Impacts of the Russia-Ukraine war on global agriculture: spillover effects and policy responses

January 16, 2024

PAER-2024-04

Maksym Chepeliev, Research Economist

An important role of the Black Sea region in the global commodity markets

The war in Ukraine has spurred considerable disruptions in the global supply of agricultural, food and energy commodities, leading to significant escalations in prices, especially during the first months following the conflict (Behnassi and Haiba, 2022; Benton et al., 2022). In a world still recovering from the COVID-19 pandemic, these additional pressures and uncertainties exacerbate an environment already grappling with heightened food insecurity, poverty, and malnutrition (Dasgupta and Robinson, 2022; Laborde et al., 2021).

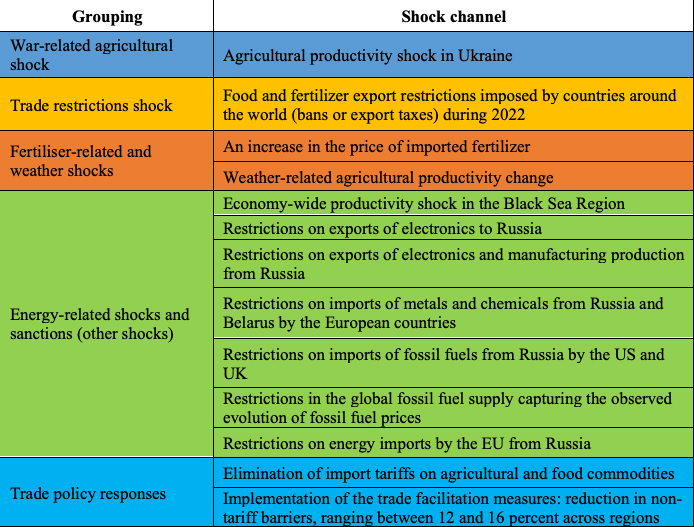

Countries in the Black Sea region (Belarus, Russia and Ukraine) have become key global suppliers of grains, oilseeds and vegetable oils over the last three decades. Russia and Ukraine rank in the top seven global producers and exporters of wheat, corn and barley (Figure 1).

Figure 1. Black Sea region share in global trade

Source: Chepeliev et al. (2023a)

Notes: Estimates of the global trade shares for food and agriculture correspond to the trade volumes in 2019; fertilizers trade is based on the value flows in 2019; trade in energy commodities represents volume shares for the 2021 reference year.

Russia and Belarus are the world’s second and third-largest producers of potash fertilizer, respectively. Brazil, for example, the world’s largest soybean producer, buys approximately half of its potash fertilizers from these two countries. The majority of Brazil’s soybeans are sold to China, which utilizes much of the crop to feed livestock. As a result, a disruption in fertilizer supplies impacts meat prices in China and around the world. The EU has banned all imports of potash from Belarus as of March 4th 2022 (Euractiv, 2022).

In addition, Russia is a major producer and supplier of fossil fuels, such as crude oil and natural gas. In 2019 Russia accounted for 18 percent of global exports of coal and 13 percent of crude petroleum (the second biggest exporter of this commodity). Russia is also a major exporter of refined petroleum products and natural gas, accounting for respectively 12 and 20 percent of global exports. Petroleum is a vital component of the transportation sector, while natural gas accounts for over half of the cost of producing ammonia fertilizer; and prices of both energy commodities have increased due to the war.

Apart from the direct commodity market disruptions, the impacts of sanctions against Russia, domestic policies that countries around the world have implemented in pursuit of food security and adverse weather events are further exacerbating the adverse implications of the war in Ukraine.

In a world of highly integrated global value chains, the interdependencies across countries and commodity markets play a major role in both transmitting the negative shocks as well as spreading the benefits of the policy responses. It is important to properly represent these complex interactions when capturing the implications of market disruptions, such as the war in Ukraine, and understanding the impacts of potential policy measures.

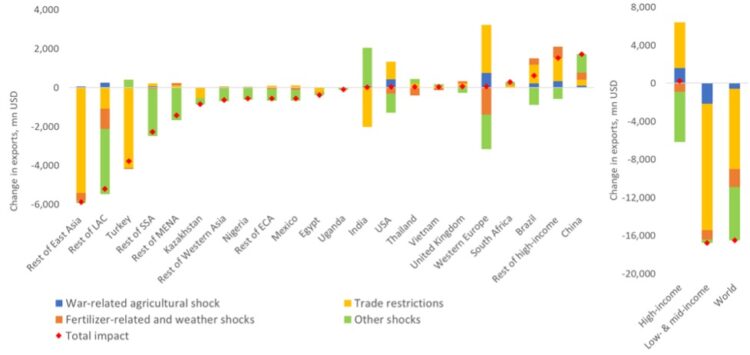

Capturing the spillover effects and policy responses requires a comprehensive assessment framework

