October 11, 2024

Northern Indiana Corn Basis Begins Weaker, but Narrows Gap with Southern Indiana as Harvest Proceeds

by Josh Strine

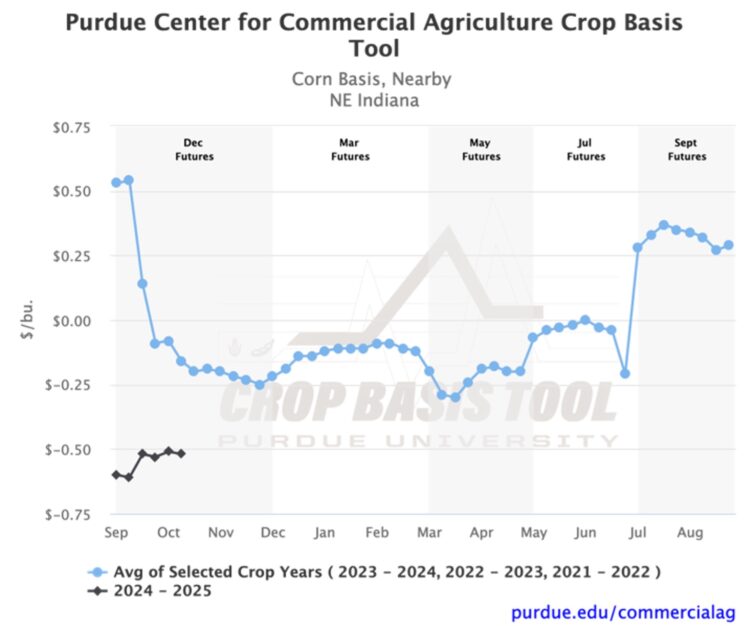

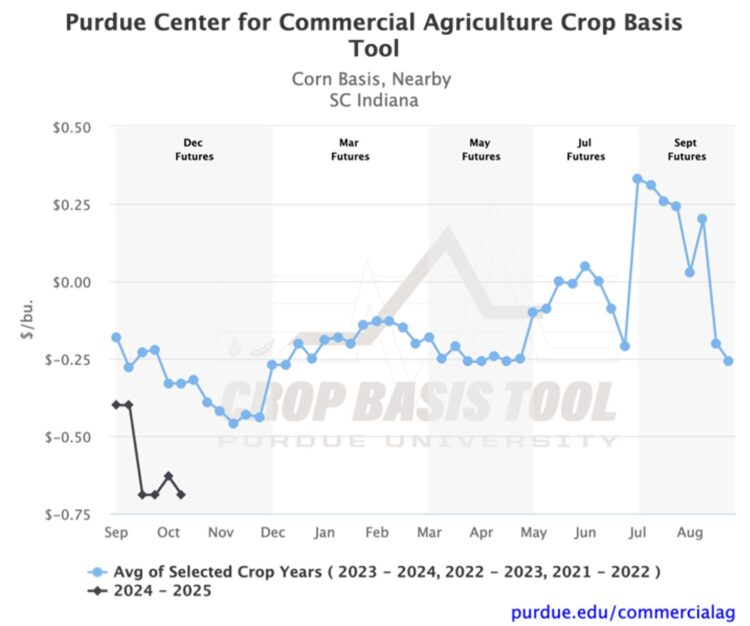

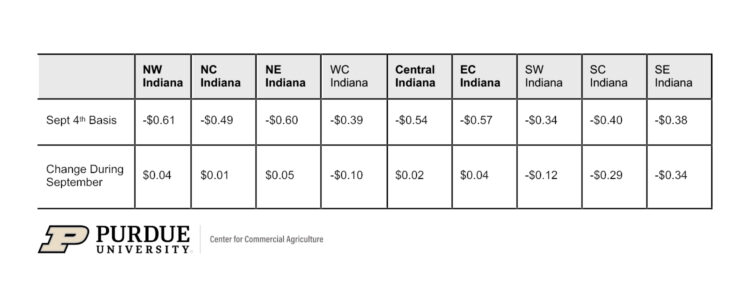

Through the first month of the 2024-2025 marketing year, two distinct patterns in Indiana corn basis have emerged. First, basis levels in the Northern and Eastern parts of the state began September significantly lower than those in Southern Indiana (Table 1). Regions with basis levels opening below -$0.40/bu. are bolded. The most extreme examples are a -$0.61/bu. nearby basis in NW Indiana and a -$0.34/bu. nearby basis in SW Indiana. Based on the three-year average, historical evidence does not indicate these regions generally have a lower opening basis. For example, this year’s basis levels in Northeast Indiana and Southcentral Indiana are shown in Figure 1 and Figure 2, respectively. The three-year average of corn basis in the first week of September is significantly higher in the Northeast than in Southcentral Indiana.

