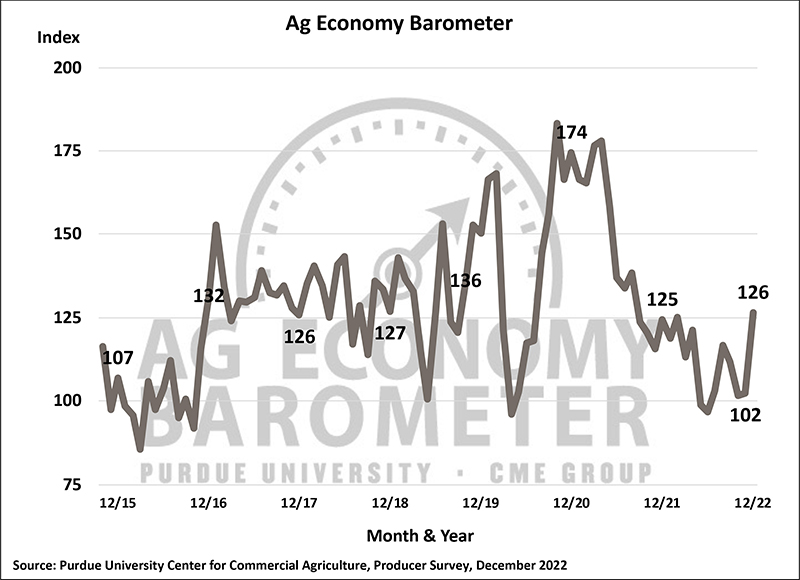

Farmer sentiment rebounds at year end on stronger 2022 income

Following a two-month decline and a year of weak sentiment, the Purdue University/CME Group Ag Economy Barometer closed out the year on a more positive note, rallying 24 points in December to a reading of 126. U.S. farmers were more optimistic about both their current situation and expectations for the future. The Current Conditions Index jumped 37 points to a reading of 135, while the Future Expectations Index increased 18 points to a reading of 122. The Ag Economy Barometer is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey. This month’s survey was conducted Dec. 5-9.

“The improvement in current sentiment was motivated by producers’ stronger perception of current financial conditions on their farms and could be attributed to producers taking time to estimate their farms’ 2022 income following the completion of the fall harvest,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture.

The Farm Financial Performance Index climbed 18 points to a reading of 109 in December. Notably, this was the only time in 2022 that the index was above 100. The turnaround was driven by a sharp increase in the percentage of producers who expect better performance than last year, which jumped from 23% to 35% of respondents, and is consistent with USDA’s forecast for strong net farm income in 2022.

The Farm Capital Investment Index climbed 9 points this month to 40, the highest reading for the index since February; yet, it remains 9 points lower than a year earlier. Among the nearly three-quarters of respondents who said it was a bad time for large investments, the most commonly cited reason was high prices for farm machinery and new construction (41%), followed by rising interest rates (28%).

Despite the improvement in farmers’ perceptions of their financial situations, both the short- and long-term farmland value indices continued to drift lower in December. The short-term index fell 5 points to 124, while the long-term index declined 4 points to 140. When examined over the course of the last year, it’s clear that sentiment among producers about farmland values has shifted. For example, compared to a year ago, the percentage of respondents who expect to see farmland values decline in the upcoming year increased from 6% to 15%, while the percentage expecting to see values rise declined from 59% to 39%. Among producers who expect farmland values to rise over the next 5 years, just over three-fourths of them said that a combination of nonfarm investor demand and inflation are the main reasons they expect to see values rise.

Looking to the year ahead, the December survey asked producers to compare their expectations for their farm’s financial performance in 2023 to 2022. Producers indicated they expect lower financial performance in 2023 and cited rising costs and narrowing margins as key reasons. Concerns about costs continue to be top of mind for producers. Nearly half (47%) of crop producers said they expect farmland cash rental rates in 2023 to rise above the previous year. Other top concerns for 2023 include higher input costs (45% of respondents), rising interest rates (22% of respondents) and lower crop or livestock prices (13% of respondents).

Read the full Ag Economy Barometer report. The site also offers additional resources – such as past reports, charts and survey methodology – and a form to sign up for monthly barometer email updates and webinars.

Each month, the Purdue Center for Commercial Agriculture provides a short video analysis of the barometer results. For even more information, check out the Purdue Commercial AgCast podcast. It includes a detailed breakdown of each month’s barometer, in addition to a discussion of recent agricultural news that affects farmers.

The Ag Economy Barometer, Index of Current Conditions and Index of Future Expectations are available on the Bloomberg Terminal under the following ticker symbols: AGECBARO, AGECCURC and AGECFTEX.

About the Purdue University Center for Commercial Agriculture

The Center for Commercial Agriculture was founded in 2011 to provide professional development and educational programs for farmers. Housed within Purdue University’s Department of Agricultural Economics, the center’s faculty and staff develop and execute research and educational programs that address the different needs of managing in today’s business environment.

About CME Group

As the world’s leading and most diverse derivatives marketplace, CME Group (www.cmegroup.com) enables clients to trade futures, options, cash and OTC markets, optimize portfolios, and analyze data – empowering market participants worldwide to efficiently manage risk and capture opportunities. CME Group exchanges offer the widest range of global benchmark products across all major asset classes based on interest rates, equity indexes, foreign exchange, energy, agricultural products and metals. The company offers futures and options on futures trading through the CME Globex® platform, fixed income trading via BrokerTec and foreign exchange trading on the EBS platform. In addition, it operates one of the world’s leading central counterparty clearing providers, CME Clearing.

CME Group, the Globe logo, CME, Chicago Mercantile Exchange, Globex, and E-mini are trademarks of Chicago Mercantile Exchange Inc. CBOT and Chicago Board of Trade are trademarks of Board of Trade of the City of Chicago, Inc. NYMEX, New York Mercantile Exchange and ClearPort are trademarks of New York Mercantile Exchange, Inc. COMEX is a trademark of Commodity Exchange, Inc. BrokerTec, EBS, TriOptima, and Traiana are trademarks of BrokerTec Europe LTD, EBS Group LTD, TriOptima AB, and Traiana, Inc., respectively. Dow Jones, Dow Jones Industrial Average, S&P 500, and S&P are service and/or trademarks of Dow Jones Trademark Holdings LLC, Standard & Poor’s Financial Services LLC and S&P/Dow Jones Indices LLC, as the case may be, and have been licensed for use by Chicago Mercantile Exchange Inc. All other trademarks are the property of their respective owners.