July 25, 2025

Leasing Pasture and Hay Ground

by Michael Langemeier

Due to low response rates, the Purdue Cash Rent and Land Value Survey has not included questions on pasture and hay ground leases since 2021. This article provides guidance on setting lease rates for pasture and hay ground.

Pasture Lease Rates per Acre

Three of the most important factors impacting pasture lease rates are stocking rate, lease period (e.g., May through September), and services provided (e.g., fence maintenance, identification of sick animals, distribution of mineral and salt, checking and gathering cattle, etc.). Due to its direct impact on the quality of the grass stand, the stocking rate should be discussed and included in any pasture leasing agreement. Stocking rates can be stated in number of animals or animal units. The average carrying capacity in the 2021 cash rent and land value survey for Indiana was 2.3 acres per cow. Pasture rental rates can also utilize animal units per month (AUM). One animal unit is defined as a 1000 pound cow. If a cow weighs 1300 pounds and has a calf that averages 300 pounds during the grazing season, there would be 1.6 AUM’s (1.3 for the cow and 0.3 for the calf). In the case of sheep, five or six adult sheep represent one AUM and five ewes with lambs equals one AUM.

Pasture rental rates should also reflect productivity. Highly productive pastures rent for more than poor pastures. Lease rates may also be influenced by market rates (i.e., higher in areas where demand is strong), location (i.e., close to farm operation), water supply, and whether the pasture is an improved pasture which requires annual fertilizer applications.

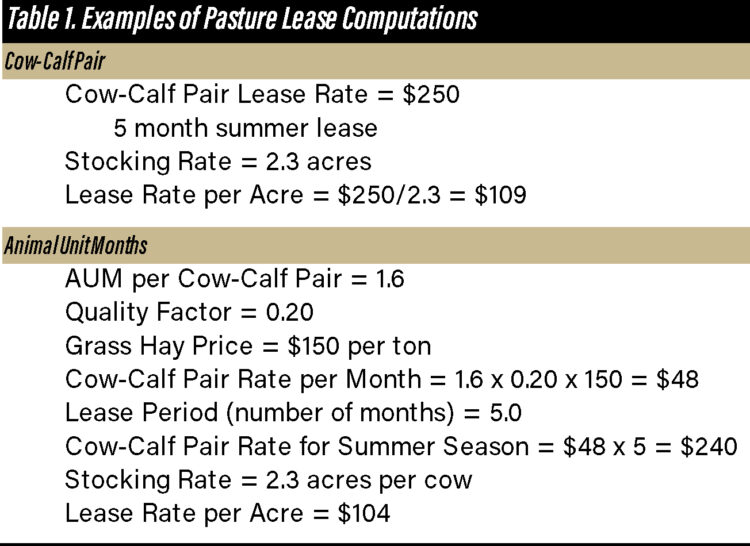

Table 1 contains examples of how to compute pasture lease rates per acre. The first example labeled “Cow-Calf Pair” uses a cow-calf pair lease rate of $250 and a stocking rate of 2.3 acres per cow to derive a lease rate per acre of $109. Information from the Western Corn Belt pertaining to cow-calf pair lease rates for the grazing season was used in the example (Bluestem Pasture Release, 2025; Jansen, 2025). There is a wide range of reported lease rates, ranging from $200 to $300 per cow-calf pair. This example uses the mid-point of the reported rates (i.e., $250). The second example closely follows Lemenager. The AUM per cow-calf pair is assumed to be 1.6. Lemenager lists the following pasture quality factors: 0.22 for lush, 0.20 for excellent; 0.15 for fair to good, and 0.12 for poor. This example uses a quality factor of 0.20. Grass hay price is assumed to be $150 per ton. Multiplying the AUM per cow-calf pair by the quality factor and hay price yields a cow-calf pair rate per month of $48.00. Using a cow-calf pair rate per season of $240 ($48.00 x 5 months) and a stocking rate of 2.3 acres per cow yields a pasture lease per acre of $104.

The Ag Lease 101 web site discusses pasture rental agreements and contains an example of a written pasture lease. In addition to signatures and property descriptions, a written lease should include the term of the lease, maximum allowable stocking rates, and service responsibilities of landlord and tenant.

