

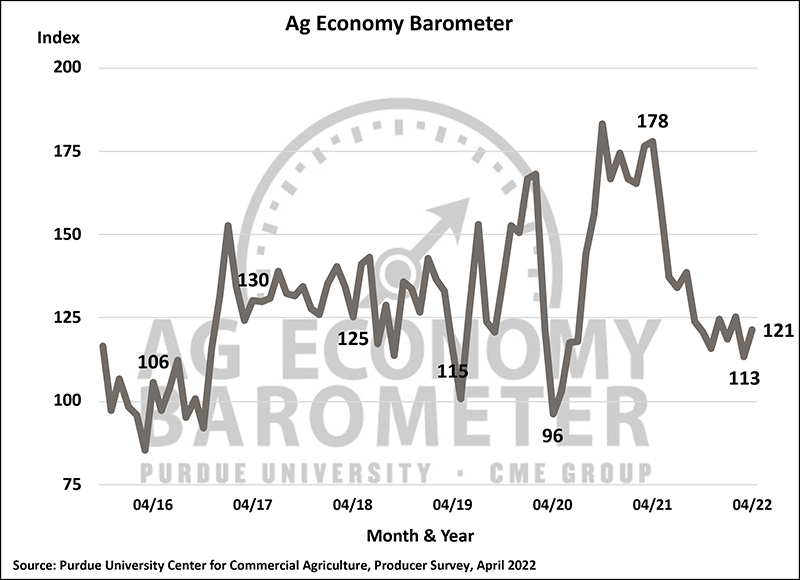

The Purdue University/CME Group Ag Economy Barometer improved in April, up 8 points to a reading of 121; however, it remains 32% below its reading from the same time last year. Producers’ perspective on current conditions and future expectations saw an uptick over the past month. The Index of Current Conditions improved 7 points to a reading of 120, and the Index of Future Expectations improved 9 points to a reading of 122. The Ag Economy Barometer is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey. This month’s survey was conducted April 18-22.

“Rising prices for major commodities, especially corn and soybeans, appear to be leading the change in producers’ improved financial outlook,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture. “However, it’s hard to overstate the magnitude of the cost increases producers say they are facing.”

The Farm Financial Performance Index improved to a reading of 95, up 8 points from March, and 12 points higher than in January and February. As Mintert suggests, much of this could be attributed to the strengthened commodity prices. For example, Eastern Corn Belt cash prices for corn in mid-April rose more than 10% above their mid-March levels while bids for fall delivery of 2022 crop corn climbed 20% over the same period. Soybean prices rose as well. Near-term delivery prices for soybeans rose about 7% from mid-March to mid-April, while elevator bids for fall delivery of new crop soybeans climbed 5% over the one-month span.

Even as commodity prices have strengthened, producers continue to say higher input costs are the top concern for their farming operation. In April, 42% of producers chose higher input costs as their biggest concern, which was more than twice as many who chose government policies (21%) or lower output prices (19%). In April, 60% of survey respondents said they expect input prices to rise by 30% over the next 12 months. This compares to an average of 37% of respondents who said they were expecting a cost increase of this magnitude when the same question was posed in the December 2021 through March 2022 surveys.

When asked specifically for their expectations for 2023 crop input prices compared with prices paid for 2022 crop inputs, 36% of respondents said they expect prices to rise 10% or more and 21% of crop producers said input price rises of 20% or more are likely. The war in Ukraine has also added a new level of uncertainty for producers. Sixty percent of survey respondents said the biggest impact of the war on U.S. agriculture will be on input prices.

Crop input challenges extend beyond their inflated cost to their availability. In April, 34% of producers said they experienced some difficulty in purchasing inputs for the 2022 crop season, up from 27% in March. In a follow-up question, producers who said they had some difficulty obtaining inputs said that herbicides (30% of respondents) were most problematic, followed closely by farm machinery parts (27%), fertilizer (26%), and insecticides (17%). In a related question, 11% of crop producers said they received notice an input supplier would not be able to deliver one or more crop inputs they had already purchased for use in 2022. Of those, herbicide availability was the top problem reported.

Despite an overall improved financial performance outlook, the Farm Capital Investment Index remains at its all-time low. Supply chain problems remain a key reason many producers feel now is not a good time for making large investments in their farming operations. For example, just over 40% of producers said their farm machinery purchase plans were impacted by low machinery inventories. The rising cost of all inputs, including machinery, buildings, and grain bins, is likely another factor causing producers to say now is not a good time for large investments.

Read the full Ag Economy Barometer report at https://purdue.ag/agbarometer. The site also offers additional resources – such as past reports, charts and survey methodology – and a form to sign up for monthly barometer email updates and webinars.

Each month, the Purdue Center for Commercial Agriculture provides a short video analysis of the barometer results. For even more information, check out the Purdue Commercial AgCast podcast. It includes a detailed breakdown of each month’s barometer, in addition to a discussion of recent agricultural news that affects farmers.

The Ag Economy Barometer, Index of Current Conditions and Index of Future Expectations are available on the Bloomberg Terminal under the following ticker symbols: AGECBARO, AGECCURC and AGECFTEX.

About the Purdue University Center for Commercial Agriculture

The Center for Commercial Agriculture was founded in 2011 to provide professional development and educational programs for farmers. Housed within Purdue University’s Department of Agricultural Economics, the center’s faculty and staff develop and execute research and educational programs that address the different needs of managing in today’s business environment.

About CME Group

As the world’s leading and most diverse derivatives marketplace, CME Group (www.cmegroup.com) enables clients to trade futures, options, cash and OTC markets, optimize portfolios, and analyze data – empowering market participants worldwide to efficiently manage risk and capture opportunities. CME Group exchanges offer the widest range of global benchmark products across all major asset classes based on interest rates, equity indexes, foreign exchange, energy, agricultural products and metals. The company offers futures and options on futures trading through the CME Globex® platform, fixed income trading via BrokerTec and foreign exchange trading on the EBS platform. In addition, it operates one of the world’s leading central counterparty clearing providers, CME Clearing. With a range of pre- and post-trade products and services underpinning the entire lifecycle of a trade, CME Group also offers optimization and reconciliation services through TriOptima, and trade processing services through Traiana.

CME Group, the Globe logo, CME, Chicago Mercantile Exchange, Globex, and E-mini are trademarks of Chicago Mercantile Exchange Inc. CBOT and Chicago Board of Trade are trademarks of Board of Trade of the City of Chicago, Inc. NYMEX, New York Mercantile Exchange and ClearPort are trademarks of New York Mercantile Exchange, Inc. COMEX is a trademark of Commodity Exchange, Inc. BrokerTec, EBS, TriOptima, and Traiana are trademarks of BrokerTec Europe LTD, EBS Group LTD, TriOptima AB, and Traiana, Inc., respectively. Dow Jones, Dow Jones Industrial Average, S&P 500, and S&P are service and/or trademarks of Dow Jones Trademark Holdings LLC, Standard & Poor’s Financial Services LLC and S&P/Dow Jones Indices LLC, as the case may be, and have been licensed for use by Chicago Mercantile Exchange Inc. All other trademarks are the property of their respective owners.