August 26, 2020

Statement of Owner’s Equity

by Michael Langemeier

This article is one of a series of financial management articles that examine financial statements and financial analysis. In this article, the components of a statement of owner’s equity are illustrated and described. This statement is used to reconcile beginning and ending owner’s equity. It is also helpful in determining whether increases in owner’s equity are due to increases in retained earnings and/or increases in asset values.

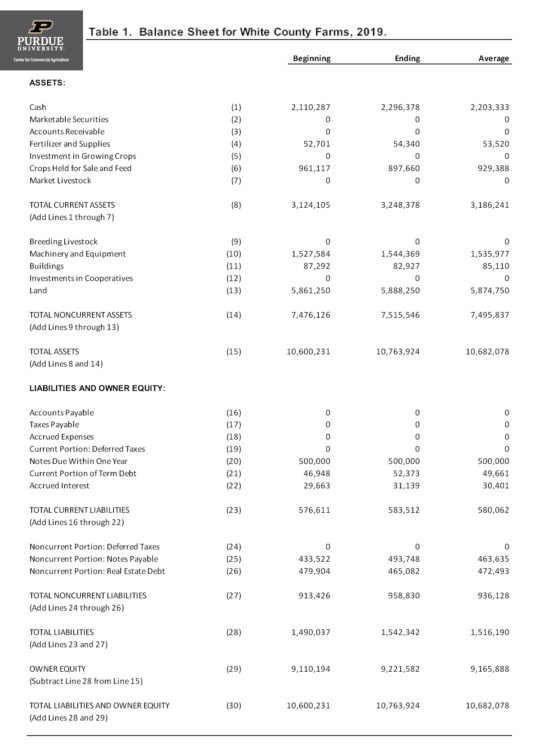

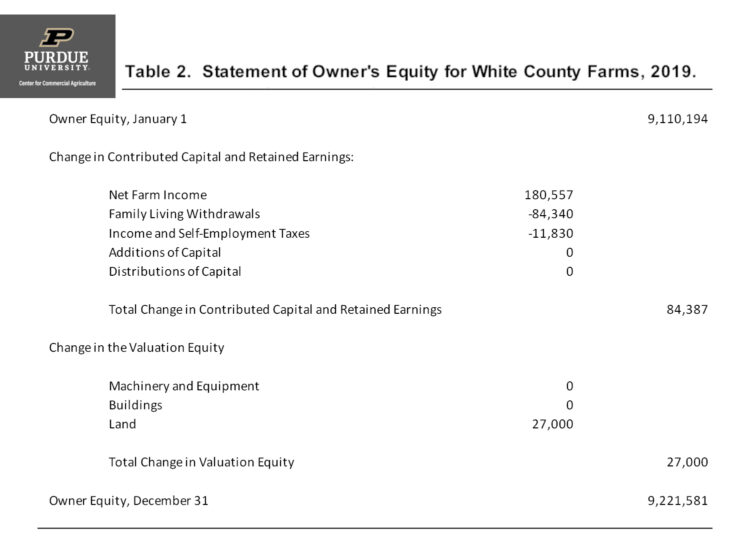

Table 1 contains an example of a market value balance sheet for a case farm in west central Indiana in 2019. Beginning owner equity was $9,110,194. Owner equity increased to $9,221,582 by the end of the year, an increase of $111,387 or 1.2 percent. The statement of owner’s equity in table 2 reconciles the change in owner equity during 2019, and illustrates the relative importance of retained earnings and increases in land values to the increase in owner equity.

Ending owner equity in table 2 is derived using three sub-totals: beginning owner equity, the change in contributed capital and retained earnings, and the change in valuation equity. The change in contributed capital and retained earnings was $84,387, and was derived by subtracting family living withdrawals and income and self-employment taxes from net farm income. In years when net farm income is relatively low, this change is often negative. In other words, in these years, net farm income is not large enough to cover family living withdrawals and taxes. The change in valuation equity was $27,000. This change was the result of increasing land values during 2019. Note that the ending owner equity figure of $9,221,582 in table 2 is equal to the corresponding balance sheet figure. If ending owner equity is not equal to the balance sheet figure, we would need to make sure that we have accurately recorded net farm income, owner withdrawals, asset valuation, and capital contributions.

Most businesses have a goal of increasing owner equity over time. As indicated above, the change in owner equity can be separated into two categories: changes in retained earnings and changes in asset values. For this case farm, the increase in retained earnings and the increase in land values contributed to the increase in owner equity. Approximately 76 percent of the increase can be attributed to positive retained earnings.

This article illustrated and described a statement of owner’s equity for a case farm in west central Indiana. Other articles in the financial management series discuss the balance sheet, the income statement, the sources and uses of fund statements, and benchmarking.

TEAM LINKS:

PART OF A SERIES:

RELATED RESOURCES

UPCOMING EVENTS

We are taking a short break, but please plan to join us at one of our future programs that is a little farther in the future.