U.S. Farmer Sentiment Stable As Inflation Expectations Subside

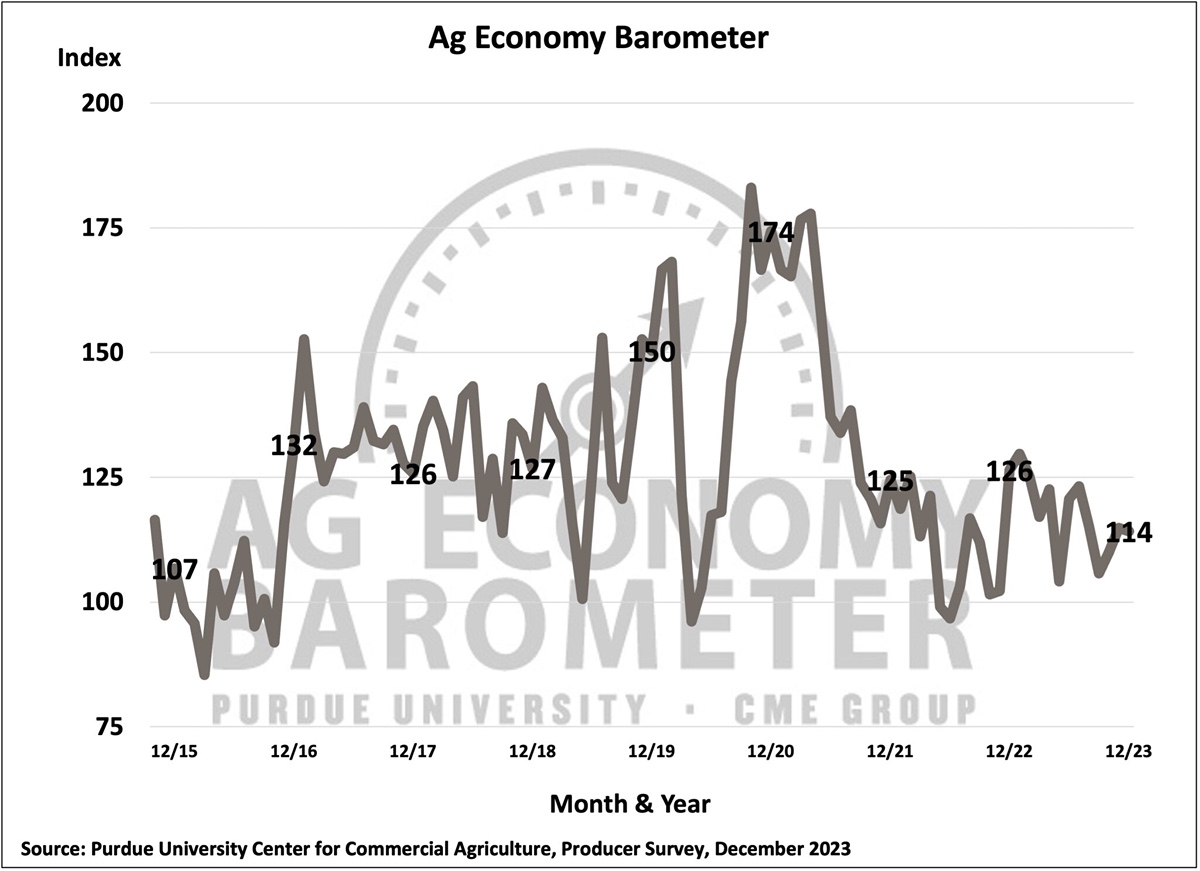

U.S. farmers’ sentiment changed very little in December compared to the preceding month. The Purdue University-CME Group Ag Economy Barometer recorded a reading of 114, just one point lower than a month earlier. Both sub-indices of the barometer, the Index of Current Conditions and the Index of Future Expectations, also fell one point below their respective November readings. The Current Conditions Index for December was 112, while the Future Expectations Index was 115. All three indices were weaker than in December 2022, with the Ag Economy Barometer falling 10% below a year earlier. Additionally, the current and future indices were 17% and 6%, respectively, below last year. Looking ahead to 2024, U.S. farmers inflation expectations are markedly lower than they were at the start of 2023. The December Ag Economy Barometer survey was conducted from December 4-8, 2023.

In December, farmers perceived continued improvement in their farms’ financial performance as the Farm Financial Performance Index rose by 2 points compared to a month earlier. Since late summer, the index has climbed 11 points and was 21 points higher than in May when the index reached its low point for the year. This month’s improvement in the financial performance index coincided with USDA’s upward revision in late November of their forecast for 2023 net farm income. Although USDA still forecasts a sharp drop in net farm income from 2022’s record high level, the November estimate for 2023’s inflation-adjusted net farm income was $10 billion higher than the forecast USDA issued on August 31.

The Farm Capital Investment Index was virtually unchanged in December, holding at a reading of 43, just one point above the previous month. Respondents who said that now is a good time to make large investments in their farm operation pointed to “higher dealer inventories” and “strong cash flows” as key factors to support this perspective. Although the percentage of respondents choosing “strong cash flows” as a reason to invest rebounded from last month, it remained less popular than in July and August. On the other hand, the percentage of producers in December citing “higher dealer inventories” as a primary reason to invest was more than double the percentage who felt that way in July.

