September 16, 2020

Schedule F Net Farm Profit and Accrual Net Farm Income

by Michael Langemeier

Introduction

It is widely accepted that accrual accounting provides a more accurate estimate of annual farm profitability than cash accounting or Schedule F net farm profit (Farm Financial Standards Council, 2017; Kay, Edwards, and Duffy, 2016). Though there are numerous adjustments needed to convert cash net farm income to accrual net farm income, two of the major adjustments include prepaid expenses and crop inventories. This article compares cash and accrual net farm income for a case farm in west central Indiana given alternative scenarios pertaining to prepaid expenses and crop inventories.

Case Farm Example

The case farm is located in west central Indiana, has 3000 acres, and utilizes a corn/soybean rotation. The case farm owns 750 acres and cash rents the remaining acres. The case farm participates in the ARC-CO and PLC programs, and purchases 80 percent revenue protection coverage.

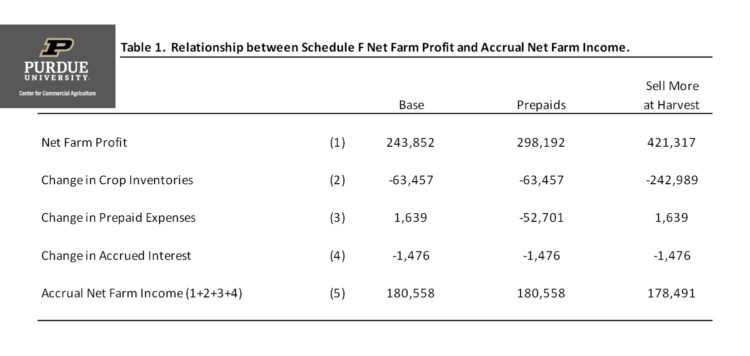

The first column of table 1 contains Schedule F net farm profit, the change in crop inventories, the change in prepaid expenses, and the change in accrued interest for the base scenario. The base scenario assumes that one-half of the corn and soybean crops are sold in the year of production and the remaining one-half is sold in the subsequent year. In other words, the farm’s marketing plan does not change from year to year. It further assumes that approximately ten percent of seed and fertilizer for the next crop year is purchased in the prior year. Of course, for some farms these percentages would be substantially higher. Beginning and ending prepaid expenses for the base scenario were $52,701 and $54,340, respectively. Under the base scenario, crop inventories were $961,117 at the beginning of the year and $897,660 at the end of the year. Using these inventories, the change in prepaid expenses and crop inventories were $1,629 and a negative $63,457, respectively. The change in accrued interest was a negative $1,476.

The difference between Schedule F net farm profit and accrual net farm income for is $63,294 for the base scenario. This difference is primarily due to the change in production levels (i.e., crop yields) between the two most recent years.

Sensitivity of Estimates to Changes in Prepaid Expenses

Due to changes in taxable income and liquidity, farms do not necessarily purchase the same amount of seed, fertilizer, and other inputs prior to the start of the year. These changes in prepaid expenses impact the difference between cash and accrual net farm income. The second column in table 1 assumes that prepaid expenses at the end of the year were zero. The crop marketing plan remained the same as that of the base scenario. Specifically, one half of the corn and soybean production was sold in the production year. Accrued interest also did not change between the two scenarios.

For the reduction in prepaid expense (i.e., reduction in supply inventories) scenario, the change in prepaid expenses was -$52,701. For this scenario, net farm profit was $298,192 or $54,340 higher than that for the base scenario. Essentially the prepaid expenses purchased in the second half of the year under the base scenario were used to reduce net farm profit. Accrual net farm income was the same under the base and reduction in prepaid expense scenarios. The difference in net farm profit and accrual net farm income was $117,634.

Sensitivity of Estimates to Changes in Crop Inventories

For numerous reasons, including changes in marketing plans, liquidity considerations, changes in crops produced and yields from one year to the next, and changes in crop prices; crop inventories at the end of the year vary over time. These changes in crop inventories have a large impact on the difference between cash and accrual net farm income. The third column of table 1 assumes that the case farm sold 60 percent the corn and soybean production before the first of the year. The change in prepaid expenses and change in accrued interest for this scenario was assumed to be the same as that for the base scenario.

For the sell more at harvest scenario, the change in crop inventories was a negative $242,989. For this scenario, net farm profit was $421,317 and accrual net farm income was $178,491. Note that the accrual net farm income was similar for the base scenario and the sell more at harvest scenario. If the crop prices received before the first of the year and the ending inventory prices were identical, there would have been no difference between accrual net farm income in the base case and sell more at harvest scenarios. The difference in net farm profit and accrual net farm income was $242,826, which is substantially larger than the difference between the two measures for the base scenario.

Obviously, the example in column 3 of table 1 is extreme. A farm would not likely increase taxable income this much. However, if the farm was interested in purchasing machinery and equipment before the first of the year using section 179 deductions or bonus depreciation, this change in the marketing plan may make sense. The point is that changes in the proportions of crops sold before and after the first of the year impact net farm profit.

Concluding Comments

Accrual accounting provides a more accurate assessment of annual farm profit than cash accounting. To compute accrual net farm income, a farm needs Schedule F information and accurate beginning and ending balance sheets. It is also important that the farm’s balance sheet is created at the same time (e.g., early January) each year.

This article examined the impact of changes in prepaid expenses and crop inventories on accrual and cash net farm income. Changes in prepaid expenses and crop inventories have a large impact on net farm profit. Farms that change their prepaid input purchase decisions and their crop marketing plans from one year to the next will increase the difference between their net farm profit and accrual net farm income. In these instances, net farm profit becomes a very inadequate measure of farm profitability.

In summary, it is important for farms to compute both net farm profit and accrual net farm income. Net farm profit is used to compute tax obligations. Accrual net farm income is used to compute key financial ratios; such as the total expense ratio, operating profit margin ratio, return on assets, return on equity, and repayment measures; and to benchmark financial performance.

Citations

Farm Financial Standards Council. “Financial Guidelines for Agriculture”, January 2017. https://ffsc.org/index.php/2017/01/01/2017-financial-guidelines-available/

Kay, R.D., W.M. Edwards, and P.A. Duffy. Farm Management, Eighth Edition. New York: McGraw-Hill, 2016.

TEAM LINKS:

PART OF A SERIES:

RELATED RESOURCES

UPCOMING EVENTS

We are taking a short break, but please plan to join us at one of our future programs that is a little farther in the future.