Farmer Sentiment Drifts Lower on Weaker Future Expectations

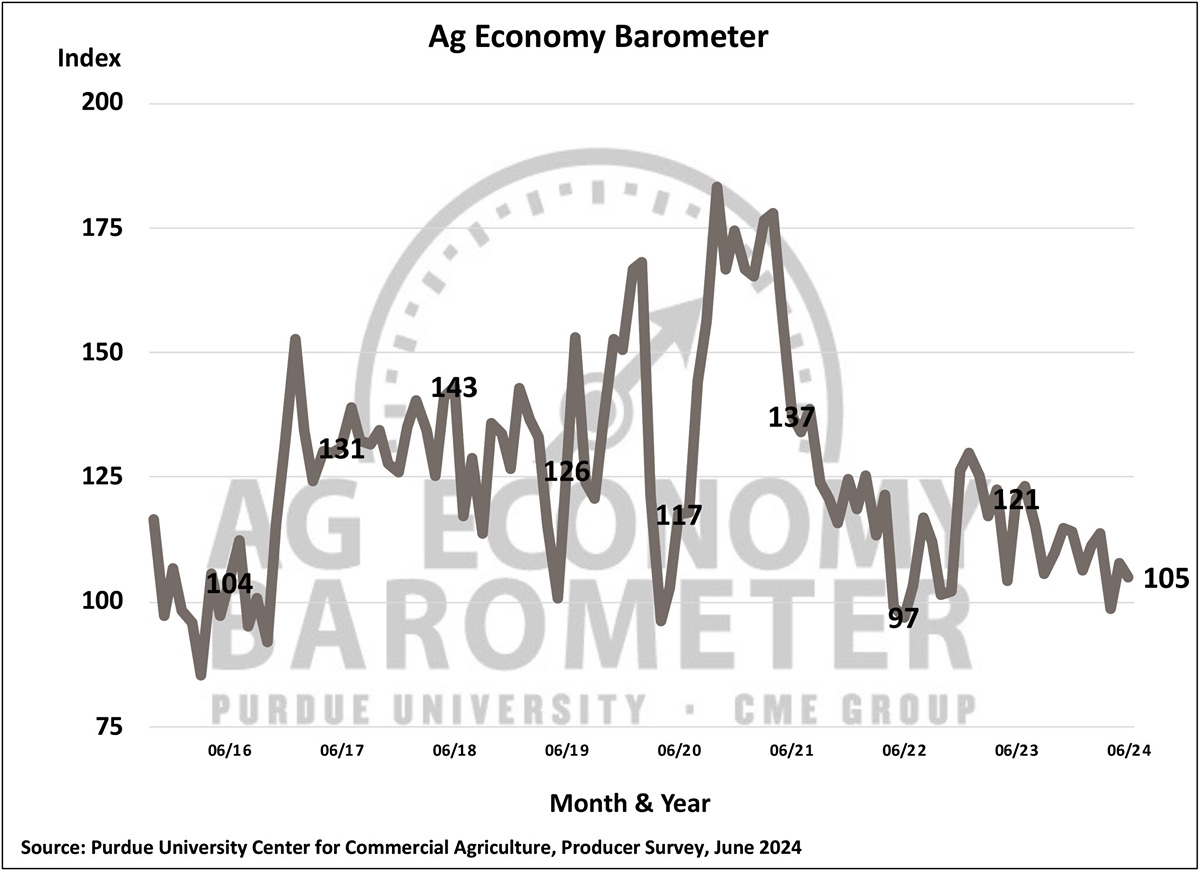

Farmer sentiment drifted lower in June as the Purdue University-CME Group Ag Economy Barometer reading of 105 was 3 points lower than a month earlier. A five-point decline in the Index of Future Expectations to 112 was responsible for the overall sentiment decline, as the June Current Conditions Index of 90 was one point above the May index value. High input costs and the risk of lower prices for the products they produce continue to weigh on farmer sentiment, along with concerns about rising interest rates. This month’s Ag Economy Barometer survey was conducted from June 17-21, 2024.

The Farm Financial Performance Index rose three points in June to a reading of 85. There’s been a tendency in recent years for producers’ financial performance expectations to bottom out in spring and improve as the spring crop growing season progresses. This year seems to be following that pattern as the index has risen 9 points over the last two months. Last year, producers’ farm financial expectations improved from spring into summer and then again from summer into fall. The index’s improvement in 2023 was driven by improving revenue expectations arising from good crop yields and a fall price rally. It remains to be seen if those conditions will be repeated in 2024.

The capital investment outlook weakened slightly in June as the Farm Capital Investment Index fell 3 points to a reading of 32, which leaves the index just one point higher than its all-time low. More producers this month said now is a bad time to make large investments than in May, with no change in the percentage of producers who said it’s a good time to invest. Interest rate concerns appear to be affecting farmers’ investment outlook. Over the last several months, the percentage of producers citing rising interest rates as a top concern for their farm operation has been rising. In February, 18% of survey respondents chose rising interest rates as a top concern. That percentage has been rising every month since then, reaching 23% in the June survey.

