May 15, 2023

What Does the Federal Fund Rate Increases at May FOMC Meeting Mean?

by Brady Brewer

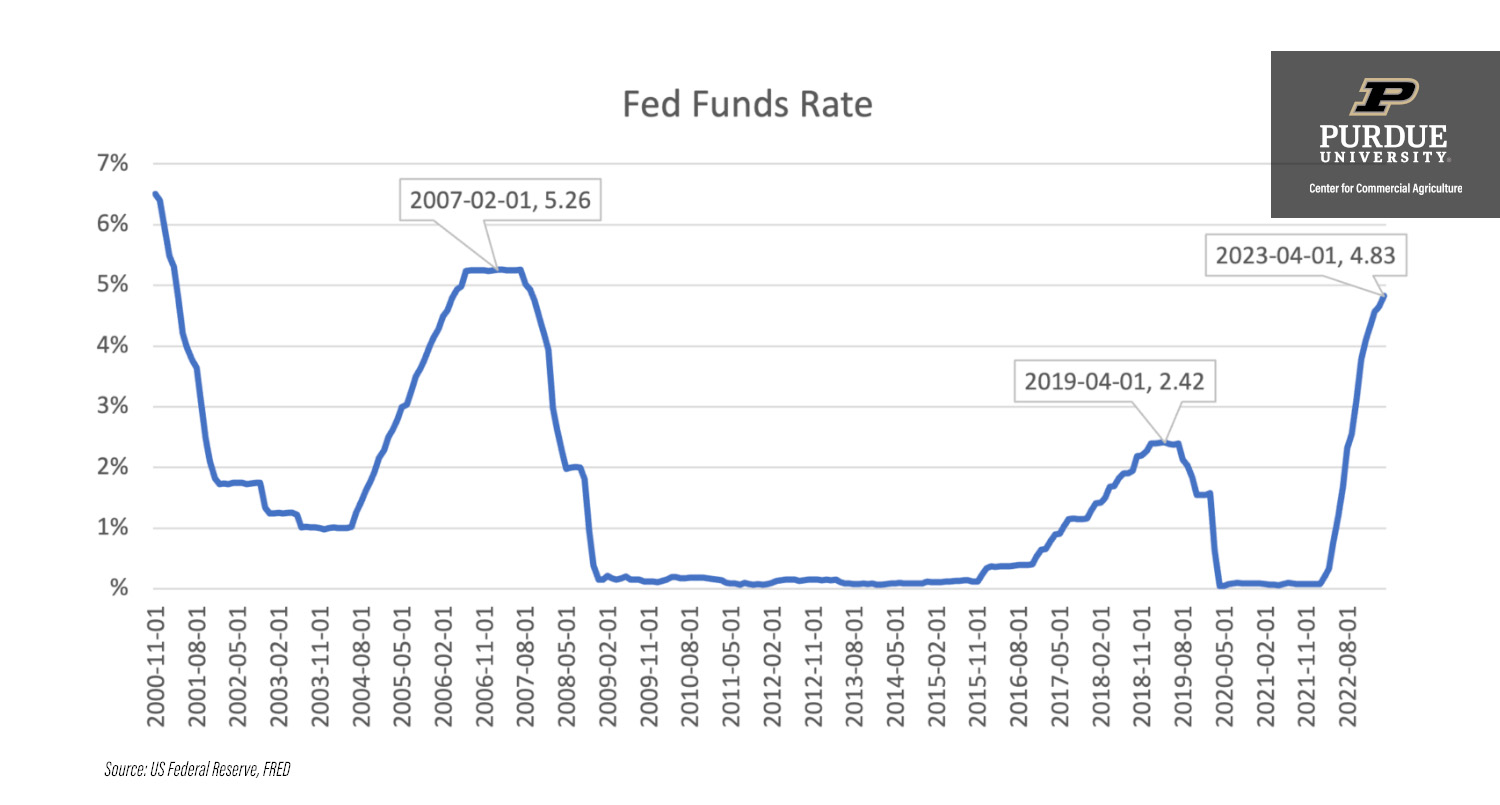

During the May 3rd Federal Open Market Committee (FOMC) meeting, the FOMC voting members raised the Federal Funds Rate by another 25 basis points; making the target Federal Funds Rate between 5% and 5.25%. This Federal Reserve has consistently increased the Federal Funds Rate during each FOMC meeting for over a year; while the raises have been historical in terms of how fast the Federal Reserve has increased the Federal Funds Rate, 5 percentage points in a little over a year, we are still below the February of 2007 rate. Figure 1 shows the average Federal Funds Rate from 2000 to 2023.

A top of mind question for many is how much higher interest rates will go. While I have written and spoken on the “Fed Dot Plot“, and believe this still provides insight, I want to instead focus on the statement the FOMC released alongside any new policy they implement – my interpretation of what this may mean for future policy we see coming from the Federal Reserve.

The first notable insight I want to point out comes from Chairman Powell’s address during the latest FOMC meeting when he said “Reducing inflation is likely to require a period of below-trend growth and some softening in the labor market conditions.” The quote seems particularly relevant as many people are asking if we are on the cusp of slower economic growth. This indicates the Federal Reserve knows the increase of interest rates is likely to slow the economy for the foreseeable future, and they are all right with it. While I am sure they would like to avoid this at all costs, it has long been known inflation is their primary mandate over a full labor force. The Federal Reserve is signaling while cognizant of the repercussions of their actions, some level of slower economic growth is okay to combat recent inflation.

The second quote I would like to focus on from the address is “In addition, the economy is likely to face further headwinds from tighter credit conditions.” Although Chairman Powell does not indicate specific data backing up this claim, there have been numerous reports of banks across the country tightening credit constraints coupled with having less money to lend overall. This reduces the amount of funding for investments and growth across the board.

What this means for Farms and Agribusiness

The implications for farms and agribusinesses are twofold. First, if you are an agribusiness providing credit to farmers for inputs or other operating expenses, you may see increased demand in the near future. I expect much of the tightening credit Chairman Powell mentioned has not been in the agricultural sector, however, if banks are looking at their deposits and the amount of funds they have to loan, there is a possibility overall lending could tighten across the board, agriculture not being an exception. Many farmers have used working capital to offset the increased cost of borrowing this year, and that may not be possible if working capital is depleted.

Secondly, if you are a farm or agribusiness company looking to expand or invest in your business, credit conditions are only going to get tighter here in the near term. Additionally, not only will they be tighter, but there could also be additional increases in the Federal Funds Rate, further increasing the cost of borrowing. Having a strategic plan in place for asset replacements and investments will ensure the cost of debt is minimized in the new interest rate environment.

TAGS:

TEAM LINKS:

RELATED RESOURCES

UPCOMING EVENTS

We are taking a short break, but please plan to join us at one of our future programs that is a little farther in the future.