Ag producers say financials stronger than 2016; predict missed financial targets in 2017

U.S. agricultural producers indicated their farm operations’ financial positions are stronger than at this time in 2016, but expressed concerns that they might not meet their 2017 financial targets, according to a monthly producer survey conducted as part of the Purdue University/CME Group Ag Economy Barometer.

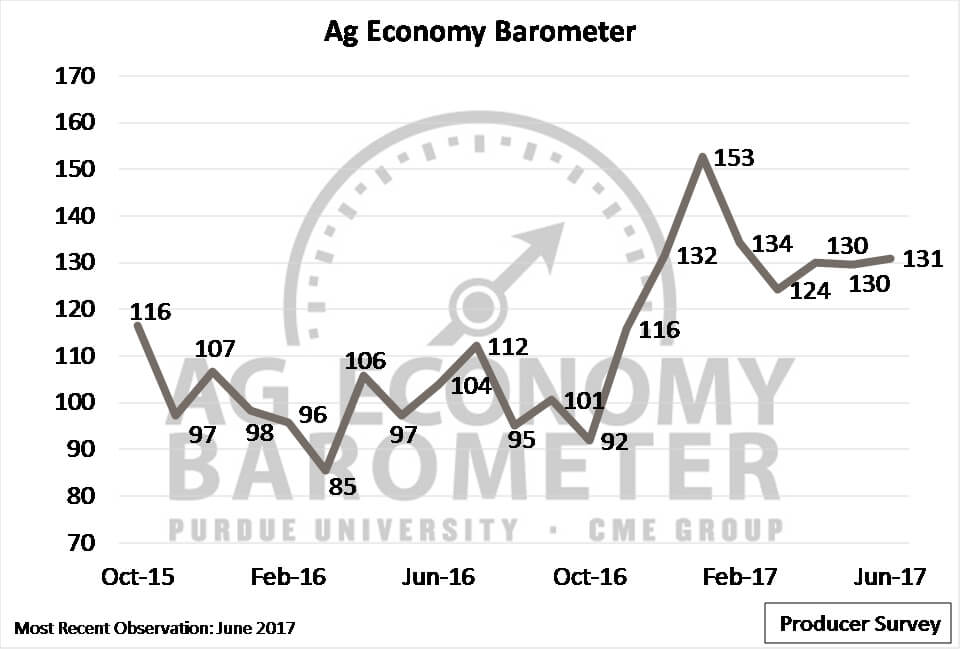

The barometer, which is based on a survey of 400 U.S. agricultural producers, read 131 for the month of June – virtually unchanged from the April and May readings of 130.“Although the Ag Economy Barometer has not changed appreciably the last couple of months, it’s important to note that it remains well above levels recorded prior to November 2016,” said Jim Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture.

In June 2017, 13 percent of survey respondents indicated that their operations were financially better off than a year before - the highest reading since Purdue researchers first started surveying producers in October 2015.

Only 3 percent of producers expressed that same positive sentiment a year earlier. However, farmers’ positive sentiment regarding their operations’ financial conditions improved steadily during the last half of 2016, before weakening somewhat this past winter. In the last three months, producers became more optimistic about their farms’ financial positions, with 13 percent of surveyed producers indicating in June that their farms were financially better off than a year earlier.

“Several factors likely contributed to the long-term shift in producers’ attitudes about their operations’ financial conditions, Mintert said. “Revenues on many farms increased as a result of record - or near record - crop yields in 2016. Also, corn and soybean futures prices strengthened from late summer through early winter while production costs, especially fertilizer, moderated when compared to last year. Farmland rental rates also continue to soften as part of the farm economy’s long-term adjustment to tight crop operating margins.

“All of this contributed to improved current financial conditions for many farm operations. Our survey data suggests that for some farm operators, financial conditions have bottomed out.”

While the barometer survey indicated the current financial situation for many farm operations had stabilized, 28 percent of producers said they expect their farms’ 2017 financial performance to be worse than they had projected earlier in the year. That concern could be connected to adverse planting and growing conditions in the Eastern Corn Belt this spring, as well as recent declines in corn and soybean prices.

The survey also revealed an uptick in producers (52 percent) expressing concerns that extreme weather events could have widespread adverse impacts on crop yields over the next 12 months.

“Compared to June 2016, producers expressed more concern about the possible impact of extreme weather on crop yields,” Mintert said. “One-third of producers in our survey said they had changed their marketing plans in response to weather concerns, up from just 22 percent in March of this year when we last posed the same question.”

Read the full June Ag Economy Barometer report at http://purdue.edu/agbarometer.

The Ag Economy Barometer, Index of Current Conditions and Index of Future Expectations are available on the Bloomberg Terminal under the following ticker symbols: AGECBARO, AGECCURC and AGECFTEX.

About the Purdue University Center for Commercial Agriculture

The Center for Commercial Agriculture was founded in 2011 to provide professional development and educational programs for farmers. Housed within Purdue University’s Department of Agricultural Economics, the center’s faculty and staff develop and execute research and educational programs that address the different needs of managing in today’s business environment.

About CME Group

As the world’s leading and most diverse derivatives marketplace, CME Group (www.cmegroup.com) enables clients to trade futures, options, cash and OTC markets, optimize portfolios, and analyze data – empowering market participants worldwide to efficiently manage risk and capture opportunities. CME Group exchanges offer the widest range of global benchmark products across all major asset classes based on interest rates, equity indexes, foreign exchange, energy, agricultural products and metals. The company offers futures and options on futures trading through the CME Globex® platform, fixed income trading via BrokerTec and foreign exchange trading on the EBS platform. In addition, it operates one of the world’s leading central counterparty clearing providers, CME Clearing. With a range of pre- and post-trade products and services underpinning the entire lifecycle of a trade, CME Group also offers optimization and reconciliation services through TriOptima, and trade processing services through Traiana.

CME Group, the Globe logo, CME, Chicago Mercantile Exchange, Globex, and E-mini are trademarks of Chicago Mercantile Exchange Inc. CBOT and Chicago Board of Trade are trademarks of Board of Trade of the City of Chicago, Inc. NYMEX, New York Mercantile Exchange and ClearPort are trademarks of New York Mercantile Exchange, Inc. COMEX is a trademark of Commodity Exchange, Inc. BrokerTec, EBS, TriOptima, and Traiana are trademarks of BrokerTec Europe LTD, EBS Group LTD, TriOptima AB, and Traiana, Inc., respectively. Dow Jones, Dow Jones Industrial Average, S&P 500, and S&P are service and/or trademarks of Dow Jones Trademark Holdings LLC, Standard & Poor’s Financial Services LLC and S&P/Dow Jones Indices LLC, as the case may be, and have been licensed for use by Chicago Mercantile Exchange Inc. All other trademarks are the property of their respective owners.