December 3, 2025

Machinery Cost Benchmarks for Corn & Soybeans

by Michael Langemeier

A previous article discussed crop machinery cost and investment (Langemeier, 2024). Crop machinery cost is computed by summing economic depreciation, interest, property taxes, insurance, repairs, fuel and lubricants, and custom hire and rental expense. This article examines crop machinery costs for small and large farms and for net return categories. Trends in corn and soybean crop machinery costs are also examined. A forthcoming article will examine crop machinery investment and net investment by farm size category.

Crop Machinery Cost

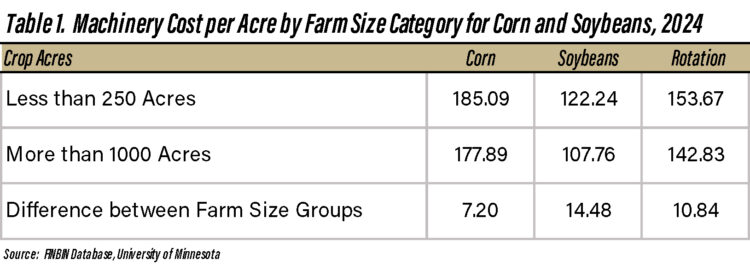

Table 1 presents machinery cost per acre for farms with less than 250 acres or more than 1000 acres of corn or soybeans in 2024. The “rotation” column averages the information in the corn and soybean columns for farms with less than 250 acres and for farms with more than 1000 acres. For corn, the average machinery cost per acre in 2024 was $185 for small farms and $178 for large farms. For soybeans, the average machinery cost per acre in 2024 was $122 for small farms and $108 for large farms. Given the difference in machinery cost between farm size groups, it makes sense to use benchmarks for farms that are similar in size. Though not shown in the paper, farms with between 250 and 500 acres of corn (soybeans) in 2024 had an average machinery cost of $189 ($119), and farms with between 500 and 1000 acres of corn (soybeans) in 2024 had an average machinery cost of $178 ($110).

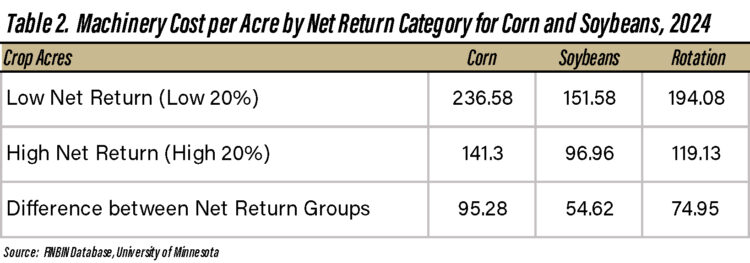

It is also interesting to compare machinery costs per acre for farms in the low 20% in terms of corn and soybean net returns with farms in the high 20% (table 2). The difference in machinery cost per acre for corn between the two net return groups was $95 per acre in 2024. For soybeans, the difference was $55 per acre. Obviously, machinery costs per acre vary tremendously among farms. We don’t encourage producers to use the low net return figures as a benchmark because we don’t know the vintage of the machinery among farms. A farm with older machinery will have lower economic depreciation and interest expense on this machinery and therefore is likely to have a relatively low machinery cost per acre. Whether this scenario is sustainable in the long-run is questionable.

Trends in Machinery Costs

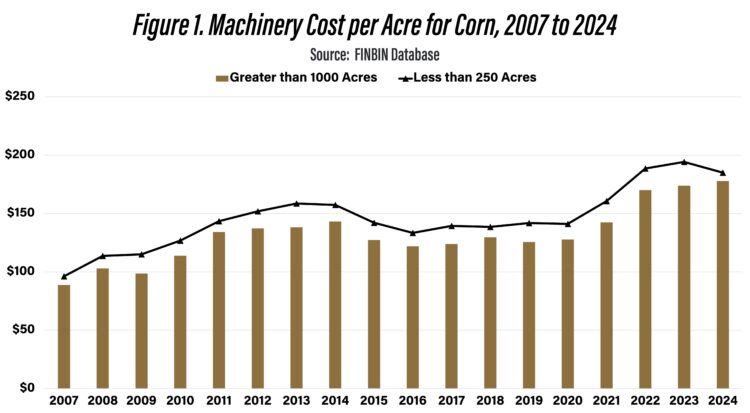

In addition to examining machinery cost per acre differences among farms in 2024, we examined differences over the 2007 to 2024 period. Figure 1 illustrates the trend in machinery cost per acre for small and large corn producers while figure 2 illustrates the trend for soybean producers. Since 2021, machinery cost per acre for producers with over 1000 planted acres of corn or soybeans has increased 25% for corn and 22% for soybeans. There was significant difference in machinery cost per acre for corn or soybean enterprises with less than 250 acres and more than 1000 acres over the time period. The average difference over the period was $14 for both corn and soybeans (i.e., 9.6% for corn and 15.1% for soybeans), suggesting that there are economies of scale related to machinery cost per acre.

Summary

This article examines crop machinery costs for crop farms using data from 2007 to 2024. Machinery costs per acre were lower for large farms. The average machinery cost per acre for large farms was $178 for corn and $108 for soybeans in 2024. A forthcoming article will examine crop machinery investment and net investment by farm size category.

Citations

Center for Farm Financial Management, University of Minnesota, FINBIN web site, accessed August 4, 2025.

Langemeier, M. “Benchmarking Crop Machinery Cost and Investment.” Center for Commercial Agriculture, Purdue University, December 20, 2024.

TAGS:

TEAM LINKS:

RELATED RESOURCES

UPCOMING EVENTS

January 27 or 28, 2026

Farm Shield is more than a conference, it’s a commitment to helping agricultural families build resilience and plan for a secure future. Don’t miss this opportunity to protect your legacy!

Read MoreJanuary 9, 2026

A management programs geared specifically for farmers. Surrounded by farm management, farm policy, agricultural finance and marketing experts, and a group of your peers, the conference will stimulate your thinking about agriculture’s future and how you can position your farm to be successful in the years ahead.

Read More