November 21, 2025

Corn and Soybean Basis Stabilizes After Seasonal Post-Harvest Rise

by Josh Strine

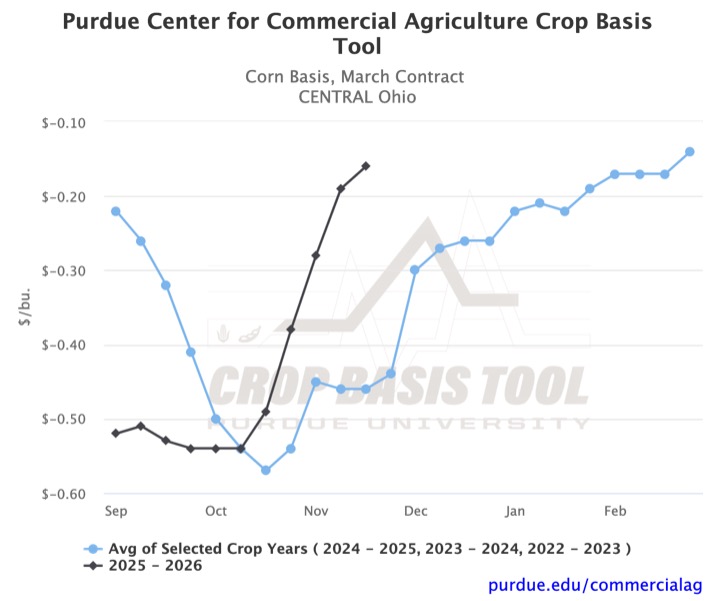

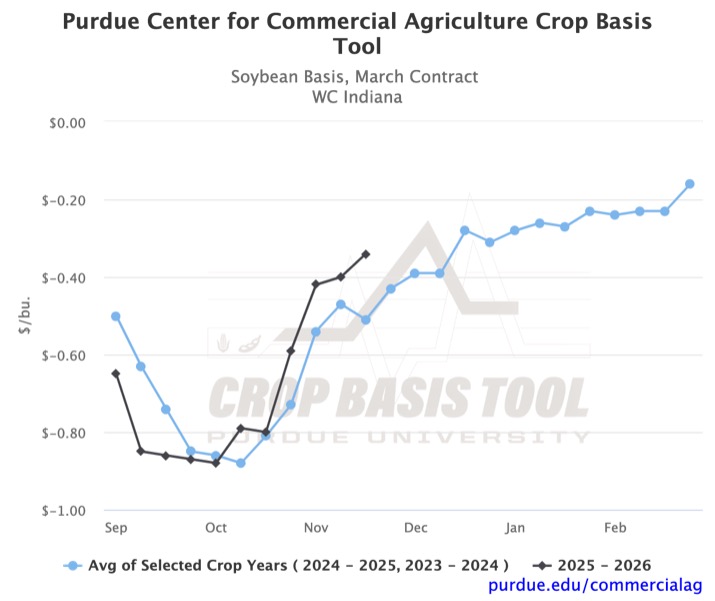

As harvest wraps up across the Eastern Corn Belt, we have observed substantial increases in soybean and corn basis. This post-harvest increase is consistent with historical patterns; however, its magnitude has kept this year’s basis above the historical trend in Indiana, Ohio, and Michigan. For example, in central Ohio, recent corn basis movement has pushed the basis to March futures to -$0.16/bu, which is $0.30/bu higher than the historical average (Figure 1). In west central Indiana, soybean basis to March futures has increased by $0.46/bu over the past four weeks, reaching a marketing year high of -$0.34/bu (Figure 2).

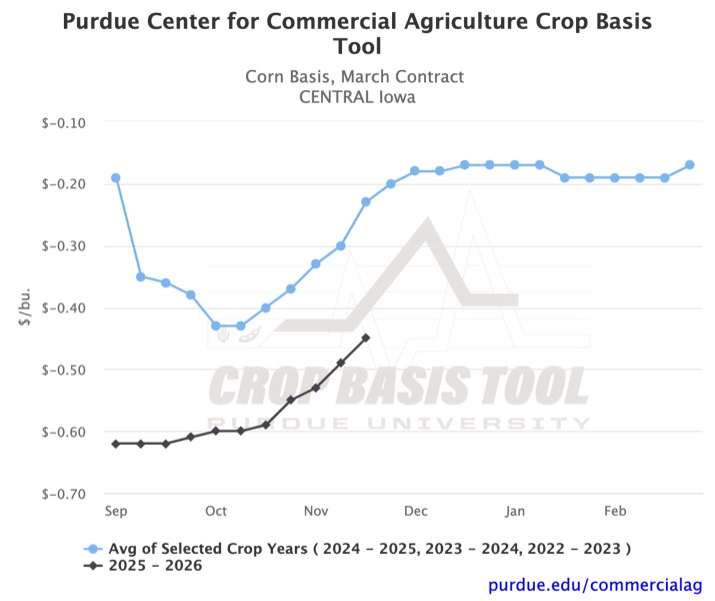

In contrast to the substantial basis increase in the easternmost states monitored in the Crop Basis Tool, Iowa has experienced a more gradual post-harvest improvement. While basis has increased across much of the state, a weak start to the marketing year has kept several locations at seven-year lows. Figure 3 provides an example using the central Iowa corn basis to March futures. Although the basis for the third week of November is a marketing year high, it is still $0.22/bu below the three-year average.

In Illinois, we observe a transition from the below-trend basis in Iowa to the above-trend basis in Indiana. The basis is below the historical average in the southwestern part of the state and above it in the southeastern part. In the rest of the state, both corn and soybean basis are within a few cents of the historical trend. For example, corn basis in central Illinois has been within $0.02/bu of the historical average since the second week of October (Figure 4). When we look at Figures 3 and 4 together, we see that the historical corn basis to March futures in central Iowa and central Illinois are very similar. In fact, Iowa’s historical trend is slightly higher than Illinois’s, further highlighting this year’s relative weakness in Iowa.

As we head into winter, historical trends suggest a slowing of the recent strengthening and a relatively stable basis over the next couple of months. Looking at recent basis movement in Figures 1 and 2, strengthening in the last week or two is already much less than that observed in October. However, in-season divergences in this year’s basis from the historical trend, as shown in Figure 1, remind us that the historical average is not a perfect predictor of future basis.

To stay up to date on your local corn or soybean basis, you can visit the Purdue Center for Commercial Agriculture’s Crop Basis Tool.

TAGS:

TEAM LINKS:

RELATED RESOURCES

Corn and soybean basis levels have improved across much of the Eastern Corn Belt in early 2026, though large regional differences remain. Learn what’s driving basis strength—and how to track your local opportunities using Purdue’s Crop Basis Tool.

READ MOREUPCOMING EVENTS

January 27 or 28, 2026

Farm Shield is more than a conference, it’s a commitment to helping agricultural families build resilience and plan for a secure future. Don’t miss this opportunity to protect your legacy!

Read MoreJanuary 9, 2026

A management programs geared specifically for farmers. Surrounded by farm management, farm policy, agricultural finance and marketing experts, and a group of your peers, the conference will stimulate your thinking about agriculture’s future and how you can position your farm to be successful in the years ahead.

Read More