In a series of recent studies (Chepeliev et al., 2022; Chepeliev et al., 2023a; Chepeliev et al., 2023b), we develop a comprehensive computational framework by linking a global computable general equilibrium model ENVISAGE (van der Mensbrugghe, 2019) with a Global Trade Analysis Project (GTAP) database (Aguiar et al., 2019) and the GTAP nutritional module (Chepeliev, 2022). Using this framework, we explore a set of policy scenarios that combine the impact of the war, sanctions and other disruptions, such as adverse weather events and export restrictions. The developed approach allows us to disentangle the impacts of various sets of shocks distinguishing between channels of impacts. We then analyze trade policy responses in the form of reductions in tariff barriers on agricultural and food commodities, as well as the implementation of the trade facilitation measures (TFMs) that can be used to ease the adverse implications of the war. Table 1 provides a summary of the applied scenario framework, while additional details available in (Chepeliev et al., 2023a) and (Chepeliev et al., 2023b).

The impacts of the war on agricultural value chains are exacerbated by other shocks

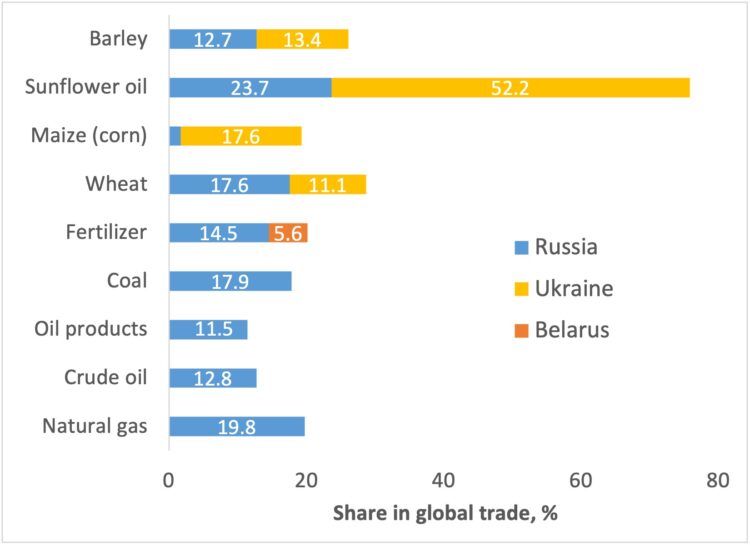

The war in Ukraine, when combined with other disruptions in the commodity markets, leads to an overall reduction in agricultural trade. As estimated by the implemented modeling framework, global exports of grains and crops decline by around 1.2 percent, while exports of processed food drop by 0.4 percent. At the same time, rising agricultural commodity prices create incentives for agricultural exporters to expand production and replace some of the exports from the Black Sea region (Figure 2).

Figure 2. Change in agricultural and food exports across countries and regions, million $2014

Notes: Selected agricultural exporters are reported as individual countries or regions on the figure. Reporting of changes across composite aggregates on the right panel includes all countries/regions represented in the modeling framework.

When decomposed across drivers of the trade impacts, the results suggest that at the global level, the contribution of agricultural trade restrictions and that of other shocks, such as energy price increases (indicated in yellow and green in Figure 2 respectively), is substantially more significant than the direct war-related agricultural shock (Figure 2). The latter substantially reduces exports from Ukraine (indicated by blue bars in Figure 2), however, these reductions are to a large extent offset by increasing exports from other countries, in particular, high-income regions. Agricultural export-restricting policies implemented by many developing countries in an attempt to ensure domestic food security, on the other hand, have a substantially higher magnitude of impacts on global trade and are only partly offset by increasing exports from non-restricting countries (indicated by yellow bars on Figure 2). Increasing energy prices, fertilizer-related and weather shocks further adversely contribute to the global agricultural trade. When all these impact channels are combined, our results suggest that the direct disruption of the agricultural supply from Ukraine contributes less than 4% of the total reduction in global agricultural and food exports, while agricultural and fertilizer trade restrictions account for around 51%, followed by the energy-related shocks and sanctions (other shocks) (34%), and fertilizer-related and weather shocks (11%) (Figure 2).

