September 12, 2025

Crop Basis Review 2024–2025 and Early Indicators for 2025–2026

by Josh Strike

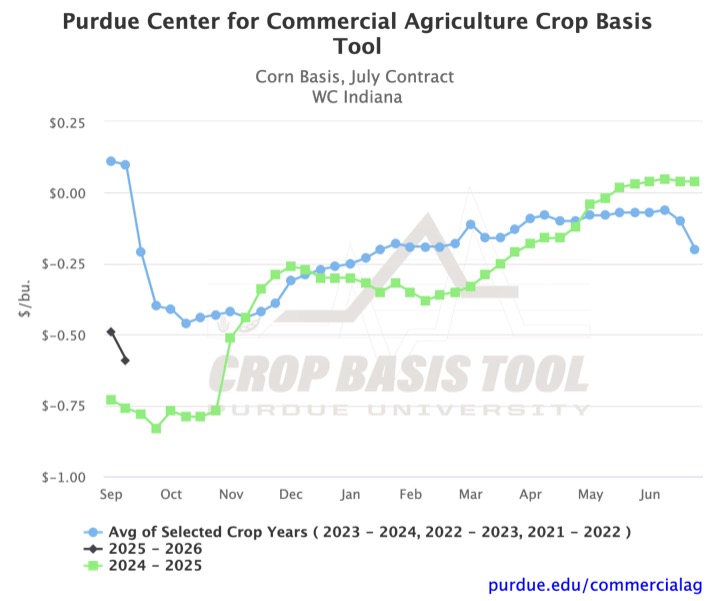

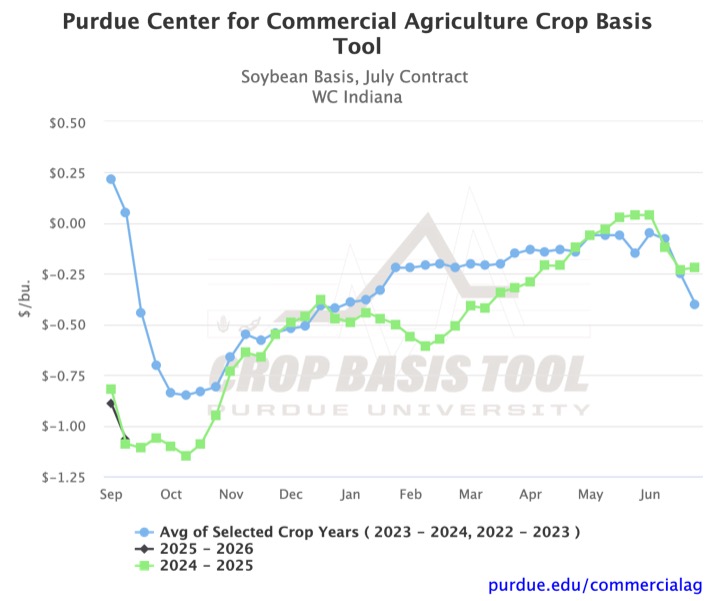

For much of the 2024-2025 marketing year, the basis for both corn and soybeans looked much different than their historical averages. Both crops started well below what previous trends would suggest. In West Central Indiana, corn basis to July futures reached a 15-year low during September (Figure 1). Similarly, soybean basis to July futures reached a five-year low in the same region (Figure 2). While not all regions reached five or ten-year lows, a common thread of opening the year below the historic trend was observed across the Eastern Corn Belt.

Although the basis started well below the historic average, the gap between the 2024-2025 marketing year and the trend lines quickly decreased. The historic average suggested that the basis would weaken between September and November. However, last year, there was significant basis strengthening from October to the beginning of December. This basis increase resulted, in part, due to the decrease in July futures for corn and soybeans during those three months. The opposing movements in the historical average and marketing year basis led to the convergence of the two series by December.

Basis once again diverged from the historic trend starting in December. The 2024-2025 corn and soybean basis both weakened as July futures for both crops increased through mid-February. As corn and soybean prices began decreasing again in February, the basis strengthened once again and converged to, or surpassed, the historical average.

As the focus turns to marketing the 2025-2026 crop, which has started to be harvested across the region, several lessons can be learned from the basis movement over the past year. Even though the basis did not start at the historical average, it still followed the general pattern of strengthening between October and June. Additionally, the highest basis levels relative to July futures were in June, regardless of prior differences from the historical average. However, basis tends to fall off as June concludes, so it is important to keep an eye on current basis activity and movement. Finally, there may be additional benefits from a storage hedge when October’s basis is weaker, assuming basis levels converge towards the historical average by the end of June.

Turning our attention to the early basis levels of 2025-2026, the corn basis is starting stronger than last year, but the soybean basis remains very similar to last year. They are both still below the historic average, which does not include last year. The historic trend suggests that the basis may weaken or remain stable over the next month as the harvest ramps up across the Eastern Corn Belt. To see where your local basis sits relative to last year and the historic average, you can visit the Purdue Center for Commercial Agriculture’s Crop Basis Tool.

TAGS:

TEAM LINKS:

RELATED RESOURCES

Corn and soybean basis levels have improved across much of the Eastern Corn Belt in early 2026, though large regional differences remain. Learn what’s driving basis strength—and how to track your local opportunities using Purdue’s Crop Basis Tool.

READ MOREUPCOMING EVENTS

We are taking a short break, but please plan to join us at one of our future programs that is a little farther in the future.