The Short-Term Farmland Value Expectations Index reading in June of 115 was unchanged from a month earlier. However, producers’ longer-term outlook on farmland values did shift as the Long-Term Farmland Values Index value of 152 was 7 points below May’s reading. Fewer producers this month said they expect farmland values to rise over the next five years, with a concurrent rise in the percentage of producers who think values will remain unchanged. Among those producers who expect a long-term increase in farmland values, most (57%) respondents continue to point to non-farm investor demand as a key driver, followed by inflation, which was chosen by 16% of respondents. June marked the third month that the survey instrument included “Energy Production” as a possible driver of farmland values, and this month, 10% of respondents with a bullish outlook chose it as a key factor.

Once again, this month’s survey asked respondents if they or one of their landowners had been approached about a possible Carbon Capture and Storage (CCS) project from an ethanol plant. This month, 8% of respondents said they had been in contact about a CCS project. The vast majority (93%) of respondents who had contact with a company about a CCS project reported that payment rates offered were less than $25 per acre, with just 8% of producers reporting payment rate offers of $50 or more per acre.

Sixteen percent of respondents this month said that, within the last six months, they had discussed with a company a farmland lease for solar energy production. That’s down slightly compared to April and May, when 19 and 20 percent of respondents, respectively, reported solar leasing discussions taking place. Lease rates have been rising since we first collected data on solar leasing in 2021. This month, 69% of respondents said they were offered a long-term lease rate of $1,000 per acre or more, up from just 27% in June 2021. This month’s survey included a more detailed list of lease rate options for respondents to choose from, and 27% of respondents said they were offered a lease rate of $1,500 per acre or more. Fifty-eight percent of respondents said the lease contract they discussed included an annual escalator clause. Among those respondents who reported discussing an escalator clause, the most common escalator range was from 2 to 3 percent per year.

Wrapping Up

Weaker expectations for the future were responsible for a modest decline in this month’s Ag Economy Barometersentiment index. Farmers long-term farmland value outlook weakened slightly in June after approaching an all-time high last month. The percentage of farmers reporting that they are concerned about rising interest rates has been increasing, which could be one reason why farmers’ future expectations, along with their outlook on capital investments and long-term farmland values, all dipped compared to a month earlier. In areas of the country where leasing of farmland for solar energy production is taking place, lease rates being offered continue to rise. This month, 69% of respondents who reported a solar leasing discussion said they were offered a long-term solar lease rate of $1,000 per acre or more.

About the Purdue University Center for Commercial Agriculture

The Center for Commercial Agriculture was founded in 2011 to provide professional development and educational programs for farmers. Housed within Purdue University’s Department of Agricultural Economics, the center’s faculty and staff develop and execute research and educational programs that address the different needs of managing in today’s business environment.

About CME Group

As the world’s leading derivatives marketplace, CME Group enables clients to trade futures, options, cash and OTC markets, optimize portfolios, and analyze data — empowering market participants worldwide to efficiently manage risk and capture opportunities. CME Group exchanges offer the widest range of global benchmark products across all major asset classes based on interest rates, equity indexes, foreign exchange, energy, agricultural products and metals. The company offers futures and options on futures trading through the CME Globexplatform, fixed income trading via BrokerTec and foreign exchange trading on the EBS platform. In addition, it operates one of the world’s leading central counterparty clearing providers, CME Clearing.

CME Group, the Globe logo, CME, Chicago Mercantile Exchange, Globex, and E-mini are trademarks of Chicago Mercantile Exchange Inc. CBOT and Chicago Board of Trade are trademarks of Board of Trade of the City of Chicago, Inc. NYMEX, New York Mercantile Exchange and ClearPort are trademarks of New York Mercantile Exchange, Inc. COMEX is a trademark of Commodity Exchange, Inc. BrokerTec is a trademark of BrokerTec Americas LLC and EBS is a trademark of EBS Group LTD. The S&P 500 Index is a product of S&P Dow Jones Indices LLC (“S&P DJI”). “S&P®”, “S&P 500®”, “SPY®”, “SPX®”, US 500 and The 500 are trademarks of Standard & Poor’s Financial Services LLC; Dow Jones®, DJIA® and Dow Jones Industrial Average are service and/or trademarks of Dow Jones Trademark Holdings LLC. These trademarks have been licensed for use by Chicago Mercantile Exchange Inc. Futures contracts based on the S&P 500 Index are not sponsored, endorsed, marketed, or promoted by S&P DJI, and S&P DJI makes no representation regarding the advisability of investing in such products. All other trademarks are the property of their respective owners.

About Purdue University

Purdue University is a public research institution demonstrating excellence at scale. Ranked among the top 10 public universities and with two colleges in the top four in the United States, Purdue discovers and disseminates knowledge with a quality and at a scale second to none. More than 105,000 students study at Purdue across modalities and locations, including nearly 50,000 in person on the West Lafayette campus. Committed to affordability and accessibility, Purdue’s main campus has frozen tuition 13 years in a row. See how Purdue never stops in the persistent pursuit of the next giant leap — including its first comprehensive urban campus in Indianapolis, the new Mitchell E. Daniels, Jr. School of Business, and Purdue Computes — at https://www.purdue.edu/president/strategic-initiatives.