January 6, 2026

Labor Standards

by Michael Langemeier

A previous article discussed labor efficiency and productivity benchmarks (Langemeier, 2025a). Labor efficiency is computed by dividing total labor cost (hired labor plus family and operator labor) by gross farm income. Family and operator labor can be represented by owner withdrawals. Labor productivity is computed by dividing gross farm income by the number of farm workers. This article examines labor hours per acre and labor efficiency for crop farms using FINBIN data from 2007 to 2024. Crop farms are broken down into four farm size categories: less than 500 crop acres, 500 to 1000 crop acres, 1000 to 2000 crops acres, and greater than 2000 crop acres.

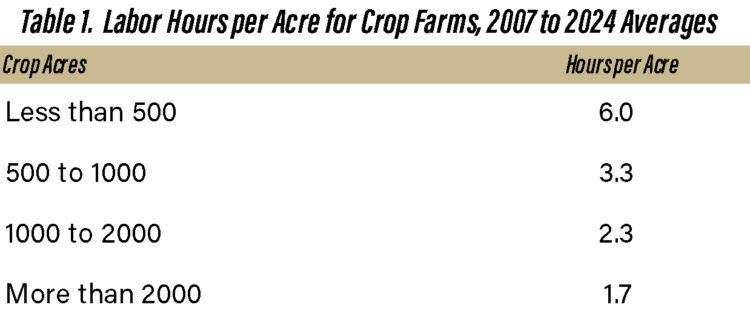

Labor Hour per Acre

Table 1 reports labor hours per acre for crop farms using FINBIN data from 2007 to 2024. Labor hours per acre dropped substantially for the first two farm categories, from 6.0 hours per acre for crop farms with less than 500 acres to 3.3 hours per acre for farms with 500 to 1000 crop acres. Labor hours continued to drop as farm size increased from 1000 to 2000 crop acres to over 2000 crop acres. Farms with more than 2000 acres averaged 1.7 hours per acre.

The average difference in labor hours per acre between the smallest and largest farm size category in table 1 was 4.3 hours per acre, which using annual data from 2007 to 2024 was significantly different from zero. Annual differences between these two farm size categories ranged from 2.9 to 7.2 hours per acre.

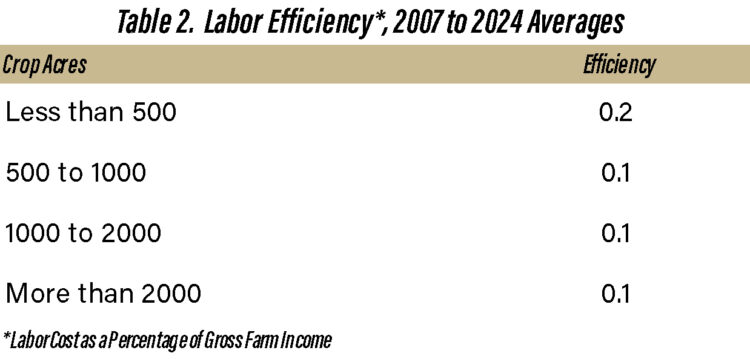

Labor Efficiency

As noted above, labor efficiency is computed by dividing total labor cost by gross farm income. The results in table 1 imply that labor efficiency improves with farm size. The results in table 2 confirm this hypothesis. The difference in labor efficiency between the smallest and largest farm size category was 0.128 or 12.8%, which using annual data from 2007 to 2024 was significantly different from zero. Annual differences in labor efficiency between the two farm size groups ranged from 0.085 to 0.190 over the study period. The average labor efficiency for the farms with more than 2000 acres was 0.089 or 8.9%.

Summary

This article examined labor hours per acre and labor efficiency for crop farms using FINBIN data from 2007 to 2024. Comparing the smallest and largest farm categories, labor hours were significantly lower, and labor efficiency was significantly higher for the large farms. Labor hours per crop acre for the large farms averaged 1.7 hours per acre, while labor cost in proportion of gross farm income was 8.9 percent for the large farms.

The labor hours per acre and labor efficiency results in this article suggest that there are economies of scale with the use of labor on crop farms. To find out how important these economies are, we also need to examine machinery cost and investment per acre for various farm size categories. High labor costs are not as problematic if they result in lower machinery costs. Recent articles (Langemeier, 2025b; Langemeier, 2025c), indicate that machinery cost and investment are also lower for larger farms. Thus, there are economies of scale associated with both labor and capital.

References

Center for Farm Financial Management, University of Minnesota, FINBIN web site, accessed August 4, 2025.

Langemeier, M. “Benchmarking Labor Efficiency and Productivity.” Center for Commercial Agriculture, Purdue University, February 6, 2025a.

Langemeier, M. “Machinery Cost Benchmarks for Corn & Soybeans.” Center for Commercial Agriculture, Purdue University, December 3, 2025b.

Langemeier, M. “Crop Machinery Investment.” Center for Commercial Agriculture, Purdue University, December 12, 2025c.

TAGS:

TEAM LINKS:

RELATED RESOURCES

UPCOMING EVENTS

We are taking a short break, but please plan to join us at one of our future programs that is a little farther in the future.