January 20, 2021

China’s Pork Sector Continues to Impact U.S.

by James Mintert

Corn and soybean prices have risen sharply since mid-August 2020. Smaller than expected 2020 U.S. harvests of both corn and soybeans are a key reason for the price rally. But just as important is the rise in exports of both crops to overseas destinations, primarily China. The rise in China’s demand for feedstuffs is tied to the resurgence in the Chinese pork sector as China attempts to rebuild its hog herd and boost the supply of pork to Chinese consumers.

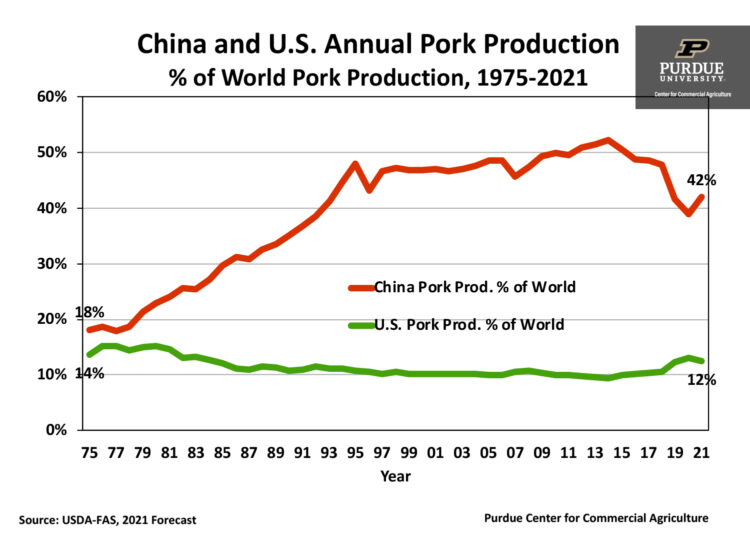

The magnitude of the Chinese hog sector is hard to grasp initially. As consumer incomes have grown in recent decades Chinese hog production has grown rapidly. Back in the mid-to-late 1970s pork production in China ranged from 18 to 19 percent of total pork production around the world. In comparison the United States pork production in the mid-to-late 1970s ranged from 14 to 15 percent of the world’s total. Although pork production has increased in both the U.S. and China over the ensuing decades, production in China has grown much more rapidly. By 2010 pork production in China accounted for 50 percent of pork production around the world while the U.S. pork sector accounted for just 10 percent of the world’s pork production. But that changed quickly when African Swine Fever (ASF) hit the Chinese hog production sector.

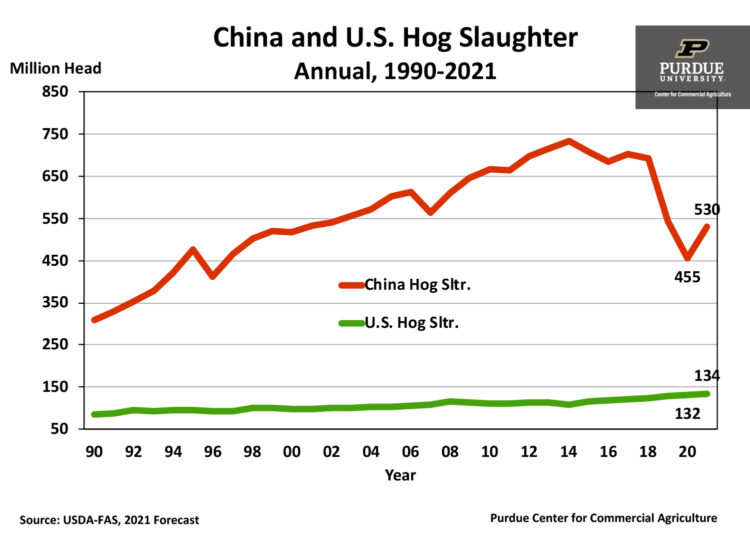

In 2017 hog slaughter in China totaled 702 million head, nearly six times the number of hogs processed in the U.S. that year. ASF devastated the Chinese hog herd beginning in 2018 and by 2020 hog slaughter volume plummeted to an estimated 455 million head, a decline of 36 percent. Chinese pork production declined from just over 120 billion pounds in 2017 to less than 84 billion pounds in 2020. To help put that difference in perspective, the 36-billion-pound reduction in China’s annual pork production exceeded the volume of pork produced in the U.S. during 2020, which was just over 28 billion pounds.

China is in the process of rebuilding its pork production sector. USDA forecasts a rebound in China’s hog slaughter from 455 million head in 2020 to 530 million head in 2021. Once again, to put that increase in perspective it’s helpful to compare it to the U.S. In 2021 USDA forecasts that U.S. hog slaughter will rise to 134 million head. So, the expected increase in hog slaughter in China this year would be analogous to a 55 percent rise in U.S. hog slaughter volume!

The impact of the expected rise in Chinese pork production is being exacerbated by a shift in the way pork is produced in China. Historically, a large portion of China’s pork production capacity came from small hog operations that didn’t employ U.S. style hog diets. In an attempt to boost pork production rapidly, China has encouraged the development of large-scale commercial type operations that rely on hog diets more comparable to U.S. feeding regimes. The industry expansion, combined with the ongoing change in production technology, is placing more pressure on China’s feedstuffs sector leading, in turn, to a large increase in demand for imported corn and soybeans.

In addition to boosting demand for U.S. corn and soybeans, ASF also provided a boost to U.S. pork exports. Preliminary data for 2020 indicates U.S. pork export volume rose approximately 18 percent above 2019’s volume. This despite the fact exports to Mexico and especially South Korea were weaker than in 2019. The biggest year-over-year increase in pork shipments was to mainland China, which more than doubled in 2020. Pork exports to China during 2020 accounted for nearly 30 percent of all U.S. pork exports, up from a market share of just 14 percent in 2019. Although pork exports to China could slow down during the last half of 2021, economic recovery in other key markets later this year could provide ongoing support to U.S. pork trade.

TAGS:

TEAM LINKS:

RELATED RESOURCES

UPCOMING EVENTS

We are taking a short break, but please plan to join us at one of our future programs that is a little farther in the future.