March 16, 2021

The Importance of Managing Hog Operation Feed Costs

by James Mintert

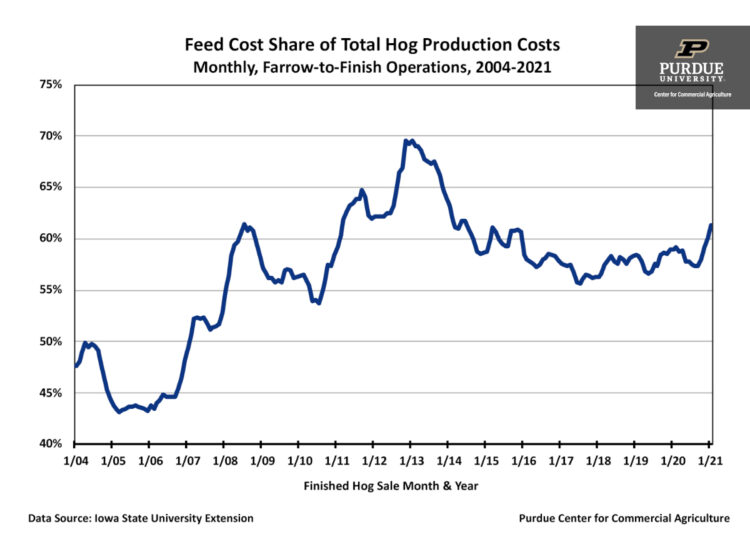

It comes as no surprise that feed costs on hog operations have risen sharply since last summer. May 2021 Chicago Board of Trade corn futures prices hit their summer low settlement price last August at $3.46. In early March, May 2021 corn futures were trading near $5.40, an increase of over 50 percent in just seven months. Feed costs share of total hog production costs since 2004 have ranged from a low of about 43 percent in 2005-2006 to a high of about 70 percent in late 2012 and early 2013, according to data published by Iowa State University. On a per head marketed basis, feed costs over that time frame ranged from a low of about $44 per head in 2005-2006 to a high of over $133 per head in 2012-2013. Feed costs have been on the upswing since last summer in the Iowa State data, rising from an estimated $72 per head in August 2020 to over $87 per head for hogs marketed in January of this year.

Examining estimated farrow-to-finish hog production costs published by Iowa State from 2004 through early 2021 reveals that nearly all of the month-to-month production cost changes can be explained by shifting feed costs. Note that the Iowa State data assumes that all feed is purchased on an as-needed basis, without any feed price risk management. The implication is clear. Effective management of total hog production costs requires management of feed costs.

It’s easy to say that feed costs need to be managed, but not quite so easy to say how they should be managed. That’s especially true this year as we enter the new crop year with much tighter crop supplies than in recent years meaning that prices could continue to rally further if crop production problems arise during the 2021 growing season. Fortunately, there are several risk management tools and strategies to consider using. In addition to cash forward contracting of grain and meal supplies, you could consider long hedging in the corn and soybean meal futures market or the purchase of corn or soybean meal call options in place of long hedges in the futures market. A relatively new tool from the Chicago Board of Trade to consider using is short-dated new crop options.

One of the challenges with using options to cover anticipated feed needs in the future is the relatively large time value inherent in premiums for options that expire far into the future. Short-dated new crop options are options on new crop futures, such as December CBT corn, that expire at various points throughout the growing season instead of late November, when the normal December corn options expire. Since they expire sooner than regular options, the short-dated option buyer does not have to pay the large time value inherent in an option premium for an option with an expiration date that’s far into the future. So, if you’re interested in protecting against a possible upward movement in new crop corn or soybean meal futures during the spring planting season or the summer growing season, you should consider adding short-dated new crop options to your risk management tool kit.

TAGS:

TEAM LINKS:

RELATED RESOURCES

UPCOMING EVENTS

We are taking a short break, but please plan to join us at one of our future programs that is a little farther in the future.