When estimated changes in the trade value flows are translated to the calories supplied via international trade channels, the impact of the imposed trade restrictions is around 7–8 times larger than the impact of the agricultural supply shock in Ukraine. At the same time, while food supply disruptions in Ukraine have less adverse implications on global food exports compared to the applied trade restrictions, the geography of Ukraine’s exports of grains and crops includes many low-income countries. Agricultural importers in Sub-Saharan Africa, such as Cameroon, Uganda, Yemen, Senegal, Niger and Tanzania, are the most vulnerable under the ongoing crises. These countries substantially rely on grain imports from the Black Sea region (Chepeliev et al., 2022) and they are also ranked among the bottom 25 least food-secure countries in the world according to the Global Food Security Index 2022 developed by The Economist.

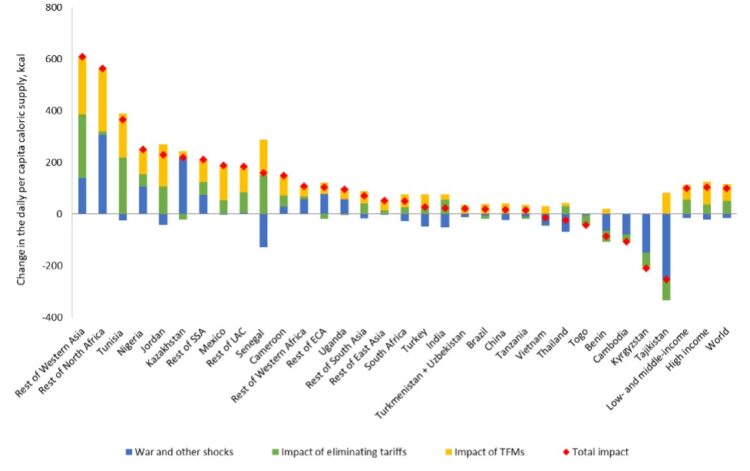

Reductions of import tariffs and trade facilitation measures could mitigate the adverse impacts of commodity market disruptions

The observed commodity market disruptions have major adverse implications for the global economy in general, as well as for the agricultural and food sectors in particular. However, if countries implement policies toward reducing trade barriers, they could to a large extent mitigate the estimated negative impacts.

Results suggest that at the macro level, eliminating tariffs on imported agricultural and food commodities together with an implementation of TFMs, could have substantial benefits, in particular for developing economies. Out of the top 15 countries and regions that gain the most (in terms of per-capita income) from the reduction in trade barriers, two are low-income countries, seven are lower-middle income economies and five are upper-middle income.

Considered trade policies lead to substantial export expansions, as the overall value of agricultural and food trade increases by over 91 billion USD (or by around 6%) – more than five times overweighing the decline observed due to the war in Ukraine and related market disruptions. While high-income countries account for around 70% of total export increases, net agricultural importers in the developing world also benefit from the reduction in trade barriers. As a result, when measured in terms of the overall caloric supply, considered trade policies fully mitigate the adverse implications of the observed market disruptions and increase net daily per capita caloric supply by around 99 kcal (by 4%) in the low- and middle-income countries (Figure 3). Due to on average higher initial level of non-tariff barriers, an implementation of TFMs has a more substantial impact on increasing global food supply than the elimination of import tariffs – in a ratio of around 55% to 45% (Figure 3). The composition of impacts between the elimination of import tariffs and TFMs, though, differs across countries depending on the initial level of tariff barriers. We find that in such countries and regions like the Rest of Western Asia, Tunisia, Senegal, India and Thailand over half of the expansion in additional caloric supply is driven by the elimination of import tariffs. In addition, the elimination of import tariffs, on average, plays a more important role in increasing the food supply for low- and middle-income regions as opposed to high-income countries. In the former case, this policy instrument contributes around half of the additional supply, while the corresponding contribution is around one-third for the high-income economies.

Figure 3. Impacts of trade policies on the caloric food supply in selected developing countries/regions and regional aggregates

However, not all developing countries benefit equally from the considered trade policy measures. Selected countries in Central and Southeast Asia, such as Kyrgyzstan and Tajikistan, as well as in Sub-Saharan Africa – Togo, Benin and Cambodia, tend to experience moderate reductions in food supply following and implementation of the global agricultural trade liberalization and facilitation policies (Figure 3). This result is driven by the reallocation of trade patterns across countries following the considered policy measures. In the case of Kyrgyzstan and Tajikistan, key reductions in food supply are related to the declining food imports from Kazakhstan, as the latter reallocates its exports of wheat toward the Rest of Western Asia. In the cases of Togo, Benin and Cambodia, the observed reductions are primarily driven by an expansion in exports. This stresses the importance of accounting for the second-order effects when analyzing agricultural trade policies.

