Farmer sentiment improves, producers credit stronger financial conditions

Farmer sentiment improves as producers credit stronger financial conditions (Purdue/CME Group Ag Economy Barometer/James Mintert).

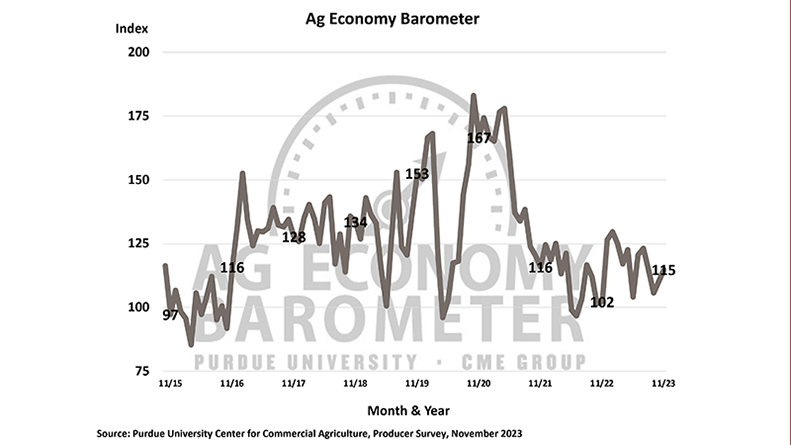

Farmer sentiment improves as producers credit stronger financial conditions (Purdue/CME Group Ag Economy Barometer/James Mintert). Agricultural producers’ sentiment increased for the second consecutive month, as the Purdue University/CME Group Ag Economy Barometer index rose 5 points to a reading of 115, a 12% increase compared to the previous year. The sentiment growth is largely attributed to farmers’ improved perceptions of their farms’ financial conditions and prospects. This month’s Ag Economy Barometer survey was conducted from Nov. 13-17.

The Index of Current Conditions rose 12 points to 113 while the Index of Future Expectations improved by 2 points to 116. The Farm Financial Performance Index also rose in November to a reading of 95, which is up 3 points from October. The financial index reached its low point back in the spring. The November reading was 25% higher than in May and 10% higher than at the start of fall harvest in September.

“Farmers’ expectations regarding financial performance have improved, with fewer producers’ expecting worse performance than a year ago,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture.

The Farm Capital Investment Index has fluctuated throughout 2023 but rebounded this month to a reading of 42, up 7 points from October. Over the last several months, producers who view the investment climate as favorable were asked why they feel that way. The percentage of respondents choosing “strong cash flows” has been drifting lower since summer when approximately 40% of respondents chose that as their primary reason. This month just 22% of respondents chose “strong cash flows” with “higher dealer inventories,” chosen by 29% of respondents, claiming the top spot as to why now is a good time to make large investments, implying a potential change in market conditions.

“This shift suggests that farmers might be seeing a moderation in farm equipment price rises, making it a more favorable time for large investments,” Mintert said.

In November, perspectives on farmland values changed little compared to October. The Short-Term Farmland Values Expectations Index maintained its position at 125, while the long-term index fell 5 points. Among respondents who expect farmland values to rise over the next five years, they overwhelmingly attribute their optimism to non-farm investor demand, followed by inflation.

Top concerns for the upcoming year include higher input costs (32%), rising interest rates (26%) and lower crop and/or livestock prices (20%). Notably, there has been a shift in concern throughout the year, with fewer producers expressing worry over higher input costs compared to the beginning of the year. Instead, more producers are now concerned about rising interest rates and lower crop and livestock prices.

This month’s survey was conducted the same week that Congress voted to extend the 2018 Farm Bill’s provisions to Sept. 30, 2024. Anticipating the extension by Congress, the November survey gauged the preferences of corn and soybean producers regarding farm safety net programs for 2024. Over two-thirds of respondents expressed a preference for the Agricultural Risk Coverage (ARC) farm program, while nearly one-third leaned toward enrolling in the Price Loss Coverage (PLC) program, assuming the extension of the current Farm Bill’s provisions. Despite preferences emerging, uncertainty prevails, particularly for soybean (52% declining to choose) and corn (43% declining to choose) producers when deciding to choose between programs.

About the Purdue University Center for Commercial Agriculture

The Center for Commercial Agriculture was founded in 2011 to provide professional development and educational programs for farmers. Housed within Purdue University’s Department of Agricultural Economics, the center’s faculty and staff develop and execute research and educational programs that address the different needs of managing in today’s business environment.

About CME Group

As the world’s leading derivatives marketplace, CME Group (www.cmegroup.com) enables clients to trade futures, options, cash and OTC markets, optimize portfolios, and analyze data – empowering market participants worldwide to efficiently manage risk and capture opportunities. CME Group exchanges offer the widest range of global benchmark products across all major asset classes based on interest rates, equity indexes, foreign exchange, energy, agricultural products and metals. The company offers futures and options on futures trading through the CME Globex® platform, fixed income trading via BrokerTec and foreign exchange trading on the EBS platform. In addition, it operates one of the world’s leading central counterparty clearing providers, CME Clearing.

CME Group, the Globe logo, CME, Chicago Mercantile Exchange, Globex, and, E-mini are trademarks of Chicago Mercantile Exchange Inc. CBOT and Chicago Board of Trade are trademarks of Board of Trade of the City of Chicago, Inc. NYMEX, New York Mercantile Exchange and ClearPort are trademarks of New York Mercantile Exchange, Inc. COMEX is a trademark of Commodity Exchange, Inc. BrokerTec and EBS are trademarks of BrokerTec Europe LTD and EBS Group LTD, respectively. The S&P 500 Index is a product of S&P Dow Jones Indices LLC (“S&P DJI”). “S&P®”, “S&P 500®”, “SPY®”, “SPX®”, US 500 and The 500 are trademarks of Standard & Poor’s Financial Services LLC; Dow Jones®, DJIA® and Dow Jones Industrial Average are service and/or trademarks of Dow Jones Trademark Holdings LLC. These trademarks have been licensed for use by Chicago Mercantile Exchange Inc. Futures contracts based on the S&P 500 Index are not sponsored, endorsed, marketed, or promoted by S&P DJI, and S&P DJI makes no representation regarding the advisability of investing in such products. All other trademarks are the property of their respective owners.