The Year of Food Price Inflation

January 13, 2022

PAER-2022-5

Author: Jayson L. Lusk, Distinguished Professor and Department Head of Agricultural Economics

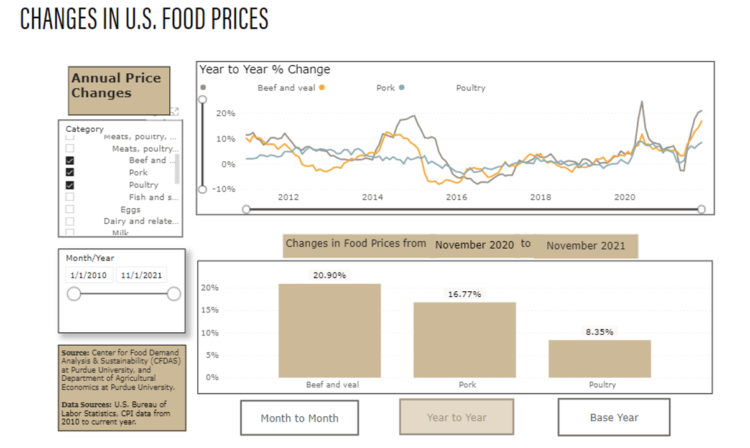

2021 will likely be a year remembered, among other reasons, for the rising prices that hit U.S. consumers. In November 2021, prices of food bought through grocery were 6.4% higher than the year prior in November 2020. The last time grocery prices increased at this annual pace was in late 2008. Likewise, prices of food away from home through restaurants rose 5.8% from November 2020 to November 2021, the sharpest annual increase since 1982. The biggest contributors to the food price increases have been meat products. Beef, pork, and poultry prices increased 20.9%, 16.8%, and 8.4%, respectively over the course of the past year. To visualize these and other price changes, see the interactive dashboard created by the Department’s new Center for Food Demand Analysis and Sustainability (CFDAS).

Changes in US Food Prices

There are three broad reasons for the run-up in food prices. The first is overall inflationary pressures caused by macroeconomic phenomena. There was a dramatic increase in money supply brought about by expansion of unemployment benefits and stimulus-type spending in response to the pandemic. As result, personal savings rates have been at unprecedentedly high levels through much of the pandemic. More dollars chasing fewer goods has led to an across-the-board rise in price levels. The overall consumer price index less food was up 7% in November 2021 relative to the same month the year prior. This is the highest rate of annual inflation since 1982.

Extra money in consumers’ pockets points to a second driving factor behind food price inflation: increased demand. Total inflation-adjusted consumer spending on both food at home and food away from home in October 2021 were both 14% higher than before the start of the pandemic in January 2020. There has also been strong demand for U.S. agricultural products abroad. The value of U.S. agricultural exports through the first 10 months of 2021 was 20.7% higher than the same time period in 2020, and 22.6% higher than the same time period in 2019. Foreign customers buying U.S. agricultural products has helped pull up prices at home.

Finally, there are supply-side factors contributing to the increase in retail food prices. Grain and oilseed prices have been higher in 2021, and this has pushed up the cost of feed for livestock and poultry. Challenges finding sufficient labor in the food and agricultural sector have led to rising wage rates. For examples, since before the start of the pandemic in January 2020, average weekly earnings of all employees is up 16.3% in food service (i.e., restaurants), 8.9% in food manufacturing, and 14.9% in food and beverage (i.e, grocery) stores. Higher retail food prices are reflecting these higher wage rates. Additional challenges associated with transportation and supply chain logistics have added further costs to the system.

Attempting to forecast future food prices is fraught with peril, but it may be more instructive to ask what will have to change for the inflationary pressures to dissipate? The “great resignation” and tight labor market has pushed up wages and presented challenges in getting food from farm to fork. Until the labor market disruptions subside, the challenges in the food supply chain are here to stay. In addition, COVID-19 continues to shift consumer buying patterns, close schools and daycares, disrupt operation of food processing facilities, and affect some people’s willingness to work in “front line” jobs. In this sense, curing COVID-19 will also help cure food price inflation. Reigning in federal spending will also help halt the rise in prices. The USDA Economic Research Service is projecting a slow-down in food price inflation, forecasting a 2 to 3% annual price food increase in 2022. It should be noted that, at the same time last year, this is the same range they projected for 2021. Only time will tell as to whether food price increases are, again, dramatically under-estimated.

Finally, it is important to put food price rises in context. Focus should not be on prices per se, but on consumers’ buying power. As noted, wages in the food industry have risen alongside rising food prices. At least in the food sector, the increase in wages has been sufficient to enable consumers to buy more food despite the higher prices. The same is not true for all workers. After adjusting for inflation, average weekly earnings of all private employees in the U.S. economy was down by 1.9% in November 2021 relative to November 2020. At this broad level, consumers’ buying power has fallen over the course of the past year, emphasizing the need to seek remedies for the current inflationary pressures.