In the hours following the release of the USDA’s highly anticipated August Crop Production Report on Aug. 10, six Purdue experts assembled to analyze the statistics. Their major conclusion: several consecutive years of high production levels have led to oversupply, low prices, and tight crop margins.

The timing of the USDA August Crop Report allows experts to comment on the growing season’s progress and to provide accurate predictions. Experts from Purdue’s College of Agriculture have made it an annual tradition to gather at the Indiana State Fair to provide Hoosier farmers with a targeted analysis. Karen Plaut, the Glenn W. Sample Dean of the Purdue College of Agriculture, convened the panel, which included: Chris Hurt, professor of agricultural economics; Bob Nielsen, professor of agronomy and an expert in corn management systems; Shaun Casteel, associate professor of agronomy and an expert in soybean production systems; Extension educator and climate analyst Austin Pearson; and Greg Matli of the USDA’s National Agricultural Statistics Service.

This year’s winter weather lingered in Indiana, including snow in April, and caused concern about planting. Nielsen explained: “It wasn’t quite a tale of two seasons, but I remember back in late April, and so many people worrying about this crop that was not getting planted and the sky was going to fall down and everything else, and then over a two week period in May nearly two-thirds of the crops got planted.”

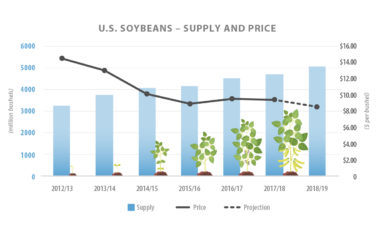

(Data taken from USDA Crop Production Report and WASDE)

As recently as July, the USDA predicted soybeans to yield 48.5 bushels per acre (BPA) harvested in America. In just the last month, those numbers have jumped to 51.6 BPA. Even higher estimates of 58 BPA are attributed to Indiana. The price of soybeans continues to fall with insufficient levels of demand. While the soybean bushel price had seen numbers well over $14 in recent years, Hurt predicts this year’s bushel price will settle at $8.60.

Hurt relayed how new tariffs are further affecting the price. “A substantial part of the decrease in price that we have on soybeans is related to the tariffs that are currently in place first, from the United States, and, then, retaliatory tariffs from some of our agricultural customers.” Hurt continued: “China is a huge buyer of soybeans. They buy very little corn from us. So, when they put a 25% tariff on corn and soybeans and wheat and other products, it really affects our soybean prices.”

- The most recent USDA World Agricultural Supply and Demand Estimates can be found here

- The most recent Crop Production Report can be found here