December 19, 2025

Corn Basis Shows Volatility While Soybean Basis Stabilizes

by Josh Strine

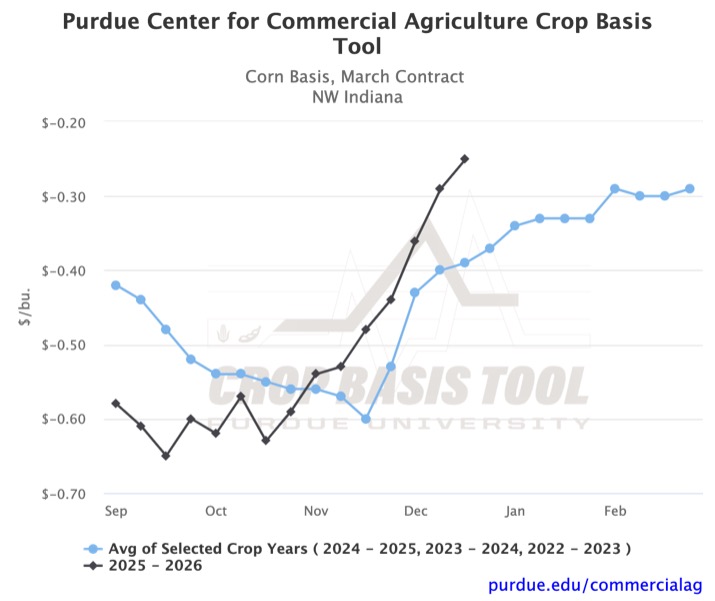

Across the Eastern Corn Belt, local corn basis has become more volatile, while soybean basis levels continue to stabilize. Until recently, we had observed consistent strengthening in corn basis across the region. In some areas, this pattern has persisted. For example, in Northwest Indiana, the basis to March futures has increased by $0.23/bu to -$0.25/bu in the past four weeks (Figure 1). This continued strengthening can be found across North and Central Indiana and Ohio and all of Michigan and Iowa. While basis continued to increase in Iowa over the past month, local basis levels in the state remain the lowest in the region and below the three-year average.

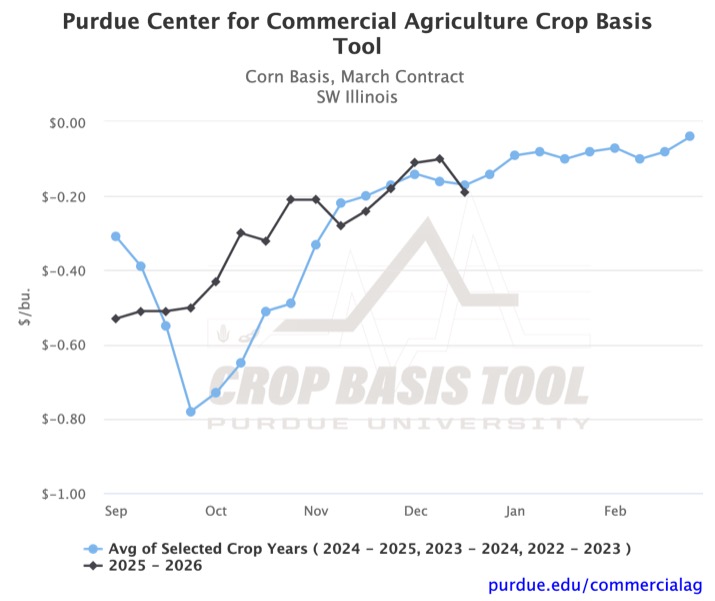

In Southern Indiana and Ohio, basis strengthening has slowed since the beginning of December. In fact, the five local basis levels tracked for the southern parts of Indiana and Ohio have stayed within a $0.02/bu range over the past three weeks. While a stable or slightly strengthening basis can also be found in Illinois, it is the only state with predominantly weakening local basis levels. For example, corn basis to March futures has weakened by $0.04/bu in Northwest Illinois, and by $0.08/bu in Southwest Illinois (Figure 2) since the first week of December.

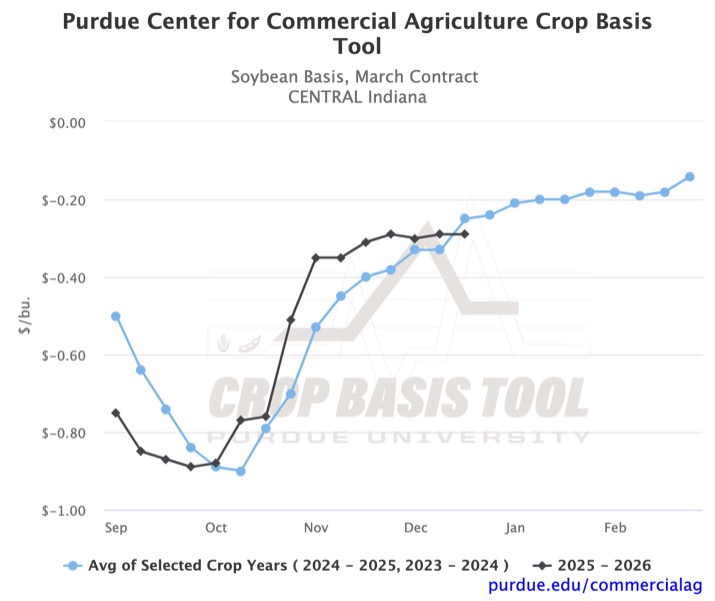

While corn basis across the region is highly variable, local soybean basis trends are much more consistent. Across the Eastern Corn Belt, local soybean movement has leveled off from the consistent strengthening that started in October. In Central Indiana, Soybean basis to March futures has remained within a $0.02/bu range since the third week of November and currently stands at -$0.29/bu (Figure 3). As a result of recent stability, the local basis is below the two-year average for the first time since the first week of October. Due to recent stability across Indiana, the local soybean basis is below the two-year average in each part of the state. In Central Ohio, we see soybean basis movement very similar to Central Indiana (Figure 4). Since the third week of November, the basis has stayed within a range of $0.02/bu and currently sits at -$0.30/bu to March futures.

Looking at the basis to March futures, basis volatility appears highest between September and December, based on historical trends. Therefore, we may expect to see continued stability as we head into the new year. However, the recent weakening of corn basis in parts of Illinois runs counter to historical trends and may warrant caution. An additional concern for future local soybean basis in Ohio and Iowa may arise from soybean processor basis that have decreased over the past six weeks, which again goes against the historical trend. To stay up to date on your local corn or soybean basis, you can visit the Purdue Center for Commercial Agriculture’s Crop Basis Tool.

TAGS:

TEAM LINKS:

RELATED RESOURCES

Corn and soybean basis levels have improved across much of the Eastern Corn Belt in early 2026, though large regional differences remain. Learn what’s driving basis strength—and how to track your local opportunities using Purdue’s Crop Basis Tool.

READ MOREUPCOMING EVENTS

January 27 or 28, 2026

Farm Shield is more than a conference, it’s a commitment to helping agricultural families build resilience and plan for a secure future. Don’t miss this opportunity to protect your legacy!

Read MoreJanuary 9, 2026

A management programs geared specifically for farmers. Surrounded by farm management, farm policy, agricultural finance and marketing experts, and a group of your peers, the conference will stimulate your thinking about agriculture’s future and how you can position your farm to be successful in the years ahead.

Read More