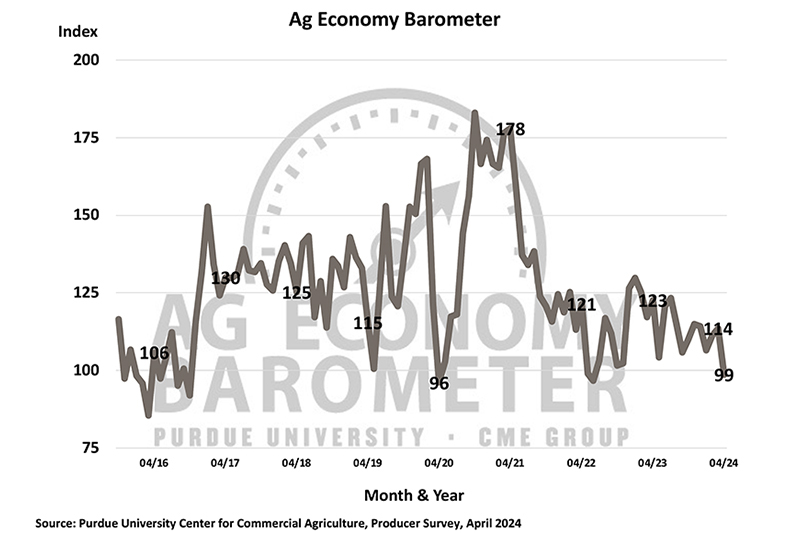

Farmer Sentiment Declines to Lowest Level Since June 2022 Amid Weakened Financial Outlook

April witnessed a steep decline in U.S. farmer sentiment, as indicated by the Purdue University/CME Group Ag Economy Barometer, which fell 15 points from March to a reading of 99. Both subindexes of the barometer also saw declines: The Current Condition Index dropped by 18 points to 83, while the Future Expectations Index fell by 14 points to 106. The month marked the lowest farmer sentiment reading since June 2022 and the weakest current condition rating since May 2020. The sentiment decline was driven by worries regarding the current financial situation on farms and anticipated financial challenges in the coming year. The April Ag Economy Barometer survey was conducted from April 8-12, 2024.

“Farmers’ sentiment took a significant hit in April, reflecting broader concerns about financial performance and farmland values,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture.

The Farm Financial Performance Index declined to 76 in April, marking a 7-point drop from the previous month and a 21-point decrease from last fall’s peak of 97. This downturn reflects farmers’ growing concerns about the upcoming year’s financial outlook, with fewer respondents expecting better or equal performance than last year.

Farmers’ expectations regarding interest rates and farmland values shifted in April’s survey. Only 24% of respondents anticipate interest rates rising over the next year, down from 32% in March. Fewer farmers this month also said they expect to see farmland values rise over the next year, despite the modest improvement in their interest rate outlook, while more farmers reported that they look for farmland values to hold steady. In the April survey, just 29% of producers said they expect farmland values to rise in the upcoming year, compared to 38% who felt that way in March. These shifts reflect farmers’ concern about farm financial performance in 2024, outweighing their improved interest rate outlook.

There is growing interest in using farmland for solar energy production, and solar lease rates appear to be increasing. This month’s survey revealed a 7-point uptick in respondents reporting discussions with companies about solar energy leases, reaching 19% compared to 12% in March. Specifically, discussions around solar leasing suggest demand for solar leases is increasing, with 58% of farmers reporting lease rate offers exceeding $1,000 per acre — up from 54% in March. Over one-fourth of respondents (28%) said they were offered a farmland lease rate of $1,250 or more per acre. Rising lease rates for energy production could be starting to impact farmland values, at least in some areas. Among producers who said they expect values to rise in the next year, 8% of respondents highlighted energy production as a key reason.

“Looking ahead, energy production activities could provide some support for farmland values and expectations in some regions,” Mintert said.

About the Purdue University Center for Commercial Agriculture

The Center for Commercial Agriculture was founded in 2011 to provide professional development and educational programs for farmers. Housed within Purdue University’s Department of Agricultural Economics, the center’s faculty and staff develop and execute research and educational programs that address the different needs of managing in today’s business environment.

About Purdue University

Purdue University is a public research institution demonstrating excellence at scale. Ranked among top 10 public universities and with two colleges in the top four in the United States, Purdue discovers and disseminates knowledge with a quality and at a scale second to none. More than 105,000 students study at Purdue across modalities and locations, including nearly 50,000 in person on the West Lafayette campus. Committed to affordability and accessibility, Purdue’s main campus has frozen tuition 13 years in a row. See how Purdue never stops in the persistent pursuit of the next giant leap — including its first comprehensive urban campus in Indianapolis, the new Mitchell E. Daniels, Jr. School of Business, and Purdue Computes — at https://www.purdue.edu/president/strategic-initiatives.

About CME Group

As the world's leading derivatives marketplace, CME Group (www.cmegroup.com) enables clients to trade futures, options, cash and OTC markets, optimize portfolios, and analyze data – empowering market participants worldwide to efficiently manage risk and capture opportunities. CME Group exchanges offer the widest range of global benchmark products across all major asset classes based on interest rates, equity indexes, foreign exchange, energy, agricultural products and metals. The company offers futures and options on futures trading through the CME Globex® platform, fixed income trading via BrokerTec and foreign exchange trading on the EBS platform. In addition, it operates one of the world’s leading central counterparty clearing providers, CME Clearing.

CME Group, the Globe logo, CME, Chicago Mercantile Exchange, Globex, and E-mini are trademarks of Chicago Mercantile Exchange Inc. CBOT and Chicago Board of Trade are trademarks of Board of Trade of the City of Chicago, Inc. NYMEX, New York Mercantile Exchange and ClearPort are trademarks of New York Mercantile Exchange, Inc. COMEX is a trademark of Commodity Exchange, Inc. BrokerTec and EBS are trademarks of BrokerTec Europe LTD and EBS Group LTD, respectively. The S&P 500 Index is a product of S&P Dow Jones Indices LLC (“S&P DJI”). “S&P®”, “S&P 500®”, “SPY®”, “SPX®”, US 500 and The 500 are trademarks of Standard & Poor’s Financial Services LLC; Dow Jones®, DJIA® and Dow Jones Industrial Average are service and/or trademarks of Dow Jones Trademark Holdings LLC. These trademarks have been licensed for use by Chicago Mercantile Exchange Inc. Futures contracts based on the S&P 500 Index are not sponsored, endorsed, marketed or promoted by S&P DJI, and S&P DJI makes no representation regarding the advisability of investing in such products. All other trademarks are the property of their respective owners.