High input costs continue to be the primary source of concern for U.S. farmers. However, over the course of the year, there was a marked shift regarding producers’ apprehensions. In January, only 16% of farmers in the barometer survey pointed to the risk of “lower crop and/or livestock prices” as one of their biggest concerns. This changed as 2023 unfolded, and by December, just over one-fourth of respondents (26%) said the risk of lower prices for crops and livestock was a big concern. The other major concern for the upcoming year cited by producers was “rising interest rates,” chosen this month by 24% of survey respondents.

The December survey queried farmers regarding their expectations for both consumer inflation and prime interest rates in the upcoming year. Producers’ inflation expectations have moderated since December 2022. A year ago, 50% of the producers anticipated consumer inflation in the upcoming year to be 6% or higher, with just 13% indicating they expected inflation to be less than 3%. Those results sharply contrast with responses received this December. In this year’s survey, 13% of producers said they expect inflation in the upcoming year to be 6% or higher with 70% of respondents looking for inflation in 2024 to be less than 4%. Concerning interest rates, about one-third (34%) of respondents said they look for interest rates to decline in the upcoming year, with an additional 22% expecting the prime rate to remain unchanged in the upcoming year.

Both the long and short-run farmland value indices experienced moderate declines in December. The Short-Term Farmland Value Index fell 4 points to a reading of 121 while the long-term index declined 2 points to 149. Compared to a year ago, the short-term index was down 3 points while the long-term index was 9 points higher than in December 2022. The moderation in producers’ interest rate expectations since late 2022 could help explain the relative improvement in the long-term farmland value index.

Wrapping Up

Farmer sentiment bottomed out in September and recovered modestly this fall as the Ag Economy Barometer closed out the year with an index reading of 114. The sentiment improvement was driven primarily by farmers’ improved perception of current conditions on their farms as the Current Conditions Index rose 14% from September to December. At year-end, U.S. farmers still pointed to input costs as their top concern for the year ahead, but the percentage of farmers choosing the risk of lower crop and/or livestock prices rose from just 16% in January to 26% in December. Inflation expectations among farmers moderated during 2023. Compared to a year earlier, far fewer producers expect inflation to exceed 6% in the new year, and a large majority look for inflation to average less than 4% in 2024. Finally, in December, farmers expressed a somewhat more sanguine view of interest rates than they did in late 2022 with just over one-third of survey respondents indicating they expect prime interest rates to decline in 2024.

Read the full Ag Economy Barometer report at https://purdue.ag/agbarometer. The site also offers additional resources – such as past reports, charts and survey methodology – and a form to sign up for monthly barometer email updates and webinars.

Each month, the Purdue Center for Commercial Agriculture provides a short video analysis of the barometer results, available at https://purdue.ag/barometervideo. For more information, check out the Purdue Commercial AgCast podcast available at https://purdue.ag/agcast, which includes a detailed breakdown of each month’s barometer and a discussion of recent agricultural news that affects farmers.

The Ag Economy Barometer, Index of Current Conditions and Index of Future Expectations are available on the Bloomberg Terminal under the following ticker symbols: AGECBARO, AGECCURC and AGECFTEX.

About the Purdue University Center for Commercial Agriculture

The Center for Commercial Agriculture was founded in 2011 to provide professional development and educational programs for farmers. Housed within Purdue University’s Department of Agricultural Economics, the center’s faculty and staff develop and execute research and educational programs that address the different needs of managing in today’s business environment.

About CME Group

As the world's leading derivatives marketplace, CME Group (www.cmegroup.com) enables clients to trade futures, options, cash and OTC markets, optimize portfolios, and analyze data – empowering market participants worldwide to efficiently manage risk and capture opportunities. CME Group exchanges offer the widest range of global benchmark products across all major asset classes based on interest rates, equity indexes, foreign exchange, energy, agricultural products and metals. The company offers futures and options on futures trading through the CME Globex® platform, fixed income trading via BrokerTec and foreign exchange trading on the EBS platform. In addition, it operates one of the world’s leading central counterparty clearing providers, CME Clearing.

CME Group, the Globe logo, CME, Chicago Mercantile Exchange, Globex, and E-mini are trademarks of Chicago Mercantile Exchange Inc. CBOT and Chicago Board of Trade are trademarks of Board of Trade of the City of Chicago, Inc. NYMEX, New York Mercantile Exchange and ClearPort are trademarks of New York Mercantile Exchange, Inc. COMEX is a trademark of Commodity Exchange, Inc. BrokerTec and EBS are trademarks of BrokerTec Europe LTD and EBS Group LTD, respectively. The S&P 500 Index is a product of S&P Dow Jones Indices LLC (“S&P DJI”). “S&P®”, “S&P 500®”, “SPY®”, “SPX®”, US 500 and The 500 are trademarks of Standard & Poor’s Financial Services LLC; Dow Jones®, DJIA® and Dow Jones Industrial Average are service and/or trademarks of Dow Jones Trademark Holdings LLC. These trademarks have been licensed for use by Chicago Mercantile Exchange Inc. Futures contracts based on the S&P 500 Index are not sponsored, endorsed, marketed or promoted by S&P DJI, and S&P DJI makes no representation regarding the advisability of investing in such products. All other trademarks are the property of their respective owners.