September 9, 2020

Working Capital: What Is It and Do You Have Enough?

by Michael Boehlje and Michael Langemeier

Maintain your working capital! This phrase is commonly heard in discussions with lenders, advisors, and management specialists in today’s environment of relatively low crop net returns or margins. This brief article answers the following questions: what is working capital and how is calculated, why is working capital needed, how much working capital do you need, what are common errors in measuring working capital, and how can you manage working capital. Working capital concepts are illustrated using a west central Indiana case farm.

What is working capital and how is it calculated?

Working capital is the liquid funds that a business has available to meet short-term financial obligations. The amount of working capital a business has is calculated by subtracting current liabilities from current assets. Numbers can be obtained from the farm’s balance sheet. Current assets include cash, accounts receivable, inventories of grain and livestock, inputs or resources to be used in production such as feed, fertilizer, seed, chemicals, and fuel, and the investment in growing crops. Current liabilities include accounts payable, unpaid taxes, accrued expenses, including accrued interest, operating lines of credit, and principal payments due this year on long-term loans.

Why is working capital needed?

In essence, working capital provides the short-term financial reserves that a business needs to quickly respond to financial stress as well as to take advantage of opportunities. It provides a buffer to a financial downturn that might impair the business’s ability to buy the inputs needed to operate as well as to service debt obligations. It also provides the financial resources to quickly take advantage of opportunities that might develop before others can do so.

How much working capital do you need?

The answer to this question depends on both the risk and size characteristics of the farm, and the volatility of the business climate. Larger farms need more working capital, so it is best to determine the amount of working capital buffer relative to either gross revenue or total expense. A frequently suggested goal is a 20-35% buffer, or working capital that is 20-35% of gross revenue or total expense. A firm facing more volatility in the business climate needs a larger buffer. When margins for a farm are negative, these operating losses are typically covered by the use of working capital, resulting in a reduction in working capital (the speed at which working capital is reduced is often referred to as the “burn rate”). If margins are expected to be negative for more than a year or two, the burn rate on working capital may be relatively high, leading to a dramatic increase in the vulnerability to financial stress. Given the margin pressures and increased uncertainty that farmers are facing today, some suggest the buffer should be 35% or greater in relation to gross revenue or total expense.

What are common errors in measuring working capital?

Clearly, the accuracy of the working capital calculation depends on an accurate balance sheet with assets and liabilities properly classified as current and non-current in terms of their ability to be converted to cash or their drain on cash, respectively. But even with an accurate balance sheet, working capital can be over-stated. First, inventories are typically valued as of the date of the balance sheet, and if values (prices) decline before the underlying items are sold, working capital will be overstated unless those prices are locked in with forward contracts or futures market positions.

Second, current assets typically include the inventory of purchased inputs such as feed, fertilizer, seed, chemicals, and fuel that will be needed for future production. If these inventories are converted into cash to cover unexpected losses or other cash needs, they must be replaced relatively quickly to continue to feed the livestock or produce the crop, so they are not readily available as a buffer for financial losses.

Third, the vast majority of farmers file their taxes on a Schedule F tax return, and the tax rules define the tax basis for raised grain and livestock as zero (0) for Schedule F filers. Consequently, any inventory of raised grain or livestock must be reported as taxable ordinary income at its full gross revenue value. Only if cash expenses are incurred for production in the upcoming season will a tax deduction be allowed. Given expected cash flow and financial pressures, farmers may not have the cash to prepay expenses at the same level as they have in the past, so income tax burdens are expected to be higher in 2020. The sale of inventory from previous years is likely to trigger a deferred tax obligation, thus reducing the cash available upon that sale and thus the financial buffer from those liquid inventory assets.

How can you manage working capital?

Managing working capital involves maintaining an adequate portion of the asset base that can be easily converted to cash, and/or controlling the short-term drains on that cash resulting from debt service, capital expenditures, or cash withdrawals. So one of the easiest ways to manage working capital is to protect cash. When the business generates cash from the sale of products, it can be held in that form, committed to the purchase of inputs for the upcoming production season, or it can be used to purchase capital items or withdrawn from the business. Purchasing assets or withdrawing cash from the business may be necessary in specific instances. However, it is extremely important in today’s environment to carefully monitor these uses of cash because their use can significantly reduce the liquid financial reserves of the business. Other techniques to preserve cash are to lease capital assets or hire custom services; to reduce expenditures that don’t increase production; to improve yield through timely operations; and to sell at higher prices. The discussion above suggests that maintaining a strong cash position is an important way to manage working capital.

In addition to the drain on cash and thus working capital from asset purchases or withdrawals, the repayment schedule on debt also has a significant impact on working capital. Shorter repayment schedules on debt used to purchase capital assets such as land and machinery results in larger annual principal payments and reduced working capital. Extending the repayment terms through refinancing can reduce principal payments and thus the pressures on cash flows, leaving more working capital to be available to buffer financial stress. If adequate collateral is available, the debt might be restructured with some of the operating line added to the term debt so that it can be repaid over more years, thus reducing current debt obligations and increasing working capital.

Finally, capital assets such as land or machinery could be sold and the proceeds used to improve the farm’s working capital position. This strategy is often not the first strategy pursued, but it situations in which cash is relatively short it cannot be excluded from the tool box. When selling capital assets, it is important to consider capital gains and losses, and depreciation recapture, which may trigger a tax obligation resulting from the sale of assets.

