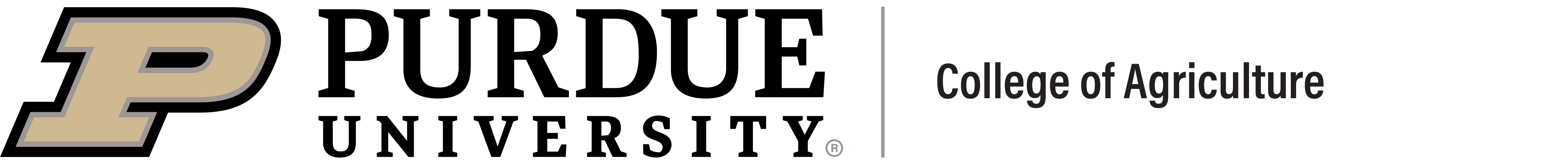

Farmer sentiment hits lowest level in over two years

Ag producer sentiment dropped to its lowest level since October 2016, erasing all improvements recorded following the November 2016 election. The Purdue University/CME Group Ag Economy Barometer, based on a mid-month survey of 400 agricultural producers across the U.S., declined 14 points in May to a reading of 101, down from 115 in April.

The decline in the barometer came about because producers’ perspectives on both current and future economic conditions worsened considerably compared to a month earlier. The Index of Current Conditions fell to a reading of 84, down from 99, and the Index of Future Expectations fell to 108, down from 123.

“Ag producers are telling us the agricultural economy weakened considerably this spring as the barometer has fallen 42 points (29%) since the start of this year,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture. “Farmers are facing tough decisions in the midst of a wet planting season and a lot of uncertainty surrounding trade discussions.”

The Large Farm Investment Index, which measures producers’ attitudes toward making large investments in their farming operation, has ebbed and flowed over the past year; however, since the beginning of 2019, the index has trended significantly lower. In May, just 18% of farmers stated it was a “good time” to make large farm investments while 81% stated it was a “bad time,” pushing the investment index down to a reading of 37. This is the lowest Large Farm Investment Index reading since the Ag Economy Barometer’s October 2015 inception.

Farmers’ optimism toward short- and long-term farmland values has also waned since the early part of 2019. For example, the percentage of farmers that expect farmland values to decline over the course of the upcoming year jumped from 21% in January to 25% in March and most recently to 30% in May. Looking farther ahead, just 39% of producers said they expect farmland values to rise over the next five years, compared to 48% expecting rising values in the March survey.

Agricultural trade continues to be a source of concern for producers. For the past three months, producers were asked whether they expect the soybean trade dispute with China to be resolved by July 1 and whether they feel the resolution will benefit U.S. agriculture. When the question was first posed in March, 45% of respondents expected the dispute to be resolved by July 1; that number declined to 28% in April and fell further to 20% in May. Regarding whether they ultimately expect an outcome favorable to U.S. agriculture, 77% said yes in March, which declined to 71% in April, and fell further to 65% in May.

“At this time, a majority of producers still expect a favorable outcome for agriculture to the trade dispute,” said Mintert, “but that majority appears to be shrinking.”

Read the full May Ag Economy Barometer report at https://purdue.ag/agbarometer. This month’s report includes more information about each of the survey questions, as well as a look into farmers’ perceptions toward their equity positions. The site also offers additional resources – such as past reports, charts and survey methodology – and a form to sign up for monthly barometer email updates and webinars. Each month, Dr. Mintert also provides an in-depth video analysis of the barometer, available at https://purdue.ag/barometervideo.

The Ag Economy Barometer, Index of Current Conditions and Index of Future Expectations are available on the Bloomberg Terminal under the following ticker symbols: AGECBARO, AGECCURC and AGECFTEX.

About the Purdue University Center for Commercial Agriculture

The Center for Commercial Agriculture was founded in 2011 to provide professional development and educational programs for farmers. Housed within Purdue University’s Department of Agricultural Economics, the center’s faculty and staff develop and execute research and educational programs that address the different needs of managing in today’s business environment.

About CME Group

As the world’s leading and most diverse derivatives marketplace, CME Group (www.cmegroup.com) enables clients to trade futures, options, cash and OTC markets, optimize portfolios, and analyze data – empowering market participants worldwide to efficiently manage risk and capture opportunities. CME Group exchanges offer the widest range of global benchmark products across all major asset classes based on interest rates, equity indexes, foreign exchange, energy, agricultural products and metals. The company offers futures and options on futures trading through the CME Globex® platform, fixed income trading via BrokerTec and foreign exchange trading on the EBS platform. In addition, it operates one of the world’s leading central counterparty clearing providers, CME Clearing. With a range of pre- and post-trade products and services underpinning the entire lifecycle of a trade, CME Group also offers optimization and reconciliation services through TriOptima, and trade processing services through Traiana.

CME Group, the Globe logo, CME, Chicago Mercantile Exchange, Globex, and E-mini are trademarks of Chicago Mercantile Exchange Inc. CBOT and Chicago Board of Trade are trademarks of Board of Trade of the City of Chicago, Inc. NYMEX, New York Mercantile Exchange and ClearPort are trademarks of New York Mercantile Exchange, Inc. COMEX is a trademark of Commodity Exchange, Inc. BrokerTec, EBS, TriOptima, and Traiana are trademarks of BrokerTec Europe LTD, EBS Group LTD, TriOptima AB, and Traiana, Inc., respectively. Dow Jones, Dow Jones Industrial Average, S&P 500, and S&P are service and/or trademarks of Dow Jones Trademark Holdings LLC, Standard & Poor’s Financial Services LLC and S&P/Dow Jones Indices LLC, as the case may be, and have been licensed for use by Chicago Mercantile Exchange Inc. All other trademarks are the property of their respective owners.