Pasture Share Leases

Occasionally, landlords would rather lease their pasture for a share of gross revenue or the calf crop than use a per acre lease. An equitable share lease is a rental arrangement where the landowner and tenant share in the revenue and costs of production based on the proportion of resources each party contributes. Pasture represents approximately 16 percent of total costs, so in an equitable lease the landlord would receive 16 percent of the gross revenue from the sale of weaned calves and cull cows, or 19 percent of the sale of weaned calves.

Hay Ground Lease Rates per Acre

The 2021 Purdue Cash Rent and Land Value survey reported a cash rent for grass hay of $95 per acre for Indiana. Cash rent varied from $67 per acre in west and west central Indiana to $132 per acre in southeast and southwest Indiana. The survey also reported a rate for alfalfa hay. In regions where there is a market for alfalfa, production of alfalfa is competitive with row crop production. Thus, this article will focus on rental rates for grass hay. Rental rates for grass hay are very dependent on hay quality and hay yields. Quality is typically incorporated into hay price, higher quality hay receiving a premium price.

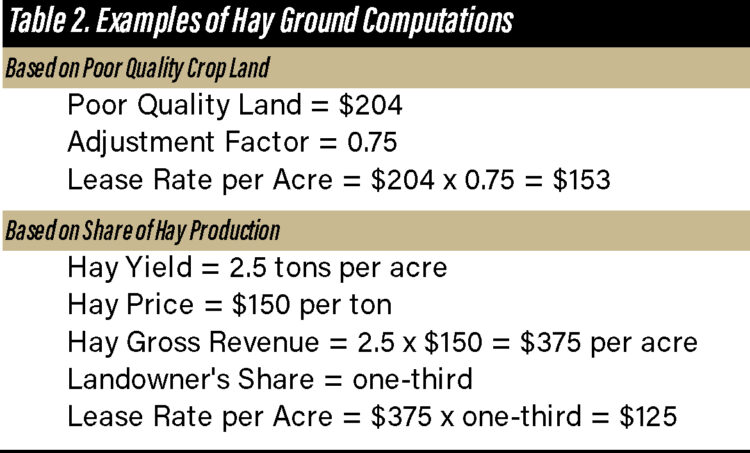

Two examples of hay ground lease computations can be found in table 2. The first example is based on poor quality land in Indiana. If the cash rent for poor quality land is $204 per acre (i.e., 2024 rate for Indiana) and hay ground is 75 percent as productive as poor quality land, the lease rate per acre would be $153. Obviously, the adjustment factor varies tremendously within and across regions. In some cases, hay ground might only be 50 percent as productive as crop ground. In other instances, hay ground could be of similar quality as crop ground. The second example uses hay yield, hay price, and the rule of thumb that farmland cost or rent represents approximately one-third of total cost to compute a lease rate per acre. Using a hay yield of 2.5 tons per acre and a hay price of $150 per ton results in a lease rate per acre of $125. Of course, this example is directly related to a share lease in which the landowner would receive one-third of the gross revenue from hay sales.

Summary and Conclusions

This article provides guidance when establishing a lease rate per acre for pasture and hay ground. Due to land quality differences, pasture and hay ground lease rates vary substantially among farms. For pasture leases, it is very important to consider stocking rates, the lease period, and services provided by the landlord. For hay ground, hay quality and hay price are important considerations.

An accompanying spreadsheet is available on the web site for the Center for Commercial Agriculture at https://purdue.ag/pastureorhaylease. This spreadsheet enables the user to change the parameters presented in the article’s examples.

References

Bluestem Pasture Release 2025. Department of Agricultural Economics, Kansas State University, May 30, 2025.

Jansen, J. “Nebraska Farm Real Estate Market Highlights, 2024-2025.” Center for Agricultural Profitability, Department of Agricultural Economics, University of Nebraska-Lincoln, 2025. https://cap.unl.edu/realestate/

Lemenager, R. “Pasture Rental Rates.” Department of Animal Sciences, Purdue University, not dated.

TAGS:

TEAM LINKS:

RELATED RESOURCES

UPCOMING EVENTS

We are taking a short break, but please plan to join us at one of our future programs that is a little farther in the future.