Working Capital Illustration

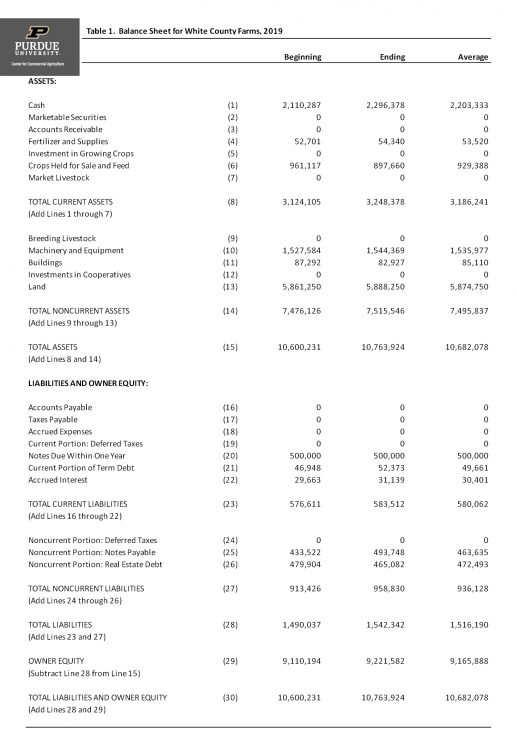

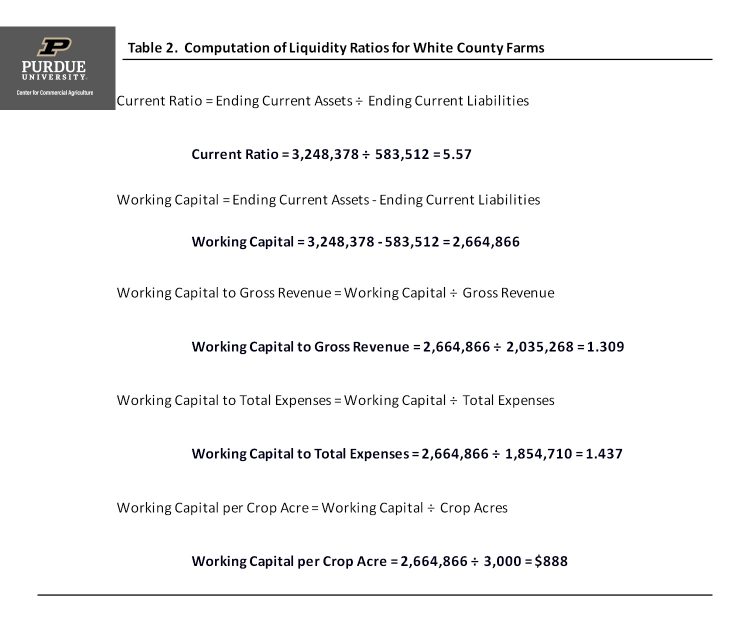

Table 1 presents a balance sheet for a case farm in west central Indiana. Liquidity ratios are frequently used to examine a firm’s working capital position. The computation of various liquidity ratios for the case farm are illustrated in table 2. The working capital to gross revenue and working capital to total expense ratios were 131 percent and 144 percent, respectively, indicating that the farm has a strong liquidity position. Working capital can also be expressed as a proportion of crop acres. For the case farm, working capital per crop acre was approximately $888. Some individuals also use the current ratio to evaluate a firm’s liquidity position. The current ratio was approximately 5.6, which is well above 2, a commonly used benchmark.

Although the case farm has a strong working capital position, several caveats are in order. First, corn and soybean prices were $4.05 per bushel and $9.10 per bushel, respectively, at the end of 2019. If corn and soybean prices fall below these values when the crops are sold, the farm’s working capital position is overstated on the balance sheet. Second, the prepaid expenses related to fertilizer and supplies are not readily available sources of working capital. Third, using a tax rate of 30 percent, the deferred income tax liability on the ending inventory of crops is approximately $269,298. Deducting prepaid expenses and deferred tax liability from working capital would yield a working capital to gross revenue ratio of 115 percent and working capital per crop acre of $780, which are still indicative of a strong working capital position.

Even after the adjustments to working capital related to prepaid expenses and deferred tax liabilities, the case farm has a relatively strong working capital position. Is this position strong enough to weather two or three more years of very low margins? As with most things dealing with economics, the answer depends. Specifically, the answer to this question depends on how low the margins will be and how many years in a row of low margins are anticipated. Let’s examine one scenario. If crop net losses for 2020, 2021, and 2022 were $100 per acre, what would the firm’s working capital position look like? Under this scenario, working capital to gross revenue and working capital per acre would still be relatively strong.

Conclusions

This article discussed important working capital concepts and provided an illustration of how working capital is computed and analyzed for a case farm. It is important to note in closing that strategies to manage working capital often require major adjustments in the business and are not easily or quickly implemented. Consequently, when volatility increases and/or losses are expected, it is critical to anticipate the potential of future financial stress and move to maintain or rebuild working capital prior to encountering actual debt servicing or cash flow problems.

TEAM LINKS:

PART OF A SERIES:

RELATED RESOURCES

UPCOMING EVENTS

We are taking a short break, but please plan to join us at one of our future programs that is a little farther in the future.