Lessons learned

Our analysis provides several crucial policy insights. First, when analyzing the impacts of agricultural market disruptions, such as from the war in Ukraine, it is important to consider a broad context of the ongoing policies, climate impacts and market disruptions. As we show, in many cases, the latter substantially exacerbates the direct impacts of the war.

Second, with rapidly increasing food prices, some countries have started imposing agricultural trade restrictions to protect domestic consumers. Our results suggest that such actions should be avoided, as they only further jeopardize global food security. Emergency restrictions, if deemed necessary, should be targeted, transparent, proportionate, temporary, and in alignment with the World Trade Organization rules. They should also account for the impact on other countries, especially the least developed – a point largely overlooked during the analyzed food crisis.

Third, the consequences of the war in Ukraine have already put disproportionate pressure on lower-income households in developing countries, who spend a large share of their budget on food and energy. Buffering the impacts on poor households via targeted support measures, such as direct lump-sum payments, is a crucial step to ease the burden on the most vulnerable.

Finally, the analysis shows that the implementation of trade facilitation measures and the reduction of import tariffs on agricultural and food commodities could mitigate the impacts of the war and other market distortions by boosting agricultural trade and increasing overall food availability. We also find that developing countries tend to benefit the most from such trade policies. Considering that tariffs account for only a small fraction of costs, long-term measures should focus on improving poor shipping connectivity, inefficient logistics infrastructure and cumbersome border processes.

Going forward, greater transparency on the evolution and impact of trade policy actions, and on the global supply of food staples, would reduce uncertainty and lower the risk of escalating measures and countermeasures. It would also ensure that financial markets don’t overreact to shocks or changes in trade policies. International organizations should better cooperate to provide real-time information on trade policy changes and their implications for global production and trade.

References

Aguiar, A., Chepeliev, M., Corong, E.L., McDougall, R., and van der Mensbrugghe, D. 2019. The GTAP Data Base: Version 10. Journal of Global Economic Analysis 4 (1): 1–27. https://doi.org/10.21642/jgea.040101af

Behnassi, M., El Haiba, M. 2022. Implications of the Russia–Ukraine war for global food security. Nat Hum Behav 6, 754–755 (2022). https://doi.org/10.1038/s41562-022-01391-x

Benton, T. G., Froggatt, A., Wellesley, L., Grafham, O., King, R., Morisetti, N., …, and Schröder, P. 2022. The Ukraine war and threats to food and energy security. Chatham House—International Affairs Think Tank.

Chepeliev, M. 2022. Incorporating Nutritional Accounts to the GTAP Data Base. Journal of Global Economic Analysis, 7(1), 1–43. https://doi.org/10.21642/JGEA.070101AF

Chepeliev, M., Maliszewska, M., and Seara e Pereira, M. F. 2022. Effects on trade and income of developing countries, in M Ruta (ed.), The Impact of the War in Ukraine on Global Trade and Investment, World Bank. https://elibrary.worldbank.org/doi/abs/10.1596/37359

Chepeliev, M., Maliszewska, M. and Pereira, M.F.S.e. 2023a. The War in Ukraine, Food Security and the Role for Europe. EuroChoices, 22: 4-13. https://doi.org/10.1111/1746-692X.12389

Chepeliev, M., Maliszewska, M. and Filipa Seara E Pereira, M., 2023b. The War in Ukraine Disrupts Agricultural Value Chains, but Trade Policy Measures Can Mitigate the Impacts. Paper presented at the 26th Annual Conference on Global Economic Analysis (Bordeaux, France). https://www.gtap.agecon.purdue.edu/resources/res_display.asp?RecordID=6948

Dasgupta, S., Robinson, E.J.Z. 2022. Impact of COVID-19 on food insecurity using multiple waves of high frequency household surveys. Sci Rep 12, 1865. https://doi.org/10.1038/s41598-022-05664-3

Euractiv. 2022. EU sanctions on Belarus target key fertiliser amid rising input prices. https://www.euractiv.com/section/agriculture-food/news/eu-sanctions-on-belarus-target-key-fertiliser-amid-rising-input-prices/

Laborde, D., Martin, W., & Vos, R. 2021. Impacts of COVID-19 on global poverty, food security and diets: Insights from global model scenario analysis. Agricultural Economics. 2021; 52: 375– 390. https://doi.org/10.1111/agec.12624

van der Mensbrugghe, D. 2019. The Environmental Impact and Sustainability Applied General Equilibrium (ENVISAGE) Model. Version 10.01. Center for Global Trade Analysis, Purdue University. https://mygeohub.org/groups/gtap/envisage-docs