August 15, 2025

Corn & Soybean Basis Weakens as Focus Shifts to New Crop

by Josh Strine

On Tuesday, the August WASDE report was released, which significantly increased the projected 25/26 corn supply and decreased the soybean supply. There were immediate effects in the futures market. September and December corn futures dropped by $0.13/bu, and September and November soybean futures increased by $0.21/bu. As we approach harvest, it is yet to be seen how this will affect the new crop basis. However, 24/25 corn and soybean basis to September futures were stable to only slightly weaker between the first two weeks of August. This follows a trend of recent weakening, which is in line with the historically suggested trend.

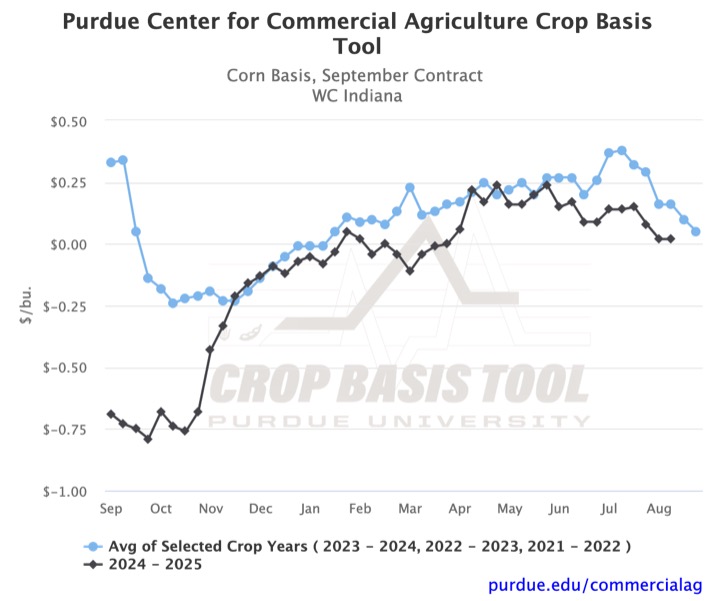

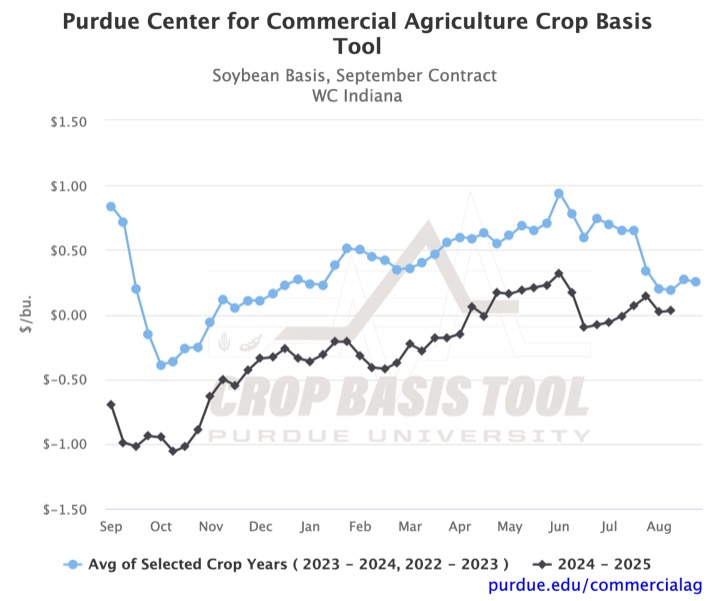

Over the past four weeks, corn basis across the Eastern Corn Belt has consistently decreased. Figure 1 depicts the change in West Central Indiana, which has resulted in a $0.13/bu weakening. This recent trend is unsurprising, given the three-year historical average, and may continue over the final two weeks in August. Since the beginning of August, soybean basis across the region has also experienced weakening. For example, the West Central Indiana soybean basis has decreased by $0.11/bu since the end of July (Figure 2). However, the two-year historic average suggests an opportunity for slight basis strengthening over the next two weeks.