The second trend involved changes in regional corn basis through September. As shown in Table 1, the basis has strengthened in regions where it started the year below -$0.40/bu. and has weakened in regions where initial basis levels were greater than or equal to -$0.40/bu. Typically, corn basis has weakened as harvest proceeds. The last time crop basis strengthened during September for any region in Indiana was the 2020-2021 marketing year. One potential reason for the unusual rise in regional corn basis is how weak the basis level was at the start of the marketing year.

Table 1. Changes in Regional Corn Basis Through September, Purdue Center for Commercial Agriculture Crop Basis Tool

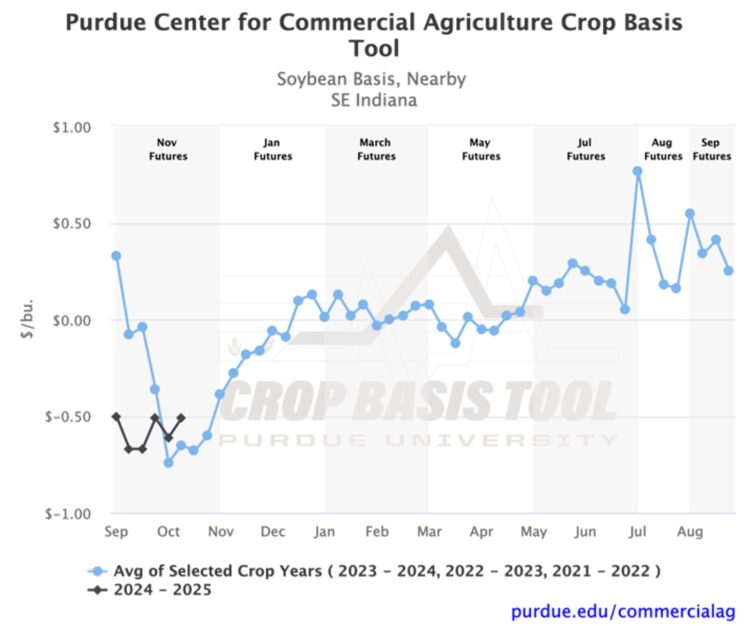

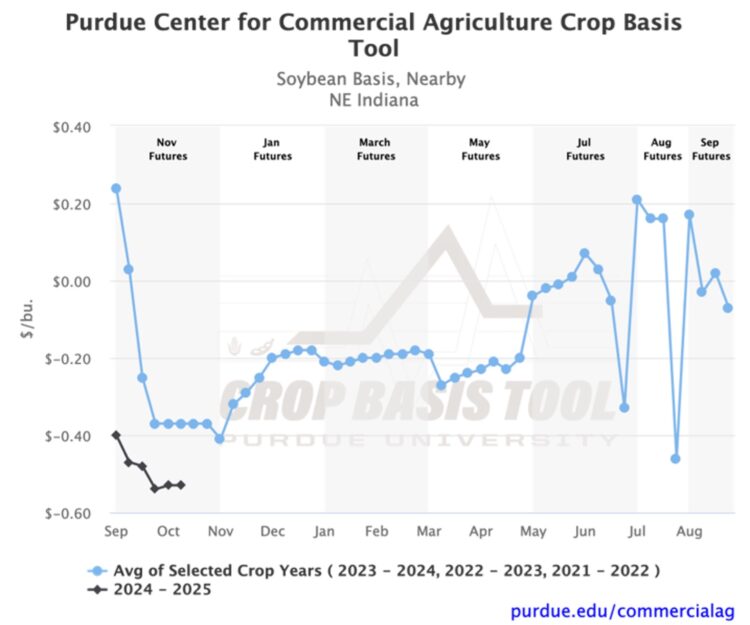

The basis movements for Indiana soybeans seem to be the opposite of those for corn. In Figure 3, the nearby soybean basis for SE Indiana is shown. There was a dip in the middle of September, but the basis was the same at the beginning and end of the month. Similar movement can be seen in SE Indiana soybean basis. Additionally, these are the only two regional basis levels for either corn or soybeans above the three-year historical average as of the second week of October. The movement of soybean basis in NE Indiana is depicted in Figure 4. Unlike corn, in the northern and central parts of the state, soybean basis has weakened throughout September.

While corn and soybean basis levels are generally lower than the three-year average, a more positive outlook can be observed in the data. Across the state, the gap between the 2024-2025 marketing year basis and the three-year average has shrunk. The sole exception is corn basis in SC Indiana. That is to say, this year’s basis levels have strengthened relative to the historical average across the state. You can see how your local basis is moving or compare it to previous marketing years by visiting the Purdue Center for Commercial Agriculture Crop Basis Tool.

TAGS:

TEAM LINKS:

RELATED RESOURCES

Corn and soybean basis levels have improved across much of the Eastern Corn Belt in early 2026, though large regional differences remain. Learn what’s driving basis strength—and how to track your local opportunities using Purdue’s Crop Basis Tool.

READ MOREUPCOMING EVENTS

We are taking a short break, but please plan to join us at one of our future programs that is a little farther in the future.