December 1, 2013

Depreciation and Expensing Options

This article reviews depreciation and expensing options for recent years and options currently available for 2013 and 2014. The discussion emphasizes changes affecting agricultural producers and farm businesses. In general, the Section 179 deduction and the special depreciation allowance are deducted from the asset’s cost before computing required depreciation. Thus, Section 179 expensing and the special deprecation allowance are discussed before depreciation below.

Section 179 Expensing

Section 179 expensing allows the deduction of some or all of the cost of qualifying assets purchased for use in the active conduct of a trade or business. To qualify for the Section 179 deduction, the property generally must be tangible personal property and used in the active conduct of a trade or business. Farm machinery and equipment; livestock used for draft, breeding, or dairy purposes; grain storage; single purpose livestock and horticultural structures; field tile; and irrigation systems all qualify for Section 179 expensing. The Section 179 expensing election is phased out if the property placed in service during a year exceeds a specified investment amount. The allowable Section 179 deduction is also limited to taxable income for any active trade or business. Also, to qualify for the deduction, property must be purchased. Both new and used asset purchases may qualify for the deduction.

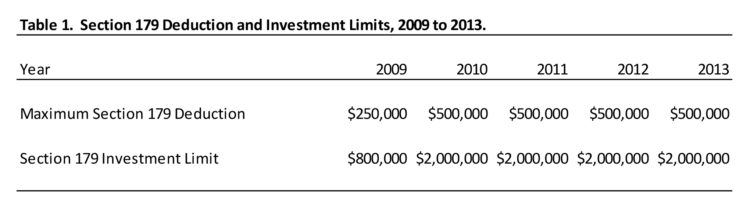

Table 1 contains the maximum Section 179 deduction and investment limit for 2009 through 2013. For 2013, the maximum Section 179 deduction is $500,000. This amount is reduced by the amount by which cost of the qualifying property placed in service during the tax year exceeds $2,000,000. A business with qualifying investment exceeding $2,500,000 would not be eligible for a Section 179 deduction. If you acquire and place in service in 2013 more than one item of qualifying property, you can allocate the Section 179 deduction among the items in any way as long as you don’t exceed the deduction and investment limits.

The Section 179 deduction and investment limit for 2014 are scheduled to be reduced to $25,000 and $200,000, respectively. Obviously, these reductions in the deduction and investment limit should be factored into tax planning this year.

Special Depreciation Allowance

Certain qualified property acquired after December 31, 2007 and placed in service before January 1, 2014 is eligible for a 50 percent special depreciation allowance, also referred to as additional first-year depreciation. This deduction is computed by multiplying the depreciable basis of the qualified property by 50 percent (100 percent for the September 9, 2010 to December 31, 2011 period). Qualifying property includes tangible property with depreciation recovery period of 20 years or less. Agricultural property with a recovery period less than 20 years includes: farm machinery and equipment; livestock used for draft, breeding, or dairy purposes; grain storage; single purpose livestock and horticultural structures; field tile; and irrigation systems. It is important to note that purchases of used assets do not qualify for this special depreciation allowance.

Depreciation

Producers and landowners can generally recover the cost of assets which last more than a year through depreciation. Depreciable assets are placed in classes reflecting their useful life under the Modified Accelerated Cost Recovery System (MACRS). For assets used in a farming business, the 150 percent declining balance method with a shift, later in life, to straight line depreciation maximizes the depreciation deduction. The amount of depreciation taken in a particular year depends on the recovery period of the asset, when the asset was placed in service, and the depreciable basis. The placed in service date for an asset is the date the property is ready for a specific use, not the date when the asset is first used.

Planning Considerations

The Section 179 deduction is currently scheduled to be reduced substantially for 2014. In addition, the special depreciation allowance is currently not available for assets placed in service after December 31, 2013. These two facts should be considered when planning for the 2013 tax year. Other important tax planning tools; not discussed in this newsletter; include prepaid expenses, deferred payment contracts, like-kind exchanges of assets, income averaging, and installment sales. More information on these topics as well as Section 179 and depreciation can be found in IRS Publication 225, “Farmer’s Tax Guide”.

TAGS:

TEAM LINKS:

RELATED RESOURCES

UPCOMING EVENTS

We are taking a short break, but please plan to join us at one of our future programs that is a little farther in the future.