August 26, 2019

The Economic Importance of U.S. Animal Agriculture

by Chris Hurt

Diversified grain and livestock farms were once the model of U.S. agriculture. Farms often had crop and animal enterprises to help capture their complementary nature such as spreading the use of family labor throughout the year and recycling animal waste as nutrients to the crop enterprise.

Today, farms are much more specialized in crops or animals, and many fewer are in both. Has this changed the relative economic importance of crop and animal agriculture in the U.S.?

Why Specialize in Crops OR Animals?

First, what are some of the drivers of greater enterprise specialization? Of course, modern technology is highly complex. Complexity tends to economically favor specialization. Specialization helps focus limited capital resources in one enterprise rather than allocating to multiple enterprises. Larger capital investments help employ the very best technology and the best managers. Specialization helps gain economies of size that would not be achievable if limited capital and management were being allocated to multiple enterprises. Specialization also tends to give businesses better knowledge in risk management, marketing, and financial management.

Over the long run, the movement to industrialization in animal agriculture has also favored specialization. Egg and chicken production tended to leave the family farm in the 1950’s and was largely replaced by specialized, industrial scale, integrated production units. Cattle feedlots moved from primarily small-scale family farms to large commercial feedlots in the 1960’s and early 1970’s. The 1970’s saw hog production move out of pasture systems and into more highly capital intensive indoor confinement facilities. The grain export boom of the 1970’s encouraged many farm families to specialize in crop production and drop animal enterprises. In more recent decades pork production and milk production have also moved sharply toward the more specialized industrial model.

Who’s Bigger: Crops or Animals?

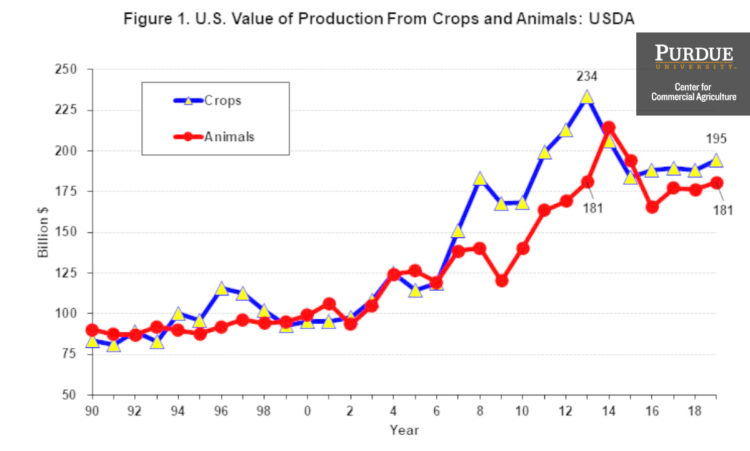

So, is the crop sector or the animal sector economically bigger today? Data are drawn from the USDA Farm Income and Wealth Statistics at the Economic Research Service where analyst estimate the farm level value of crop and animal production, by state, and for the U.S. As shown in Figure 1, the value of production for the crop and animal sectors have made roughly the same economic contributions dating back to 1990.

Overall, the value of crop production has been modestly larger than animals, and has tended to move upward more quickly when agricultural demand is strong. There were two of these strong demand periods shown in the chart. The first was the growth of Asian demand in the mid-1990’s and secondly, the bio-fuels and Chinese demand surges from 2007 to 2012. In each of these periods the value of crop production rose more rapidly than the value of animal production.

Those events increased the demand for grains and oilseeds, thus increasing grain and oilseed prices and immediately increasing revenues from crops. But there is a lagged impact on the value of animal production. Rising feed prices cannot be immediately passed to consumers. Instead, there is a multiple year process of adjusting animal production down to a level where the prices in the animal sector increase sufficiently to cover the higher feed costs. This period of adjustment can be seen by the rising value of animal production from 2009 to 2013.

Since 2016, the long-term relationship of the value of crop and animal production being of roughly the same size has returned. The bottom line is that the economic size of the animal sector is about the same size as the crops sector for the county as a whole.

Geographic Concentration of Animal Agriculture

The movement to large-scale industrial animal production has also meant more geographic concentration of production. Large scale animal production can concentrate production in certain areas, and then have little production in other regions. Cattle feeding is highly geographically concentrated in the Great Plains as an example. In another example, one state may have several large-scale egg production and processing facilities, yet a neighboring state with similar land resources may have none of those egg facilities.

The natural resource base of an individual state will be the primary factor in determining the mix of crops and animals for that state. Animal production can move to locations that minimizes costs of production and distribution. On the other hand, crop production is tied to the land that is not mobile. One of the implications is that the importance of crop production compared to animal production could change over time for individual states.

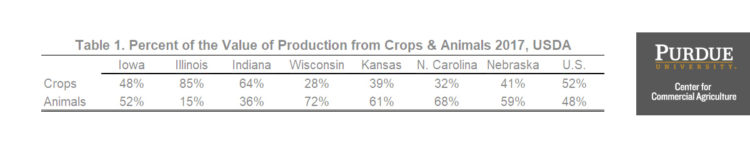

Some of that variation is shown in Table 1 for selected states. Remember that in 2017 the U.S. value of production was 52 percent crops and 48 percent animals. Iowa was close to that equal mix with 48 percent crops and 52 percent animals. Illinois, in major contrast, was 85 percent crops and only 15 percent animals. Wisconsin is specialized in milk production so animals represented 72 percent of the value of all farm production. Kansas and Nebraska are major beef producers, especially feedlots, and the value of animal agriculture is about 60 percent and dominates crops. North Carolina was a leader in industrialization of poultry and especially pork production so it is not surprising that the animal sector contribution was 68 percent.

Summary Points

On a national basis the economic size of the crop sector and the animal sector are about equal as measured by the value of production by USDA.

The animal sector continues to add value, jobs, and rural economic activity as it has always done.

Farms have become more specialized in either crop or animal production over time.

Animal production has had dramatic structural changes shifting toward large-scale industrial production systems.

These large-scale industrial systems have allowed locational movement which has resulted in more geographic concentration of production.

This geographic concentration, means that some states have become more animal dominate while others have become more crop dominate.

How individuals view the importance of animal production may be based on observations in their home state.

TAGS:

TEAM LINKS:

RELATED RESOURCES

UPCOMING EVENTS

We are taking a short break, but please plan to join us at one of our future programs that is a little farther in the future.