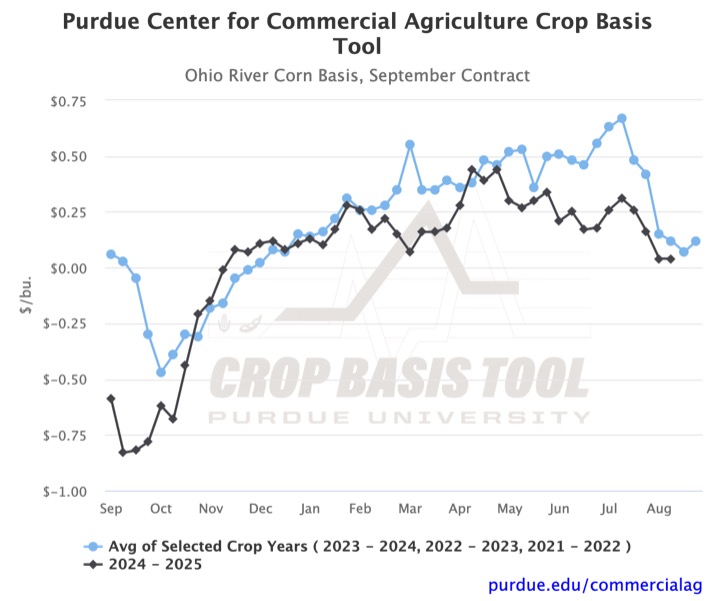

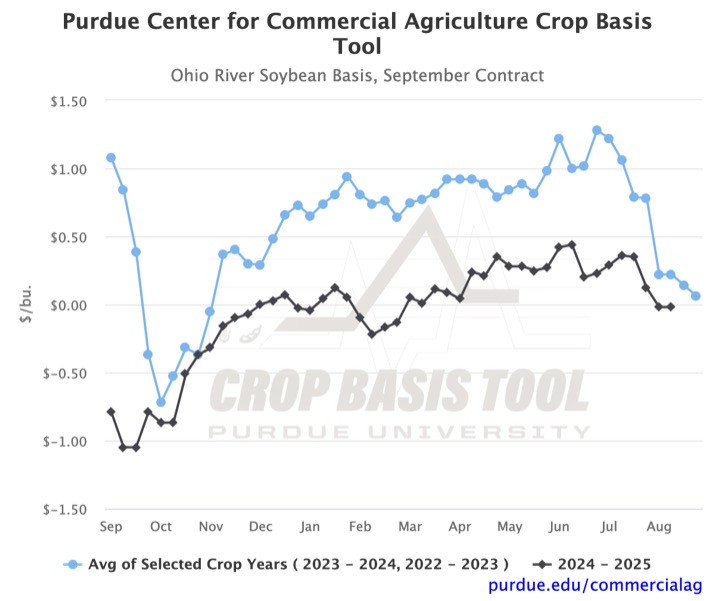

Trends in basis at ethanol plants and soybean processors have followed those of the regional corn and soybean basis. The historic averages also suggest similar changes as the marketing year comes to a close. On the other hand, the corn and soybean basis at Ohio River delivery points have slightly different outlooks than the rest of the markets across the Eastern Corn Belt. Figures 3 and 4 suggest there is an opportunity for Corn basis to slightly recover over the next two weeks, while soybean basis may continue to decline over the next two weeks. However, based on the historical average, potential basis gains are minimal, and the highest basis of the year has already passed.

As the marketing year comes to a close, you can visit the Purdue Center for Commercial Agriculture’s Crop Basis Tool to see how your local crop basis has evolved over the past year. In September, we will look back at the full 24/25 marketing year, examine how the most recent year will move the historic average, and get a first look at the 25/26 corn and soybean basis.

TAGS:

TEAM LINKS:

RELATED RESOURCES

Corn and soybean basis levels have improved across much of the Eastern Corn Belt in early 2026, though large regional differences remain. Learn what’s driving basis strength—and how to track your local opportunities using Purdue’s Crop Basis Tool.

READ MOREUPCOMING EVENTS

We are taking a short break, but please plan to join us at one of our future programs that is a little farther in the future.